If you had topped up your Supplementary Retirement Scheme (SRS) at any point before to reduce your income taxes, you should note that your funds only earn measly 0.05% p.a. interest. With elevated inflation levels today, avoid losing the value of your retirement funds by investing them instead. Here’s how.

It is crazy to think that while banks have raised their interest rates over the last 2 years to keep up with the Fed hikes and retain deposits, none of that applies to our SRS account, which still earns a miserable 0.05% p.a. Good for the banks, I suppose, but terrible for us.

And that’s why I don’t just keep my funds idle in my SRS account. But it was shocking to learn that 1 in 5 Singaporeans do that, and whether this is due to ignorance or pure laziness is anybody’s guess.

As a taxpayer in Singapore, the SRS is a great way to legitimately reduce one’s income taxes payable…capped at a limit of $15,300 per year. I’ve talked about it often, and you definitely should use the SRS if you’re trying to pay less taxes!

Then, once you turn 63 (i.e. hit the prevailing statutory retirement age), you’ll be able to make penalty-free withdrawals from your SRS account to fund your retirement lifestyle and be taxed at only 50% of the sum withdrawn.

Psst, the statutory retirement age is set to be revised to 65 by 2030. Opening your SRS account before that happens and funding it (even if just with $1) will help you to “lock in” your withdrawal age at 63.

Important note: This applies for Singaporean citizens. For Permanent Residents and non-citizens residing in Singapore, different taxation laws apply, which you can view here on IRAS.

But you know what’s even better than that?

When you can get away with paying ZERO taxes 😉

That’s right, with careful planning, you can even avoid paying income taxes entirely on your funds withdrawn!

Here’s how it works in today’s context:

- Folks with an annual income of $20,000 or less are not obliged to pay any taxes in Singapore (the income tax rate for this group is 0%).

- So the trick is for you to withdraw $40,000 each year from your SRS account, you’ll only be taxed on 50% of that i.e. $20,000.

- In other words, you won’t have to pay any taxes 😉

Based on current tax rates, the ideal sum to have in our SRS account at the point of withdrawal would be $400,000 in order to pay zero taxes.

This figure may change if IRAS changes their income tax rates.

However, if you’re a high income earner or a skilled investor can grow your SRS funds to a larger amount (e.g. $800k), your tax rate can still be low e.g. withdrawing $80k a year from your SRS only incurs a $350 tax.

So let’s imagine that we max out our yearly contributions of $15,300 between the age of 35 – 55 (20 years). This translates into $306k in total.

Even if we are lucky enough to continue earning a high salary between age 55 – 60 and can contribute for another 5 years, that works out to be $382,500 at the end (or $384,996 to be accurate, after accounting for 0.05% p.a. interest).

That’s hardly close to the ideal amount of $400k at all!

Thus, you can see that in order to meaningfully grow your SRS retirement funds, you need to invest it to earn better returns.

What can my SRS funds be used to invest in?

Today, there are a wide range of investments that you can choose from for your SRS funds.

A misconception is that you can only invest via the SRS provider where you have your account with (e.g. DBS / OCBC / UOB). In fact, you can use almost any broker of your choice, as long as you link your SRS account as the source of your funds.

Important Note: You can only use local brokers to invest your SRS funds, which means popular low-cost brokerage firms such as Tiger Brokers, MooMoo, WeBull, Interactive Brokers, TD Ameritrade, Saxo Capital, uSMART, etc will not be available for you to invest your SRS funds in.

I’ll cover a few ways that you can explore investing your SRS funds in, while sharing about which methods I prefer to use:

Singapore Savings Bonds

For the super risk-adverse who do not want to take any risk on your capital, you can invest in Singapore Savings Bonds – the latest tranche currently yield an average return of 2.81% p.a. The good news is, you can invest up to $200,000 (MAS has raised the limit up from $100k previously).

Exchange-Traded Funds

Those who wish to invest and get market returns can consider exchange-traded funds, which typically track an underlying index as its benchmark. This is an easy way to diversify and get broad-based exposure without having to do too much research on individual stocks either.

In Singapore, popular ETFs used by many SRS investors include those tracking the Straits Times Index (STI), bond ETFs and REIT ETFs.

Regular Shares Savings (RSS)

A RSS plan is an easy way to invest in stocks, bonds, ETFs or REITs listed on the SGX from as little as $100 a month. If you prefer to dollar-cost average into the market instead of trying to time the market, this could be a good option for you.

You can set up an RSS plan with any of the below 4 local brokerages:

- FSMOne ETF Regular Savings Plan

- POSB/DBS Invest-Saver

- OCBC Blue Chip Investment Plan

- Phillip Share Builders Plan

Stocks

You can also use your SRS funds to invest directly in stocks listed on the SGX, such as in strong blue-chip companies like DBS Bank, OCBC or Capitaland Trusts.

However, I personally don’t practise this because I prefer to have liquidity in my stock account. There’s nothing wrong with this method, but this is just my personal preference.

Robo-Advisors

Digital robo-advisory platforms such as MoneyOwl and EndowUs also allow you to use your SRS funds to invest with them, such as in their cash management accounts or low-cost unit trusts (e.g. Dimensional Funds).

Insurance

You can also use your SRS funds to invest in single-premium insurance products, endowments or annuities. As the 10-year withdrawal period limit for SRS accounts does not apply to annuities, this makes SRS annuity products even more attractive.

However, the downsides are that returns on such insurance products are generally low (averaging 2 – 3%) and comes with larger sums for investment, with extended lock-in periods.

This is not something I favour since I’m still young and have a longer term investment horizon, but I’m covering this as it continues to be a popular tool used by many SRS investors.

So…what does Budget Babe invest her SRS funds in?

Personally, my preference would be for ETFs or unit trusts when it comes to managing the funds in my SRS account.

That’s because I want something for the long-run, which I don’t have to consistently monitor as often, and can let it run more passively in contrast to my active stock investment account.

Another reason is that I have a lower risk tolerance when it comes to my SRS funds, as these are meant primarily for my retirement and I don’t want to take on too much capital risk. Since the volatility in individual stocks are higher, I prefer not to deploy my SRS funds here.

Use your SRS as a tool to boost your retirement income

My husband and I are planning for our retirement in such a way that we hopefully will not have to rely on our kids giving us allowance to survive. You can also read about how I feel about this “parental allowance” topic here on CNA.

As the name suggests, your SRS should supplement your other retirement funds, so don’t make the mistake of relying on your SRS funds alone for retirement as that is unlikely to be enough.

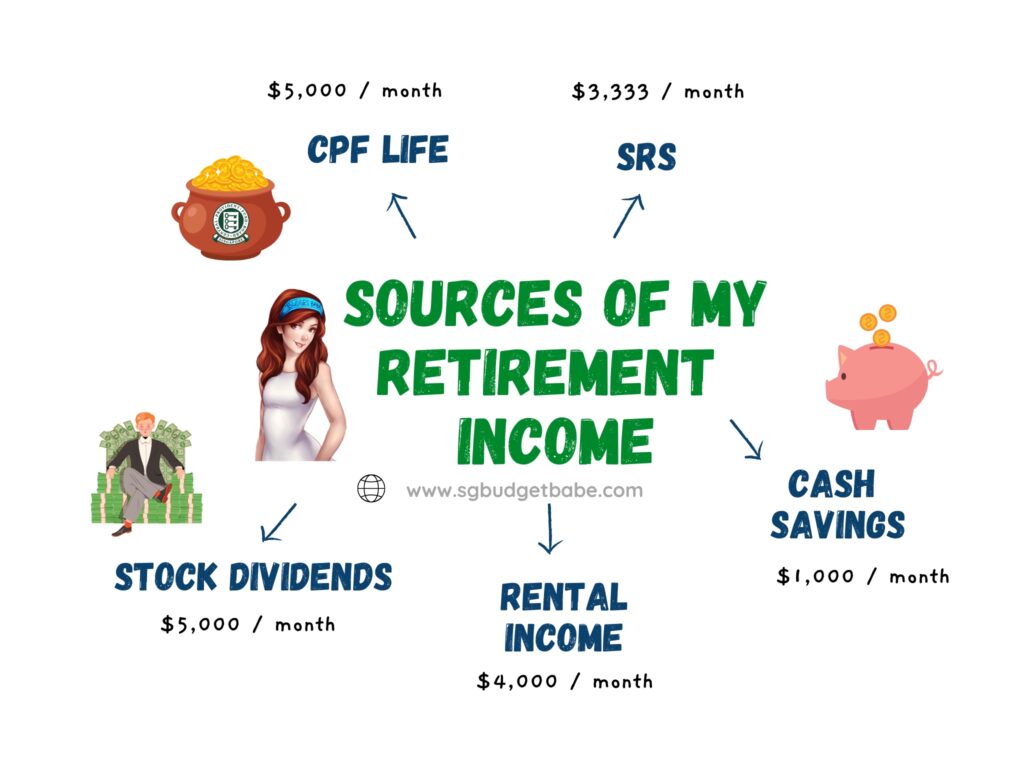

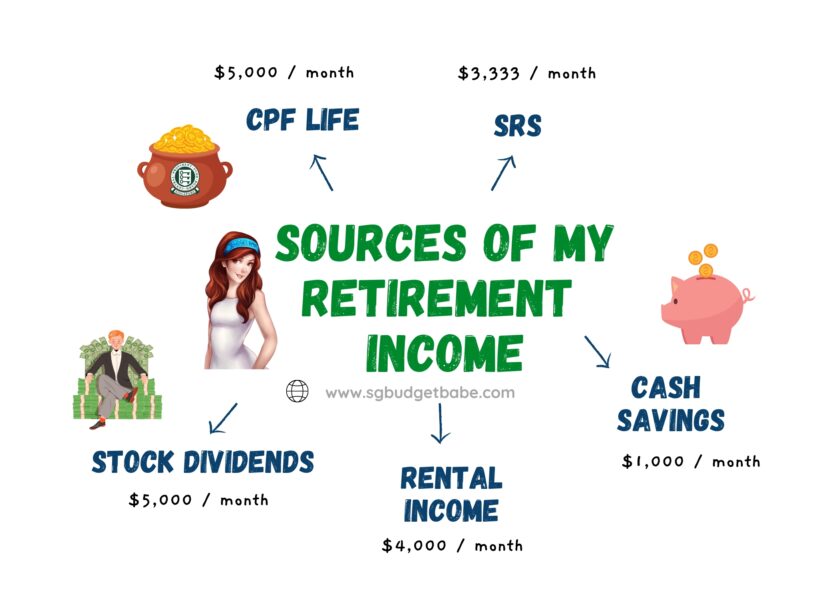

At $40k withdrawn a year, that works out to be about $3,333 a month – but given inflation levels and the rising cost of living, you’ll need to make sure you have other income sources funding your retirement years as well.

Here’s mine:

I’ve already planned for my CPF Life payouts – click here to see how I’ll be achieving $5,000 a month. My SRS and stock dividend portfolio are still very much a work-in-progress and I’ll be continuing my efforts there to build it up over time.

Some of our friends have already secured their investment property for their retirement plan, but at the moment, we are still a few years away from making ours become a reality (mostly due to MOP timelines). Once that’s settled, I’ll breathe another sigh of relief.

Finally, I hope to eventually have enough cash savings set aside in fixed deposits, treasury bills and short-term endowment plans for the purpose of liquid cashflow in the event of any emergencies. 20% will be always kept fully liquid to enable a monthly withdrawal of $1,000 each month.

If my plan works out, this will allow us to have a comfortable retirement – one where I can not only pay for our own living expenses, but also travel abroad and even pay for meals and gifts for our children without worrying that we’ll run out of money.

The most encouraging part is, even if you’re clueless and eliminate the portion from stock dividends and rental income, you too, can secure a decent retirement amount for yourself by building with your CPF and SRS from the start. The key thing then, is to start early.

How are YOU planning for your retirement?

With love,

Budget Babe

9 comments

Could you post the link on how you can get $5,000pm from your CPF Life? The link in the article is not working. Many thanks.

40k/12.

thank you for spotting that typo! i’ve corrected it 🙂

$5k is SRS, and not CPF life?

No, the plan is for $40k SRS withdrawal yearly, so $40k/12 months = $3333 per month.

$5k is correctly indicated under CPF Life payouts under prevailing schemes, with details on how I plan to get there. I’ll publish this shortly in a subsequent post so do keep a lookout for that! 😉

You might want to make explicit that the rules around SRS are different for citizens, PRs and foreigners. The above only applies to citizens. Both contribution and taxation rules differ for the three categories.

Good article but I would add two things

I) etfs are preferrable because they have low fees. Fees are essential for long term investing

II) single stock investments are a very bad strategy for lonh term investing no matter what your preference. In the long run it is as good as guessing. Especially if you only buy SG stocks.

Hi Chris, thanks – great shoutout there! I would have thought it was obvious but upon re-reading it after your comment, I think you raise a valid point and thus I’ve added the disclaimer in 🙂

Hi John,

Agreed but for your second point, I think it really boils down to the skill set. Just like how there are great and bad fund managers, there are also great and bad retail investors.

I actually know of quite a few folks who did individual stock investments in SGX-listed equities only and made quite a lot of money – both from capital gains and dividends.

Comments are closed.