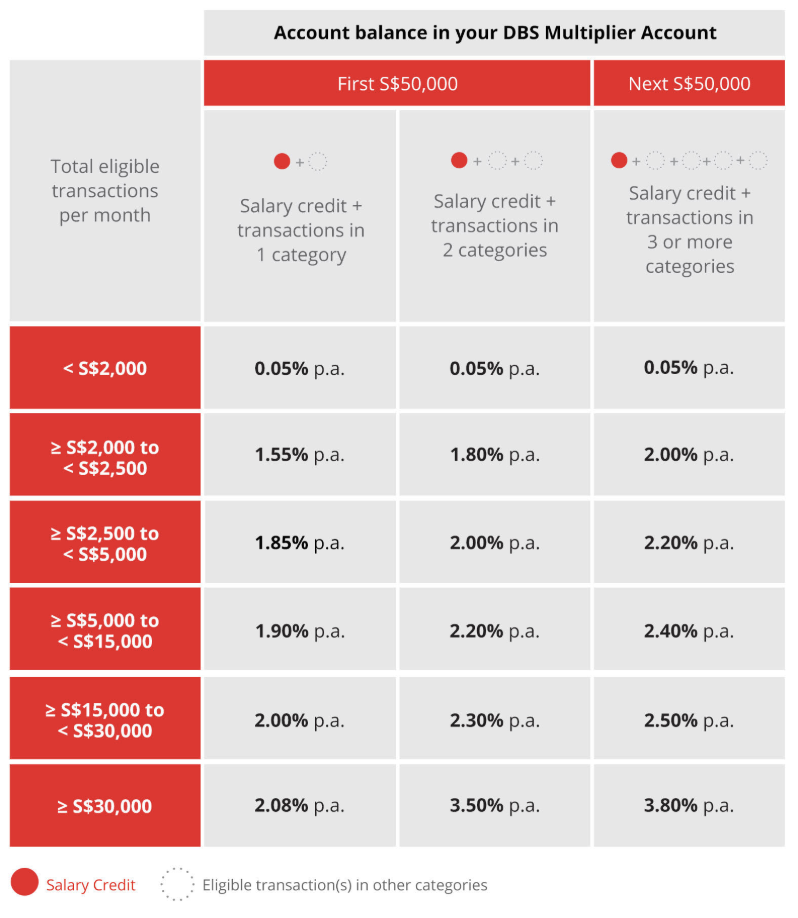

DBS has just announced several changes to their Multiplier account. What do these changes mean for you?

For those unfamiliar with the DBS Multiplier account, you may refer to this previous article I wrote to understand how the account works, and what kind of interest rate you can realistically expect from it.

One of the drawbacks of the (previous) DBS Multiplier account was that the bonus interest was capped at the first $50,000 in deposits. For folks with savings higher than that amount, it thus made more sense to park the rest of your savings into another high-yield savings account instead.

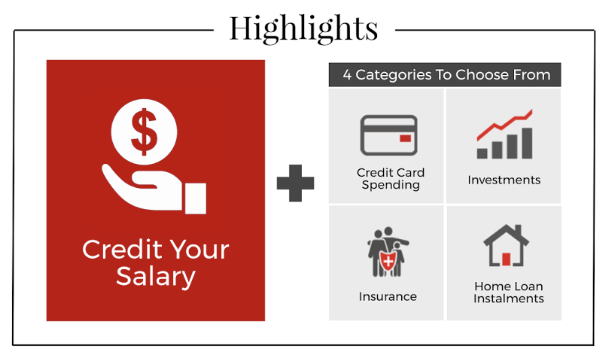

The revamped DBS Multiplier changes can be summarised in 2 aspects:

- Get up to 3.8% interest p.a.

- If you meet 3 transaction categories

- This bonus interest is on your next $50,000

I’ll detail a few hacks to get the most out of the DBS Multiplier Account in this article. So before you jump, understand how it works first and checks if the changes will benefit you.

DBS Multiplier Account: Pros vs. Cons

The key consideration in deciding whether the DBS Multiplier Account will work for you lies in whether you can fulfil the salary credit criteria together with at least 2 transaction categories (out of 4). The more you transact each month, the more bonus interest you earn.

It’s a great starter account for almost everyone I can think of.

What’s there to like about the DBS Multiplier Account

1) Salary Credit – Two parties can benefit from a single salary credit

Did you know that a single salary credit can help you qualify for bonus interest on both accounts? Simply:

- Open a DBS Multiplier account each

- Open a joint DBS/POSB account with your spouse

- One of you will credit your salary into this joint account

- Both of you will now fulfil the salary credit portion for each of your Multiplier accounts!

Update: Many of you have messaged me asking if your salary credit to POSB SAYE qualifies for the bonus interest on DBS Multiplier as well. The answer is, yes it does!

2) Credit Card Spending – There’s no minimum transaction required

I love the OCBC 360 and UOB One account, but one downside is that you’ve to spend a minimum of $500 on the bank’s credit card(s). The only problem is, that credit card might not be the best for your lifestyle spending and needs…or you might fail to hit the minimum amount required every month.

DBS has an interesting proposition here where they do not impose any minimum spend on the credit card spending category for your DBS Multiplier account. You read that right, that means that even $1 on any DBS/POSB credit card will help you to qualify for the category!

Unbelievable, but totally real.

- purchase stocks/bonds/unit trusts/RSP plans and/or

- credit your CDP dividends into any DBS/POSB account!

This means that if you credit your CDP dividends into your joint account that you used in (1) for salary credit, the same trick applies – one person’s CDP crediting will help both parties to qualify for the bonus interest for this category. Perfect if you’re married to a lazy partner who needs you to manage his savings for him.

I would personally just use DBS Vickers to make more equity transactions for this category though. Especially if you do cash upfront trades, for which DBS Vickers’ 0.12% fee and $10 minimum commission is among the lowest in the market.

4) Insurance – term, medical and retirement plans are accepted too

Most of the other banks require you to commit to a life insurance or endowment plan in order to meet this category requirement, but DBS gives you a lot more flexibility when it comes to product choices (see full list here). It is also the only bank that doesn’t impose a minimum premium amount before you qualify, which is superior because

- OCBC 360 requires a minimum of $2,000 yearly premiums for term life insurance (my term insurance doesn’t cost me anywhere near that amount)

- Maybank SaveUp requires a minimum of $5,000

- Standard Chartered Bonus$aver imposes a minimum of $12,000 annual premiums

Another trick is that you just need to be the policy-owner. There’s no rule stipulating that you have to be the life insured in order for you to qualify. You’ll need to buy the insurance plan of your choice either through a DBS relationship manager at one of their branches, or apply directly online.

What this means is that for parents looking to buy a term life insurance on your child, this might just make perfect sense because premiums are generally cheaper (due to their young age) and it helps you to earn bonus interest too, since you own the policy.

I can get an insurance plan for my 5-month-old son to qualify 😉

5) Home Loan Instalments – if you have a DBS/POSB home loan

If your mortgage loan is with DBS or POSB, you might want to pay close attention. If you’re on HDB Loan, you should always consider refinancing every few years anyway to pay lower interest, and DBS/POSB home loans can generally be quite competitive so it’s worth a look.

DBS Multiplier is the only high-yield bank account that recognises home loan instalments for the entire duration of your loan.

To qualify for this category, you only need to be a borrower on the loan, but not necessarily the one paying (be it in cash or CPF).

Here are a few scenarios that could play out:

- Unmarried son buys a house with their retired parent. Both names are on the loan, but only the son pays each month

- (Couples) The employed spouse pays monthly instalments via cash, whereas the other pays via CPF

- (Couples) The employed spouse pays via cash, whereas the other unemployed partner doesn’t pay a single cent

In each of these cases, you can be the borrower on the loan (but not the one paying) and still qualify for this category. DBS is also the only bank to recognise joint borrowers in this way and reward you with bonus interest on your DBS Multiplier account for beyond the first 12 months of instalments! You’ll continue to get rewarded till the end of your loan tenure.

What’s there (not) to like about the revamped DBS Multiplier Account

The two new changes sound fantastic, but that’s only if you’re able to meet the additional requirements of another qualifying category and extra deposits.

It’s not too hard, but may not be that easy for some people as well.

If you don’t have or don’t intend to get a home loan with the bank, the Insurance category might be the next easier milestone to hit, especially on a low-cost term life plan.

The biggest beneficiaries of the changes would be folks who transact across several categories with DBS, more so if your volumes are above $30,000 with the bank – either through a high salary credit or significant equity transactions (especially if you trade frequently and/or purchase significant lots each time you buy any stock). But unlike other high-yield savings accounts, DBS does not impose a minimum per category, leaving you free to tweak what works for you.

Is the DBS Multiplier the best for me?

Yes and no. The answer is, it depends on whether you can meet the qualifying criteria, as with every other high-yield savings account available in the market today.

If you can’t meet the home loan criteria, it is still not too difficult to transact across credit card + insurance + investments. I’ve already shared how exactly I intend to do this.

Moreover, two features I really like about the DBS Multiplier account is that

- It is the easiest way to earn bonus interest because you don’t have to worry about minimum spend. That makes it super convenient to ensure you’ll be getting a decent interest every month.

- It concurrently serves as a multi-currency account.

2 comments

"You'll need to buy the insurance plan of your choice either through a DBS relationship manager at one of their branches, or apply directly online."

hi BB, do you know where is the to apply directly? i am currenly overseas, so i cant go down to the branch

Through your ibanking interface! Can also apply credit cards and some other accounts directly via there 😉

Comments are closed.