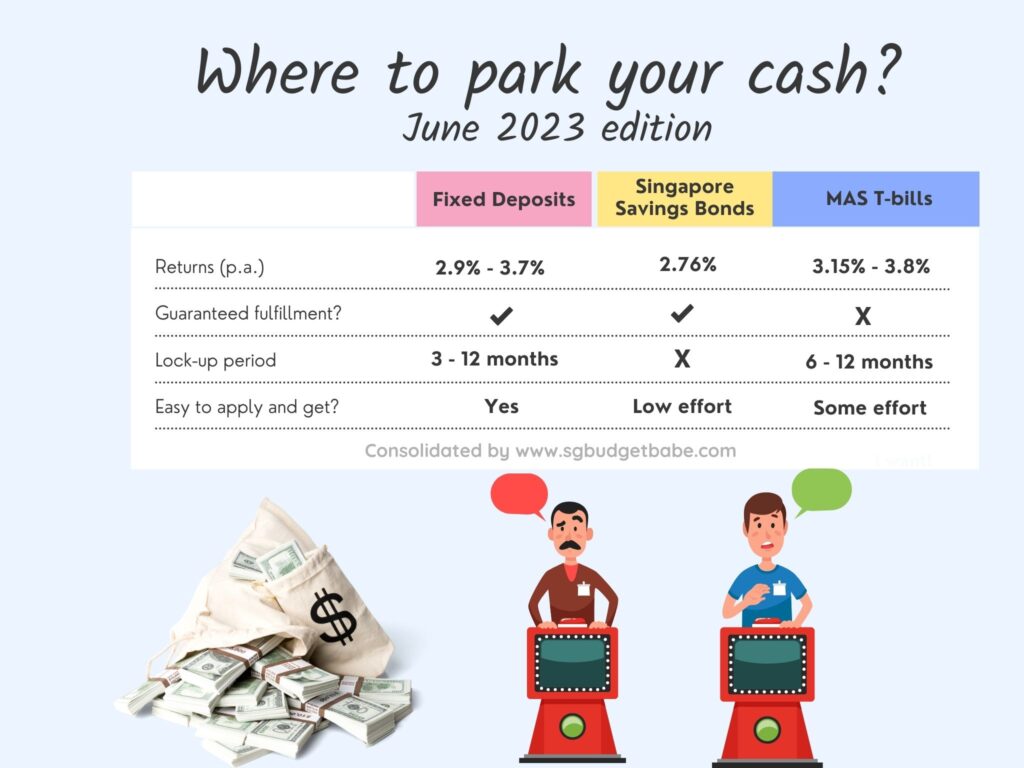

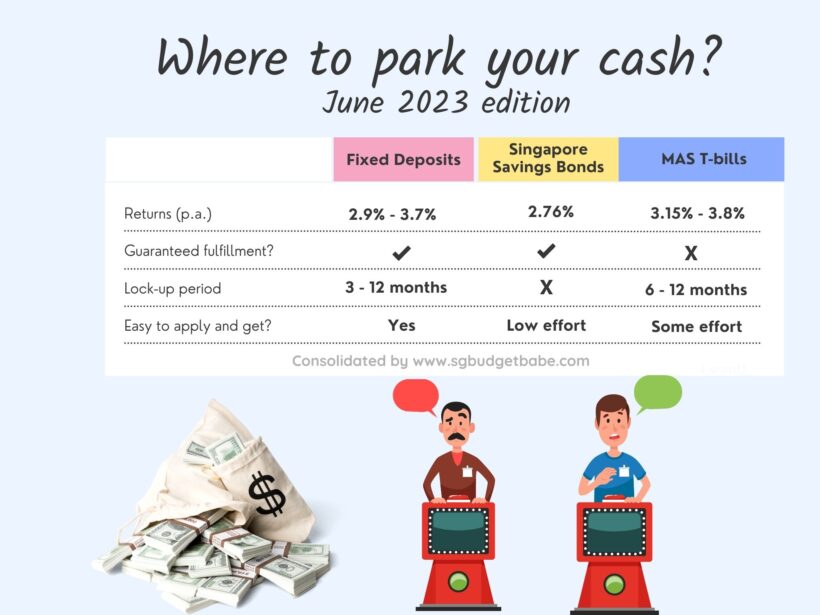

Ever since the Fed started to raise interest rates, many of us have been shuffling our cash between various options – including fixed deposits, treasury bills and short-term endowment plans – as we seek out higher returns without risking our capital in the stock market. What’s the current climate for savers? Here’s a quick look.

The latest inflation numbers for Singapore came in at over 5%, and many of us have already started to see our bills and fixed expenses rise in the last year.

The question is, is your income rising fast enough to keep up?

Are your cash savings growing fast enough to outpace inflation?

If you’re still sitting on the fence and waiting for inflation to come down, here’s the bad news: higher prices are now the new normal. Instead of waiting around while inflation erodes the value of your dollars, here are some options where you might want to put your money in instead.

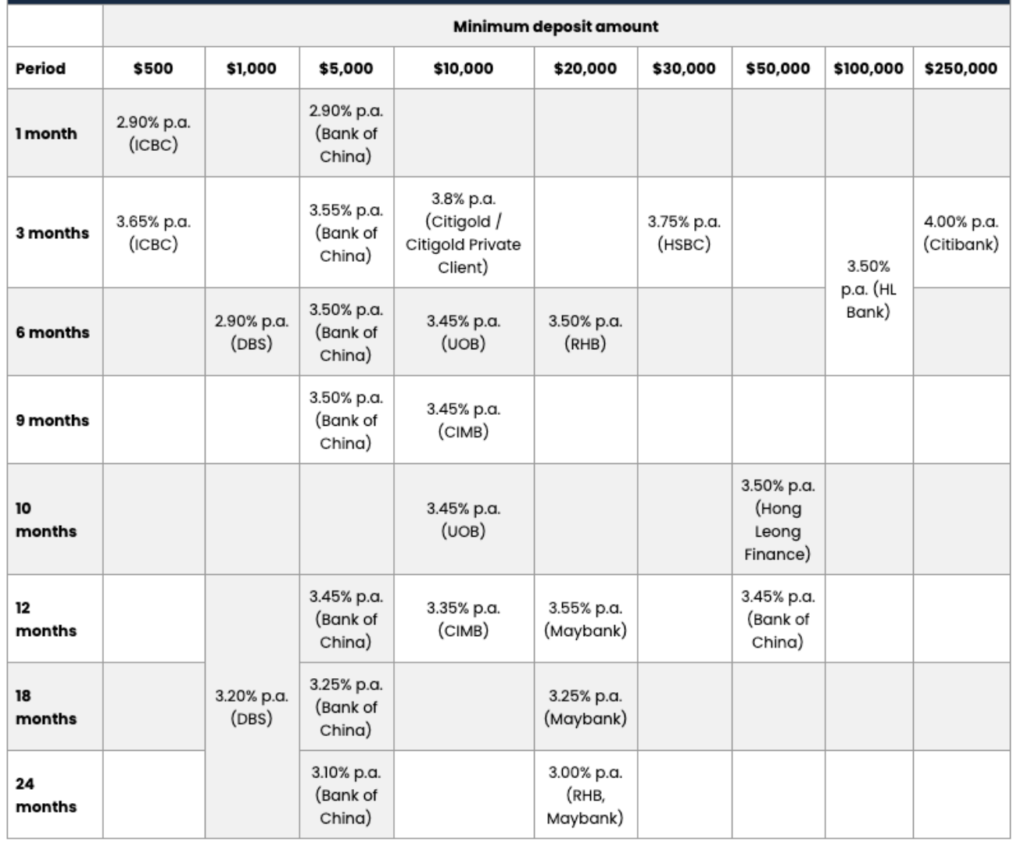

Fixed deposits

The good thing about fixed deposits is that they are fairly nimble – most come with short lock-in periods and can be applied online, at a bank branch or even on your mobile.

Just last year, the shortest lock-in period for fixed deposits was at least a year, but today, even the banks have reduced that to as little as 1 – 3 months.

For someone with $10,000 but less than $100,000, you can expect to get anywhere between 3.35% – 3.75% in the current climate.

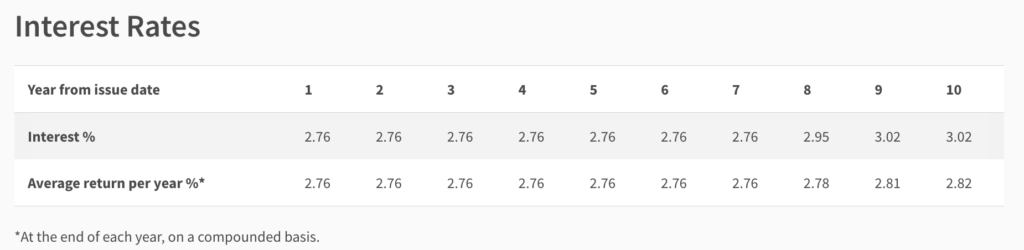

Singapore Savings Bonds

The latest Singapore Savings Bonds (SSBs) this month will give you 2.76% p.a. in your first year, with the average 10-year return at 2.82% if you were to hold for a full decade.

Savers who prefer putting their money in SSBs over fixed deposits are often those who want to maintain high liquidity i.e. the ability to terminate early and withdraw your funds within the following month. However, the return on SSBs have dropped in recent months; it wasn’t too long ago when it was yielding over 3% p.a.

MAS T-bills

MAS Treasury Bills (T-bills) have become a popular short-term instrument for many people, including among savers, folks using it for stashing aside their emergency funds, as well as investors putting aside their cash war chest while waiting for market opportunities.

The latest 1-year T-bill came in at an average yield of 3.27% p.a., whereas the most recent 6-month tranche (8th June) provided an average yield of 3.36% p.a.

There are generally 2 – 3 tranches of 6-month T-bills released each month. If you prefer a longer duration, you’ll have to wait for the next 1-year T-bill application on 20 July.

Short-term endowment plans

These are rapidly catching on among the general public as well, as several insurance companies have launched short-term endowment plans.

The downside is that these plans aren’t always available for long – they typically have short application periods due to popularity and tranche size available from the insurers.

To make it into one of such attractive short-term endowment plans, you should probably remind your financial representative to keep a lookout for you or stalk the insurer’s website and social media updates since most of these plans can now be bought online.

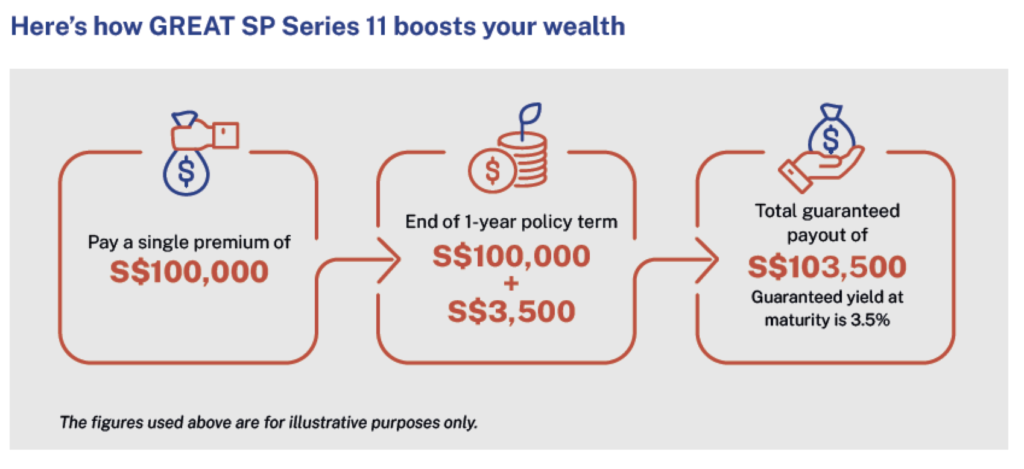

If you haven’t already heard, Great Eastern is bringing back their latest GREAT SP Series 11 on 21 June 2023.

Disclosure: The Great Eastern Life Assurance Company Limited ("Great Eastern") has kindly invited me to do a review and explanation of their latest offering, and the following section is sponsored by them.

Here are some key detalis:

- 1-year single premium non-participating endowment plan

- Guaranteed return of 3.5% p.a*. upon maturity

- Minimum S$10,000^ to apply

- Can use cash or SRS

This plan also provides insurance coverage against death and total and permanent disability at the same time.

You can either apply here or get access through your preferred Great Eastern financial representative.

Conclusion

As inflation rates remain high, we have to start being nimble with our cash. In this article, I’ve chosen to cover only the lower-risk options which are generally capital guaranteed i.e. you won’t have to worry about losing money even if the market turns.

I personally use a variety of instruments, including several high-yield savings accounts offered by the banks, to get higher returns on my emergency funds and idle cash that aren’t being invested in any assets or stocks.

But some people aren’t a fan of such accounts, either because they don’t meet the requirements…or they find it too much of a hassle to keep jumping through hoops to “earn” extra interest each month. And woe betide the saver who forgot to meet a certain criteria (like clocking a minimum spend on their credit cards) and missed out on the bonus interest that month.

While I previously stashed some of my cash into the Singapore Saving Bonds, I’ve neglected them in the past one year because Treasury Bills and some 6-8 month fixed deposits were offering me a much higher yield instead. And now, with the upcoming GREAT SP Series 11 being launched, I like the fact that it will give me a 3.5% p.a.* yield on my money for the simple act of holding it for 1 year until maturity, which is why I’ll be applying for it myself.

While this is not any indication for you to follow suit, I hope my review gives you a good idea of what it is and the other options that you should also weigh before you decide whether it is suitable for you.

Depending on how much cash you have, you may want to use one, or even several of the tools covered in this article to earn a higher rate on your idle cash.

Disclaimer: This post is brought to you in collaboration with Great Eastern, who fact-checked the provided product information about GREAT SP Series 11. All opinions in this post are mine, including the decision to invest into it.

Notes: *Guaranteed survival benefit of 3.5% of the single premium will be payable on survival of the life assured at the end of the policy term. ^The minimum single premium amount will depend on the entry age (as of next birthday) of the life assured and the payment method.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you. Protected up to specified limits by SDIC. Information correct as 21 June 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

8 comments

I think you got some misunderstanding on how T-bill is priced along with the yields (uniform price auction) work.

Thanks Babe. l appreciate your frank, great reviews and suggestions.

This article is article is already outdated!

SSB not guaranteed fulfilment.

Hi, Thanks for sharing! I park my idle cash on SSB and Tbills.

A great way to earn fixed interest and the flexibility to redeem at a shorter time frame. See my blog post: https://sporeshare.blogspot.com/2023/06/ssb-singapore-saving-bond.html

Indeed, SSBs and T-bills are great instruments, I use them too in my arsenal of cash tools. If your objective is short-term / almost immediate liquidity at all times, then endowments would be less appropriate for sure.

For me, I like that short-term endowment options have come down from the previous 3-year-minimum commitment, to 2-years lock-in, and now we’re seeing 1-year. It works better for folks like me where I want to stash away my emergency cash but not willing to commit anything longer than 1 year.

Still relevant leh. In fact, I regret missing the last GE 1-year endowment earlier in March (which I also mentioned, albeit on my social media only). My 6-month T-bill at 4.2% upon expiry with the next T-bill at 3.6% ended up being less in total. Oh well, hindsight is always 100%!

You can correct me then! I was quoting average yield so not wrong – you can cross-check the numbers on MAS website.

For me, my personal experience is my last 2 competitive bids all failed and didn’t get allocated a single cent. When I checked against the auction results afterwards, turns out I was marginally off each time. But that’s already some lost time yield there, I got only a 0.05% p.a. on those funds because they don’t qualify for the high-yield interest rates either.

Comments are closed.