At 4.5% p.a. guaranteed* return on your deposits, how legit is Chocolate Finance and how are they able to promise such a high yield when the banks can’t?

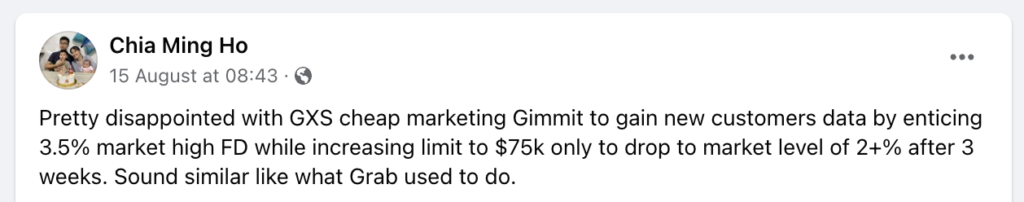

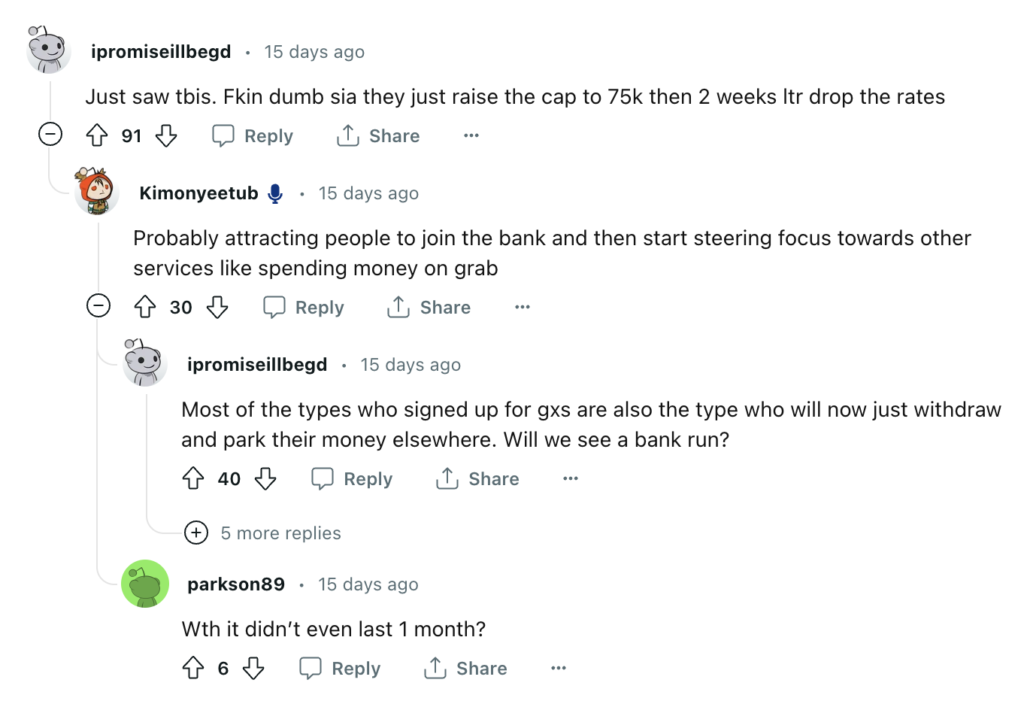

Singaporeans rushed in after GXS opened its floodgates for its 3.48% p.a. return on deposits, but barely a month in, GXS decided to slash their interest rates to a lower 2.68% p.a. instead.

Needless to say, that move left many customers pretty pissed, especially those who did take the trouble to sign up for an account and move their funds over.

Not cool.

While I knew it was only a matter of time before GXS would slash their interest rates, I certainly wasn’t expecting them to act so soon – if I had known, I may not have bothered to open an account and transfer my funds, much less write on it back then! But I did, and I moved my own funds as well, so now I’m in the same boat as everyone else who has to either

(i) adjust their own expectations and be satisfied with the lower 2.68%, or

(ii) find a better place to park their cash.

I happen to belong to the latter (why earn 2.68% when I can get higher?) so I’ve been looking for options to shift out my funds into.

Then a reader asked me about Chocolate Finance, so I met up with my old friend, Walter de Oude (former founder of Singlife) to understand more about his newest venture Chocolate Finance, which is offering 4.5% p.a. on a by-invite only basis.

For those of you who aren’t familiar with Walter, you might recognise him as the former CEO of Singlife. I’ve known Walter since 2017, and seen the miracles Walter had pulled off with Singlife when he launched the Singlife 2.5% p.a. account – at a time when banks were paying low interest rates – as well as the obstacles he overcame as he established Singapore’s first digital insurer…so I was definitely intrigued.

So I met Walter for coffee, and put on my investigative journalist hat because I needed to grill and understand how exactly he and the Chocolate Finance team was able to give 4.5% p.a., especially at a time when GXS was cutting their rates.

We had a great time talking about how banks make money, how the Singlife account used to generate its returns under Walter’s leadership, and even the recent Silicon Valley Bank collapse.

At the end of the day, I got my answers, and that led me to put in my own cash, so here’s my review.

Important disclaimer: This article is NOT a recommendation to invest your funds in Chocolate Finance, nor is this review sponsored by Chocolate Finance. It contains my own notes and observations after I grilled Walter on his newest venture, and explains why I felt comfortable enough to put in my own money - with the pros and cons explained so readers can make their own informed decision at the end. Your licensed financial advisor is unlikely to ever recommend you to invest in savings like these either, since they do not receive a commission or any renumeration for doing so. You are more likely to hear a recommendation from your FA on savings endowment plans instead, which they also get compensated for. And, as loyal readers know, I don't delete my old posts. Hence, in the event that anything were to go south, this article will also serve as a documentation of why I did what I did - with an update on results.

What is Chocolate Finance?

First things first, Chocolate Finance is something quite new, and quite innovative (in the same vein, it might take a bit of getting used to, which is why I’ve bothered with this explainer – also while documenting my own decision so I can look back on this article in the future and reference it).

It is NOT a bank, nor a money market fund. Instead, it is a managed account operated by Havenport Investments Pte. Ltd. (UEN: 201015315N), which is a licensed asset management company regulated by MAS in Singapore since 2010, serving private investors, sovereign wealth funds and global pension funds. Chocolate Finance’s investors include Peak XV Partners (previously known as Sequoia), Prosus, Credit Saison, GFC and Dara Holdings.

Unlike the banks, which generate returns by investing customer deposits mainly in mortgages and credit, Chocolate Finance’s managed account primarily invests in short-duration fixed-income funds and money market funds.

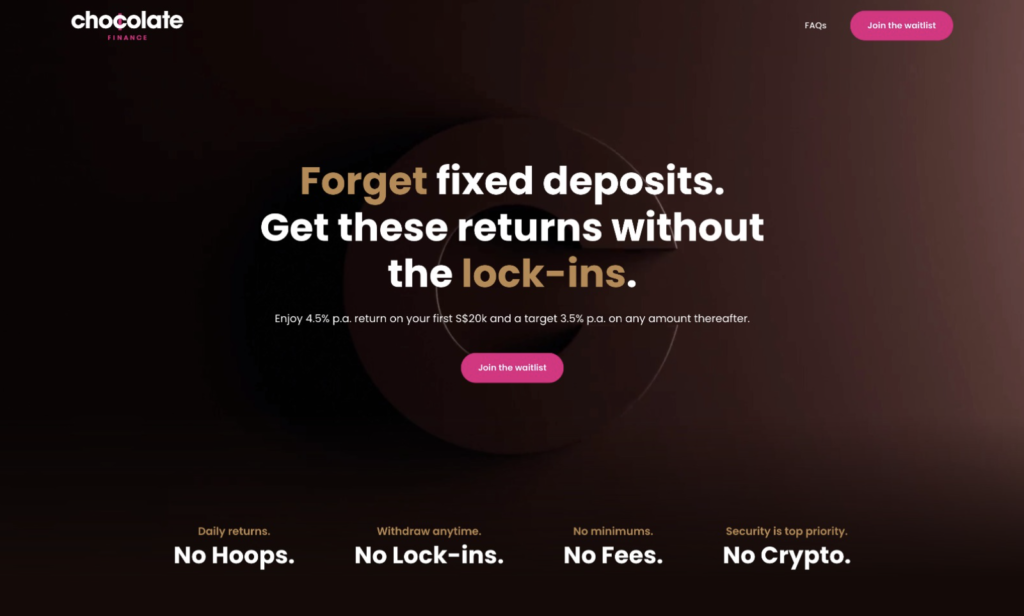

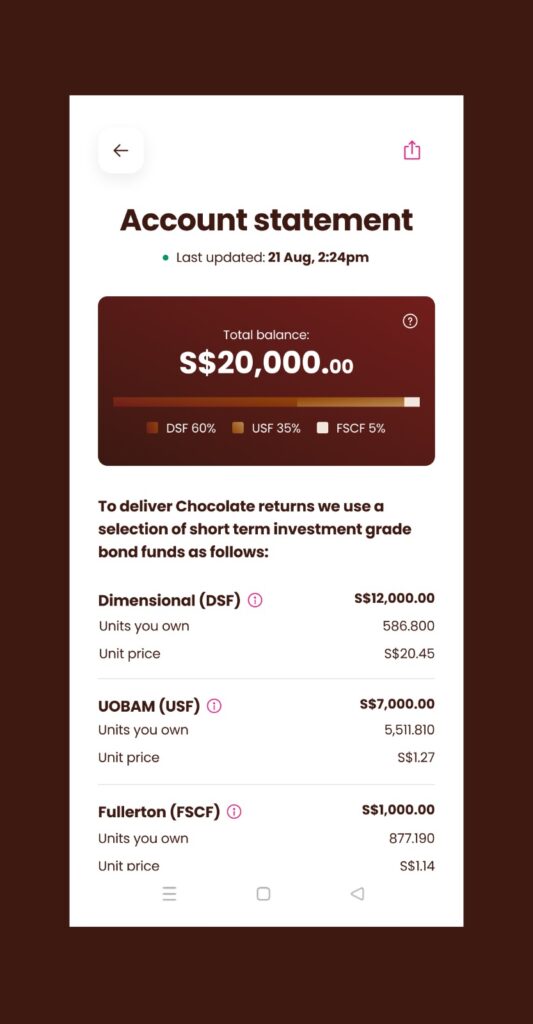

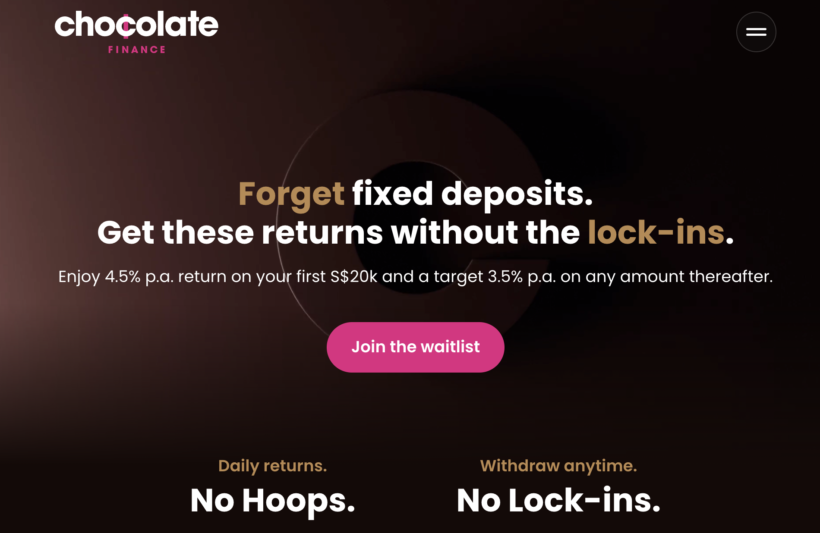

The compelling offer by Chocolate Finance now is that they’re giving a 4.5% p.a. return on the first S$20,000 of funds deposited per customer, and a subsequent target 3.5% p.a. for anything higher.

After his success with the Singlife account, Walter started Chocolate Finance to see if he could generate even higher returns for consumers without similar lock-ins, albeit in a different manner.

Together with his team – which also includes leaders who formerly served in pretty notable roles before Havenport; as co-CEO of Legg Mason Singapore, Managing Director of DBS Asset Management and Investment Director of Rothschild Asset Management – this is what they came up with.

On your first S$20,000, Chocolate Finance gives you a 4.5% p.a. return (while taking any upside as a fee; similarly, if there are any underperformance then they use their own funds to top up the difference so you still get paid your 4.5%).

This is why there are currently limited slots for $20k per person, because in the event that Chocolate Finance has to top up the difference by drawing from its shareholder capital that has been put aside for this purpose. So far, though, their actual projected returns are closer to 5%, which is why they can confidently offer 4.5% p.a. right now.

But here’s the “catch”: just like banks, if or when market rates fall, the target returns will adjust accordingly. But I guess that is to be expected.

How is the 4.5% p.a. return derived?

To determine whether the 4.5% p.a. is legitimate, I questioned how customer funds are used.

Note: It is CRUCIAL that you understand this part before parking any dollars into Chocolate Finance!

In summary, your funds get invested into a selected portfolio of short-term high-quality bonds determined by the portfolio managers at Chocolate Finance. At this moment, the portfolio is currently made up of:

- Dimensional Global Short-Term Investment Grade Fixed Income Fund (SGD)

- UOBAM United SGD Fund

- Fullerton SGD Cash Fund

You might recognize some of these names, as I’ve talked about the fund(s) on my blog / Instagram previously to explain how they worked (when some of you were asking me about investing in unit trusts and funds). For those of you who wanna pore over the individual fund documents like I did, I’ve linked it here (Dimensional), here (UOBAM) and here (Fullerton).

For the eagle-eyed, you may be wondering, hey, I can find these funds on several brokerage or fund platforms like EndowUs, FundSupermart, POEMS, etc as well! So what’s stopping me from investing in them directly?

NOTHING 🙂

If you’re a savvy investor who prefers to manage your own fund investments, then why not?

But if you’re someone who is just looking for a place to park your spare cash for higher returns without having to bother or manage too much, then you can see why Chocolate Finance’s managed account now looks appealing, like it does to me.

What’s the worst-case scenario?

Ok, there are no guarantees in life, and since this is technicially backed by an investment account and and not SDIC-protected, I needed to know what the risks and worst-case scenario would be – and how my funds are protected instead in other ways, if any at all.

With the SVB collapse still fresh on everyone’s minds, you might also be wondering, could a SVB collapse happen?

Watch this short explainer video on why and how the collapse of Silicon Valley Bank happened. Now you understand why a SVB-equivalent scenario is unlikely to hit Chocolate, because the funds used by Chocolate are short-term and liquid, so the interest rates change that killed SVB will not have the same impact on Chocolate.

OK, but what about liquidation or bankruptcy?

If Chocolate Finance ever goes under, customers funds will still be around because they are kept in a custodised account completely separate from Chocolate’s.

A good analogy would be to think of it like a fireproof safe (your custodised funds and assets) inside a house (Chocolate Finance). Whatever is inside is still safe, even if the house were to burn down. (This analogy is taken from Chocolate Finance’s FAQ section in the app.)

Your assets (your stake in the portfolio funds holdings) are safe because they sit with the investment manager’s custodian, i.e. State Street for Dimensional and UOBAM, and HSBC for Fullerton. In the unlikely event that Chocolate ceases operations, your assets held under custody will not be affected as they will either be returned to the customer or transferred to another agent of your choice.

Your cash is not SDIC-protected, but instead separately custodised.

Note: Here’s the second CRUCIAL point that you must understand before moving any money into Chocolate Finance!

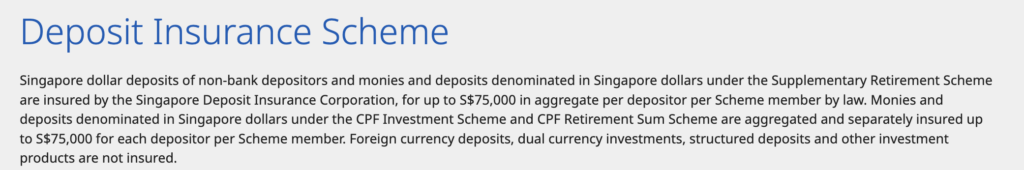

I’ve seen some questions floating around online asking why the funds in Chocolate Finance are not protected by SDIC.

That’s a gross misunderstanding of what and how the SDIC operates.

Firstly, the SDIC only insures banks and insurers. There is no equivalent protection of the SDIC for asset managers nor investors, because investments are not guaranteed or insured, but in return, that’s where you can potentially get higher yields. So if you invest in a bank’s wealth products (investments), there is no SDIC protection either – you better know this by now! P.S. if there was, then Credit Suisse AT1 bondholders would not have had to resort to this lawsuit.

There’s a limit to how much returns banks can offer you on your savings or fixed deposits that are SDIC-protected, because in exchange for that protection, they are limited by what they can invest in (usually mortgages, credit and sometimes high-quality loans).

Since Chocolate Finance is not a bank, but fundamentally an asset management company, the consumer protection works differently here.

What you should be questioning is how customer funds are held, segregated or custodised, and by whom.

You should also be questioning where (your) funds are being invested in, so that you can make a judgment call on whether that portfolio of investments is something you are personally comfortable with.

Secondly, another common misconception people often have about SDIC-insured funds is every dollar of their money is protected. But that’s not true – scroll to the fine print on the terms and conditions of every bank account, fixed deposit or insurance savings plan that you’ve signed up with, and you’ll see that it is up to only S$75,000 “per depositor per Scheme member by law”.

Ok, so what does that mean in simple English?

This simply means that the S$75k limit is tagged to each financial institution, so in the scenario where you have a $50k savings account with Bank A and $100k in their fixed deposits, then if Bank A ever goes to dust, you’ll only get back $75k (not $150k).

Yep. Shocker?!?! Not really.

So if you’re super kiasi and care about having every single dollar insured by the SDIC, then you probably shouldn’t have anything more than $75,000 sitting in any single financial institution. You guys showing off your $100k balances in UOB One, I’m looking at you.

What’s an alternative to Chocolate Finance?

Although not really an apple-to-apple comparison,other closer alternatives one might consider could be the money market funds, asset management firms (if you’re an accredited investor)…or maybe even investment-linked products (ILPs) with underlying bond investments in their primary portfolio holdings.

There are a few key differences though:

- There’s no sales charge, management or wrapper fees

- No lock-ins

- No minimum capital to start

If you’re considering other options for your cash, you might also be comparing against:

- Fixed deposits

- Treasury bills

- Bonds or bond funds

All are not exact competitors, but they share one attribute in common: they’re all common options that we investors tend to consider when deciding where to park our cash.

Honestly speaking, if you’re savvy and hardworking enough to manage your own investment portfolio, there’s nothing stopping you from investing in the same underlying portfolio as what Chocolate Finance invests in. Some people might even use this as a “hack” – put in some money with Chocolate just to get access and see what their underlying portfolio holdings are, and then replicate the same for yourself elsewhere.

It’s not a secret – just a matter of effort vs. convenience and ease.

Who is suitable vs. who’s not?

OK, I know there’s been a lot of chatter about Chocolate Finance’s juicy 4.5% p.a. return, especially after their eye-catching booth at this year’s Seedly PFF 2023 held at Suntec.

So I hope this article makes it clearer to you (or anyone considering whether to move funds in, like I did), on whether Chocolate Finance might be a suitable option for you.

In short, if you care only about SDIC protection, then stay away.

But if you’re comfortable with the protection that custodial segregation provides, and don’t mind your money being managed and invested into these underlying portfolio holdings in exchange for a 4.5% p.a. return, then why not?

What’s more, if you have spare cash and have already maxed out all the other guaranteed options that you can possibly find (such as government treasury bills, fixed deposits or high-yield savings accounts with criteria and hoops that you can meet for bonus interests), then this could be an option.

I can also imagine bond investors who have gotten tired of managing their own portfolio might want to use Chocolate Finance instead. Do note that above the first S$20k, only a target 3.5% p.a. will be paid out though – this is not covered nor will it be topped up by Chocolate Finance in the event of any shortfall.

Lastly, any equity investors who want a place for their warchest but are not keen on the fluctuating returns of money market funds offered by their brokerages (e.g. Syfe Cash+, moomoo Cash Plus, Tiger Vault), may also be attracted to Chocolate Finance’s offering here.

Why Budget Babe moved her own funds over

You guys watched me move my funds into GXS when they offered 3.48%, so it boils down to a simple question for me:

Do I leave my spare cash in GXS for 2.68% p.a. now that the rates have been cut, or do I move them out into Chocolate for 4.5% p.a. Instead?

As an investor, the answer was obvious.

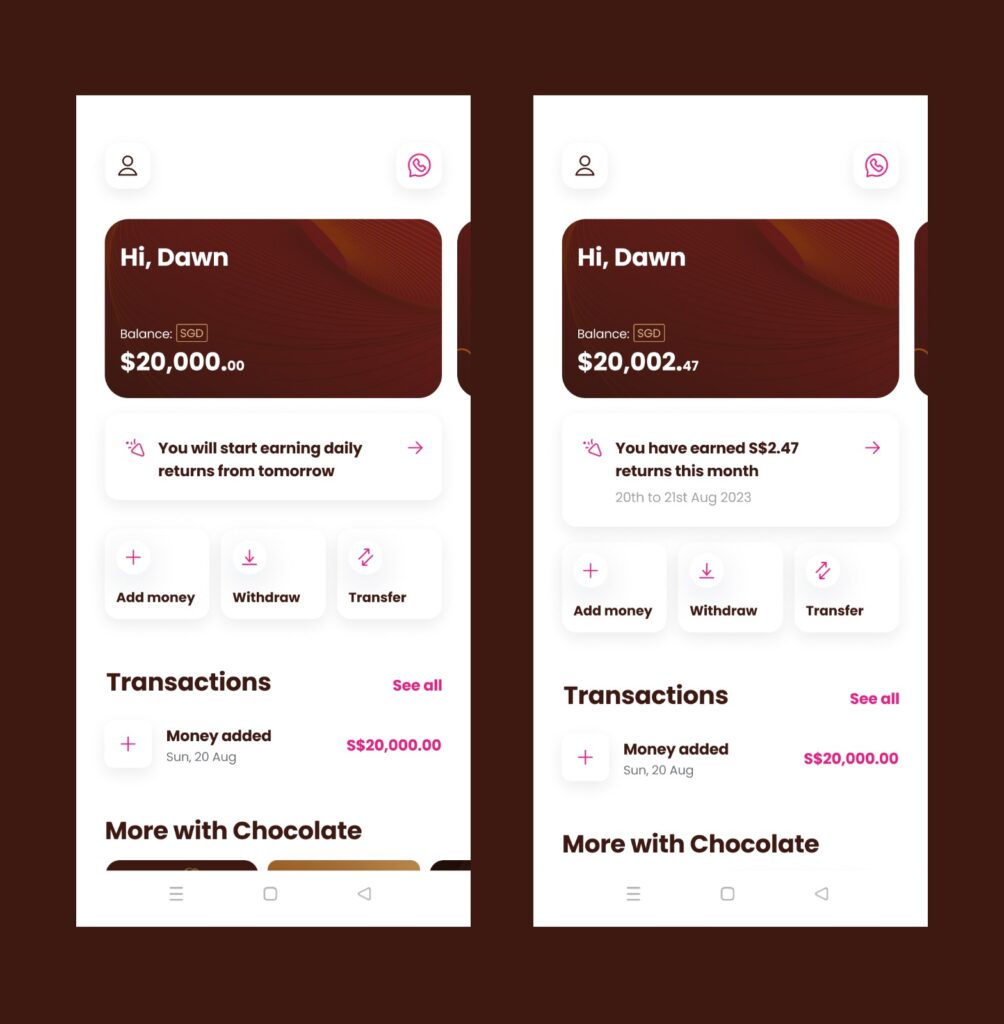

My experience on Chocolate Finance

I know slots are limited right now, so I won’t add to the FOMO or bore you too much with screenshots of how my experience went.

But I do want to highlight a few key points:

- The sign-up process was really easy and completed within seconds, using my SingPass.

- I transferred using PayNow (you can also use bank transfer) and the funds arrived almost instantaneously.

- I attempted a withdrawal, and the funds arrived within seconds in my bank account.

Unfortunately, slots are limited now on a by-invite only basis, so if you failed to put your name on the waitlist during the Seedly PFF event previously and only enter it in now, you’ll probably have to wait a lot longer for your turn.

But sheesh, here’s a short-cut. You can get in if you know someone who’s already in.

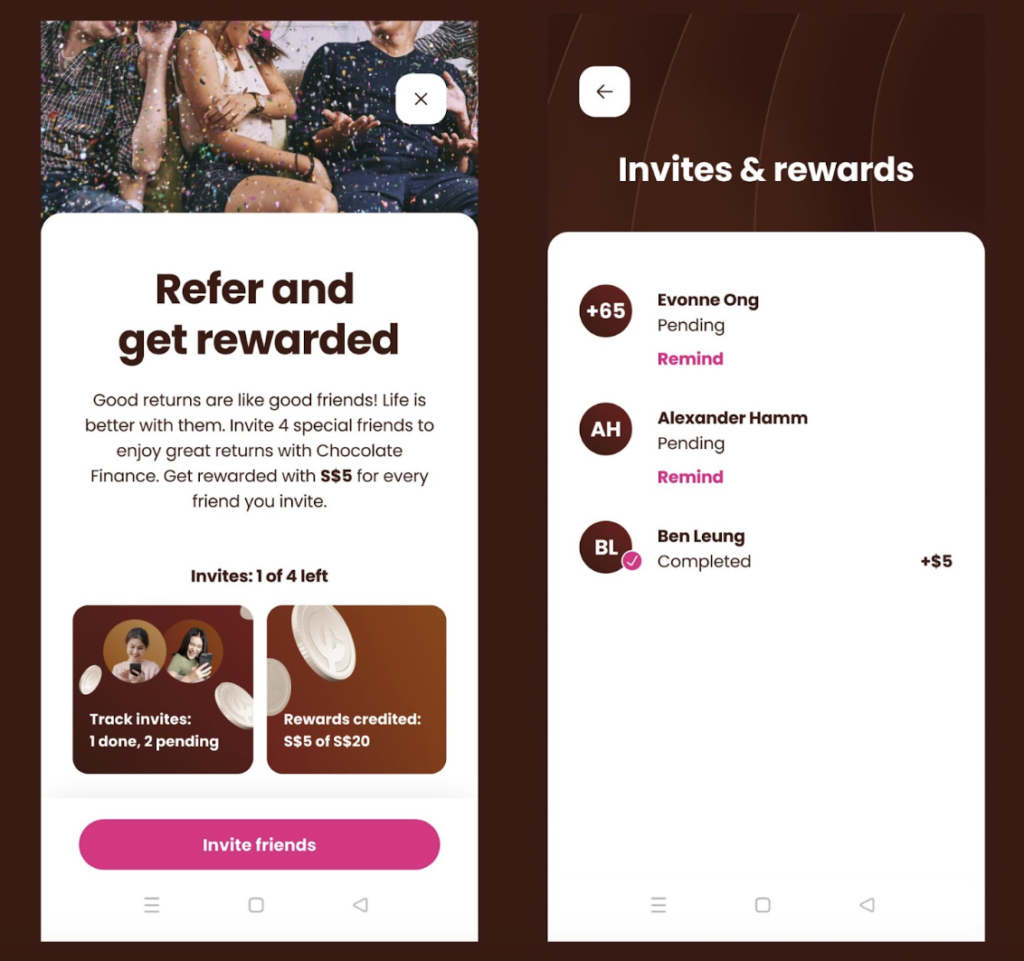

I get to refer friends too (albeit capped), and in return, I get $5 if you join and fund.

You don’t have to use mine – if you have friends who are already on Chocolate Finance and can invite you as well, feel free to use their code so the $5 kopi money goes to them instead!

Just make sure you’ve fully read through this article first, before you do anything.

Chocolate Finance is not 100% risk-free, although after understanding its mechanics, you may see why it is a low-risk investment.

I’ve told Walter that since I don’t have the HP numbers of you guys to invite each of you directly, can we have a special Budget Babe readers code instead, and he has agreed – albeit to a cap. So…if it gets all snapped up by the time you see it, you can always just add your name to the waitlist via Chocolate Finance’s website and wait patiently for your turn.

TLDR Conclusion

Remember, your funds are not SDIC-insured with Chocolate Finance, but in return, there’s a juicy 4.5% p.a. return waiting to be taken. Risk-adverse folks who do not trust the underlying funds, or asset managers, or the team, may want to stay away.

P.S. And no, Walter has said that Chocolate Finance has no intention to pull a GXS Bank and cut support for the 4.5% p.a. anytime soon – provided the market behaves – so you’ll be able to enjoy it for a good while if you do make the move.

Important Disclaimer: This is a review and NOT a recommendation on whether to invest your funds in Chocolate Finance.

I am a consumer giving my review of a product that I did my own thorough due diligence on prior to putting in my money. For new readers to this blog, you should note that I am not a licensed financial advisor so if you need personalised advice, please seek out your own MAS-approved advisors.

This is neither a paid post nor a sponsored advertorial. I wrote this article of my own initiative, and the only benefits I’m getting are from the $5 referral programme which is similarly open to everyone. I also encourage you to use your friend’s referral codes for Chocolate Finance, if they have one, unless you would like to tip the $5 to me as a form of thank you for my work on this article instead.

What are your thoughts about Chocolate Finance?

Let me know in the comments below!

19 comments

The promo code to be released on 26 Aug is for signing up Chocolate Finance ?

Hi Budgetbabe, first time writing to u (I do follow your podcast with CFC).

In Chocolate Finance Q&A, one of its replies is as followed:

“We advise that 3.5% p.a. is not guaranteed and there is a potential for capital losses. Past performance is not necessarily an indication of future performance.”

My understanding is that this vehicle invest in money market funds as the underlying funds. What are the scenario(s) that could occur and there are capital loss?

I can’t comprehend and I am not sure if this is a general statement to shield itself from any accusations on its performance?

Have you tried putting more than $20k and check out the returns? Was it credited daily as well?

Never cos “target 3.5% p.a.%” I don’t want. That’s beyond my risk appetite liao, and I don’t have so much spare cash anymore! If you try, let me know please!

Great question on the scenario(s). One very plausible scenario I can think of is if the market suddenly moves and there’s a huge interest rate spike, which could cause the underlying MMFs to plunge…until it smoothens out again. Exactly like SVB, except that theirs was long-term dated whereas Chocolate Finance has opted to use short-term ones (max 1-2 years). So if Chocolate is (i) forced to sell, like with SVB and (ii) there is a bank run i.e. customers withdrawing their deposits en masse at the same time, and (iii) Chocolate does not have enough funds in their private shareholder pot (the one they’re using to promise the 4.5% and top up for any shortfalls) to hold and smooth over while the MMFs correct, then that could lead to liquidation of assets at a loss in order to fulfil the cash withdrawal requests.

The main difference is the holding duration. SVB’s was longer term, whereas CF is really short. And the risk of a huge interest rate movement again will be less likely since we’re already in the cycle.

Still a risk though, and hence yes, definitely risk of capital loss there. That’s why my answer is not to invest beyond the $20k either.

My current personal promo code requires that I have your HP number to send you the SMS invite to cut the queue, but I don’t want to be collecting my readers’ personal mobile numbers and be responsible for data privacy, think about potential breaches, etc…

So I’ve sent in a formal request to Chocolate Finance for a temporary promo code and they will release it on 30 Aug, so stay tuned to my Facebook as I’ll be announcing the code there!

its up now, but only valid for 48 hours starting 30 Aug 8pm. Head over to my Facebook to get the special code!

Are you a licensed financial adviser? If yes, can you state your full name and license number. Else it is illegal for you to recommend a financial investment or product to your readers. It is very risky and they could lose their entire money. Are you going to be fully responsible?

Thank you, I’ve joined Choc Finance. But may I know whether I can refer our friends to join the “refer and get rewarded” programme?

Yes you can, click on the referral program in the app to understand how it works! There’s a limit though as Chocolate Finance has to control the inflows due to the promised rates.

It is not illegal to post or publish reviews on financial products. My readers know that I am not a licensed financial adviser, and I have made it pretty clear that this is a review and NOT a recommendation. Please reread, as I’ve stated “stay away” at least twice in my article and even bolded both instances. Nonetheless, thank you for your feedback, which has prompted me to add even more disclaimers at the bottom of the blog to make it clear to any new readers like you who might not be familiar with my background nor my past work.

This is a review, as stated, where I said “I hope this article makes it clearer to you (or anyone considering whether to move funds in), on whether Chocolate Finance might be a suitable option for you.” If the reader’s conclusion is that it is not, then that’s good too. Ultimately, this article merely highlights the benefits vs. risks trade-offs and leaves the reader to make their own conclusion whether it is suitable for them. IT IS NOT A RECOMMENDATION IN ANY WAY.

If any part of this article is misleading, I encourage you to raise it. You can also flag it to MAS for their attention, as I welcome any feedback and correction on how to make a review more balanced without it becoming a recommendation. The last I checked, MAS does not prohibit financial reviews from consumers online.

The people behind Chocolate Finance are HAVENPORT PTE. LTD. (202325851H)

HAVENPORT PTE. LTD. is a Singapore EXEMPT PRIVATE COMPANY LIMITED BY SHARES. The company was incorporated on 03 Jul 2023, which is 0.2 years ago. The address of the Business’s registered office is ONE GEORGE STREET, 1 GEORGE STREET, #10-01, Postal 049145. The Business current operating status is Live Company. The Business’s principal activity is OTHER HOLDING COMPANIES. The company’s paid-up capital is SGD 2. The company UEN is 202325851H, registered with ACRA on 2023-07-03.

Havenport Pte Ltd is the company behind CF. CF The advantages of a private limited company, when compared to the sole proprietorship, are many. The company directors and shareholders are not liable for the debts incurred by the company. However, the liability of the company towards its creditors is unlimited.18 Jan 2023

The advantages of a private limited company, when compared to the sole proprietorship, are many. The company directors and shareholders are not liable for the debts incurred by the company. However, the liability of the company towards its creditors is unlimited.18 Jan 2023

I lifted two paras from your review below. I have a question on that two paras.

Will investors’ monies be paid out first before other creditors in the event of a chapter 11 for CF?

“If Chocolate Finance ever goes under, customers funds will still be around because they are kept in a custodised account completely separate from Chocolate’s.

A good analogy would be to think of it like a fireproof safe (your custodised funds and assets) inside a house (Chocolate Finance). Whatever is inside is still safe, even if the house were to burn down.”

I attempted my withdrawal 4 days ago and due to the elections I have not got my funds back yet. This is in stark contrast to this blog post and kelvinlearnsinvesting review of chocolate finance.

To be fair, Do take note that this withdrawal is in excess of 20k and might have triggered a kyc review.

Either way, this withdrawal experience had made me lose confidence in their controls and I will not deposit any money with them anymore.

This is a good question. My understanding is that the creditors won’t be able to lay hands on the funds, because it is in a custodized account and accounted for under each customer’s name. Customers like myself should then be able to go to the bank and investment custodians (HSBC, etc) to get our money back.

However, can see from your comments that you wouldn’t be the right target for CF though! So best not to put your cash in? There are safer instruments that you can go for instead, as mentioned in my review.

Do write in to them to check, and update us if your funds really didn’t come back to you? Cos that would be SUS indeed (and I would definitely add your feedback and experience into the review article here in big red fonts once confirmed). I’m not sure about Kelvin but I didn’t attempt a 5-digit withdrawal sum like you so mine was pretty fast!

Hi Jayne!

Btw I see in their FAQ (link here: https://www.chocolatefinance.com/faqs?id=how-long-does-it-take-to-withdraw-money-from-chocolate&category=money-inout#) that any withdrawals up to $20k should take place either instantly or within a day. For any above this threshold, it should take no more than 1-5 business days. Since you said yours was before the elections, barring the PH and weekend, you should either have gotten your money back in your bank by now or within this week?

please confirm and let us know k.

Hi budget babe.

I wrote in and they confirm to have seen my fund withdrawal request.

As my funds was in excess of 20k they cancelled my withdrawal request and I did my withdrawal within 2 days.

19k in day one and balance in day 2 after 12am.

Just some feedback that their withdrawal process is abit screwed up (especially in excess of 20k) so I really don’t suggest anyone to put any amount they can’t afford to lose (or need quick liquidity).

After all any Amount is not guaranteed by sdic, any risk is up to the individual to accept

Comments are closed.