Raise your hand if you’ve a problem with figuring out which card is best to swipe for each transaction for maximum rewards. With Max MRS, you can now manually look up the MCC before you pay. Still sounds like too much work? Then hang on tight for Max Card, an AI tool that promises to automatically search and route it to the best card on your behalf.

Most of us tend to have multiple credit cards, especially since different cards offer varying levels of rewards on different types of spend.

But how do you know which card to use for which transaction?

To solve that question, you’d need to know:

- The merchant category code (MCC)

- Minimum spend and/or category limits

- Ongoing promotions and credit card offers

- Changes in T&Cs

- Exclusion categories

Most people end up NOT earning their full credit card rewards

As you can see, there’s a lot to remember and take note of when it comes to getting the most rewards out of one’s credit cards. It can be a really tedious endeavour, so most people either resort to (i) rough guesstimates or (ii) give up and stick to one all-in card.

The problem with guesswork is that you inevitably lose out on various rewards, especially when you guess wrong or fail to keep up with T&C changes in your credit card e.g. you could previously earn miles / cashback using AMEX cards for Grab top-ups, but that has since been nerfed earlier this year.

And while using a single card is certainly convenient, the trade-off is that you settle for a lousy reward earn rate too (e.g. 1+ mpd instead of 4mpd). Which is a little silly when you could optimize (albeit with some effort) to get more than double your miles, effectively shortening the time and amount you need to spend before you qualify for your desired flight(s)!

What’s the Merchant Category Code (MCC)?

Credit card issuers generally award you with reward points, miles, or cashback based on the MCC of the merchant where a purchase is made. These MCCs are assigned by payment card organisations (e.g. Visa, MasterCard, American Express). Note: MCC codes are not always consistent either; it is possible for a merchant to be coded differently on Visa vs. MasterCard.

To add to the confusion, a merchant’s registered MCC may not always correspond with its nature of business! Here are some examples I’ve encountered:

- Tempted to use your best dining card for your bill at Prego (located in Fairmont Hotel)? Not so fast – Prego falls under MCC 3590 (Hotels), which is a subset under Travel.

- Using your 4mpd for online purchases on iShopChangi? Sorry, but that falls under MCC 4582 (Airports) even if you’d made your payment online.

- You can’t use your best online card to pay for your Facebook ads, because that is categorized under MCC 7311 (Advertising services), which are typically excluded by most cards for bonus rewards.

While there is a list of MCCs, there is no list that matches them to the businesses in Singapore. Previously, we could search on WhatCard or use the infamous HWZ credit card spreadsheet, but even the founders behind both have since given up, which means the card rewards tracked there are now outdated and there’s no way to check for newer merchants such as Spago or even TikTok Shops.

But the good news is, we now have another workaround.

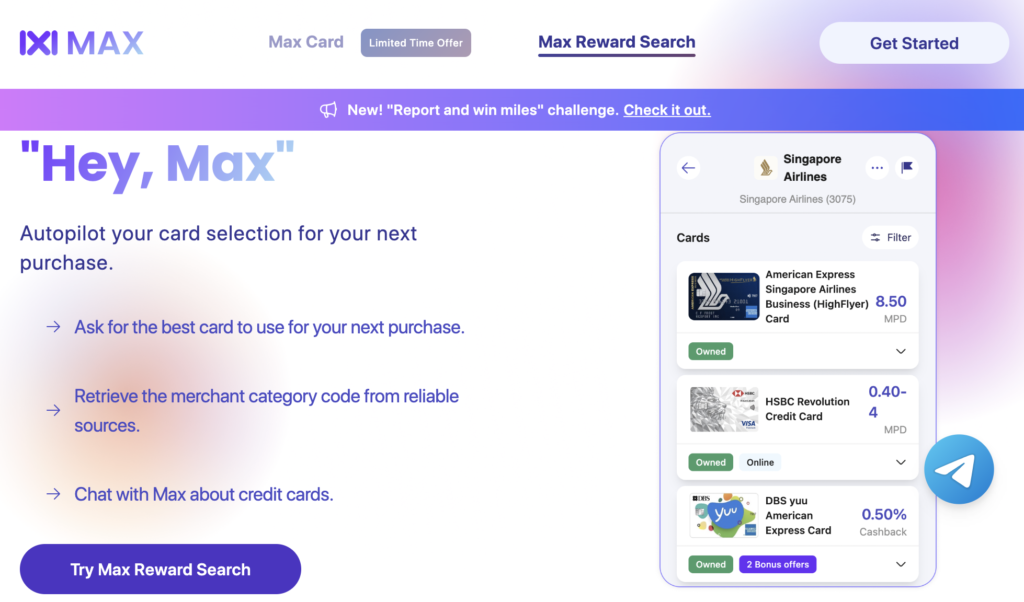

Introducing: Max Reward Search

Otherwise known as Max MRS.

Max MRS is a new MCC-lookup tool, which allows you to look up a merchant’s MCC before swiping your card, so you can maximise your miles or cashback on every transaction you make.

For those of you who want to be sure before you transact and not risk losing out on any rewards, you’ll love this.

The MRS dataset leverages known Visa, MasterCard and AMEX MCC codes as well as crowdsourced feedback.

This reminds me of the now-defunct WhatCard and HWZ spreadsheet, except that the team is still actively populating data, and there’s more merchants being covered – not just in Singapore, but overseas as well.

You can already use this tool – simply sign up for an account here!

At any rate, this is far easier than the other (still available) method via the DBS digibot, which requires you to:

- temporarily block your card,

- attempt to charge your transaction anyway,

- then check with the DBS digibot (under the Declined Transaction category),

- retrieve the merchant description from the failed transaction details

- match it to Citi’s MCC list here.

My friend Aaron over at the MileLion has a helpful article describing the exact process of how this works. For those of you who don’t mind the hassle (and potential embarrassment in front of the cashier) involved in this method, check out the article here.

While Max MRS is already a welcome tool today, what’s more exciting is that the company behind it aims to launch Max Card later this year.

Max Card: Use the best card each time

Come Q4 2023, you may not even need to manually consult Max MRS to find out MCC codes anymore. Instead, Max Card will automatically route your transaction to the best credit card that earns you the highest rewards.

This means you won’t even need to carry around multiple cards in your wallet anymore – the Max Card is the only one you’ll need!

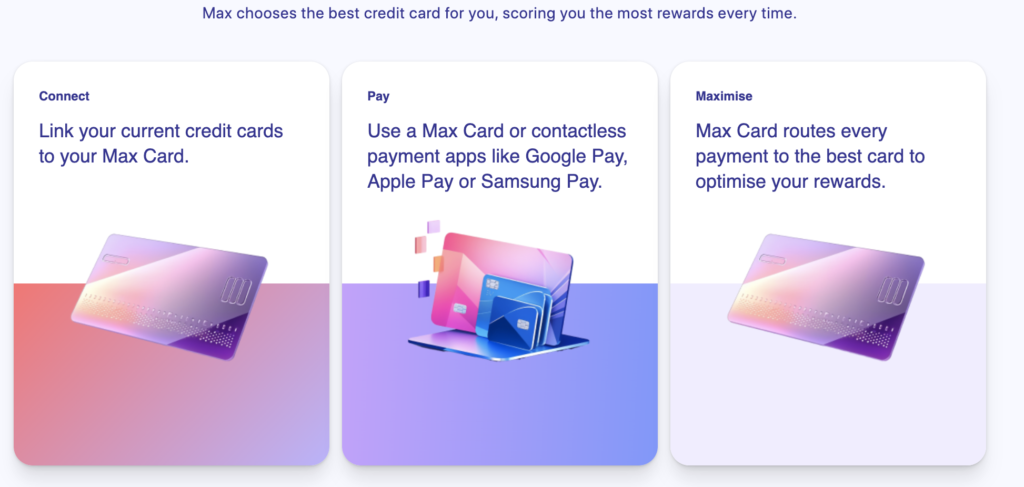

- How it works is that the user taps the Max Card at the terminal

- we receive the transaction information, which will include the merchant

- We take the merchant information and put it into our Max Reward Search algorithm

- Redirect the transaction to your card that gives you the most rewards.

I asked the team how that is even possible, and here’s their explanation:

- When you tap the Max card at the payment terminal, it sends the information to Max

- The merchant’s MCC is then run through the Max MRS engine to assess what reward it would earn for each credit card

- The transaction goes through and gets routed to your card that gives you the most rewards

This solution beats ALL the others currently available, which basically requires the user to manually check for the MCC online or through Max. What’s more, additional data – such as limited time deals by the banks / merchant / other apps – will also be presented on your Max app if you want to check whatever promotions are available before you head over to make your payment.

In other words, Max Card sounds like the answer to the perennial question of, “what credit card should we use for this transaction?”

If the team is successful, Max Card could really simplify the complex credit card space by eliminating the need for us consumers to memorize terms and conditions, keep track of min/max spend requirements, changing promotions and bonus rates, annual fee waivers, and more.

Aside from MCC codes, Max also supposedly tracks:

- Latest credit card offers

- T&C updates

- Credit card waivers

This means that theoretically, you could use the Max Card to earn 6 mpd on your UOB Lady for dining and auto switch back to HSBC Revo once that’s up. And if your HSBC Revo $1,000 cap has been met? Well, Max should then route it to your next best card for dining.

Since Max is already equipped with knowledge of the various MCC codes on the back end, this proposition actually sounds feasible.

Well, what happens if you find out Max has routed a particular transaction to the wrong card?

There’s apparently a Max Time Machine feature, which will enable you to switch cards even after you paid.

I thought this sounded a bit dodgy, until I questioned the team and they told me that the feature already exists over in the UK:

Of course, even if the technology is perfected, there’s bound to still be edge cases where I can imagine Max getting it wrong. The team has said that to address this issue, they run a Telegram group chat here where you can provide feedback and report such edge cases for them to correct.

Let Max Card keep track of everything for you. Best rewards, T&C updates, transactions, loyalty programmes. It can even handle your credit card fee waivers!

Sponsored Message

My thoughts on the Max Card

Some of you guys might remember that once upon a time (pre-kids), I built a credit card app with a fellow reader that was meant to solve this perennial problem. Of course, it being a 2-man show, the app died a natural death a few years later when both of us could no longer afford the resources needed to upkeep the app.

So while hearing about the Max MRS was exciting, but the Max Card sounds even better, and I sincerely hope the team is successful.

My biggest concerns are

- whether the team will be able to successfully ship the product,

- and then make it commercially viable (because we all know there’s only so much a team can do for “free”, even if in the public interest)

- and finally, how they intend to stop the banks and credit card issuers from blocking it.

After all, giving out cashback / miles / reward points is a real cost for the banks, so I bet they won’t be happy.

Conclusion

If you’re struggling over the question of “what MCC?”, use the Max MRS tool to get your answers.

If you want more help with your multiple credit cards so you never have to DIY your own rewards optimization process, then stay tuned for the Max Card.

Although Max Card is still not available (yet), you can help make that happen by signing up for the waitlist here.

The first 1,000 sign-ups on the waitlist will get a 10,000 Max Miles bonus when the card launches.

Sponsored Message

In case you’re late, you can still earn a 2,000 Max Miles bonus by being among the first 10,000 sign-ups.

Sign up here today and help make the Max Card become a reality!

Disclosure: This article is brought to you in partnership with Max Inc. as I found the technology too unbelievable to cover it on my own as an organic post (that doesn’t get run through any factual checks by team or product creators itself). On my end, as someone with multiple cards myself, I truly want to see this solution become a reality (who wouldn’t?!), so let’s help out and waitlist so that the team can make this happen sooner rather than later!

2 comments

The Max Card is not actually a credit/debit card. It is simply an interface card that redirects the transaction to the respective stored card details in the Max Card. Its like a e-wallet that has added logic to filter discounts/rewards for the credit cards that you setup in the Max Card. But i doubt that it will be able to do a consolidated comparisons based on potential future purchases (e.g. when i want to hit a target to earn extra miles/cashback, i need to plan based on consolidated future purchases that i have in mind). I believe this Max Card can only make a decision based on each individual transaction.

Yes, as mentioned the Max Card is an AI tool embedded in a card, or in specific terms, it functions as a router. I like your term of “interface card” as well! But I don’t think it is an e-wallet – a different license entirely will be needed to make that happen.

Indeed, I doubt the Max card (nor the technology Max itself) will be able to do a comparison for FUTURE purchases that you’re planning for. That will still need manual effort for now, but at least one part of the problem is being solved i.e. which card should I tap NOW (or, did I tap the right credit card just now?!)

Comments are closed.