Are you unknowingly being nurtured to cultivate more reckless spending habits?

A few years ago, when Buy Now Pay Later (BNPL) services were first launched, a lot of folks questioned why the authorities were so concerned and stepping in, arguing that it was hindering innovation in the scene.

But 2 years on, and after watching this video from CNA on how the young are using BNPL services, surely we can all understand their concerns.

More consumers are now spending more than what they can afford and making impulsive buys, largely due to a false perception of increased purchasing power thanks to BNPL services.

The ability to say no to purchases and to distinguish between paying for what you want vs. what you really need is a skill to be cultivated over time.

And if you’re not careful, allowing yourself to use services which are aimed to dull this ability…is going to set you up for bigger trouble later down the road.

How using BNPL on smaller purchases can mess with our minds

We tend to think twice about buying something when we have to pay for it in full. But when you split the sum up into smaller amounts, our mind tends to “justify” the purchase as something that we can afford.

That $76 foundation is now within my means because it only costs me $25 per month to own it.

With the exception of unexpected, large-ticket items that we need to get (such as when the fridge breaks down), using BNPL services to pay for your Shein clothing purchases, Sephora makeup or even food…isn’t exactly the wisest choice.

And as BNPL merchants have confirmed, cart abandonment rates have gone down when they offer BNPL payment options. The CNA video also pointed to how much higher consumers are spending through BNPL services:

What this means is that fewer consumers are thinking twice about their purchases, vs. the past where we would add an item into our cart and mull over the decision for a few days before deciding whether to buy. While this is good for the merchants, it is less so for us and our pockets.

Don’t count on the merchants or advertisers to help you cultivate better financial habits; it is in their interest to ensure that you spend more and buy more of their products.

SG Budget Babe

If you’re trying to cultivate better financial habits, it might be better to avoid BNPL services and spend only when you can pay in full within that month itself.

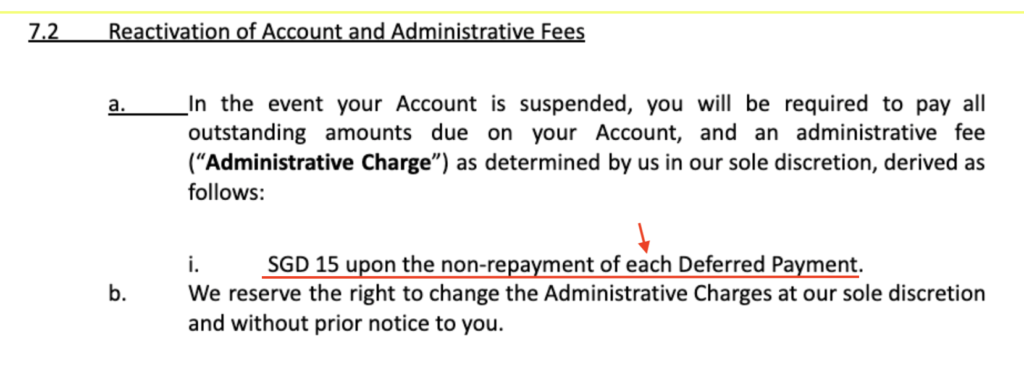

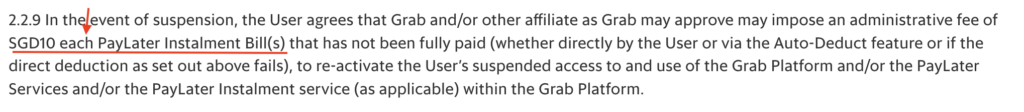

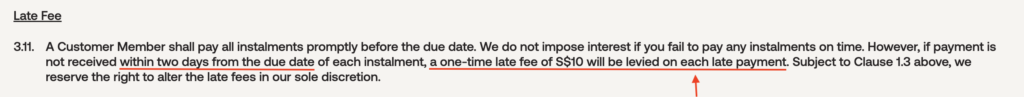

Beware of late fees

Most BNPL users tend to look at the late fee caps and think, “I can handle that”. But little do they realise that the fee is applied per instalment payment, which means it could very easily snowball into much higher fees than credit card charges if one is not careful.

How so? Well, consider these 2 scenarios:

- You spot fraudulent transactions on your credit card, so you immediately call your bank to cancel it, but you forgot that you have 8 BNPL instalments tagged to that card across Atome, Pace and Grab. The late fees get applied the following month, and you immediately incur 8 x $10 of charges ($15 on Atome) Congratulations.

- You run into financial issues that month (perhaps a client paid you late, as a gig worker) and thus have difficulties paying your credit card bill, so you think, I’ll just incur the $100 late fee and 26% rolling interest for a month. But you forget that you have your BNPL instalments too, and that you’re also being charged a late fee on each of them.

These are very real – and common – scenarios that could happen to any of us.

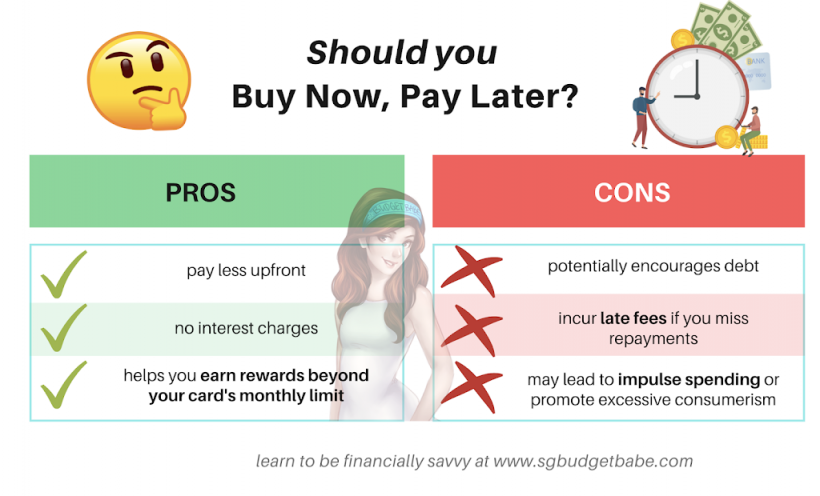

Now, I’m not saying that BNPL services are evil. On the contrary, there are huge benefits you can reap from using BNPL – read about them here.

But the problem is, the tool cuts both ways. And as it currently stands, young people make up a large portion of BNPL users, even though not all of them are financially savvy enough to handle it.

Still thinking of using BNPL services? Read this first.

Use the 10X spending rule instead

One helpful guideline would be to buy only if you earn more than 10 times of what the item costs you.

For instance, if you’re thinking of buying a $700 Dyson hairdryer, you might want to first check if you’re earning at least $7,000 a month so that the purchase takes up a smaller portion of what you worked hard to earn.

If you’re earning $10 / hour and you want that $700 Dyson hairdryer, ask yourself, are you willing to exchange 70 hours of your life for that purchase?

It is up to you whether you want to apply this 10x rule based on your monthly or annual income. Personally, I use annual limits for bigger-ticket items (i.e. anything above $1,000) and use monthly limits for smaller purchases like my skincare products or clothing.

Measure by utility and not price

I also prefer to apply the 10x rule together with the concept of utility cost – which measures how much value I can get out of the product – and ask myself, how many times will I be using this?

Like many females, I get tempted by the latest season of fashion wear as well, especially when it is repeatedly shown to me as ads on social media, as posts by the brand and its ambassadors / influencers, or more. But using this concept of utility has helped me to walk away from many purchases where I’ve not been able to justify wearing the outfit enough times to spend that much on it.

That way, I know my money is only going towards things that will be useful to me, instead of an impulsive purchase that will only end up sitting at home as a white elephant.

Bonus: this is not just beneficial for your wallet, but also better for the environment 😉

With love,

Budget Babe