If you thought the name Webull sounded familiar, you probably read it in passing in 2021; in the aftermath of the Gamestop saga on Robinhood where many US retail investors flocked to Webull instead.

The good news is, Webull has finally launched in Singapore and is officially the cheapest brokerage you can use, because it is FREE^ to trade with them. No commission fees and zero platform fees^!

The bad news is, you only get access to the US and Hong Kong markets – for now.

Details below.

No commissions or platform fees^

Webull isn’t the first low-cost, digital brokerage in Singapore.

But they’re certainly disrupting the market with their entry, because you don’t have to pay anything for Webull’s services. No commission fees, and no platform fees either^.

If you’re looking for the cheapest broker to buy US shares / US options / HK stocks in Singapore, there’s no competition for now – Webull wins, hands down.

Of course, the reason why I can’t say it is completely free is because the usual fees that are payable to regulatory authorities and clearing houses apply – these are pretty standard across every broker you use, so there’s no escaping that. Even if you use another broker, you’ll still be incurring those type of fees.

Many of the other platforms have since moved to offering zero commissions on US stocks, but their platform fees remain. Webull, on the other hand, charges nothing for their platform, and has extended the zero commissions for not just US stocks, but also US options and ETFs as well^!

Key Benefits

Aside from being the cheapest brokerage at the moment, there are also other features to like:

- Easy and intuitive user interface

- Fractional shares for most US stocks and ETFs – from as low as US$5

- Stock screener – filter based on financial metrics such as PE ratios or EPS to get stock ideas

- Technical charting tools – the app gives you 17-line chart options and 60 technical indicators so you’ll be spoilt for choice.

- Get real-time quotes with access* to NASDAQ TotalView and NBBO quotes, and OPRA data subscription

- Competitive foreign currency conversion rates – only a small spread over the Interbank rate

- Fast deposits – via electronic DDA (almost instant), FAST or telegraphic transfers. (Tip: go for eDDA or FAST instead, and avoid TTs which comes with bank charges)

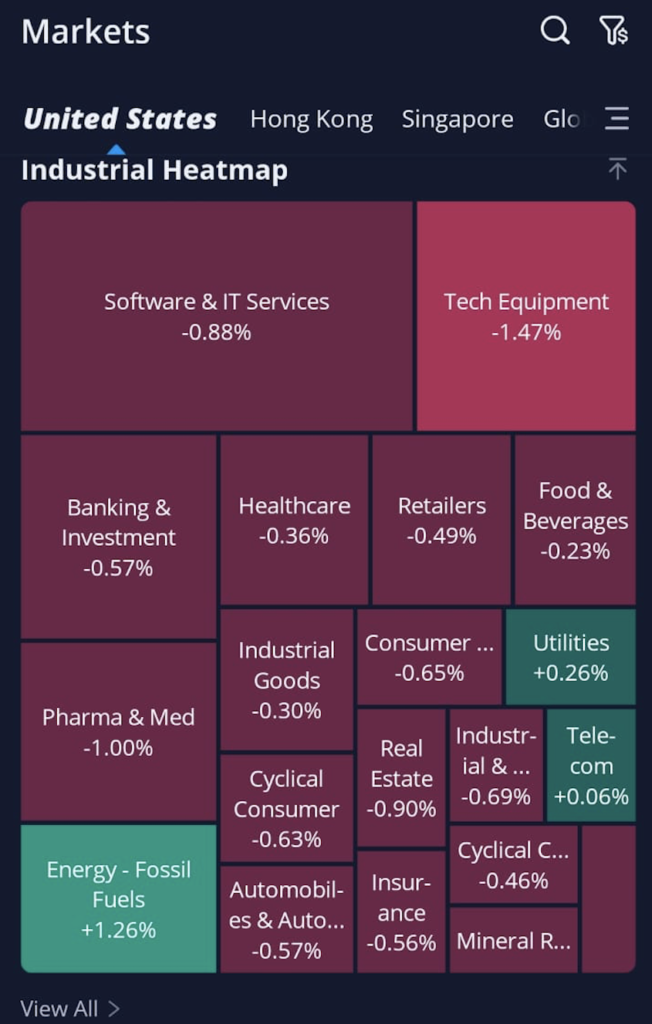

I quite like the Industry Heatmap, which provides me with an easy overview to get a sense of which sectors might be overbought or oversold at the moment. Another feature that some of you who are more into index investing may like would be the Popular ETFs page, which can give you ideas on more ETFs to explore for your own portfolio.

Don’t just take my word for it, download to try it out for yourself and see how easy it is to navigate the app!

And when it comes to withdrawals, take note of the handling fee; this is S$20 and charged by the remitting bank (not Webull).

*Complimentary access to Level 2 US market data (NASDAQ TotalView) for the first month. Complimentary real-time data subscription to Options Price Reporting Authority (OPRA) for 1 month, which can be extended for an infinite number of times as long as you execute 1 options trade every 30 calendar days.

Cheapest for US / HK markets

If you’re based in Singapore, Webull is undisputedly the cheapest brokerage you can find if you’re investing or trading in the US or Hong Kong markets.

It doesn’t make much sense to use the local brokers for overseas stocks, because of the hefty custodian fees (usually $2 per counter per month!) and dividend handling fees that they charge. As a beginner, these fees can add up real quick and limit the moves / shareholdings you can make! That’s why for overseas markets, I recommend going with a low-cost digital brokerage instead.

You can buy or sell any US stock, option or ETF on Webull with zero commission or platform fees^. For Hong Kong, this is limited to stocks and ETFs only.

Unfortunately, Webull currently does not have access to SGX stocks, so I recommend that you pair it with another brokerage that can give you low-cost access.

For those of you adamant about owning your SGX stocks instead of having it in custody, I recommend DBS Vickers (Cash Upfront) for its low $10 fees.

Any downsides?

For beginners, I do think you guys should definitely consider using Webull because:

- The interface is super intuitive and easy to navigate, making it less likely for you to accidentally make mistakes.

- Its fractional shares feature will allow you to build your portfolio across several US stocks and ETFs, even if you have a smaller starting capital.

- The fees are

super lowthe cheapest.

Having said that, if you’re a seasoned investor who’s gotten used to trading on desktop, then Webull might not be as appealing to you as they only have a mobile app for now.

For investors who want access to multiple markets within a single broker, note that Webull only has the US and HK markets for now. This may change in the future as they expand, though.

Is Webull safe to use?

If you were wondering, Webull Securities (Singapore) Pte. Ltd. is regulated by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services (CMS) Licence to operate here.

In terms of its background, Webull was founded by ex-Alibaba employee Wang Anquan, and its parent company is Fumi Technology – a Chinese holding company with financial backing from Xiaomi, Shunwei Capital, and other private equity investors in China.

Their global Twitter account has over 117k followers, and they’re pretty mainstream / popular in the US among retail investors. So while they may be fairly new to the Singapore market, they’re definitely not a newbie in the global scene at all.

In terms of your assets, they are held in custody and any monies that you deposit with Webull are held in trust. These are the requirements as a MAS licensed custodian, and Webull is required to comply with the Securities and Futures Act and all subsidiary legislations. In the US, Webull has also built a strong and secure name for itself as it is also regulated by the SEC and is a member of the Securities Investor Protection Corporation (SIPC), so I reckon there’s little incentive for them to jeopardize their business in any way.

And for those of you who are super worried, even in the rare event of insolvency, liquidators will have no claim to your assets held by Webull. You can read more about these rules binding Webull here.

Personally, all my Singapore stocks go through the local (bank) brokers and are owned directly in my CDP account, whereas I use a mix of low-cost brokers for my US and HK trades.

Now that Webull is offering FREE trades for US stocks, options and ETFs as well as HK stocks and ETFs^, I’ll be using them as well.

Welcome Offer

As part of their sign-up offer, you can now get up to USD 100 worth of TSLA fractional shares when you register and trade with Webull^.

Note: The welcome offers change periodically, so be sure to check this page for their latest promotion before you sign up.

In short, I do think it is worth signing up with Webull, especially given how you get charged the lowest fees for your trades on the US and HK market.

Keen to get started?

Sign up for an account here today.

Disclosure: I’ve included my own affiliate links in the article. This article is written in collaboration with the Webull Singapore team, especially for fact-checking! All opinions are independent and that of my own.

^Terms and Conditions Apply. Please refer to https://www.Webull.com.sg/ for more information.