Have you ever wondered how a typical day is like for a professional forex trader? Or how life would be like, 10 years down the road, if you start putting your capital to work in the stock / forex markets now while you’re still in your 20s?

|

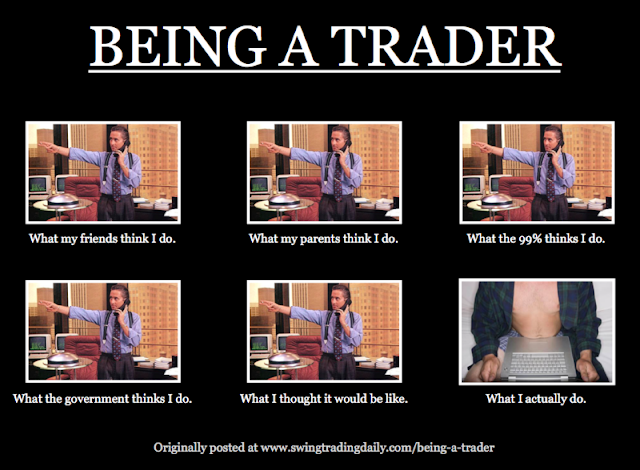

| Just for laughs! |

I must admit, I’ve always been seduced by the idea of becoming a full-time investor. While most of my investments are parked in equities at the moment, I know of folks who make their living from being a full-time forex trader, and have always been curious about how their journey has been thus far.

I was recently introduced to Mr. Terence Tan, a 37-year-old who left a 5-digit monthly-paying job to become a full-time professional forex trader in April last year. (He was also one of 4 traders who were recently rewarded with a helicopter sightseeing tour around Singapore by IG.) I interviewed him to find out more about how his life has been so far and his answers were so insightful that I thought it’ll be worthwhile publishing them here to share with you guys.

Having graduated from NUS Computer Engineering, Terence initially started buying stocks together with his peers in 2005. After learning that technical analysis (TA) works better on Forex due to better liquidity, he made the switch to Forex Trading a year later and has never looked back since. He mostly relies on his algorithm to trade for him, which has since given him 85% profit over the last 3.5 years.

Upon hearing those numbers, I expected Terence to tell me about how much effort and hours he spends on forex trading. However, contrary to what I thought, Terence does not spend most of his time monitoring live forex data on his computer screen. Having already done most of his homework when he first started out (he did a lot of self-studying and got CMT-certified in 2013), he then focused his efforts on developing an algorithm which would work for him. While there is indeed a lot of analysing work required on the FX market, most of his trades are passively managed by the program which he self-built.

Note: The section below was based on my interview with Terence Tan . His replies appended below my questions are direct quotes from him.

My trading is mainly done algorithmically, which means that I set out the buying and selling rules in a computer program, and that program trades for me automatically. I have been algo trading for four years now. A typical day for me starts with me logging in to see how the algo is performing so far, before getting ready to go to the office or gym in the morning. When I get to office, it is about either testing out existing strategies that I am looking to develop further, or exploring/discovering new trading strategies with the help of various tools.

Do you have a target each day? Any KPIs?

I guess the question is more like “Do I give my algo a KPI?” haha! The latest algo that is going live soon is looking at about 1% profit every 1-2 weeks. Doesn’t sound like a lot, but when you look at it annually, it is targeting about +50% per year.

Do you enjoy working alone? Do you interact with other traders?

I like the quietness which allows me to think deeply when developing new algos or fine-tuning existing ones. I also like to network with traders (esp. algo traders) to discuss about various different angles of looking at the same markets.

How do you balance your family time, especially if you trade at night?

Once I reach home, that time is dedicated to my little baby (currently 13 months old) and my wife, where we have dinner over Korean dramas (we just started on Descendants of the Sun!). Once our baby is asleep, I sometimes continue to work on my algos if I had been doing something on the algos halfway before leaving office.

How do you deal with the stress of Forex?

I find that trading is stress-free to me! Once trading is done algorithmically, the program does all the buying and selling decisions based on the rules that I have set within it. That takes away the fear and greed elements of trading, and it becomes very mechanical. I must say that it also allows me to be fully detached from the market, and allows me to look at the market in a very rational and quantitative matter.

There’s one advantage which IG has over all the rest of the forex trading platforms: Guaranteed Stops. Instead of placing a normal Stop Order to cut my losses when the market goes against my position, I can instead choose to use a Guaranteed Stop instead, which prevents my Stop order to be filled with a large slippage when I feel the market is extremely choppy.

Loads! The main differentiating factor is that it supports this 3rd party platform called ProRealTime, that allows anyone to set their buy and sell trading rules in, almost without the use of programming knowledge. I am using that a lot in trying to discover new trading strategies whenever I hear about them from internet sources or from friends. IG also supports MetaTrader 4 (or simply MT4) which is extremely useful and easy to use for traders who are able to pick up programming and thus implementing their trading strategies within MT4. I also keep a manual trading account with IG for those times when I spot a new trend emerging from the markets, and simply just want to take advantage of this new trend.

Your experience using IG so far?

One of the best price quality in the market as it is fair and transparent. I also like the wide range of products offered, which are useful for me to monitor other markets even when I am not trading them. I especially love the Guaranteed Stops, that’s unique in the Forex market space.

Most memorable experience thus far trading Forex?

I must say Technical Analysis and Price Action works so much better on Forex than other markets, that I urge anyone who is still trading only stocks to start looking at Forex.

Any advice for those who are interested to pick up Forex?

Be conservative yet be ambitious. Do not be afraid of the leverage that you can get with Forex, yet do not abuse that. A good starting leverage factor to use when starting out trading Forex is about five to ten times. Also, keep at it, do not be discouraged by losses when you get them, it’s simply part of the game. Just aim to be overall profitable.

Any last words for BB’s readers?

Get started right now, while you are still young enough to profit from the fruits of your hard work in trading.

All views expressed in the article are the independent opinion of Budget Babe. Sponsored by IG Asia Pte Ltd.

6 comments

Forex is cited on an "offer" and "offer" value framework. This implies you can purchase a coin from a merchant for their "offer" cost. Forex business sector is unquestionably not a diversion for novice and you have to catch up on your aptitudes before getting your hands wet.You need more data welcome to visit us Usa Forex Signals

including reasonable comments here… Code Fibo Scam

Forex is really good for those who are willing to earn high returns from the market. Services of advisories like epic research are always beneficial for earning better returns.

Due to the various currencies, people in this business have a lot of options and there is actually a very small percentage of a possibility for a downfall.

— Sani Nair( epic research )

SBI to hike minimum balance for savings A/c; hit 310 mn people State Bank of India has decided to increase manifold the minimum balance required for maintaining savings account from April 1, hitting 31 crore depositors including pensioners and students.

Equity tips

Thank you a bunch for this with all of us you actually realize what you are talking about! Bookmarked. Please also seek advice from my site =). We could have a hyperlink change contract between us!Forex Trade Copier

Comments are closed.