|

| If you can jump over this gap, then congratulations! Perhaps you’ll receive a huge payout sum from your life insurance policy. However, in real life, this hardly ever happens. |

Any agent who tries to sell me whole life insurance will, very quickly, find that I don’t give them my sale.

Yes, you read that right. Budget Babe is strongly against buying whole life insurance. I expect to get a lot of hate mail from insurance agents after this post, but if no one speaks up for the consumers, then who will?

So here goes!

1. I don’t need it.

Whole life insurance is not necessarily a bad product, but it just isn’t suitable for me, nor for most of my peers who are still fairly young working adults.

Despite its name, if you asked me, life insurance should really be called death insurance instead, because it is mainly designed to pay out upon the insured’s death.

This means that the money doesn’t come back to you until you die. And if I die, then why on earth do I need the money? (Spot the pun? Oh, never mind -.-)

The money will mainly go to my loved ones when I die. Which means that if you’re a selfish idiot, or are poor and lonely, then you might as well skip the life insurance.

|

| Credits: MetLife, an insurance company. |

Having said that, who needs whole life insurance? I can generally think of a few scenarios. The first is if you think your family won’t have enough to cover your death expenses (like the hospital fees, if you were brought there before you died, or your funeral costs). Or if you have a spouse or children who might not have enough income to live on should you pass away prematurely.

But none of these sound like me! Right now, I’m single, and my parents / sister aren’t that poor that they can’t even afford my funeral expenses if I die tomorrow. (Touch wood! Thank goodness I’m typing on a wooden table.) I’m not married yet, nor do I have any children, so there’s really no need for me to get life insurance at all.

Agents who have been trying to sell me whole life insurance try to convince me that it is cheaper to buy now than later. Yes, that may be true, but why should I buy something I don’t need?

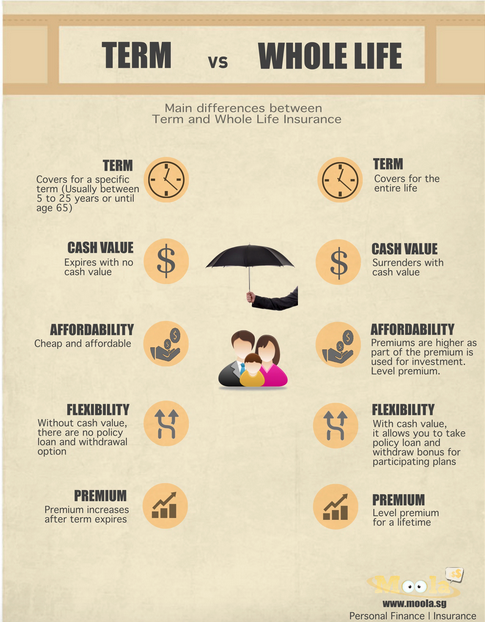

2. There are cheaper alternatives.

The main reason why I don’t buy whole life insurance is because I don’t see the point of paying over 10 times more the price of something I can get at a much cheaper rate.

I’m an advocate on term insurance (more on that in another post), which is also what I’ve bought for myself. Take a quick look on CompareFirst to see the huge differences you have to pay for yourself.

Whole -life insurance for $200,000 assured:

Term insurance for the same coverage:

In other words,

If you can get the same gold bar for $1,000, why do you want to pay $17,000 for it?

But your insurance agent will conveniently leave out the fact that there is a lower-cost option available, or they’ll try to dissuade you by “sharing” about its negative sides.

3. Whole life insurance gives higher agent commissions to agents than term insurance.

No one ever got rich from selling only term insurance, and there’s a good reason why. It is a well-known fact that whole life insurance policies pay out higher commissions than the paltry sums term insurance gives.

If my agent is being paid higher to sell me Product A over Product B, that’s a conflict of interest to me. I spoke to 3 separate “financial advisors” telling them I wanted to buy term insurance, and every single one of them tried to convince me to take up whole life insurance instead. (I teach my GP kids that anything which is put in quotation marks by the author basically means the author’s disagreement with the quote, so no prizes for guessing what I think about that!)

The next time your agent tries to sell you life insurance, look them in the eye and ask, “How much do you get for the next 3 years if I buy this from you today?”

I bet you they’ll flinch, or try to smoke you with some lousy answer. But rubbish has a smell, and I’m sure you’ll be able to sniff it out by yourself.

4. Lack of transparency.

Here’s the biggest reason why I terminated my ILP – I got irritated when I found out how much truth had been conveniently “hidden” from me in the process of selling me the policy. (Well, not really “hidden”, because it was clearly stated in one of the clauses under the extremely lengthy terms & conditions. Does anyone even read that?)

When I first bought it, no. But 2 years later, while reviewing my policy, I decided to take a look, and I realized that there were many factors that had not been laid out clearly for me before I bought.

In other words, I had made an uninformed decision when I bought my insurance policy back then.

Ah, the foolishness of youth!

Any insurance policy that promises to give you a payout when you’re still alive should be a sure red flag for you to check their terms and conditions, because there is truly such a good thing, then all insurance companies would be broke. When I read my terms and conditions, the biggest thing that struck me was the lack of transparency in fees. For instance, there is first the commission to the insurance agent who sold me the product. Then there are also “distribution costs”, administrative costs, the actual cost of the insurance, etc. The worse part? I also read something about the insurer having the right to modify the allocation of fees without notification to the consumer at any time, and that was the last straw for me.

5. Whole life policies are one of the most popular insurance plans sold – does that have anything to do with the massive wealth of insurance companies?

Insurance companies are rich. Anybody knows that.

But what bothers me is the fact that among the most popular / best-selling policies of many insurance companies, are whole-life policies, ILPs and endowment plans. (I’ll write on the other two types next time)

Coincidence? Or are our consumer dollars paying towards that wealth?

You also probably know about the MDRT – Million Dollar RoundTable within insurance companies. The name speaks for itself, but here’s a post I quote from the blog belonging to the ex-CEO of NTUC Income:

|

| Credits: Tan Kin Lian (ex-CEO of NTUC Income) blog |

Conclusion:

Before buying a life insurance policy, ask yourself these questions first:

– Have I looked at the other options available?

– Can I get the same insurance coverage at a cheaper price?

– How much is my agent and his insurance company earning from this sale?

Our needs change at different periods of our life. For instance, right now I don’t need life insurance, but when I get married and have kids (and hopefully more wealthy by then), I might just purchase whole life insurance, especially if I think my husband may not be able to cope by himself if I leave this Earth earlier than planned.

The biggest question you should ask yourself is – Do I need life insurance now?

If you don’t, then there’s no harm waiting. And don’t be swayed by what your financial advisors tell you – there’s really no point in paying extra years for a policy that you do not need now.

From a pure insurance perspective, whole life insurance is generally not needed for the majority of young people. It is also much more expensive than term insurance (17 times more!).

So if you ask me, I’ll say: Forget whole life insurance. Buy term insurance, and invest the rest.

|

| Credits: Moola |

I’ll be writing about my own experience and decision in buying term insurance soon, so stay tuned.

In the meantime, if you liked this, you might also want to read my post on Say No to the Financial Advisor – The Best FA Is Myself which I wrote for DrWealth.

Disclaimer: Budget Babe is not a qualified financial advisor, and all statements on this post are purely of her own opinion and should be misconstrued as fact. In any case, consumers should always speak to a qualified insurance agent before making decisions on any purchase of insurance policies.

45 comments

Hi BB,

I saw this and I just had to log in to comment.

Thanks for writing this post, I think it will benefit a lot of people since your reach is far and wide. This is a topic that gets very thorny especially amongst insurance agents and people who (unfortunately) have already bought whole life insurance policies for themselves. Many people cannot handle the simple fact that with no estate tax in Singapore, there is no good reason to have whole life insurance.

I have term insurance and that is also what I recommend to my friends and family to get for themselves. However, I find that way way way too many people are just too lazy and cannot be bothered to find out about the differences for themselves.

"If an insurance agent is selling this policy and all the people I know have such a policy, how can it be a wrong decision?" I've heard this too many times and even after highlighting all the important differences to them, many just feel that the "herd" should be right and I'm kinda crazy and a bit too passionate about insurance.

I find it depressing that so many people our age are committing themselves to lifelong monthly payments of several hundred dollars a month – just because they are too lazy or naive to find out for themselves.

Great story BB – it's a shame that insurance agents can get away with being so deceitful

Im not an insurance agent. I sgree ilp is no good.

Term n life will depend on individual. No right no wrong.

Term is cheap n use moneybsaved to invest. Yay.

True but premium increase when older.

Main pro abt life is. Its for life. I dun understand why must wait till die. Insurance is also to protect one wealth. If hit by disease still can get payout to cover medicine etc etc which hospitalisation insurance will not cover.

Its the peace of mind that knowing u r covered even in your 60n70s 80s and premiums are already paid. If disease hit, we can still depend on payout to cover medicine transport etc. No need to die. If very healthy and need money, also can redeem the life plan for cash. Though not recommended as my objective is to cover from unexpected illness in old age where term insurance premiums is too unaffordable

Just my 2c , i am not a insurance agent .

Whole life policy limited pay with TPD ( 10 years…15 years for example) together with early critical rider might not be as bad as you thought

What you have mention do have it's merit , however , i have to highlight that many whole life policy do come with total permanent disability , which pays out a lump sum to you in case you are paralysed etc . this money paid to you can be used to pay for your future spending .

Although term plan policy can also take care of this , in your later life ( especially after 55/60 years old ) , it will get progressively expensive ( about $400 now in your 20s to $4000 in your 60s ) , it is that expensive , you can check through your insurance web site to check

Another point that i should raise is that newer whole life policy comes with early critical rider , which also pays you lump sum should you get early critical illness , which is money you depend on while you are still working , you would get reduced salary as you need to go for chemotheraphy etc .

Personally for me , i have both term plan ( Aviva SAF + NTUC LUV plan , both which is the cheapest among all insurance ) and whole life limited payment ( AXA ) , my term plan will be used for my early age till 55 , after 55 i will cancel the term plan as it will be very expensive to maintain them . As the whole life limited pay( 10yrs) , the AXA whole life has a early critical rider which will provide payout in case i get any early stage cancer etc .

Overall , i think we need to think of our life in totality . As in present budget as well as future need and be comprehensive enough to cover our family needs in the future if we are no longer around

Hi GMGH,

Always good to hear from you!

Herd mentality is also akin to "monkey see, monkey do". But we are not monkeys. We have evolved to far more mature beings than that. If someone is too lazy to read and find out more about insurance before purchasing a policy, then they should only blame themselves. With the plethora of government sites, finance blogs, ST Money section and other valuable sources, there really is no excuse.

What I wish was that people wrote about the truth of ILPs 2 years ago before I had bought it. It only came to light this year with more articles shedding insight on this sort of plan, which reinforced my belief to terminate it asap and cut short my long-term losses.

Having said that though, insurance policies are becoming more complex these days (few are vanilla whole-life insurance plans any more), or could it be the insurance companies becoming smarter about how they package their plans and fluff it up with marketing talk?

Hey Tim! How have you been? 🙂

Yes, what I think is worse though, is that these black sheeps have given the insurance industry a bad name. I also really dislike the repackaging of the term "insurance agent" to "financial advisor". The sad truth is, most of the FAs I meet don't even meet my bare expectations of a knowledgeable person who is qualified to truly give me finance advice that I trust.

Having said that, I still believe there are some good insurance agents out there who work for their clients' interests rather than the commissions of the sale. But they're also very rare like a…unicorn.

Hi Rokawa,

Life insurance is designed to mostly pay out when the insured dies. Even for the policies which do pay out while you're still alive, don't forget that there are underwriters whose jobs are to prevent too many people from making monetary claims successfully from their insurance company. Not every claim also goes through.

Buying insurance for a peace of mind should be the way to go. But investing in insurance is like mixing up salt and sugar – they both look the same, but are vastly different in purposes.

Hi Starmaster,

You make a very good point.

I think what one also needs to consider is – can we afford the level of protection we desire?

What I want is different from what I need. I want early CI coverage, CI protection, TPD, a $1M sum assured, an accident plan, a hospitalization plan, etc …but I cannot afford to pay for all of these when my income is not even stable yet, nor when I'm not making big bucks.

I intend to add on more protection and coverage for greater peace of mind as I grow older, but at this point in time, and likewise for many young working adults who have little financial responsibilities, I personally believe term insurance will suffice for now.

Of course, this is only my opinion. Each individual's circumstances will differ, and that's the job of a insurance agent to help recommend the right policies. Unfortunately truly good insurance agents who are altruistic and not driven by commissions are rare 🙁

Hi BB

You bring out many factual and good points. For example ILP structures are a mess since it is overly complex to general public. Their performances are poor.

Another is the poor representatives by the agents, which they may not be fully competent yet as the industry is highly competitive.

However, Starmaster mentioned the truth. You have to use same company term vs life plan because aia and manulife are different pricing with ntuc income. Use whole life limited pay vs term. You will be surprised over the lifetime, term could be more costly in some cases. Plus, you pay riders for limited years (for example, 15 years), you will be covered for life.

The key is to choose the "right" insurance agency. It is good that people can start comparing insurance using DIY. However, they are unable to compare the surrender/maturity values of similar plan? (Didn't try DIY platform yet).

Buy term and invest the rest is great, but whole life (not ILP) could be useful too.

Anyway, I am not an insurance agent. 🙂

Hi Frugal Daddy,

Yes, there are some limitations. But the DIY platform is also limited, hope you can understand that there are various assumptions made behind the comparison, and it may or may not be the best comparison depending on what one is looking for. My main comparison criteria was to have identical sum assured and costs in that alone. Of course, some insurance policies are not that simple.

I also agree with you that there is a certain value to whole life policies, but my stand for the young working adults is that they'll be better off with term insurance for the moment. Having said that though, I do intend to add on whole life insurance in a few years time when I'm married / have kids / am a bit more stable in terms of my finances.

Thanks for sharing a different perspective! 🙂

Cheers,

BB

Nice thoughts.

Distribution costs are really a killer & make most of the ILP & WLP bad investment decisions.

In many parts of the world, lavish parties & Overseas excursions are common incentives for Insurance agents who hit particular targets. and as always it is the customer who is paying for it.

I would not blame the agents for this as they are trying to earn their living & most of the time they believe what they are telling you as they are not financially savvy as most of the readers of this blog.

Getting to know the facts we can help our friends to take better decisions about the money & life.

Yea i agree with you. Unfortunately, I believe it to be something of a legacy to my loved ones to have something when i leave. It gives me a piece of mind to know they are taken care of with the payout should anything happen to me while i strive to achieve my targets using my investments.

Like all games, you need to learn to defend and attack to win the game. This is afterall, the game of life.

Fully agreed that Term insurance will be a better alternative to Whole Life for young working adult w/o family.To add on, CPF have a more cheaper optional term insurance known as Dependants’ Protection Scheme (DPS) which cover till the age of 60.This will give insured member or family members a payout amount of $46000 if the insured become permanently incapacitated or pass away. Using AXA Term as an example: a 21yo insurer paid a total of $6278 for 43yrs compared to DPS $4548 for 39 years.

Term plans come with TPD.

Term premiums are fixed throughout the term.

Riders such as CI can be added to term plans as well.

Hi Investing Wolf,

It is a form of legacy as well. I remember seeing this clearly illustrated in Taken 3, although that might not be such a positive example, but it was certainly memorable!

I may also consider buying whole life when I'm much older, married and have kids. But at the moment, there's not much of a legacy for me to leave behind yet, so I rather not buy in so early for now.

Hi GP Blogger,

I have to agree with you on that. Insurance is as much a profession as other jobs are, but seeing how many insurance agents profit at the expense of their clients simply gives the whole profession such a bad name. And while MDRT and other incentives can be a good motivator, who pays for them? Sometimes it can also make the agents want to sell the more profitable policies, instead of the suitable ones, in order to achieve those targets.

It's a scary industry. So I still believe in self-education. That way, we don't have to fall prey as easily to insurance agents when they are trying to smoke us. And we'll also be able to identify and recognize good FAs who know their stuff well when we see them 🙂

Hi Dividend Town,

46k is a very low payout but it's better than nothing! Thanks for sharing about the DPS, that was insightful.

Hi BB

Haha… didnt manage to catch Taken 3… Nonetheless, if you are going to get Whole Life in the future, it might be better to do it earlier as there is a compounding factor on the bonus earned. The later you start, the lesser it compounds and harder to catch up to those who bough earlier.

I'm not saying that all of us should go with WL (it depends on your financial status). To me, 2-3k a year is not that significant for the amount of coverage i have (plus 3x payout if i go before 70).

I look at it a different way… I concentrate more on the Total payout vs Total premium paid.

Overall, my total premiums paid will be lesser than the guaranteed payout my family will receive if i go early.

plus it uses the CPF money which you wont be able to touch most of the time – Medisave.

Hi Dividend Town,

I think you are not comparing apple to apple here. AXA Term has $200k coverage at $6,278 for 43 yrs, while DPS is $46k at $4,548 for 39 yrs.

Premium for AXA is cash, which has an interest rate of 0%, CPF-MA interest is 4%. Your opportunity cost for using CPF-MA is 4% as well.

Hey budget babe ,my advice for you is to buy the =optimum= coverage

I understand that as a young working adult , we have very limited money to spent

all of us needs H&S plan , never ever skim on that even if you are on budget , any insurance company H&S with appropriate rider will be good ( H&S policies are regulated in Singapore ) but i have heard of bad review of Aviva….caveat emptor …and they happen to be the cheapest

I think for your age , 1Million seems too much to cover yourself…. how about 400-600k range? , they should accordingly reduce your premium amount .

I am 29 this year and I am covered for around this range . Anyway the bulk of these cover should be borne by term cover

You should buy a affordable term plan ( look at LUV+ plan ) with sufficient coverage together with CI and TPD cover .Important is to get it early because if you have any illness , the illness will be be the exclusion list ( for example , if you have high blood pressure , many many many illness will not be covered )

Next if you have additional budget , you can then look for whole life limited pay , look for those with early CI , as term plan with early CI are damn expensive and not value-for-money in singapore . I myself is on a 10-year limited pay early crit policies .

I like to share my recent experience and you decide if life insurance is good for you.

I bought life insurance with critical illness coverage after I became a mother.

My monthly premium was $110.00 (I considered $110.00 as forced savings)

Had I bought it at a much younger age my premium would be lower.

3 years ago I was contemplating to surrender my policy because my children were grown up and I have no more commitment.

I wanted to cash out the policy to enjoy my savings.

I would have made a small profit of $10k if I surrendered the policy.

But my friend advised against it since I am not in need of the money.

Sad to say, I was diagnosed with cancer last month

I submitted my insurance claim after my surgery, and I received the cheque 5 working days after my submission.

The amount I received yesterday was 3x my pay out.

Life insurance is not designed to pay out only upon the insured' death

I am grateful to my friend who stops me from cashing out the policy.

I am also grateful to my agent who always has my interest at heart.

Insurance agent does not have a salary. They deserved the commission for their hard work. Every biz needs to make profit.

The person who ultimately gained from the policy is actually me, the insured not the agent.

StarMaster highlighted an important point

Important is to get it early because if you have any illness, the illness will be the exclusion list (for example, if you have high blood pressure, many many many illness will not be covered)

Investing Wolf highlighted a good point

it might be better to do it earlier as there is a compounding factor on the bonus earned. The later you start, the lesser it compounds and harder to catch up to those who bought earlier.

Hi,

Thanks for sharing with us your experience!

You have a good agent. Do keep him/her. I'm also not saying that all agents do not have their clients' interests at heart, although we must always be skeptical how well these interests balance with their own. Yes, all work deserves to be compensated, but I personally believe more in a fee-based financial advisor scheme, where agents are retained on a maintenance basis on regular payouts, rather than one lump commission which encourages the buy and buy model instead.

Ultimately, insurance is also a risk for your risks. One has to decide if he/she has the financial ability to pay for risk protection in the long-term. There are pros and cons, unfortunately most of us are not educated about the cons, which is why I've tried to provide a more balanced debate here.

I wish you all the best with your cancer recovery!

– BB

I don’t suppose many of websites give this kind of information.whole life insurance rates

This comment has been removed by a blog administrator.

I used to work for Financial Advisors and Insurance Agents. I can tell you that yours not a popular opinion among clients OR the salespersons. (For completely opposite reasons.)

Having said that, it is a good idea to carefully research and consider every option before making any financial commitments. Your research is on point and should be taken into account.

Lachelle Muse @ Ernstam

Trouble comparing insurance quotes? InsuranceGuru will help you to find the best Life Insurance Singapore quotes as per your needs to save time and money.

what is the meaning of insurance?

Life Insurance

I wanted to thank you for this great blog! I really enjoying every little bit of it and I have you bookmarked to check out new stuff you post.

Finance

What is insurance?Explain?

cheap Life insurance

Another helpful post. This is a very nice blog that I will definitively come back to several more times this year!

Muskegon

Hey buddies, such a marvelous blog you have made I’m surprised to read such informative stuf

cheap whole life insurance policy

It is a form of legacy as well. I remember seeing this clearly illustrated in Taken 3, although that might not be such a positive example, but it was certainly memorable!thanks for sharing!!

work injury compensation

Each time I used to always check blog posts within the first hours in the break of day, because I like to get information increasingly more.is first to die life insurance term insurance

Do you want to know when is the best time to buy life insurance for individuals? Discover it in this article: http://goo.gl/K5tXCd

Thank you for sharing such great information. It is informative, can you help me in finding out more detail on Life Insurance,i am interested and would like to know more about this field and wanted to understand the basics of Life Insurance

This discussion unexpectedly takes my attention to join inside. Well, after I read all of them, it gives me new idea for my blog. thanks

Insurance Cover for the Owners' Corporation

Thank you for sharing such great information. It is informative, can you help me in finding out more detail on Insurance Policy,i am interested and would like to know more about this field and wanted to understand the basics of Life Insurance

Thank you for sharing such great information. It is informative, can you help me in finding out more detail on life insurance policies,i am interested and would like to know more about this field and wanted to understand the basics of Life Insurance

Thank you for sharing such great information. Term Insurance and so on.

Thank you for sharing such great information.It is informative,can you help me in finding out more detail onTerm Insurance Premium,i am interested and would like to know more about this field and wanted to understand the basics of Term Insurance Policy

Thanks for sharing us this information. I really want to buy life insurance in the Philippines as soon as possible. I think it is a way of preparation for my future.

Silver Gold Bull is the most reputable silver and gold dealer. You will be provided with competitive, up-to-minute rates and they will guarantee that your gold and silver is delivered to your door discreetly and fully insured.

Thank you for sharing such great information, can you help me in finding out more detail on Child Education Plans

Thank you for sharing such great information. It is informative, can you help me in finding out more detail on online life insurance policy, i am interested and would like to know more about this field and wanted to understand the basics of online life insurance policy

Comments are closed.