Parents, you can even do this for your children. Here’s why I think a Regular Savings Plan (RSP) will be the one of the best moves you can make for your own financial future – whether in terms of actually beating inflation, cultivating positive financial habits, automating your investments so that it runs while you pursue your career…or even as a teaching and legacy tool while your children are growing up.

When I first started investing in my early 20s, initial capital was a real problem.

Back in those days, the minimum lot size on SGX was 1,000 units. As an investor who wanted to buy just 1 lot of DBS shares at ~$20 back then, I needed to commit upfront a minimum of approximately $20,000 (1,000 x $20 = $20,000). I thought that was a lot of money for a new investor like me – for exposure into just one single stock!

Thankfully, SGX reduced the minimum board size down to 100 units in 2015, which then made individual stocks more accessible for me. But if there is one thing I wish I had done differently when I first started investing, it would have been to set up a Regular Savings Plan (RSP) right from the start.

What I observed was that many retail investors who started their investing journey during the pandemic were drawn by the allure of US stocks and spurned the Singapore market. Many ended up buying hyped stocks such as Tesla, Peloton or Palantir, causing their own investing journey to be fraught with much volatility. The outcome today? Many are sitting on losses now and not wanting to touch – or even look – at their portfolio.

On my recent podcast interview with ex-GIC chief and former Presidential candidate Ng Kok Song, he pointed out that the US stock market is now 70% of the global market cap, yet the American economy is only 20% of the global economy – a possible sign that valuations are at inflated levels, pushed up by technology and AI stocks in recent months.

If you asked me, I always feel that it is better for new investors to start with their home market to build their circle of competence with a RSP first, rather than jump immediately into stock picking as an inexperienced newbie.

Not convinced? Here’s an example back test to illustrate.

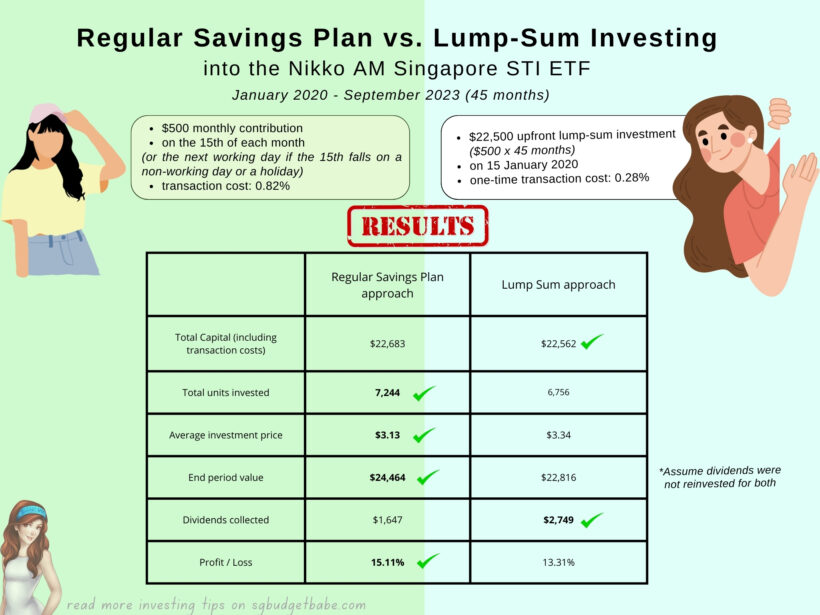

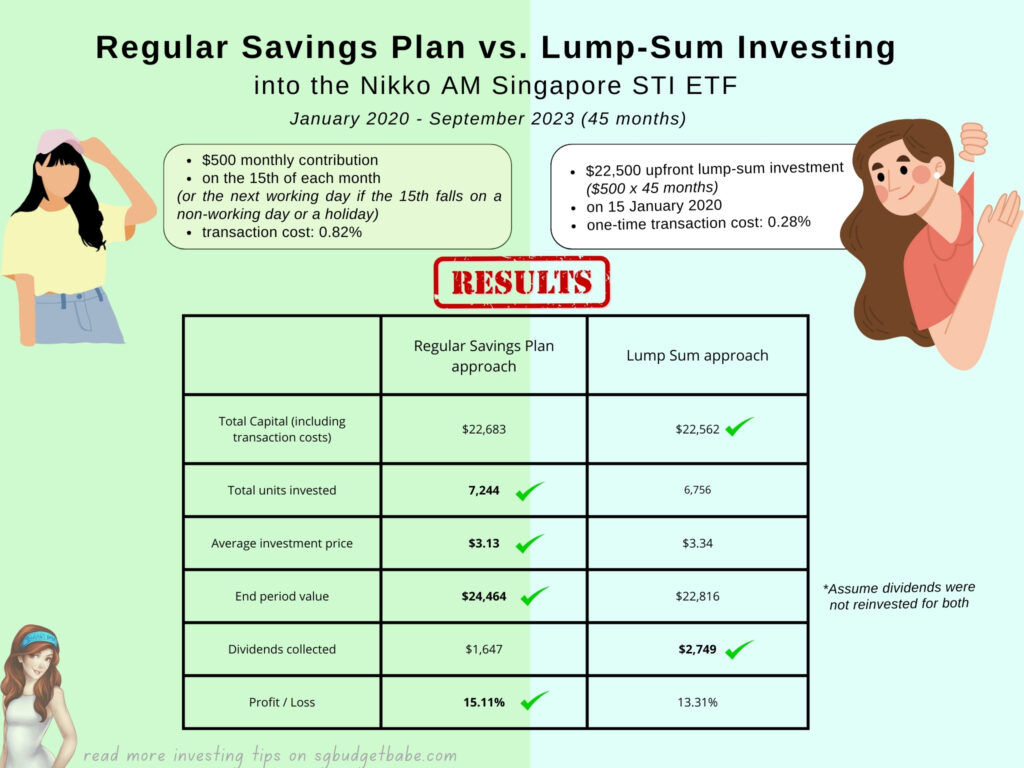

Let’s imagine 2 investors, both of whom invested in the STI ETF in January 2020 and held their investment until now. One chose to do it via a RSP system of $500 a month, whereas the other had more cash on hand and chose to invest the entire sum upfront ($500 x 45 months) in a single move:

For these 2 investors, we can see that the RSP approach to investing during this period in question (January 2020 till now) yielded slightly better returns, and it did not require the investor to have a large initial investment amount ($22,500) to deploy right away on Day 1. Instead, the RSP investor was able to build up her investment holdings slowly over time, and in this period, ended up with even more units of the Nikko AM STI ETF than the lump-sum investor.

Now, this is not to say that regularly investing a fixed amount (a.k.a. Dollar Cost Averaging, or DCA) will always outperform lump-sum investing, as different time periods will yield different results:

- In a rising market, lump sum will generally outperform DCA. The premise here is that you would have been fortunate enough to time the market to have entered at the bottom (or near it) and you had the entire sum to deploy upfront at that point in time.

- In a U-shaped market, DCA generally outperforms lump sum investing.

- In a falling market, DCA generally outperforms lump sum investing.

Hence, you can see why DCA is such a great tool for investors, as it distances you from the emotional roller coaster that comes with investing. It doesn’t require you to accurately time the market (something which even Warren Buffett has admitted he hasn’t the “faintest idea about”) and neither do you need to have your entire investment capital right at the start.

This is not just all theoretical. Here’s anecdotal evidence I found which shows there are real people in Singapore who have been disciplined about this and seen positive returns using a similar approach:

In the bestselling book “Atomic Habits”, author James Clear writes about how to make good habits inevitable and bad habits impossible:

Make your bad habits more difficult by creating what psychologists call a commitment device i.e. a choice you make in the present that controls your actions in the future. It is a way to lock in future behaviour, bind you to good habits, and restrict you from bad ones.

The key is to change the task such that it requires more work to get out of the good habit than to get started on it. When the time comes to act, the only way to bail is to cancel the [commitment device], which requires more effort and may cost money.

James Clear, from “Atomic Habits”

And if you asked me, setting up an RSP today can possibly be the one of the best commitment devices you can create for your financial future. It will bind you to good habits (of disciplined investing) and restrict you from bad ones (of attempting to time the market, or ditching your investments during periods of fear). So when the time comes to act, the only way to bail is to terminate your RSP, which requires you to take the effort to do it but thankfully, will not cost you money as there are no penalties or early termination fees unlike an insurance investment plan.

How do Regular Savings Plans (RSPs) work?

For those of you who are unfamiliar with RSPs, here’s a quick crash course.

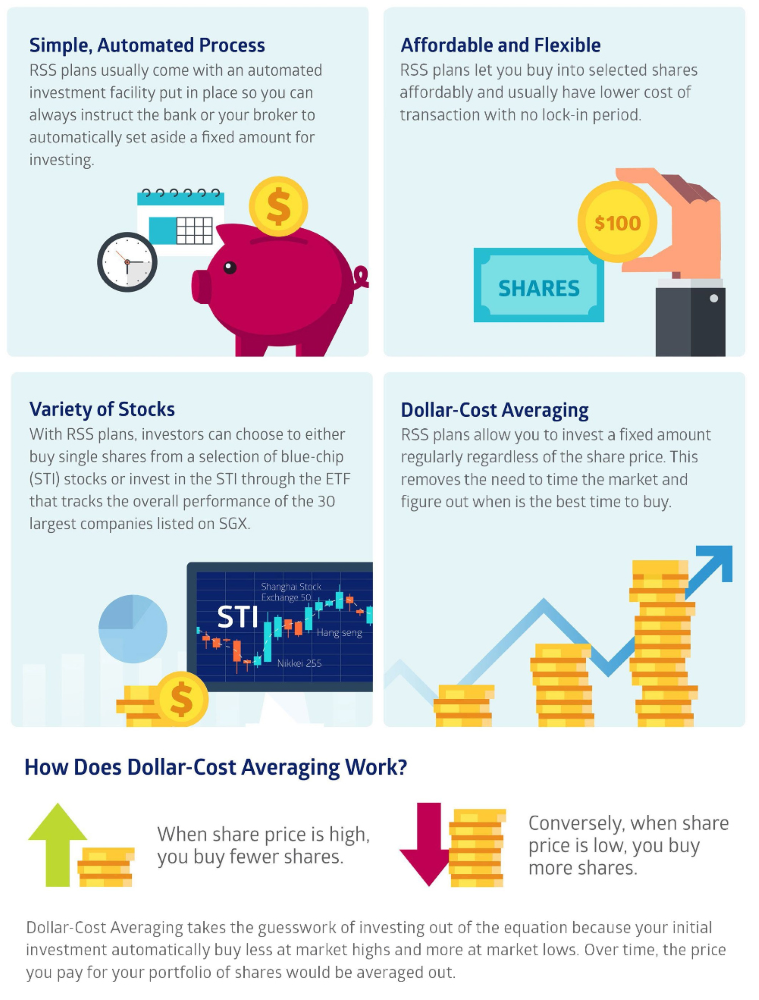

An RSP is simply a regular investment plan that helps you invest a fixed sum of money into shares, exchange-traded funds (ETFs) or unit trusts (UTs) on a periodic basis every month. When you set up an RSP, you’ll be automating your investments to buy more shares when prices are low, and fewer shares when prices go up (see below chart from SGX Academy).

Most of us already do this naturally – stock up on something when it is cheap, and less when it is more expensive. The difference is that an RSP automatically does that for you, so you don’t even need to lift a finger every month to achieve that.

This is also known as Dollar Cost Averaging (DCA), which is a simple but effective strategy to invest, as it helps you to avoid timing the markets and stay invested over time to let your money compound.

You can set up an RSP to dollar cost average into your choice of investments such as ETFs, unit trusts, individual stocks, etc. For most investors, as your investments add up over time, an RSP can be seen as one of your fundamental building blocks in your investment portfolio, providing you with a solid capital base towards having a decent nest-egg for your future.

Who are RSPs suitable for?

Given the relative hands-off nature of RSPs, they’re great for the following groups:

- People who do not have a large sum of money (e.g. young investors)

- Investors who may not have sufficient expertise, time, means and resources to monitor the market constantly, and react accordingly.

- Folks who can’t be bothered to manually invest each time and prefer to automate their investments, since RSPs run on auto-pilot after your initial set up

- Parents who wish to invest for their children without too much effort

As a parent myself, I find RSPs a great tool to use for children if you’re hoping to raise them to become financially savvy, while leaving them a legacy portfolio for when they come of age, at the same time. You can read my prior interview here with a corporate high-flyer who uses this exact same method for his kids.

Setting up your RSP on FSMOne

I’ve talked about how you can ride on Singapore’s economic growth through various local ETFs offered by NikkoAM a.k.a. one of the more reputable ETF managers here.

If you wish to automate that, you can consider setting up a regular savings plan via FSMOne’s ETF RSP feature.

Among the local RSP providers, I like FSMOne the most right now as their charges are the lowest at just 0.08% (min. S$1) per transaction (source). No other brokerage comes close, and the only cheaper way would be to do it yourself via a low-cost digital brokerage. If you have lots of time, discipline and energy but less money, then you can decide for yourself if the cost difference is worth the convenience of having it automated for you.

P.S. You can now enjoy 0% processing fees for RSPs on FSMOne from now until December 2023! As an investor, you can also select your desired frequency of how often you wish to buy into the ETF every month, up to a maximum of 4 times per month and with a minimum starting amount of just S$50.

Message from Sponsor Make 2023 the year you start getting into a habit of investing regularly. As a bonus reward, you might even walk away with some exciting prizes such as a fitness watch (Apple Watch Series 9) or the latest vacuum (Dyson V8 Slim Fluffy). From now until 22 October 2023, invest a minimum of S$200 a month into any of the following Nikko Asset Management ETFs via FSMOne’s ETF RSP feature to be eligible for the lucky draw: - Nikko AM Singapore STI ETF (G3B) - NikkoAM-ICBCSG China Bond ETF SGD (ZHS) - NikkoAM-StraitsTrading Asia ex Japan REIT ETF (CFA) - NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobile ETF (EVS) - Nikko AM SGD Investment Grade Corporate Bond ETF (MBH) - Nikko AM ABF Singapore Bond Index Fund (A35) And if you’re a new FSMOne customer opening your account for the first time for this RSP promotion, you’ll also receive $10 worth of cash credited to your FSMOne Cash Account!

For the full details of the promotion, find out more here!

Read how to set up your ETF Regular Savings Plan on FSMOne here.

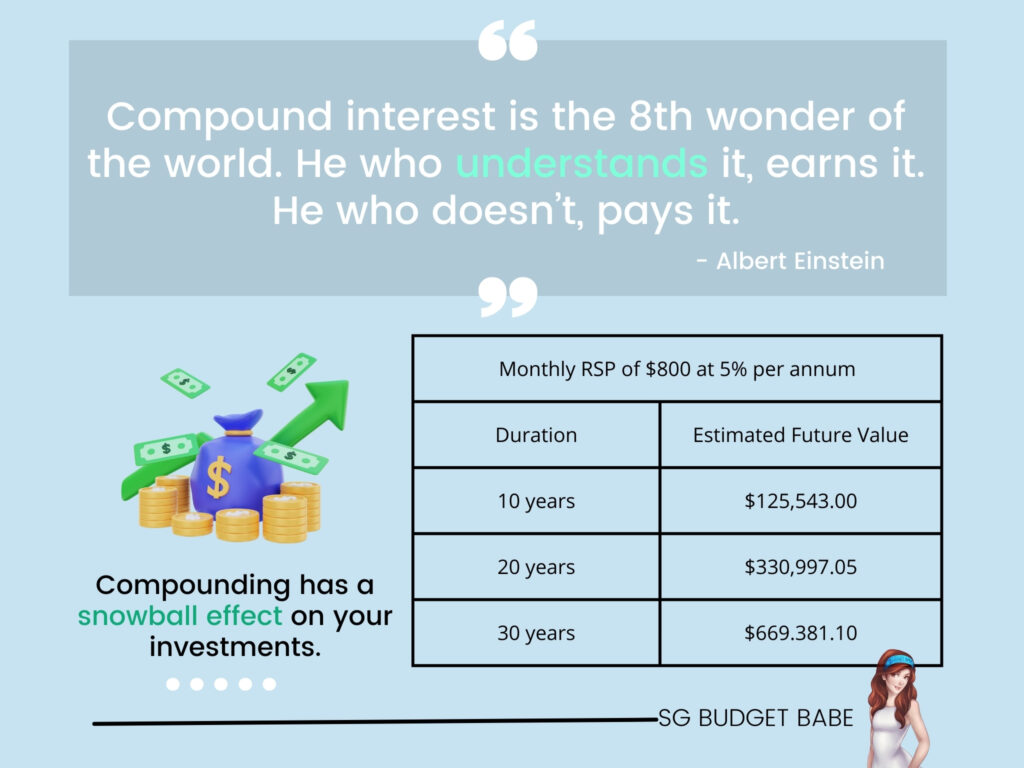

In the long run, the cumulative value of your RSP investments will naturally grow, boosted by the power of compounding. And the best part? You would have been able to benefit from the most overlooked eighth wonder in the world – compound interest (over time) – without even doing anything.

Disclaimer: Whether an RSP or lump-sum investing will work better for you is a deeply personal decision that you will have to make. There are no guarantees that either method will outperform the other as it depends on many factors, some of which have been highlighted. Investing involves a possible loss of your capital and automating your investments through an RSP does not protect you from this risk – nothing can. If you are not a full-time investor who is committed to monitoring the markets closely to act on lump-sum investing whenever the (time) opportunity appears, then doing dollar-cost averaging through an RSP may be an option you want to consider instead.

Keen to learn more about the benefits of RSPs? Read about regular investing on the Nikko AM website here.

TLDR Conclusion

As someone who has been investing actively for over a decade, the biggest mistake I see most people do today is not setting up their fundamental investment building blocks for their future.

If that’s you, and you have been procrastinating on starting your investment journey because you didn’t know how to or are too overwhelmed to start, then this article is for you.

If you ask me, I feel you can make a real difference to your own financial future when you set up a Regular Savings Plan as a commitment device.

With the ease of use, low minimum sums (from as little as $50) and an easy set up – you can benefit* from a RSP.

So start investing today, even if it is just $200 a month.

Your future self will thank you.

*Note: RSPs are still subject to investment risks. Important Note: Monthly investment plans in Singapore are all custodised accounts. This means that the shares will be held under FSMOne and not in your own CDP account, however, you can always pay a transfer of the shares to your CDP account if you wish.

Disclosure: This article is brought to you in collaboration with Nikko Asset Management Asia Limited. All calculations and opinions are that of my own. Nothing in this post is to be constituted as financial advice since I do not know the details of your personal circumstances. You are encouraged to read more about RSPs on MAS-licensed providers including FSMOne and Nikko Asset Management to help you understand and decide on how an RSP can fit into your investment objectives. Information is accurate as of 3 October 2023.

Important Information by Nikko Asset Management Asia Limited: This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”). Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund. The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore. Nikko Asset Management Asia Limited. Registration Number 198202562H.