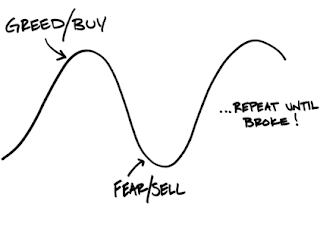

A month ago, I wrote about how one should not be too tempted by a stock’s 52-week low prices because I foresaw that markets would continue to fall, and advised readers to focus on getting their fundamentals right first before jumping in.

However, I got a few criticisms from some readers, all of which could be summarized into:

“Who does she think she is? As if she can foretell the market!”

“Rather than trying to time the market, I will buy at low prices, which includes when a stock price touches its 52-week low.”

Quite a number of investors were going in after the STI recovered from its “bear” levels of 2800+ and broke resistance at 3000 points again.

Well, let’s just say that the stock market’s performance this week clearly shows that the worse is yet to come.

Rickmers Maritime have declared that they will be suspending their dividends payouts. This was a darling stock for many income investors (those who mainly look at dividend yield when buying) as it was trading at high levels of even 13% – 14% payouts i.e. if you invested $10,000 you could expect to get back $1,300 every year. The news certainly came as a shock, though it wasn’t entirely unexpected.

Nera Telecommunications have reported reduced earnings for their third quarter this year, which is down by 43.3% from the same quarter last year. They have also acknowledged that the environment ahead will continue to be challenging, and it is uncertain if they will continue to maintain their relatively high dividend payouts of ~6% for most retail investors. This stock caught the attention of many investors in recent years, but its stock price has since declined significantly with the news.

Cache Logistics Trust issued new units to raise funds from investors, but effectively diluting shareholder interests in the process. The stock is currently trading near its lowest levels since its IPO, but do you have faith in the management so as to stay vested, or even jump in? I certainly don’t feel like the management is aligned to the interests of its stakeholders, so this is something I’m taking off my watchlist for now.

OSIM International has been seeing its earnings fall despite the launch of new massage chairs. Growth has slowed significantly and the future looks bleak. The share price has declined by as much as 17% in the last few weeks alone. Those who had rushed into buying in July and September when the stock was trading at its 52-week low ($1.44) are feeling the pain with today’s price of $1.36.

Fellow financial blogger Christopher, who is better recognized as a key income investor who relies on his investment income which allowed him to become financially independent at 39, has also blogged about his recent actions after the spate of bad news here.

With 3QFY15 results out for many companies, many are now acknowledging the very bleak reality that the markets can only get worse from here.

So what should we do now?

My advice remains the same – focus on getting company fundamentals right first and don’t be too greedy to jump in. I cannot predict the market, but I will still be waiting out on the sidelines watching before I go in.

I’ll also be clearing some of my annual leave in the coming weeks to spend some time on investment matters with fellow like-minded friends, to equip myself better for when the market drops. What about you? Are you looking at prices alone, or are you really delving into company research and fundamentals to make sure you’re eyeing the right stocks?

With love,

Budget Babe

4 comments

I personally feel that Asia is due for a major correction. The 2008 global financial crisis did not affect us too much thanks to a wave of hot money from China. Now that China is slowing down (some say going into recession), we may see a repeat of 1997-2003 where Singapore undergo a real battle tested recession.

Hi BB,

Guess the world is a little uncertain now with all the easy money floating in usa, europe, Japan for so many yrs now. In addition to China's rising debt-to-GDP ratio n its rising inventories in the heavy industry, plus EMs potential risks, the outlook ahead is hazy. Sg strong interconnectivity with these economies will not escape the haze blown into our country. Guess having a well diversified portfolio now is important.

Well BB,

What's bad for me may be good for you as you are in an aggressively accumulation stage in your life.

There's no better time to invest in dividend stocks. Caveat is to focus on variety and target up to about 20-30 counters.

Regards

I came to know your blog through a mutual friend whom you know. Good post!

Doesnt matter if market is bleak – its the time to hunt for opportunities, to train the investor in being disciplined and not run away from the first sign of economic trouble. Companies' earnings go up and down, depending on the type of business. As long as you have studied the internal analysis of a firm's capabilities and the business model, you are able to have a stronger conviction. You can also do a bankruptcy test to assess if the firm fails. In terms of management, look at how the CEO/Managers utilise their assests, actively hunt for growth or be superbly conservative. Ask questions to management. Send email and schedule a call. Hope to see u around 🙂

10 people say market is doomed. You say the business will work. You will see a vision moving forward 🙂

Comments are closed.