If you’re trying to clock up enough miles fast, here are the best credit cards in Singapore to use right now and what I personally recommend.

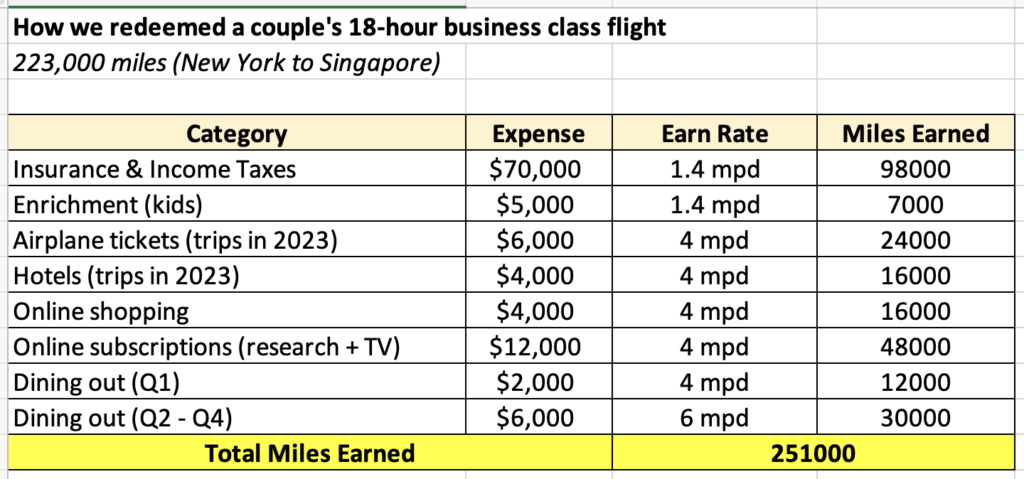

I redeemed our first business class tickets on Singapore Airlines last month for a New York-Singapore trip as a couple, and many of you asked how I accumulated that much. It’s not rocket science, and loyal readers would probably already see me talk about these strategies before, but here’s a breakdown of how we got ours anyway:

However, some of the cards have since reduced their rewards benefits (e.g. UOB Lady’s), so here’s an updated post on what you should get for 2024.

My credit cards strategy

To clock miles at the FASTEST possible earn rate, you should be doing these:

- Use specialised credit cards that give 4 mpd for most of your spend

- For everything else, use general credit cards of 1.4 – 1.7 mpd

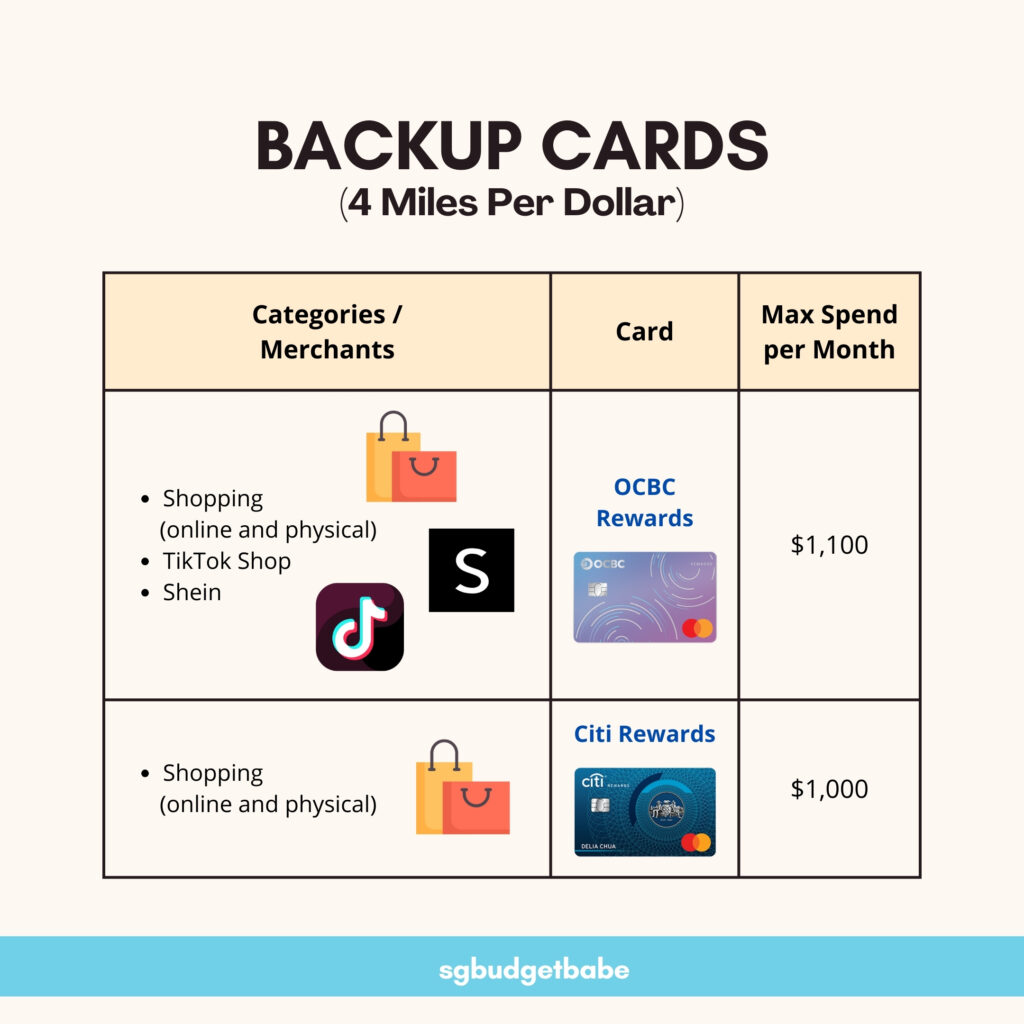

- Keep backup cards or months when your spending exceed the max caps (especially for online shopping – think 11.11 and Black Friday sales)

Best cards for regular spending

If your regular spending looks anything like mine, you’ll likely be clocking expenses across:

- Dining out

- Online shopping (e.g. Shopee, Lazada)

- Online subscriptions (e.g. Netflix, Spotify, ChatGPT)

- Groceries / Supermarkets

- Petrol and transport (includes ride-hailing and public transport)

- Entertainment tickets (e.g. SISTIC or Ticketmaster)

- Travel (flight tickets, hotels, tourist activities, etc)

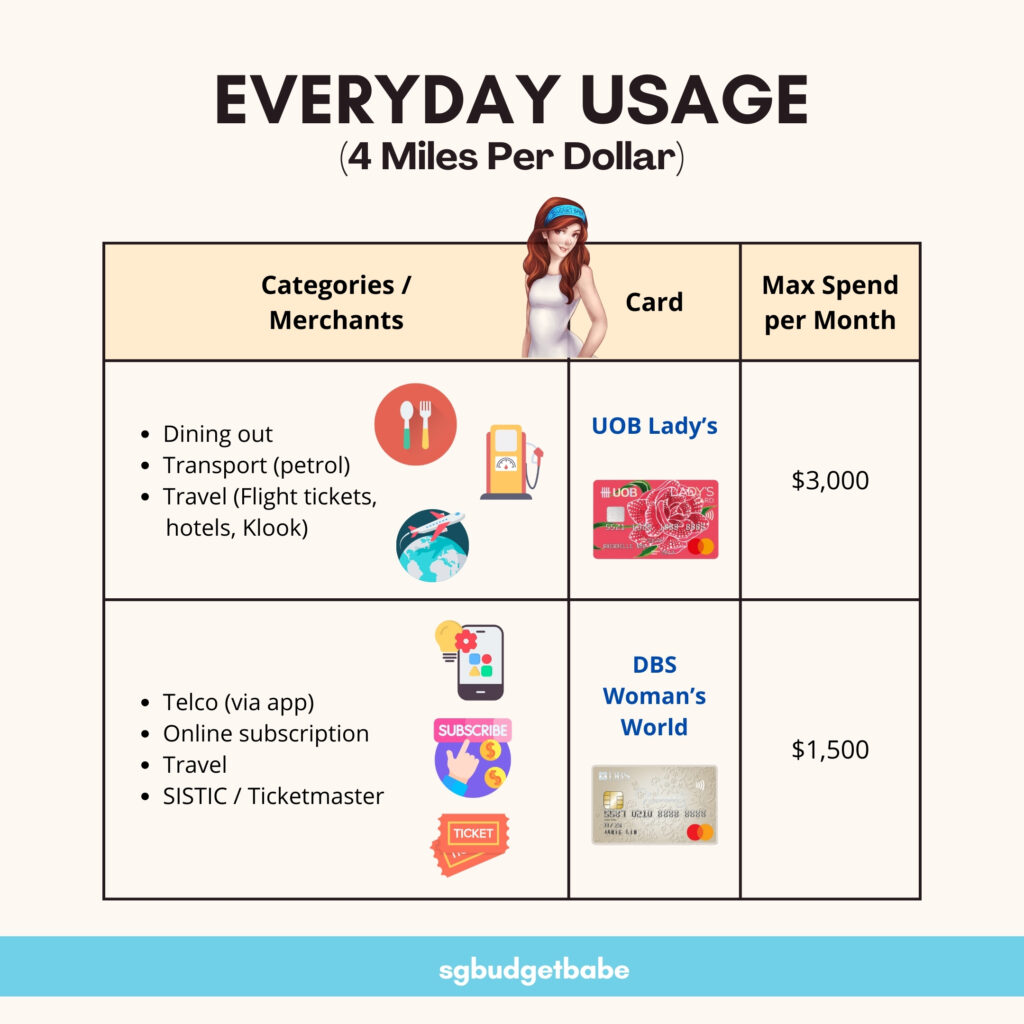

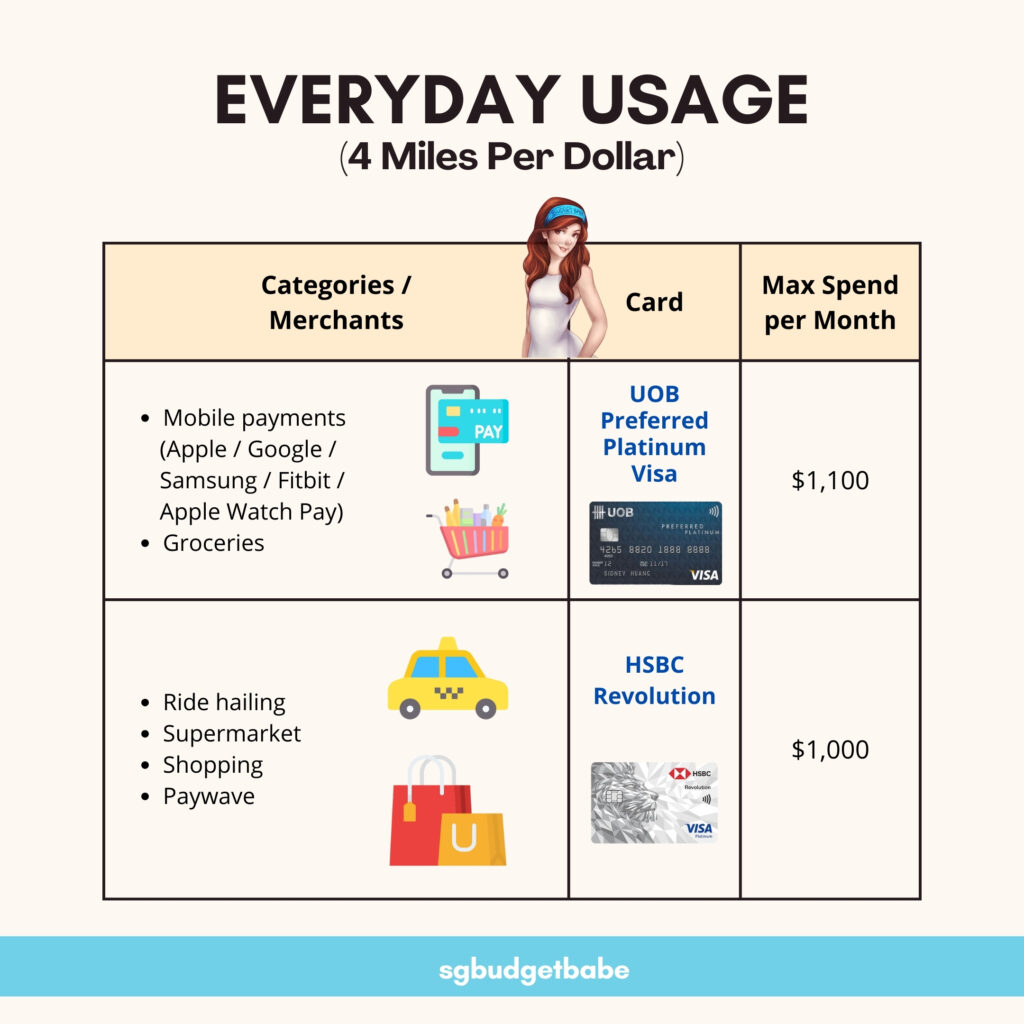

In that case, here’s the best 4 mpd cards I would recommend for you to check out for each category:

Note that the standard UOB Lady’s card is only 4 mpd on your first $1,000, so you qualify for the UOB Lady Solitaire Card, go for that so that your max. reward spend will be increased to $3,000 instead!

Same for DBS Woman’s Cards, if you go for the DBS Woman Card you’ll only be getting 2 mpd, whereas the DBS Woman’s World Card will give you twice of that (4 mpd)!

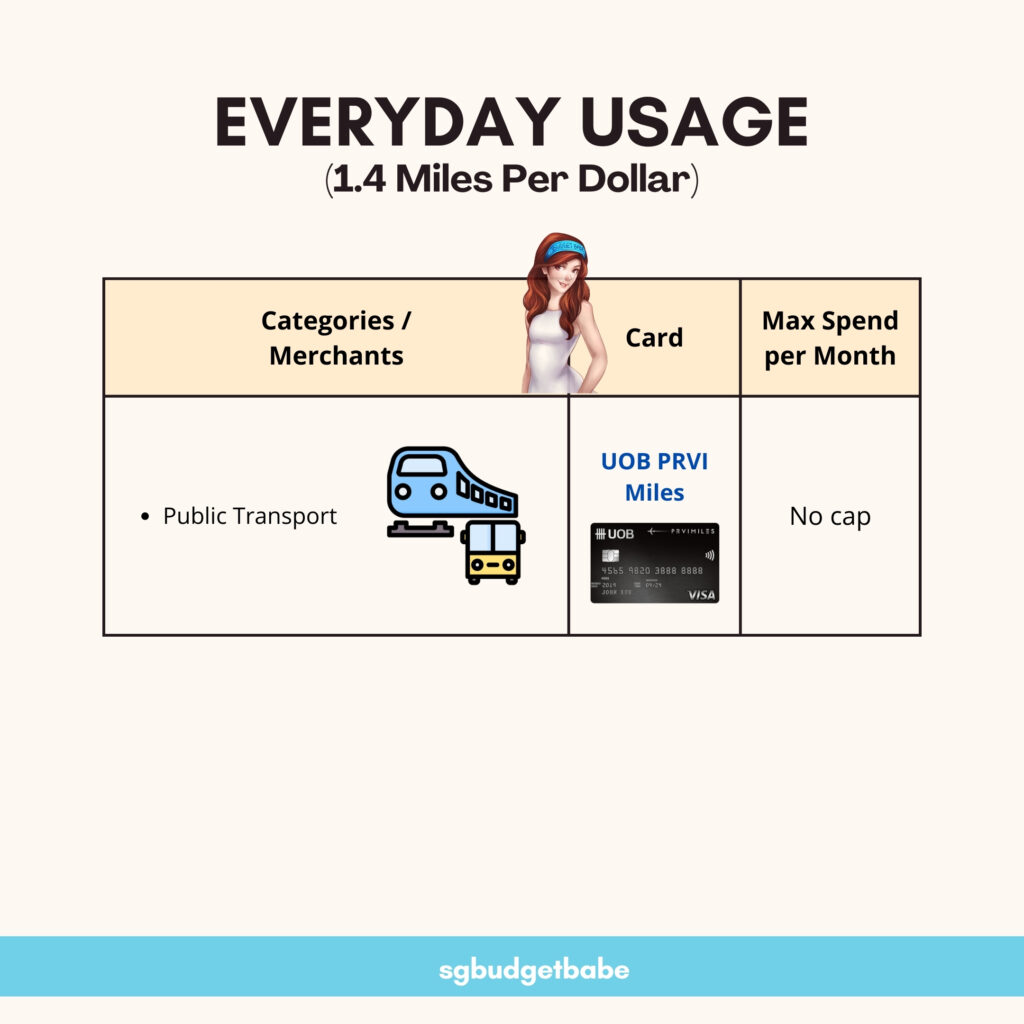

Whenever I take public transport, the UOB PRVI Miles Card is my top choice for clocking miles. Unfortunately, there isn’t a 4 mpd option now for public transport so we’ll just have to settle for the general 1+ mpd cards here. If that changes, let me know!

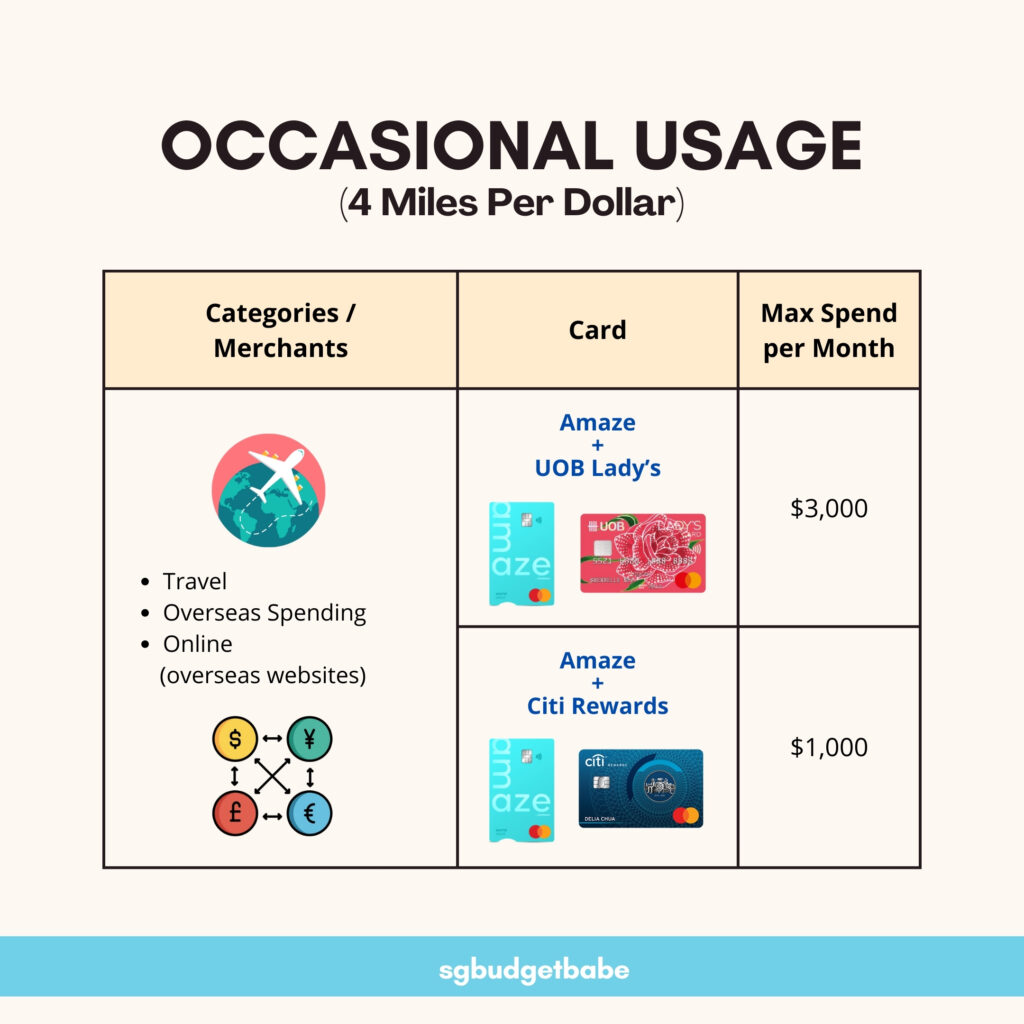

Each time you travel abroad, make sure you first use a 4 mpd to book your travel-related expenses – the UOB Lady’s Card and DBS Woman’s World Card are my top choices.

But when I travel abroad and have to spend using foreign currency, I typically pair that with either my UOB Lady’s Card or the Citi Rewards Card, since they both give 4 mpd when used with the Amaze card for favourable FX conversion rates.

That way, Amaze settles the FX conversion (at pretty competitive rates) which I continue to earn 4 mpd on my underlying card on the purchase. Win-win!

Q: What about using my FX credit card directly when I’m abroad for miles?

A: UOB PRVI Miles Card may give 2.4 mpd on foreign currencies charged directly to the charge, but you’ll be subjected to the bank’s prevailing FX conversion rate…which is hardly compelling. This is the same for any direct foreign currency charged to a credit card, so I prefer to stick with my Amaze pairing combos instead.

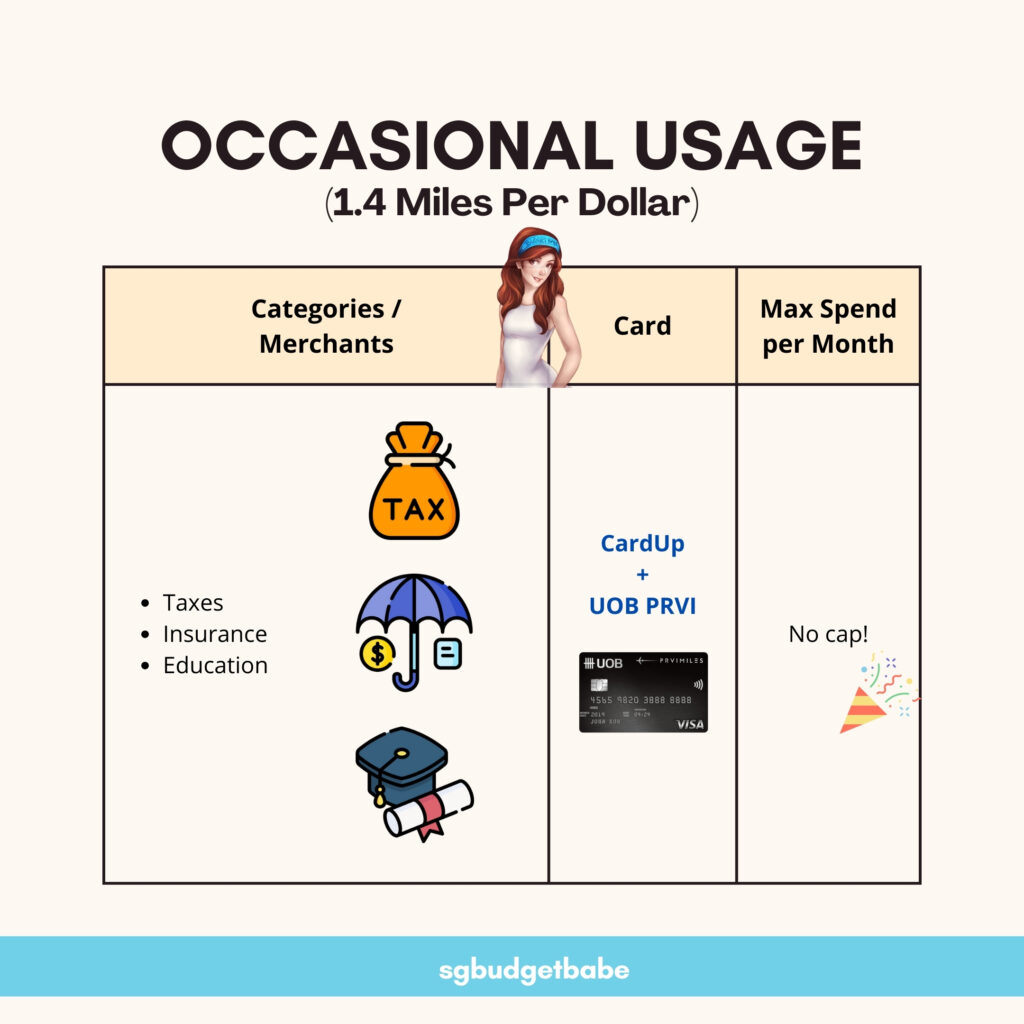

Most of our largest expense each year will likely come from your taxes, insurance and education fees. For those of you who stay in condominiums, your monthly MCST charges can add up too. The good news is, you can earn miles on them through CardUp, which I’ve been sharing about since 2018 on this blog!

You can check out CardUp’s list here on what cards can be used with them, but my personal preference is for UOB PRVI Miles Card, which I’ve been using since eons ago.

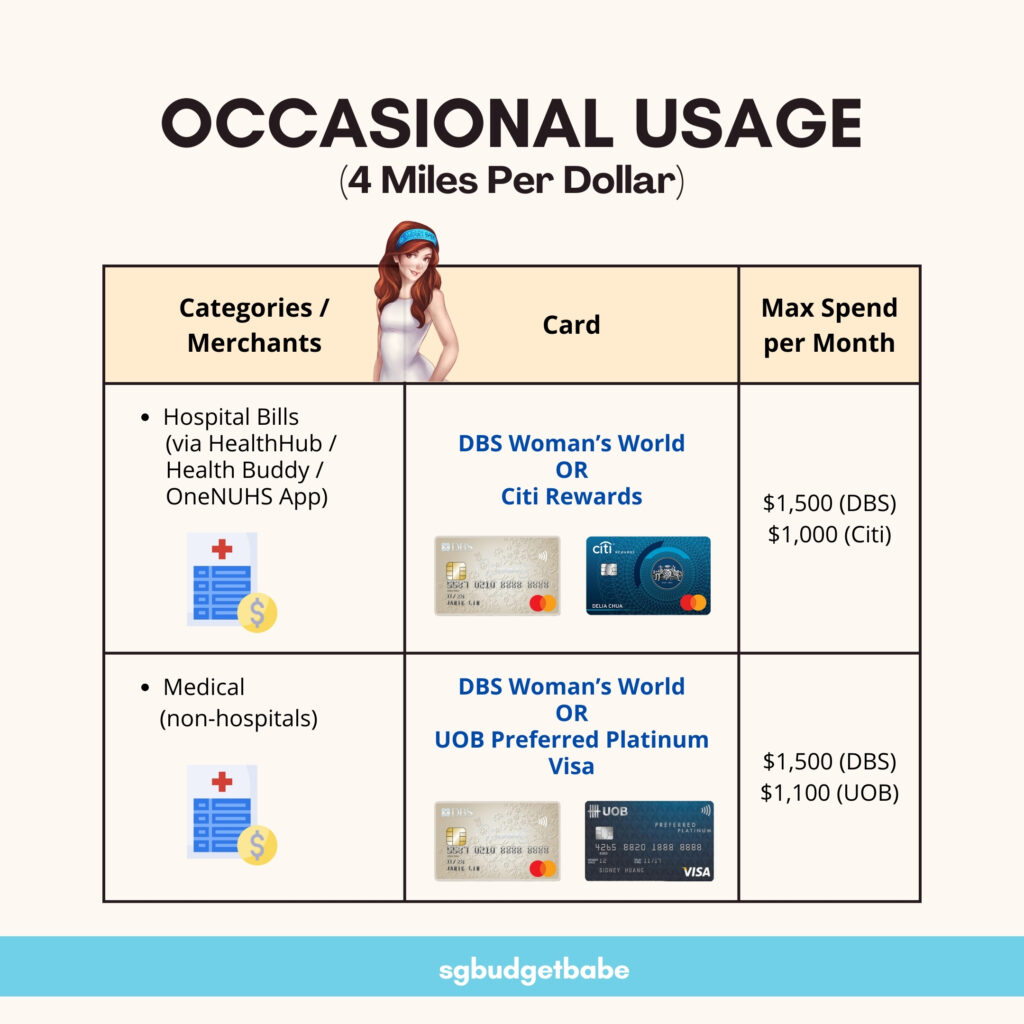

Earlier this year, my kid had to undergo surgery so I looked into seeing how I could get miles for the procedure, since it would be a sizeable bill.

Luckily, there’s a hack around this which my good friend Aaron (Milelion) shared, and that is to try and route it through HealthHub, Health Buddy or the OneNUHS app. Paying the bill in this manner with my DBS Woman’s World Card earned us a few miles over what would have been zero if we had simply paid at the counter in-person.

And finally, you’d probably want to have some of these backup cards on standby as well in case you bust your max spend (eligible for rewards) on the previous cards. Months where mega sales like 11.11 or Black Fridays, for instance, can often see you busting these limits rather quickly. In this case, have backup cards so you can continue earning 4 mpd on them instead of wasting the dollars!

And that wraps up my 2024 arsenal of credit cards that I’m using to clock and earn my miles faster towards our next business class flight.

- UOB Lady’s Card

- DBS Woman’s World Card

- HSBC Revolution Card

- Citi Rewards Card

- UOB PRVI Miles Card

- + CardUp (use promo code: SGBUDGETBABE for discount)

Are there any in this list that I’ve missed out which you personally use and find helpful? Let me know in the comments below!

With love,

Budget Babe

4 comments

Hello! How do you tackle orphan miles? I’m trying to minimise dealing with a few banks so that won’t have orphan miles

Hi, I am quite new to miles game and I really appreciate the works and information. I wish to check for overseas (Malaysia) usage such as education, insurance and government payment, is Amaze+UOB Lady’s and Amaze+Citi Rewards still earn 4MPD?

No, I don’t think so because those should be coded under the blacklisted MCCs? You will have to check the MCCs on Visa network to roughly guess, but usually those 3 are excluded from rewards. For UOB Lady’s there’s no category (among the 6) where education, insurance and govt payments fall under so that wouldn’t be a valid pair for sure. Usually for these 3 types of spend, CardUp would be more appropriate.

I try to put most of my miles spend on 2 – 3 banks max so that I won’t end up with too many orphan miles. Right now HSBC miles transfers are quite a headache among every other bank that I’ve used so I hardly use the HSBC Revolution Card.

Comments are closed.