Buy Now, Pay Later. Are BNPL services worth using, and what are the possible repercussions? Learn how to use it right in order to maximize your cashflow, and what to avoid so that you don’t end up busting your budget or running into late fees.

Traditionally, you could either pay for a purchase in full or via monthly instalments.

Payments via instalments are not new – the banks and credit cards companies have been offering this for decades, earning as they charge you late fees and hefty interest rates (~25% p.a. on average) for missing payments.

How does BNPL work?

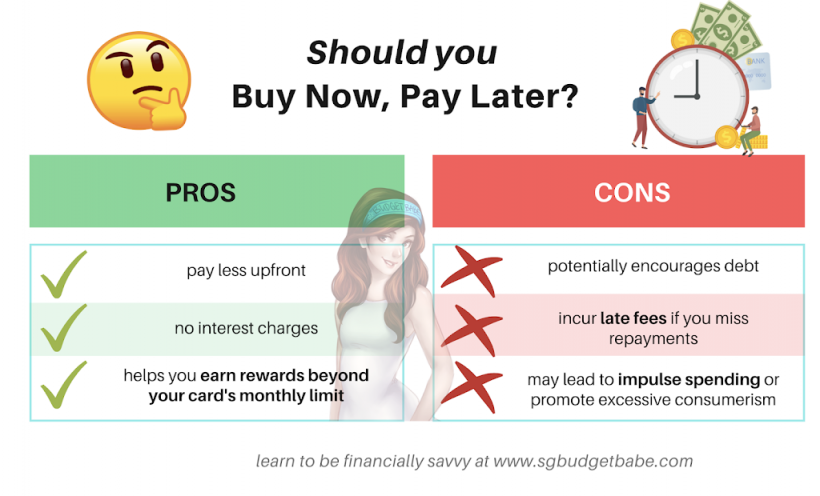

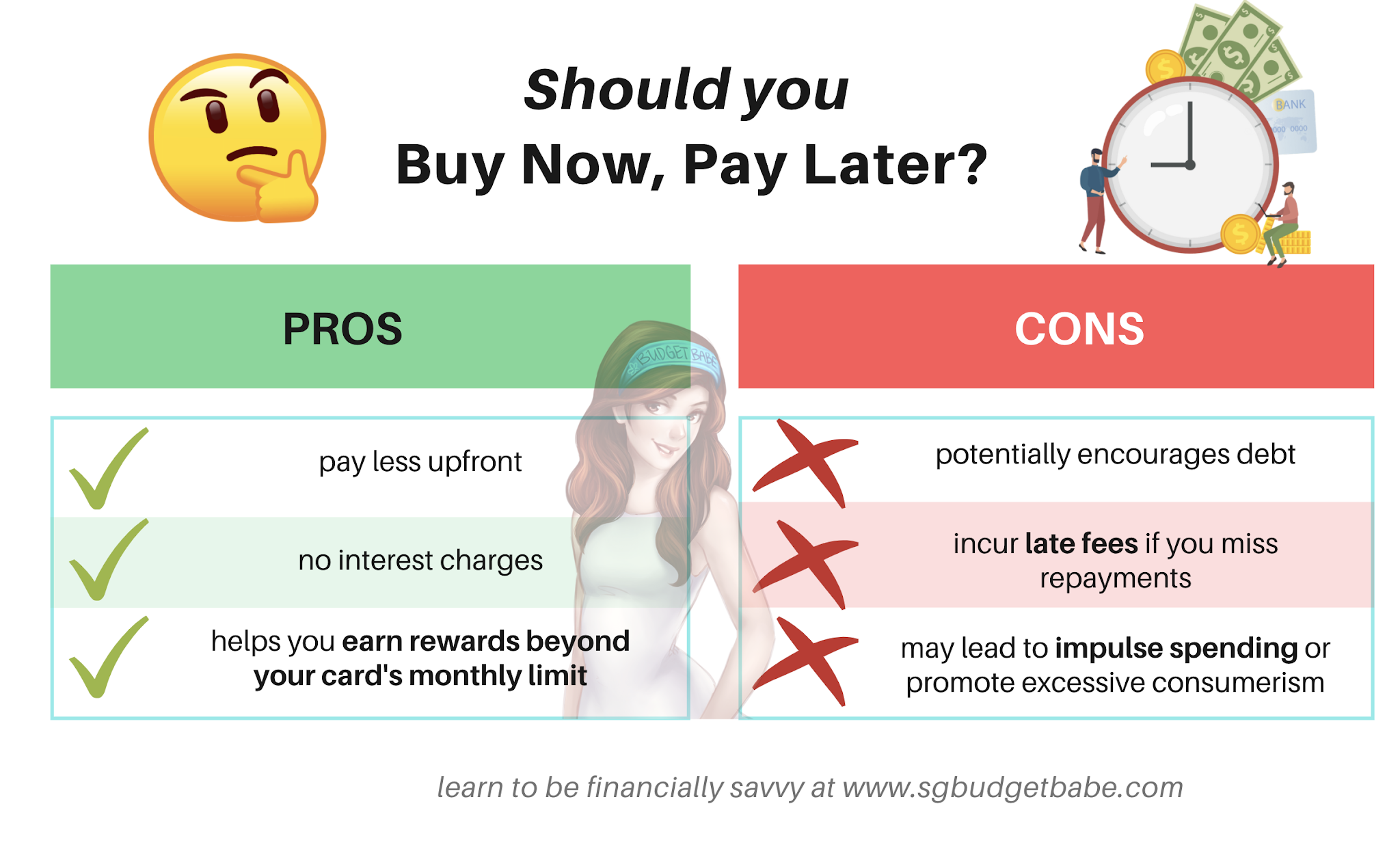

Pros and cons of BNPL

What most BNPL services don’t tell you

Most BNPL providers will gladly tell you about the discounts or cashback you can get while using their services, or that it costs you nothing to use them. (In case you are curious, it’s possible for a BNPL service to be interest free because e-commerce merchants pay these providers a commission to tap on this service.)

They emphasize 0% interest and no hidden fees. Or that by splitting the cost into several instalments, you pay lesser upfront.

Unfortunately, that’s not the full story.

As some consumers have come to realize, BNPL services do have fees involved for the customer…when you fail to make your payments on time.

And if you charged that to your credit card for the next few months without first making sure that you’ll have enough to afford the item in the first place…you might even find yourself having to deal with $100 credit card late fees and ~25% p.a. interest rates on the amount overdue.

Which is why while there are many service providers to choose from, I personally will only choose and recommend those that have satisfactory safeguards in place to protect consumers from the problems highlighted earlier.

And when I say “satisfactory safeguards”, I mean that by SGBB’s standards, not as a factual assessment of whether the measures implemented are good enough.

This means that only BNPL providers who

-

- conduct responsible marketing communications that educate consumers on both the benefits and downsides of using their service

- do not charge high fees for missed payments (or if they do, then communicating these fees upfront in a transparent manner is equally important)

- impose a lower maximum amount – to prevent consumers from overspending

will fit my criteria.

At this moment, I find that PayLater by Grab ticks these boxes.

What Grab wants you to know

Our non-negotiable take is that you should only use BNPL services if you

- have money to pay for your entire purchase upfront (this can be money that you already have in your savings, or stable income that you are confident will come in within the next few months)

- use your debit card to function like a credit card without any of its associated fees (e.g. late payment fees or interest)

- looking for a way to spread out your purchase over a few months using BNPL services to maximise your credit card rewards (e.g. not bust your cashback reward cap)

Don’t use BNPL just because you’re drawn by the attractive discounts or merchant offers. You’ll need to make sure you exercise financial responsibility when you choose to buy now and pay later.Avoid financial ruin from late fees and missed payments by making sure you have set aside money (or even a reminder) to pay off your bills on time. With Grab, you can do this by automating payments from your GrabPay balance or linked (debit/credit) card.

How you can use BNPL to your advantage

TLDR: Use financial products (like BNPL) well

What other tips do you have when it comes to using BNPL?

Share with me in the comments below.

P.S. There seems to be some confusion over how using Grab PayLater can still entitle you to enjoy your credit card rewards. Basically, how it works is that the amount will first be deducted from your GrabPay wallet (some credit cards have stopped giving points for wallet top-ups, but some cards have yet to exclude it). So if you’re one of those who don’t generally top up or keep funds in your GrabPay wallet (like me), then the wallet won’t have enough funds, so Grab will be charging your linked credit / debit card directly.

This post is written in collaboration with Grab Singapore. All opinions are that of my own.

—————————–

Sponsored Message

Grab launched PayLater as an alternative to traditional financial services to provide customers the flexibility to make interest-free payments over 4 instalments or at the end of the following month. We do not charge any interest, which means you will never pay more than the amount of your purchase as long as payments are made on time. In the event that you’re late to pay, your PayLater account will be deactivated, and we charge a $10 admin fee for each reactivation..

As a financial provider focused on providing accessible, convenient and transparent services for our customers, Grab hopes that PayLater will help more consumers to manage their cashflow better and get more out of their monthly spend. Explore PayLater under the Payments tab in your Grab app today.

2 comments

where to find this function in the grabapp?

Under Payments! U need to register first so your account for the service gets set up and for them to assess if you're suitable.

Comments are closed.