While the Singapore government’s latest Budget 2023 doled out several goodies, it also came with one unexpected shocker (especially for many working mothers) when it was announced that there’ll be changes to the Working Mother’s Child Relief (WMCR) scheme from 2024 onwards.

The scheme is one of the government’s efforts to encourage married women to stay in the workforce even after they have kids. And for several years now, you could say the scheme has been relatively successful at achieving its objective, especially as being a working mother meant one could get a lot more benefits from the government vs. if one chose to quit and be a stay-home mum.

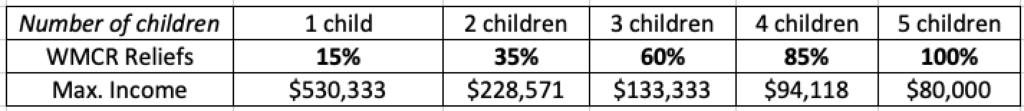

The old scheme, which allowed working mothers to claim a percentage of income tax reliefs for every child, was good in the sense that even for women who were high-flyers at their workplaces and earning a high income, could benefit if they decided to have more children and contribute to Singapore’s birth population.

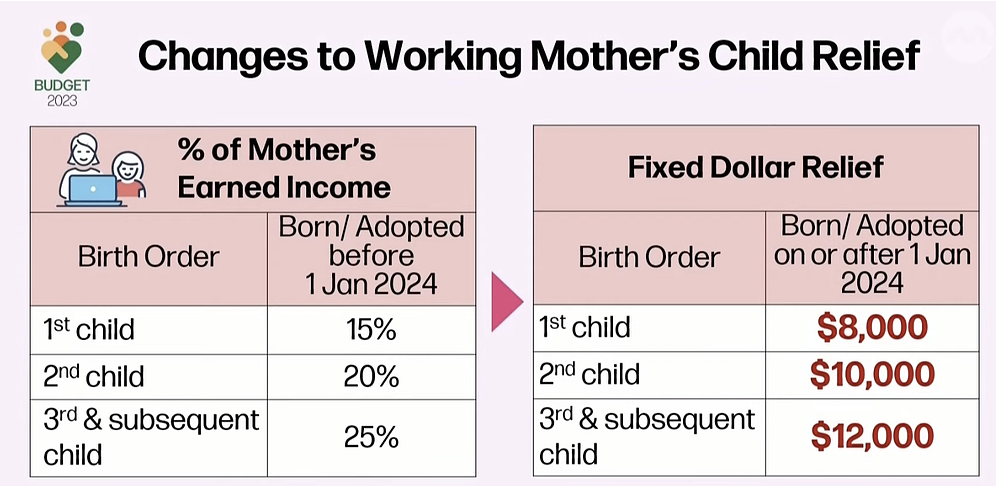

Of course, there were certain limits to ensure this wouldn’t be abused. For instance, the maximum reliefs were capped at $80,000 per mother (regardless of the number of children) and 100% of her income for those who have more kids.

But come 1 January 2024, mothers who give birth after this date will now have their reliefs pegged at a fixed dollar rather than a percentage of their income.

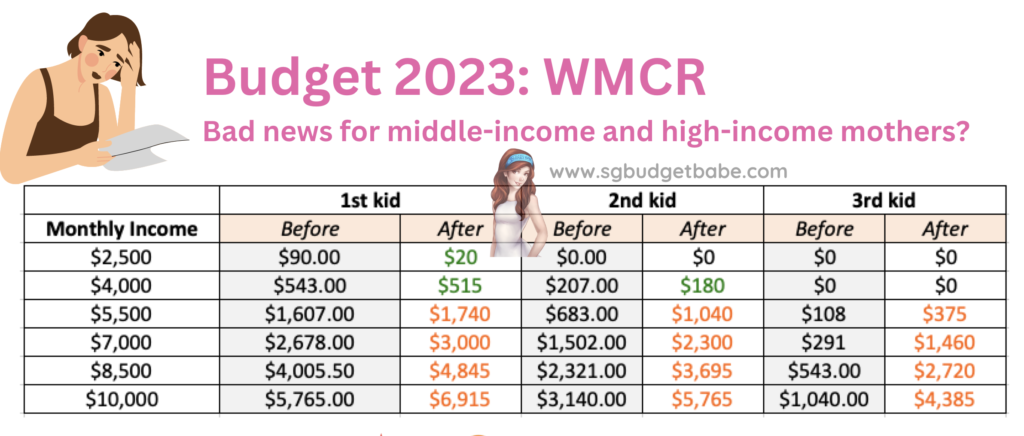

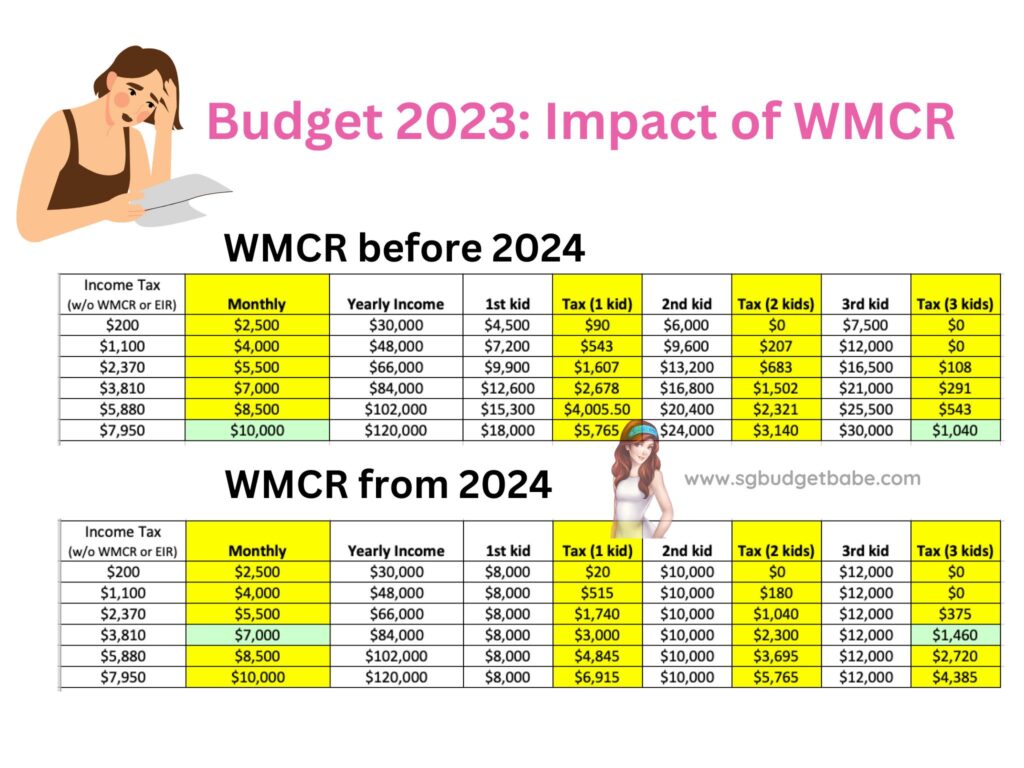

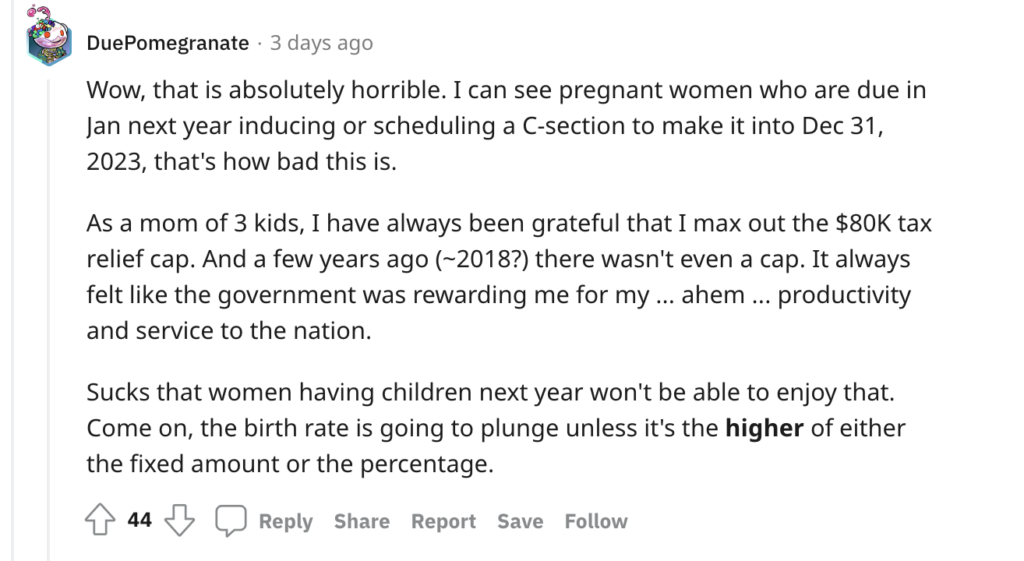

This move has been said to be a form of wealth tax, where the higher income are taxed disproportionately more than the poor. However, based on my calculations, it looks like the middle-income will also bear a significant brunt from now:

I’ve calculated the various income scenarios, and found that for working mothers who earn $4,200 or more and have children next year onwards, the new WMCR changes will hit them the hardest.

And if you look at the fields I’ve highlighted in green, you might be shocked to see how a mother of 3 earning $7k will now have to pay more taxes ($1,460) vs. her older peer who earns $10k ($1,040), despite doing what the government wants and producing the same number of kids (3).

On social media, the sentiments are mixed. Most people aren’t too happy about the change, but more importantly, while it does help the lower income mothers more, you can see from the table above that the dollar impact really isn’t that much. On the other hand, a lot more taxes is now being collected from both the middle-income AND higher-income mothers, adding further to the stress that successful career women already face as it is.

With inflation and rising costs, it is already difficult to justify raising 3 children even if a female earns $7,000 a month ($84k a year). While I get that there are many other factors that ultimately leads a couple to deciding how many children they want to have, the government removing this does not bode well, in my opinion.

And when we consider how having kids is becoming increasingly expensive, this may make higher-income women think twice about whether to have more children, so it is possible that we might see the birth rate drop among this group.

Essentially, any smart or capable woman earning more than $4,200 will now be affected. Considering how the median income for fresh university graduates is already at $4,200, this will have significant impact on the females.

Giving a bigger Baby Bonus ($3k more) doesn’t really cut it when you consider how that’s a one-time payout, whereas paying income taxes is across many years, typically 20 – 40 years for most mothers.

I’m all for paying taxes, especially wealth taxes, but I’m not sure I like how the government has chosen to take more of it from a group who’s already stressed out enough as it is – working mothers who are struggling to do well at their job and climb the corporate ladder WHILE concurrently being a good and present parent as well.

What do you think of the newest policy changes?

Share your thoughts with me in the comments below!

15 comments

Many sharing the same sentiments too, including myself. Sigh

Doesn’t affect me per se cos I’d be done this year but it’s a terrible move indeed (so bad I made it a point to visit your blog to leave this comment in support of fellow mummies to be who’d still wanna have a career) – literally telling the best earning females you’d now have way less support to have another kid. And the impact of the numbers in terms of $$ is huge – a bigger diff the more you earn!

I’m not sure if this makes any sense. It’s more like the working mothers are being punished? So just, stay home and birth instead.

Is the govt telling young capable mothers earning more than 4.2k per month to stop at 2 kids? Or does the govt think that this group of mothers have an easy life? I honestly don’t get this policy. Beyond speechless and what a major disappointment

I have a kid and plan to have more but this change is making me to give second thoughts. This tax relief change is quite unfair like what you mentioned, mum who earn more and have children pay less than tax as compared to new mum with children born after 2024. It also works the other way round as those lower income mums who supposedly to benefit still have to pay higher taxes as children born before 2024 are under old scheme. The govt should consider either having both schemes whichever is higher (best of both worlds) or make mums with children born before 2024 to follow new scheme (median and higher income mums worse off but more fair than current). This is a huge step back and it seems the policymakers are doing the opposite of what they want (more children)

As someone who is planning to have kid and just had miscarriage (and dont think can conceive in the next month), it doesnt feel fair that i will need to increase my yearly expenditure to pay income tax VS if i still had the baby and supposed to give birth in 2023. I rather not have additional baby bonus and use the tax relief savings on my kid. Cost of living is increasing, the baby bonus given by gov will not cover much of the increase in cost for the baby.

Moreover, this new policy seems to be discouraging higher income ladies (not even high income earners) to give birth. At the same time, it doesnt encourage lower income mothers to work (esp those w husb earning sufficient).

Thanks sgbudgetbabe for doing the calculations and showing us that the changes in WMCR is less about providing more support for new working mothers earning less than 4k a month (a measly less than $100 additional tax savings) but rather to take away tax reliefs for new working mothers earning more than 4k a month. So much for encouraging new working mothers to continue to stay in the work force and contribute to society.

The WMCR scheme revisions will mean a much higher tax burden on any future working mother earning more than $4k a month, where such mothers will be severely disadvantaged compared to someone of equal means who just happened to have given birth before January 2024, who contributed the same way of x number of children for Singapore.

As an early 30s female who has a whole lot of considerations going into becoming a mum (not even considering such financial incentives from the govt) this is surely sending the wrong message on encouraging a higher birth rate and discouraging potential new working mothers especially those earning more than 4k a month (easily exceeded based on median gross monthly income statistics from the govt).

Sincerely hope to see the government take this into consideration and revise the changes.

I am not happy about this. Should just remain the same way of tax relief.

Thank you for writing this!

The recent change in working mother relief actually discourages me from working and from having children 😅

I totally agree with you!!!!! As a mother of one who was still on the fence about having no. 2, I have decided not to have no. 2 unless this policy changes. It’s very disappointing to see such a backward change. I wish there is a petition to undo this change and our voice could be heard.

Thanks for speaking up on this issue. The recent change in WMCR is ridiculous. I’m deciding to stop at 1 thanks to this! Does anyone know how hard it is to work hard in career and raise a child at the same time??? Workers Party Louis Chua also made a fair and objective argument about this as well: Mr Chua also expressed concerns about the changes to the Working Mother’s Child Relief (WMCR), which he described as a puzzling move that could have the unintended opposite effect of discouraging married women to remain in the workforce after having children.

“Based on my estimates of working mothers’ income within married couples in resident households, roughly 20% of mothers will benefit from the WMCR change to the tune of up to $40 while the remaining 80% of mothers will either be unaffected or worse off. I wonder if the WMCR truly seeks to reward families with children and encourage married women to remain in the workforce after having children, or does it have the unintended opposite effect?” said Mr Chua.

He suggested that a motherhood tax rebate for working mothers earning below a certain income could be a better way to support lower to middle income working mothers and strongly urges the Government to reconsider the changes to the WMCR.

The revised WMCR applies only to children born on or after 1 Jan 2024. That is to say, for the YA2025, if you have 2 children born before 1 Jan 2024, WMCR will be calculated as a percentage, and if you have a third child born on or after 1 Jan 2023, the WMCR for the third child is $12,000.

Extremely disappointing. This change will actually make a huge difference in my tax situation. Why are higher earning working women getting punished.

This is a very good article

Can you start a petition with your content please?

I am sure many working mothers will support!

💰We want to hear your views about Budget 2023! 📣

Check out the survey via https://bit.ly/REACHBudget2023

Working mums, please share your feedback via this survey link.

I also hope someone can start a petition on this to remove the changes to the WMCR

Comments are closed.