Automatically track and manage your expenses while get more rewards on what you’re already spending on. Just leave it to Dobin! It has been a long time since I got this excited over a new finance app, especially one that helps me to save more without upselling me other investments or insurance products!

Managing cash has become complicated – today, most of us have multiple bank accounts and credit cards, but also money sitting in our e-wallets (Grab / ShopeePay / amaze / Youtrip).

I don’t know about you, but I certainly don’t fancy having to track my cash using a spreadsheet. Trying to optimize my own credit cards and bank accounts for maximum bonus interest (jumping through all those hoops) each month is already tough enough!

SGFinDex has been a welcome change, but since you can only use it via a bank or insurer’s application, the trade-offs include the fact that the financial recommendations shown to us are mostly to buy more insurance products or invest in the bank’s robo offering. It helps me to manage my overall finances but does nothing to save any more money or earn extra rewards (that I didn’t know existed) on my current spending habits.

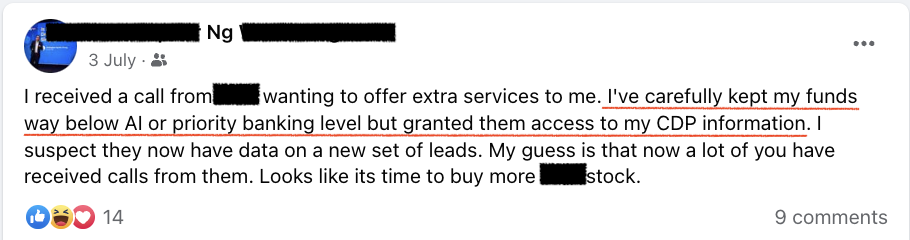

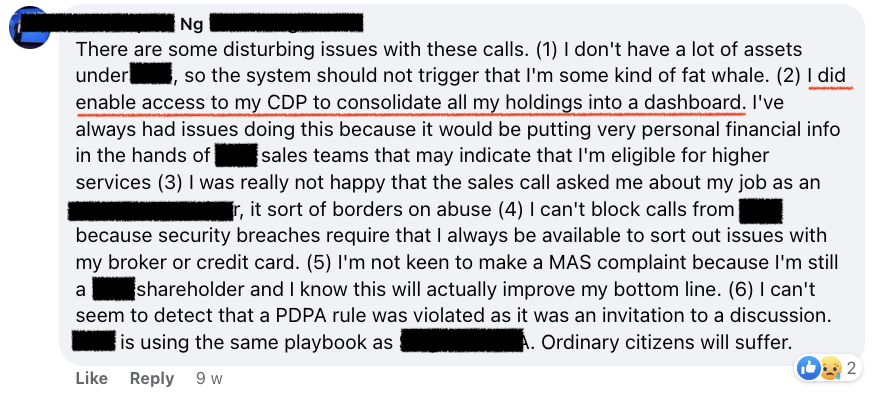

Another drawback is that people have also started reporting unsolicited sales calls, now that the banks have visibility on their assets held with other financial institutions:

As a consumer, I don’t necessarily want to be sold more financial products when I share my data. Instead, I want unbiased advice and recommendations along the lines of:

- Switch to another credit card – to get more rewards on your same spending categories!

- Shopping with your usual merchants? Here’s a promo code for your next purchase!

At the end of the day, when I choose to share my financial data, I want to be able to benefit from it – in the form of savings, rewards, or how I can better optimize my money.

Unfortunately, the current market players on SGFinDex are not incentivized to help me save money or get more rewards because it does almost nothing for their bottom line. Consumers like you and I still need to put in the effort to research and curate relevant offers for ourselves.

Today, most discounts are given to incentivize further spend, instead of helping consumers save more on existing spend. Your bank can now see you tend to spend more on dining out, but are they using that to recommend that you switch from your current credit card (3%) to another card of theirs that can give you higher rewards (8%) on the same spend? Or, if the best credit card for dining is in fact from another bank, what’s in it for them to tell you that?

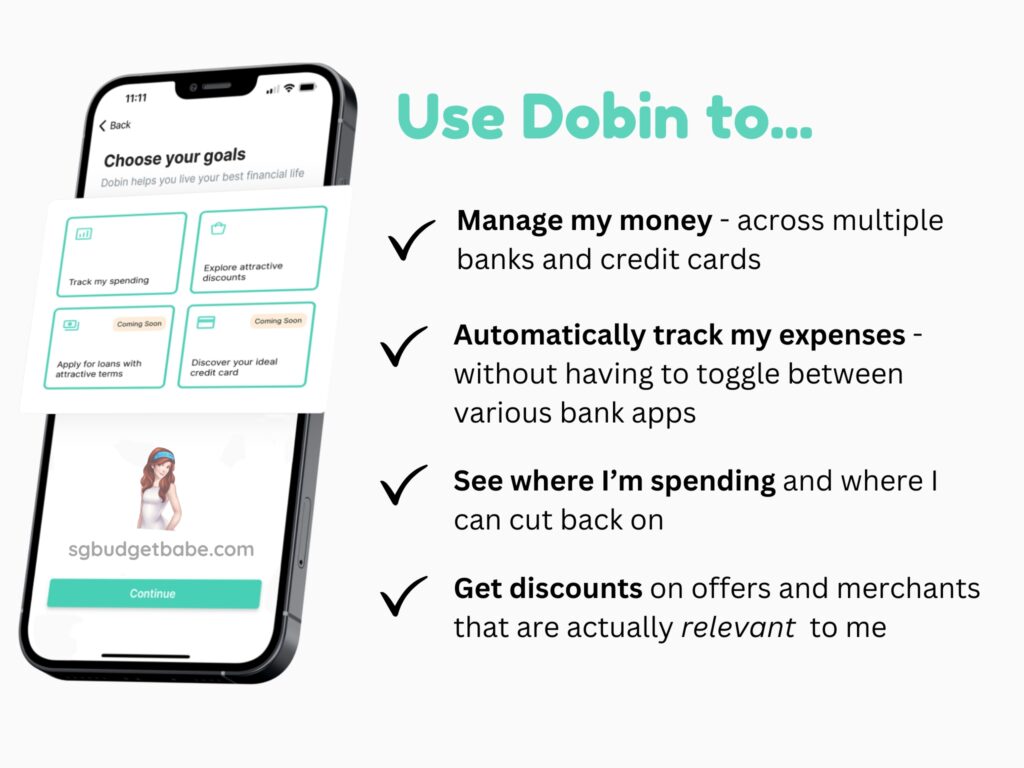

Earlier this year, I wrote about my ideal version of an app that would:

- help me manage my multiple bank accounts and expenses, while using that data to

- curate relevant promotions and discounts for me.

A reader pointed me to Dobin, where I got a sneak preview (media perks!) and I’ve been on the waitlist since. Now that it’s available for Android users, here’s my review!

If you want to learn how to manage your cash and get the most out of your rewards, then you’d want to give Dobin a try.

Disclaimer: This review is sponsored by Dobin.

Manage your finances in one app

Dobin fills a current gap in the market, which is the need for an independent, non-FI app which can help consumers save money and get better rewards on their existing spending.

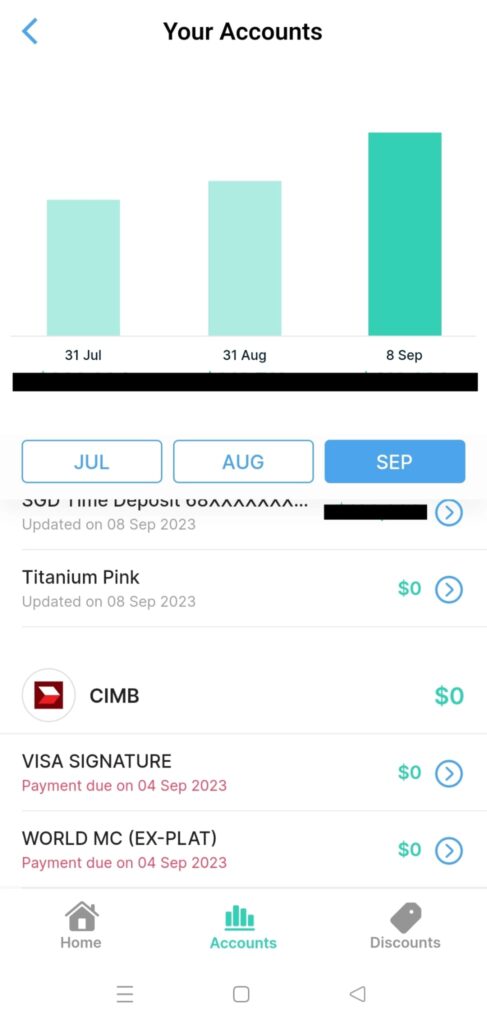

It also connects to AMEX, CIMB and Bank of China, which you still cannot get on SGFinDex.

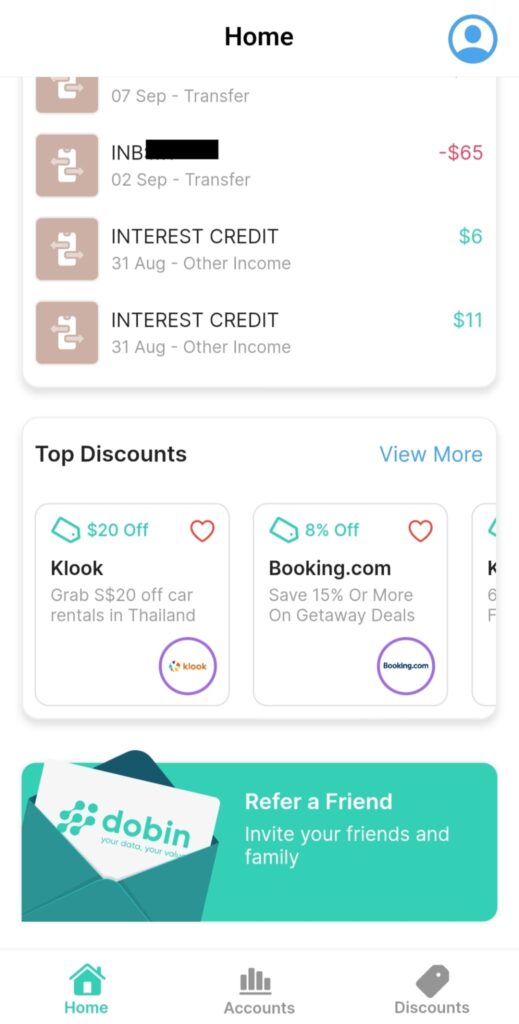

Since its launch, I’ve been using Dobin to do the following:

- Manage my money across my multiple bank accounts and credit cards

- View all my recent expenses in one place (without having to toggle between multiple bank apps!)

- Automatically categorize my spending for me – so I can see how much I’m spending + spot overlooked charges quickly (such as annual credit card fees that I forgot to call in to request a waiver for!)

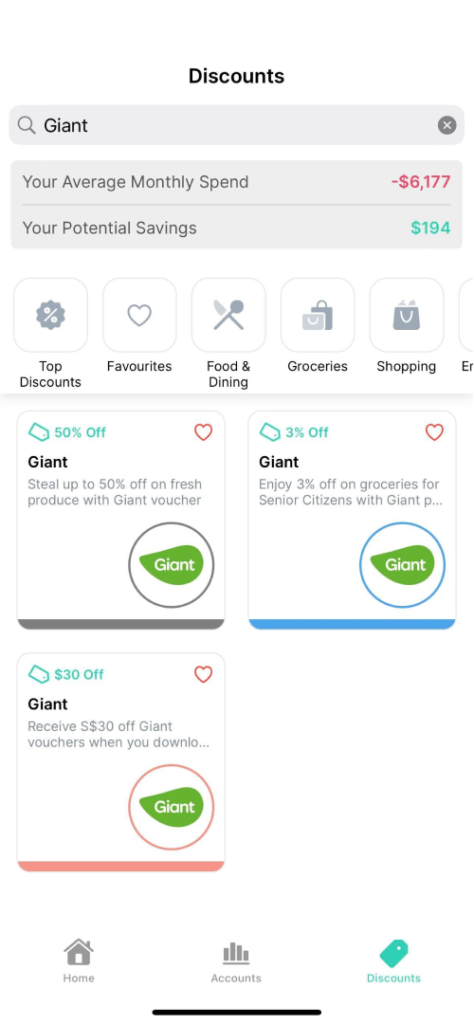

- Save time searching for discounts relevant to me – it has shown me promos for Shopee, Grab, FairPrice and Giant so far (exactly where I shop at)

- (this feature hasn’t been launched but is coming soon) Point out a better credit card to use for higher rewards, based on our everyday spend.

Let’s talk quickly about each of these benefits.

1. Manage your multiple bank accounts and credit cards

Right now, the only way for me to manage this would be to individually open up my DBS / OCBC / UOB / Standard Chartered / CIMB app to track how much I have, what I’ve spent in the month, what I owe on my cards and when I need to pay.

Let me just say this – it is super painful and tiring.

Now that I can connect all of them to a single interface – Dobin – it has been so much easier for me to see all of my money in one place. And for the absent-minded folks, it can even flag out to you when each respective credit card bill is due for payment.

I love it!

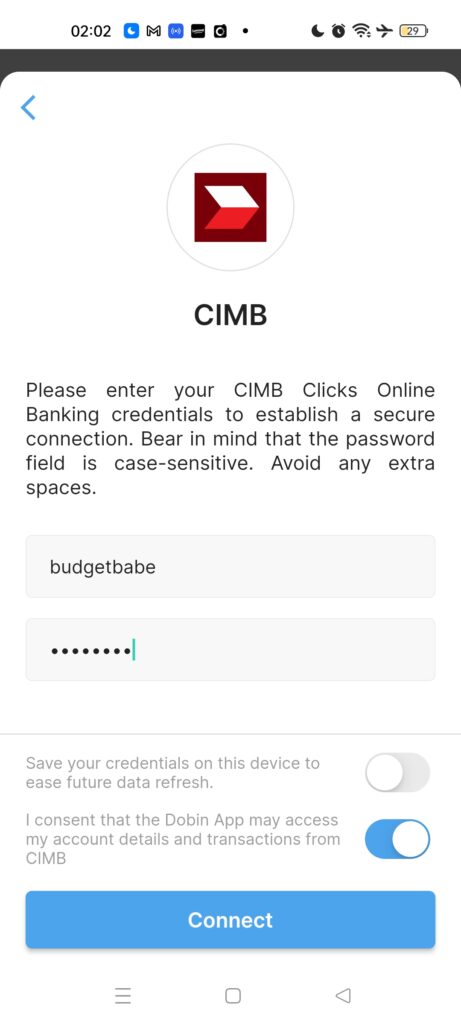

I’ve included a quick guide below to show how the connection works, but really, the instructions on-screen should be pretty easy to follow for most people.

The current list of the 8 financial institutions you can connect to Dobin are as follows: DBS, OCBC, UOB, Standard Chartered, HSBC, AMEX, CIMB and Bank of China.

Citibank is currently not available but will be in due time. I also wish Dobin would also be able to see how much I have in my e-wallets (since I often forget about them), and I have already raised this as a feature to be considered for future development, so let’s see when it gets added!

That’s a game-changer, because there’s no other app or dashboard right now that allows you to see all of that in one place.

2. Automatically track and categorize your expenses

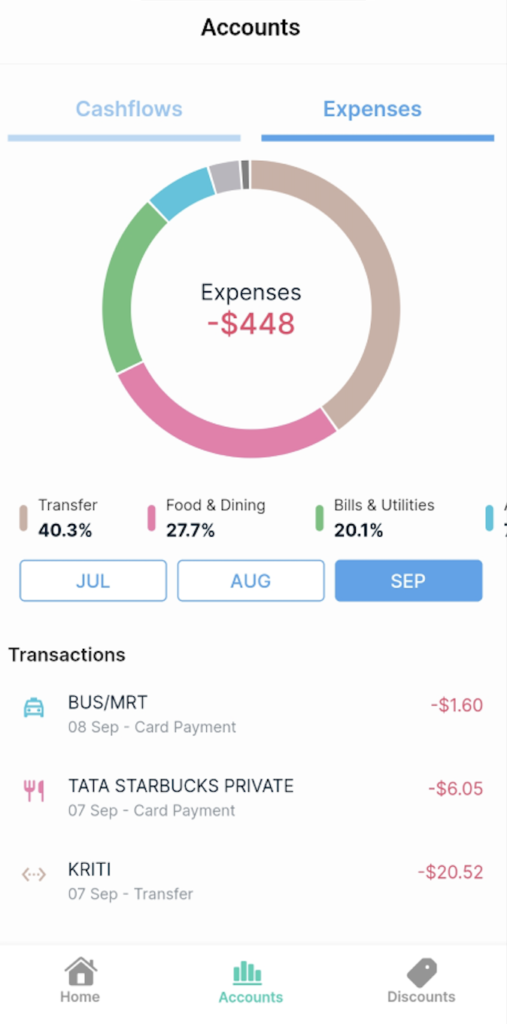

Now that all my cash can be consolidated on my Dobin dashboard, I can now track trends in my spending and income, see which categories take up more of my budget, and hone into any areas of overspending.

For anyone who cares about staying within budget, this is really empowering.

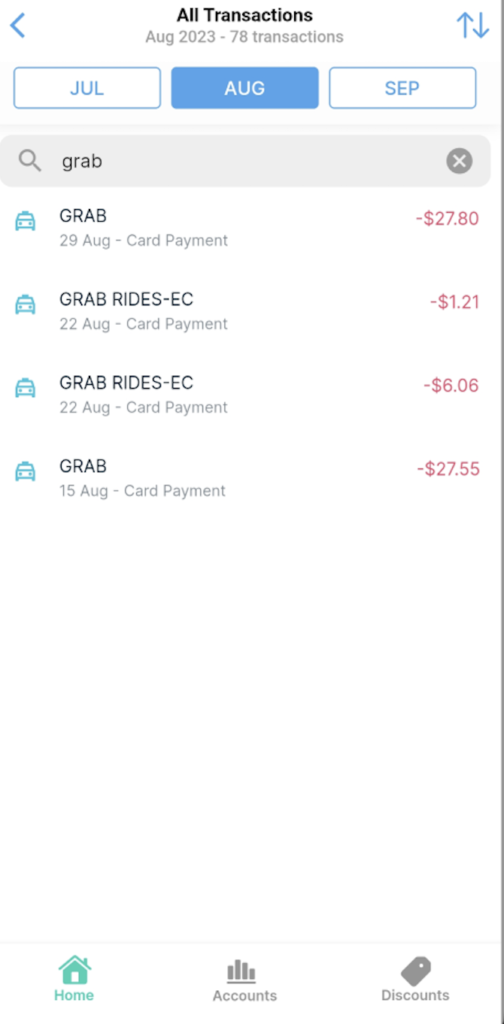

I’m especially impressed that I can filter my transactions by searching for specific brands (e.g. Grab, Shopee) and even view month-on-month expense trends to see which transactions drove the biggest change.

What’s more, I’m sure most of you can agree that it becomes easier to miss certain line items or payments, due to the multiple cards we must manage today and all the auto-billing arrangements that we had set up in the past.

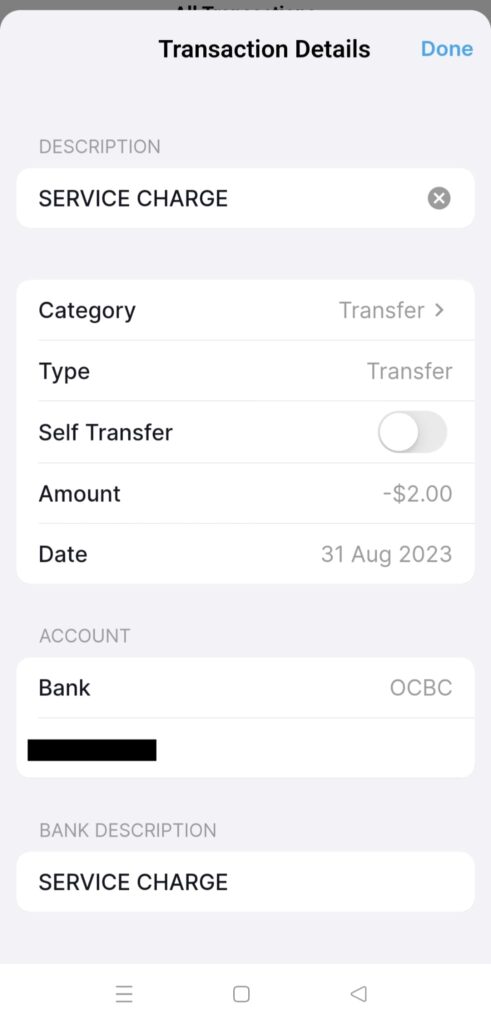

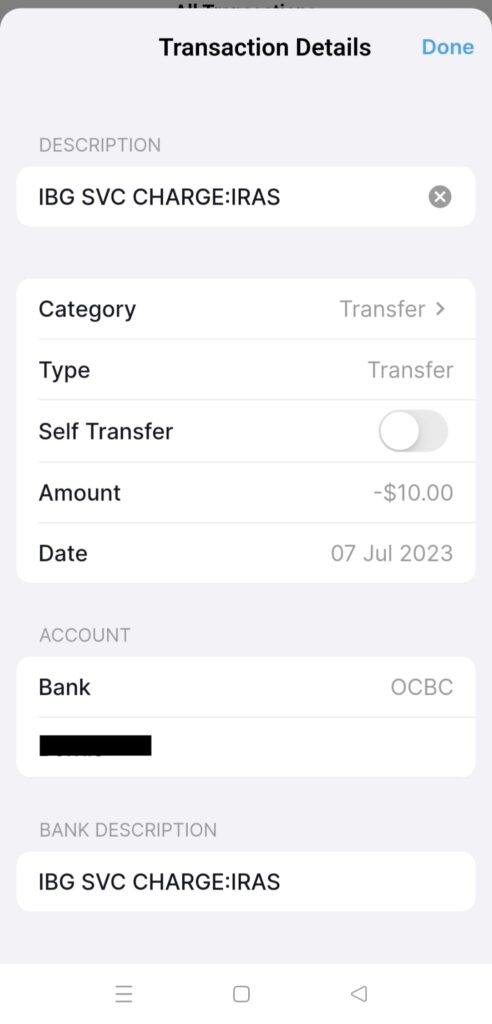

With Dobin, you should now be able to spot a few transactions that you would otherwise have missed, such as a late payment charge on your credit card, or even the below “service charge” fees which I never knew the bank had been deducting from my account all this while!

I called OCBC to ask and apparently, this $10 charge is levied because my GIRO payment with IRAS failed to go through and hence there’s a fee. I’ve been doing this for years and never once knew?! As loyal readers would know by now, that’s because I route my income taxes through CardUp in order to earn miles, which is why the GIRO arrangement would fail since I deliberately kept insufficient funds in my designated account for paying income taxes.

Thanks to connecting everything on Dobin, the app even helped me to identify a credit card annual fee that I had overlooked last month, thus prompting me to immediately give my bank a call to get it waived!

On my dashboard, Dobin helps me to aggregate total expenses vs. savings vs. income and lets me drill down into spending by category.

Easy peasy, because it is all automated and done for you.

You’ll be able to use these insights in many different ways – from thinking of which categories you’d like to cut back on in subsequent months, or even whether you should be rethinking your budget for certain stuff now that inflation-adjusted prices are here to stay. Go experiment!

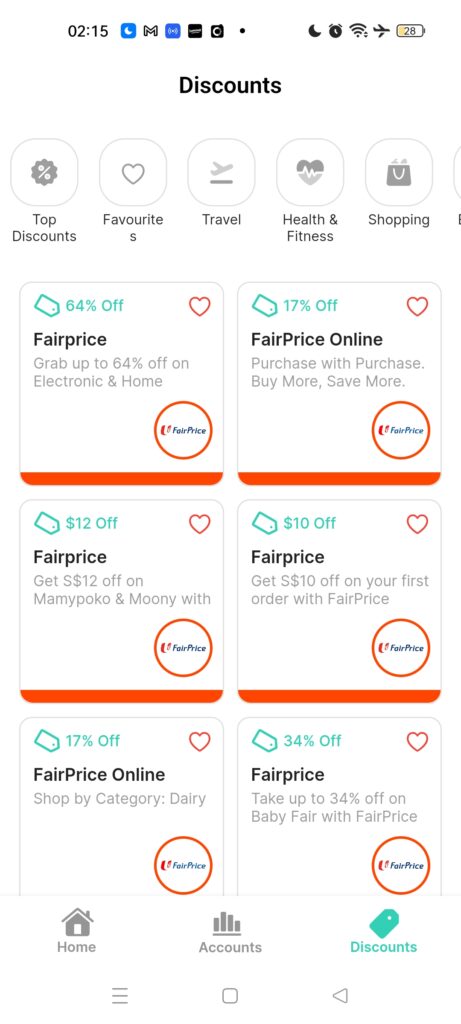

3. Get recommended discounts

The best part is, I can even use this data to get more rewards on my existing spend without me having to spend unnecessarily more.

How Dobin pulls off is:

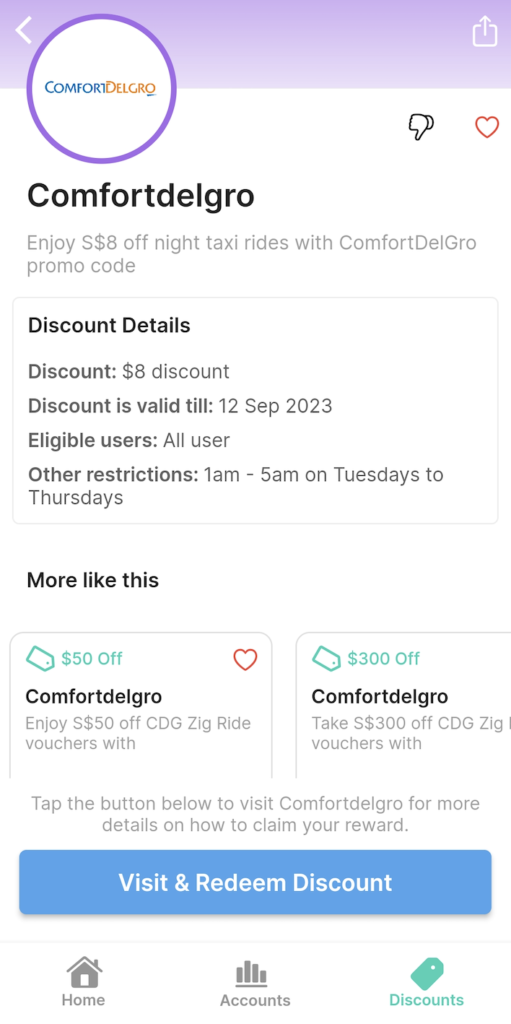

- When I share my data with Dobin, the tool returns me personalised offers that are tailored to my spending. So far, I’ve gotten discounts for Shopee, Lazada, FairPrice and Giant shown to me, which are merchants I shop heavily at.

- By recommending that I use another one of my credit cards (or get a better credit card) based on my spending habits tracked. This feature is not launched at the time of publishing, but will be out soon.

The app could pick up that I had just returned from a Penang trip (given my card transactions abroad) and was thus showing me travel discounts on my home screen. You can also search on the Discounts tab for your favourite merchant to see if any promotion is being listed!

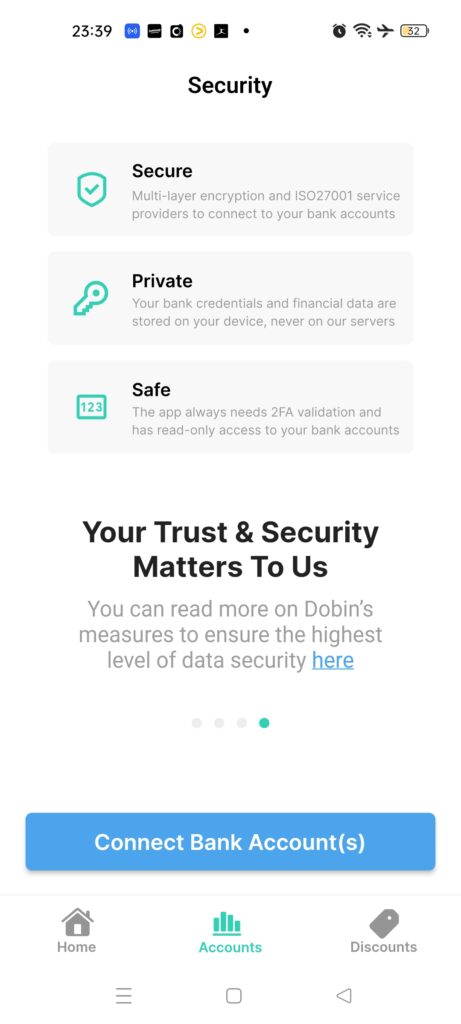

How safe is my data on Dobin?

Ok, so the app is all great and useful, but…how safe is it, really?

In light of all the increased scam cases, you can imagine how I was naturally skeptical about keying in my usernames and passwords into Dobin to allow for the syncing of data.

However, the same steps are needed for SGFinDex anyway, so I understood why this was necessary. This is also where – upon enquiring – the Dobin team assured me that their access is “read-only”, which means Dobin can only view information and will not be able to send any instructions to the user’s bank account (e.g. cannot withdraw or transfer money on your behalf).

For the tech geeks, how this works is that your user credentials are never stored on Dobin’s servers; instead, they are encrypted and saved on your own device password management system such as Apple Keychain or Android Keystore.

What’s more, it is up to you whether you want to save your credentials on the device to ease future data refresh whenever you log into Dobin subsequently. If you prefer not to, then you’ll simply have to re-connect each time you open up your Dobin app – which shouldn’t be a big issue in exchange for the peace of mind that you get, I guess.

You can read about Dobin’s data privacy and security controls here. What I took away was that my banking credentials are never sent to Dobin’s servers i.e. the app does not store any sensitive or personal information such as addresses, payment information or card details. Instead, the data goes from my bank to my mobile phone, and stays there i.e. it is not shared with the Dobin back-end platform, unless I explicitly decide to share with Dobin – in which case my data will get anonymized before sharing.

You also won’t have to worry about receiving unsolicited sales calls from your bank reps to upsell you any investment products anymore, since your data isn’t shared with them nor their relationship managers when you use Dobin!

TLDR Conclusion

To sum it up, you may find different benefits from your financial data dashboard on Dobin vs. the value I personally got out of it, but for me what I appreciated the most are the following features:

- It helps me to see all my credit card payment due dates in one place. Now there’s no more excuse to miss a bill or incur late fees again!

- Dobin helped me to spot charges and transactions that I didn’t even know I had been paying for, such as the $10 service charge fees for my income tax to IRAS

- It automatically categorizes my transactions into categories for me, which are pretty accurate – I’ve not spot any errors I had to manually correct so far. This allows me to understand where my money is going, and do stuff like ensure my dining expenses does not exceed 30% each month if I want to stay within budget.

- I can even search by merchant to see how much I’ve been paying…or even overspending e.g. I’m certainly guilty of having spent on too many Grab rides this month due to my tighter schedule.

As someone who cares about staying within budget and not overspending, much less paying for “avoidable” fees like late charges or credit card interest, I truly appreciate the amount of thought that has gone into building Dobin and making it one that truly serves the consumer’s needs.

Right now, the app is free to use, so go ahead and test it out!

If you have multiple bank accounts and credit cards like I do, you may want to start by syncing your most commonly-used cards and spending accounts first.

And if you don’t want to sync certain bank accounts (perhaps because your secret wealth is stashed away there), you can choose not to.

That way, you get to enjoy the insights and analytics that Dobin can offer, while benefiting from the personalized discounts and promotions shown to you based on what you’re already spending on.

Save more and get greater rewards.

How does that sound?

Try it out for yourself by downloading Dobin today!

For iOS users, you can download it here. Android users, get Dobin here on the Google Play Store.

Disclosure: This article is written in collaboration with Dobin.

2 comments

Hi Dawn,

I was just wondering, with all the scams going around now, how do we tell if a site like Dobin (or any other such site) is legit? Is there a way to tell? Cause I noticed we have to type in our bank login and pw to connect to Dobin, and if not for someone known like you recommending it, I would be even more weary about entering my login and pw.

That’s a great question, because I too, was skeptical initially about putting it my credentials. Luckily for Dobin, their launch came after SGFinDex, so I now understand that why the login credentials are needed to gain access (the same way we have to key in our banks / insurance login credentials when we use SGFinDex to read information). I also do 2 more things: (1) check if the access is read-only or transactional, and make sure I have 2FA activated on my banking devices for transactions so that I can catch if there are any scams or attempts to withdraw my money which I have not authorized for; (2) check on the team behind the app.

The CEO of Dobin is an industry veteran, formerly held leadership roles in the advisory and data analytics arm of Visa across Asia Pacific, and before Visa, he held multiple leadership positions at American Express. Prior to that, he was from Societe Generale. The CTO was formerly the CEO and CTO of Bitsmedia, a company that developed a world-renowned Muslim lifestyle app with more than 150 million downloads globally. Prior to that, he held tech leadership positions at Google, Akamai, and Vivendi.

Your skepticism and reluctance is natural (and good! especially in light of increased scams) so if you’re still worried, my advice would be to leave perhaps the bank accounts where you have the most money parked in? That way, you still have a “safety net” to fall back on if anything ever goes south.

Comments are closed.