In case you missed the news, Singapore has been declared to be in an “emergency phase” due to the steep rise in the number of cases for dengue fever. In case you get bitten, make sure you’re already covered by your insurer (or sign up for dengue cover to get protected for free) and practice the following prevention steps in your home.

Last month, our Minister of State for Home Affairs warned that Singapore had reached an “emergency phase”, given the steep increase in the number of cases on a weekly basis.

The current number of dengue cases has exceeded 15,000 – with 378 clusters and 139 dengue-alert areas classified by NEA* as red danger zones. That includes my estate 🙁

*Numbers accurate as of 27 June. Check the latest updates from NEA here.

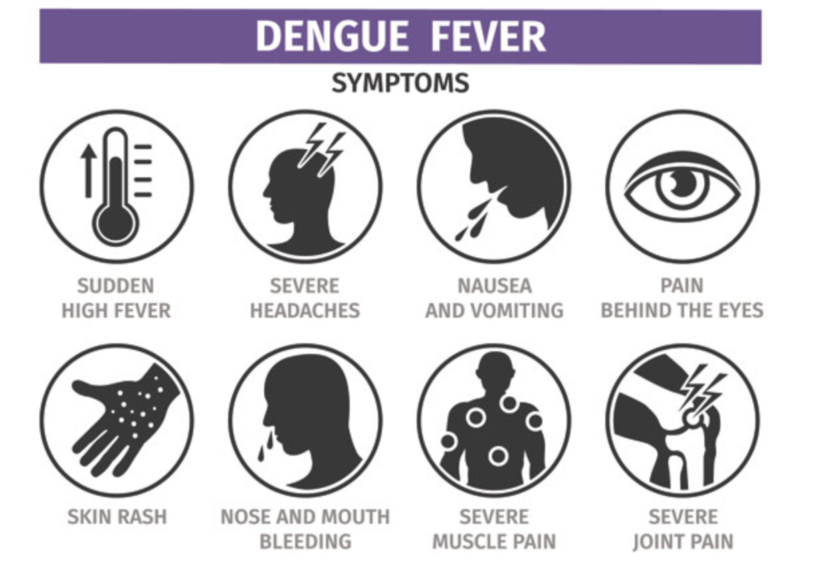

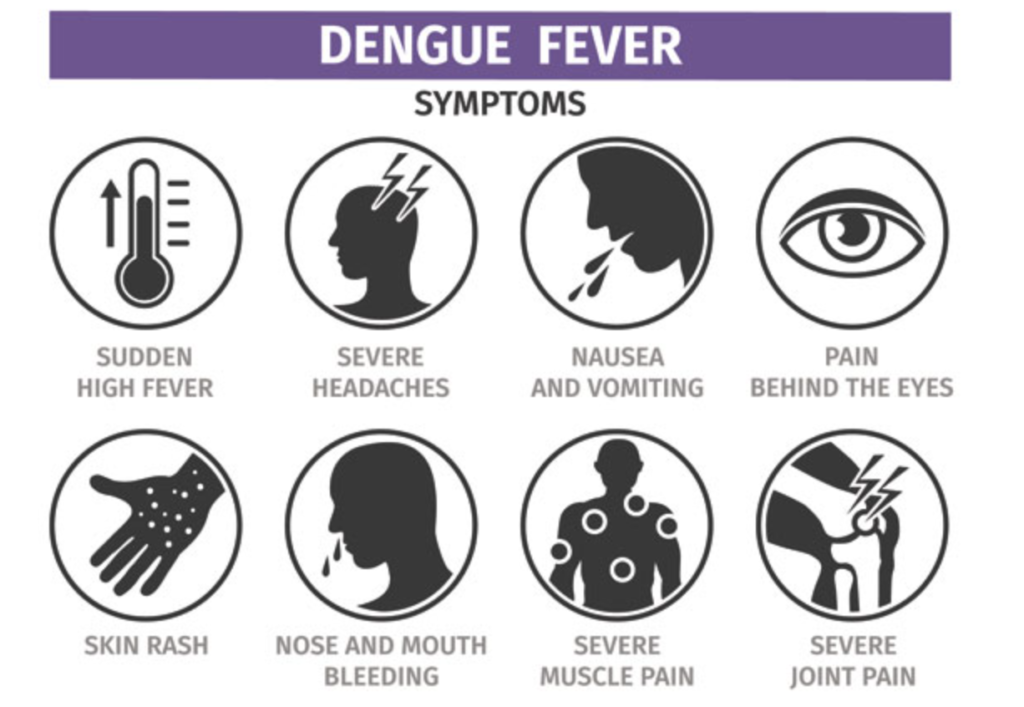

While the symptoms of dengue are similar to the common flu, the biggest tell-tale signs are rashes, bleeding and/or bruising even from light knocks or bumps. This is because dengue causes your platelet count to drop, which affects your natural blood-clotting abilities.

For some people, getting bitten could eventually result in hospitalisation. By now, you may have already seen the unfortunate news about the 82-year-old woman who successfully evaded COVID-19 during the pandemic but eventually succumbed to dengue. The critical phase is typically from Day 3 – 6 of the illness (although actual progression timelines may differ), where even if your fever starts to subside, your platelet count could in fact be dropping significantly.

Previously, when my father-in-law was stricken with dengue, he had to go to the doctor regularly for blood tests and was told that if his platelet count dropped too low (under 80k per ml), he would require hospitalization. For reference, normal levels are around 150k to 450k per ml. That’s because with a reduced blood clotting ability, the body can go into shock, internal bleeding, organ failure or even death.

And if you think you’re immune this time because you got it before, that may not be the case because there are 4 different serotypes (aka. strains) of dengue virus: DENV-1, DENV-2, DENV-3 and DENV-4. Although recovering from one serotype generally provides lifelong immunity against it, this does not extend to the other serotypes, meaning that an individual can potentially be infected with dengue up to four times.

The current dominant serotype circulating in Singapore right now is DENV-3, which was previously uncommon and thus less immunity within our population against it. After all, prior to 2020, DENV-3 was not the dominant serotype during previous major dengue outbreaks in the last 3 decades.

How much could dengue cost?

For mild cases, you will only need to worry about the cost of blood tests and consultation fees – this can be anywhere between $20 for a consult to $120 (if a blood test is required) via the public route (also depends on how much your doctor charges).

However, if you end up in hospital, the bills can climb higher. For a recent patient, her medical bills crossed $126,000 last month due to hospitalisation and rehab fees.

Of course, not all cases may cost that much. According to AIA Singapore, they paid out over $200,000 in claims for dengue fever costs in the year 2020 (which was the last major dengue outbreak). The actual costs incurred will ultimately depend on your body, your existing health conditions and how the infection progresses as well.

Of course, the good news is that you don’t have to bear the medical bills by yourself, as dengue fever is a condition that you can potentially claim from your insurance.

Make sure you can claim from your insurance

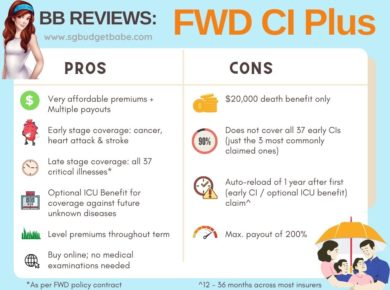

If you haven’t already done so, please check if your insurance covers you for dengue fever. Most comprehensive personal accident plans – such as AIA’s Solitaire PA – should cover it, but not all do, so check your T&Cs to be sure.

If you need coverage against dengue fever, you can get it now for free (for a limited time only).

In AIA’s case, their latest no-cost dengue cover plan provides for:

- $1,000 hospitalisation income benefit due to dengue fever*

- $100 non-hospitalisation benefit upon diagnosis with dengue fever^

- $10,000 lump sum death benefit due to accident or dengue fever^

* Note: Minimum 6-hour hospital stay is required

^A waiting period of 10 days applies for dengue fever before this benefit will be payable. Dengue must be diagnosed in Singapore by a Registered Medical Practitioner.

The policy is pretty straightforward, but you can also read the full list of T&Cs here.

My husband and I have already signed up for ours. Hurry, get yours here today.

Prevent dengue at home by practicing B-L-O-C-K and S-A-W

With most of us on a hybrid work arrangement these days, you wouldn’t want your house to be a breeding ground for the Aedes mosquitoes, so make sure you practice B-L-O-C-K at least once every few days.

All the below images are sourced from NEA.

And if you’re living in a red zone (like I am) which means there’s a high population of Aedes mosquitoes in your area, try practicing S-A-W to prevent yourself from being bitten.

In my household, we also use an electric mosquito bat to swat these pesky mosquitoes whenever we see them! Most provision shops sell it, but if not, you can also order online.

I also stick mosquito repellent patches on my kids whenever they head out! While it isn’t 100% effective, but it does help to deter (or reduce) the number of bites they would otherwise have gotten without the stickers.

Prevent AND protect. That’s the best we can do.

Sponsored Message

To help Singaporeans in the fight against dengue, AIA is giving away FREE dengue cover, limited to the first 100,000 policies only. The policy protects you and your loved ones (up to a maximum of 7 dependents) until 31 August 2022.

Sign up to be protected against dengue fever for FREE here by 31 August 2022.

If you’ll like more, you can also meet up with an AIA Financial Services Consultant for a review (by 31 August) and receive a complimentary $10 GrabFood voucher.

T&Cs apply. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. The insurance plans are underwritten by AIA Singapore Private Limited (Reg. No. 201106386R ("AIA"). All insurance applications are subject to AIA's underwriting and acceptance. You are advised to read the policy contracts for the precise terms and conditions of these plans, including exclusions whereby the benefits under these plans may not be paid out.