I was chatting with a few friends previously when the topic turned to our healthcare insurance, and I was quite shocked when all of them (but one) told me they didn’t see a need to buy anything else because “MediShield is enough”.

Another one asked, “I’m already covered by my company, so why should I waste money on buying additional medical insurance?”

I’ve been so worried ever since that I decided to write a post on this, to educate every other Singaporean out there who might be wondering whether they should buy additional healthcare insurance.

My advice? You should. At least, I did.

Back then, when I was fresh out of university and landed my first full-time job, many friends (or acquaintances) tried to meet up with me under the guise of a “catchup” session and ended up trying to sell me different insurance policies. Because I was young and naive back then, it resulted in me believing and purchasing what these agent friends of mine advised me to buy. After all, they were the experts, right?

Wrong.

After I finally quit my extremely taxing and energy-draining job, I decided to spend some time reviewing my financials and my insurance policy. I realized the plans I had were not ideal and did not provide adequate coverage for what I needed at all! As a result, I ended up having to “restart” i.e. cancel my plans and sign up for new ones.

That also meant over $2,000 flushed down the drain to the private insurers who profited from my stupid mistakes. Which is why my mantra now is that no one else will ever be a better financial adviser than ourselves.

Fun fact: My agents then sold me an ILP – I was uncovered for everything else. Which meant that if I had gotten into an accident or hospitalized during that time, nothing would have been covered at all…unless I was diagnosed with a terminal illness or died. (Touch wood!)

Shocking?

Well, just like my friends, one of the agents told me that since I had a tight budget, there was no need to worry about other plans since my medical insurance is covered by my employer anyway.

He probably didn’t take into account the fact that I would end up resigning from my first company (months before they were chased by debtors and shut down for good)…and thus lose my coverage in the process. Or the fact that I am not covered by my current company either.

You see, the coverage you enjoy by your company cannot be a guaranteed cover for the long-term. What if HR needed to downgrade their employees’ policies tomorrow because the CFO decided to slash the company’s budget on employee expenses? Or what if you get fired next month?

What happens to my company medical insurance when I leave my job?

You lose your coverage. Simple as that.

When an employee leaves, the company will usually cancel the individual’s policies – after all, there’s no point in wasting money paying for someone who is no longer a part of the team, right?

As a result, you have to then either (i) turn to your new employer for medical coverage or (ii) buy your own. Note that both situations involve getting new policies.

There are a few problems when this happens:

1. You might now have to pay higher rates for the same level of coverage.

A common situation many people encounter is that as a result to their recent health and medical history (eg. if they sought medical treatment for a major condition before), they no longer qualify to be insured at “standard” rates or at the same terms and conditions i.e. you might have to pay higher rates for the same level of coverage.

2. Pre-existing conditions will be excluded.

If you developed any new illnesses during the period at your old job, these would usually be excluded from your new policy.

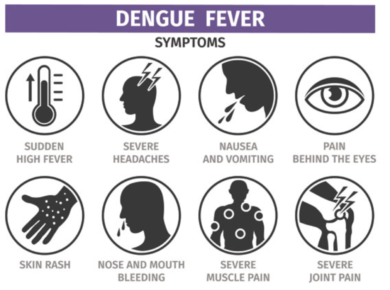

Imagine if you were a healthy 23-year-old when you started your first job, where you stayed for the next 15 years before you got fired. During that time, you were diagnosed with diabetes and high blood pressure due to the stressful working environment you were in. Thankfully, your MediShield and company insurance helped to pay the bills, resulting in you paying less than an affordable sum of $5,000 for each stay (mostly for the upfront deductible and co-insurance).

If you stayed on with the company, future visits to the hospital will be covered in a similar manner (up to a maximum, depending on the policy terms and your MediSave).

However, when you leave the company and your new employer (or yourself) goes ahead to purchase the medical coverage for you, you will no longer be able to claim for any hospitalization visits related to your diabetes or high blood pressure. You now have to foot the entire bill by yourself, which can easily rack up to over $10,000.

3. Limitations of your employer’s policy coverage.

The other aspect many of us do not see is that most employers tend to accept certain limitations to the policy terms and conditions – including sub-limits, deductibles and co-insurance. As employees, we are often not aware of all of these limitations, and HR will seldom bother explaining this in full to you even if you asked. (Most will probably just shrug you off by saying “this is the company’s standard policy.”)

Since most health policies bought by your employer do not require you to declare your medical history or submit past medical documents, these policies also automatically exclude all pre-existing illnesses or medical conditions at the time of inception, and often even for the 12 months after as well. I do not have much detail on this, as I did not get much insight into my employer’s coverage, nor am I covered by my current employer (because…company policy).

4. When you retire and have to buy your own medical insurance.

Even if you were lucky enough to survive on company-paid medical insurance for the whole of your working life, when you retire, all these benefits will no longer be available to you. This is where some people then realize they have to get their own medical insurance to protect themselves for the remainder of their life.

However, certain policies have a maximum age limit for purchasing. I encountered this when I tried to upgrade my father’s hospitalization plan (after realizing that my sister might not pay for my father’s bills at all, which won’t be surprising since she hasn’t given him a cent since she started working) but was rejected by the agent because my dad was too old. If only he had bought it earlier for himself!

It is foolish to assume that your current healthcare coverage provided by your employer is sufficient.

If you truly believe you will stay at your current job forever, then sure, go ahead and skip the additional plans.

But seriously, there will always be job uncertainties. Nothing is for sure in this day and age anymore. That is why I decided to buy additional medical insurance to protect myself. I wouldn’t want to see my life savings, or my entire emergency funds, be wiped out overnight due to unexpected hospitalization stays or illnesses.

So if you asked me, should I buy health insurance even though I’m already covered by MediShield Life and my employer?

My answer is yes.

With love,

Budget Babe

7 comments

Here is an additional reading of why Group Heath Insurance is a big wastage.

http://dollarsandsense.sg/is-your-company-group-hospital-surgical-insurance-a-big-waste-of-money/

It is a stunning post. Exceptionally valuable to me. I preferred it.For more details about me,log on to cash for credit card in chennai

Thanks for your opinions. I just started a new job two weeks ago so soon I will have to make the difficult decision on what and how much medical insurance to obtain. I consider myself pretty healthy and usually only visit the doctor once every two years, but you just never know when or if you may become very ill.

Steven Keltsch @ Allied Insurance Managers, Inc.

Read your blog and it is rally informative keep updating with newer post on medical insurance policy

This comment has been removed by the author.

We offer individual health insurance, family floater health cover, extended health insurance, medical insurance policy, and women specific critical health insurance.

This comment has been removed by the author.

Comments are closed.