Investors of the Astrea IV PE bonds have enjoyed a 4.35% p.a. interest in the last 5 years. Now that the bonds have been fully redeemed, what are some other options that we can explore instead?

With the recent news of Singapore’s first listed retail PE bonds redeemed and with an extra 0.5% bonus paid, there has been more interest in similar options that will give us investors a high yield or payout.

The same question was posed in one of my group chats, where a handful of us were holding the bonds.

At a rate of 4.35% p.a. paid every 6 months, the Astrea IV PE bonds were good while it lasted. Some of you might recall that 5 years ago, I wrote my analysis on the said bonds, where I publicly disclosed my application.

Fast forward to today, and even my bonds have been fully redeemed as well just last week.

So…where should I put the money in next?

I took a quick look at the latest MAS T-bills, but unfortunately those aren’t as compelling as rates have fallen to below 4% since last year. Well, it was good while it lasted.

So I opened my moomoo app to screen for some stock ideas instead.

How to find high dividend stocks in Singapore by using moomoo

One of the most popular forms of investing is when you invest for dividends, especially given how rewarding it can feel when you literally see money get deposited into your bank account on a regular basis.

The best kind of dividend stocks often are of businesses that not only pay a good yield, but also grow their share price over the years. That way, investors get rewarded with both dividends AND capital gains simply by holding their stock position.

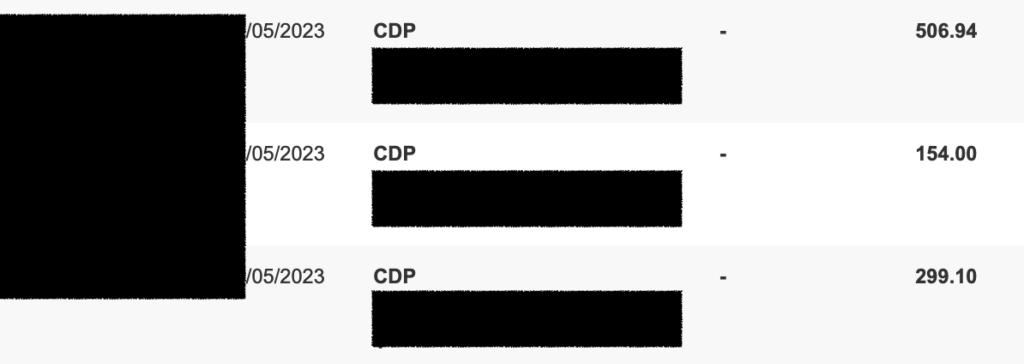

My own experience with this form of investing has been quite rewarding as well, and it always feels shiok when I log into my bank account and see “free” money coming in like these:

While it used to take me hours on the desktop to screen for good dividend stocks, today, all of that has been replaced by simply using my moomoo app.

With just a few taps, I can quickly pull up the highest-yielding dividend stocks in Singapore, as well as filter them according to the criteria that I want.

Here’s how I do it:

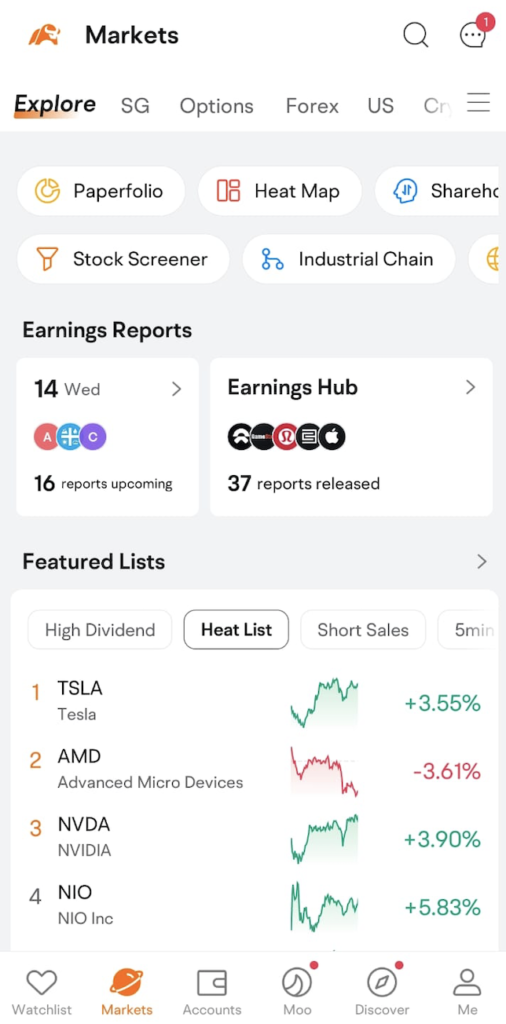

First, tap on “Markets” and scroll to “Featured Lists”.

I usually tap on the arrow to pull out more, because when looking for quality, dividend stocks in Singapore, I usually start by screening with the following parameters:

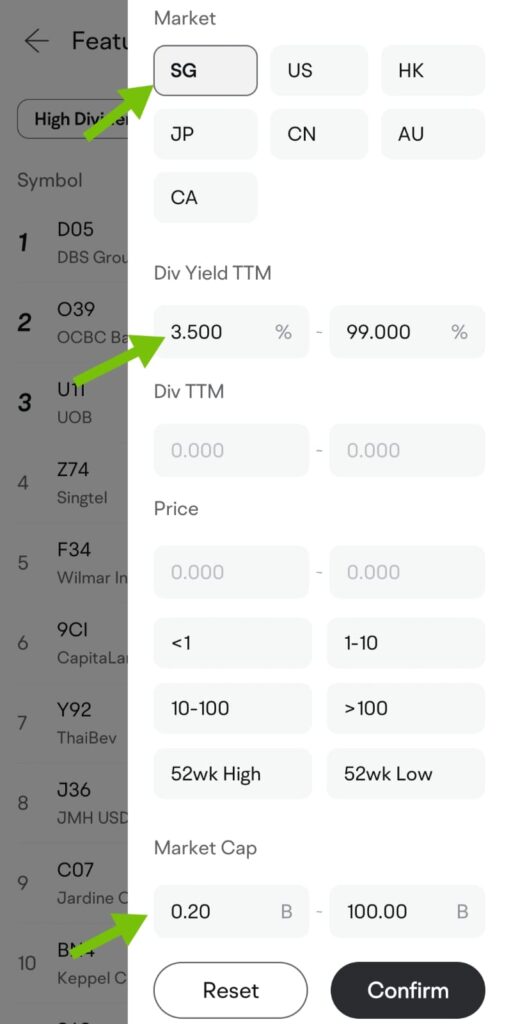

- Market: Singapore (so I don’t have to deal with withholding taxes eating into my dividends)

- Dividend yield: min. 3.5% (I determine this based on the prevailing fixed income environment)

- Market capitalisation: min. 200 million

Tap on “Filter” at the top right corner and adjust your parameters according to your preferences.

Using my criteria, the app reveals the following stocks for a start. You can then toggle on the “Dividend Yield TTM” tab so that the list will rank the highest-yielding stocks at the top for you.

However, as I’ve warned before, investing in high-dividend stocks don’t always pay off, and can even lead to huge losses if you’re not careful. What’s more important is to assess the underlying business quality to determine if the company will be able to maintain or even increase its dividends over time.

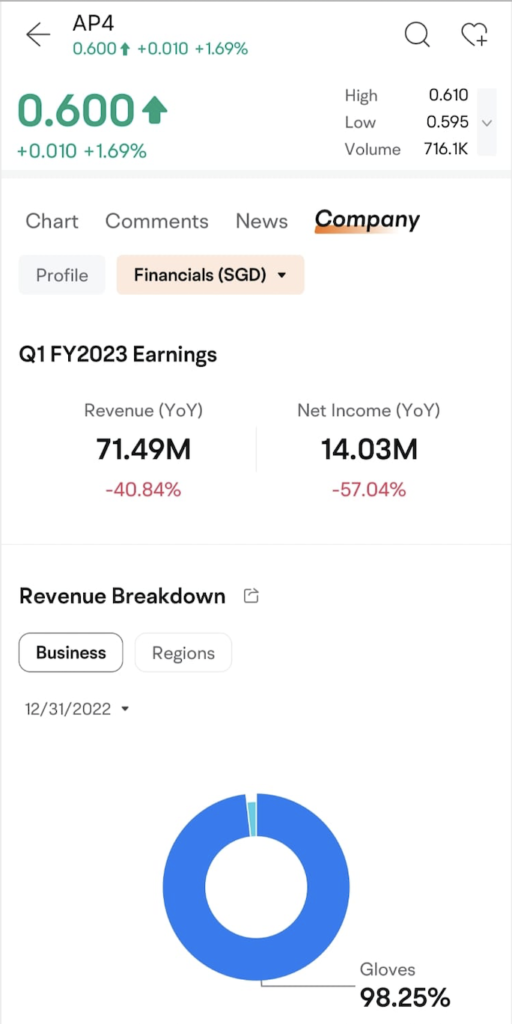

Let’s use Riverstone as an example. Upon tapping into the company profile, you can already see why the highest-yielding stocks may not always be the best to invest in. The moomoo app immediately shows you at the top that Riverstone’s most recent revenue and net income has fallen significantly since the pandemic.

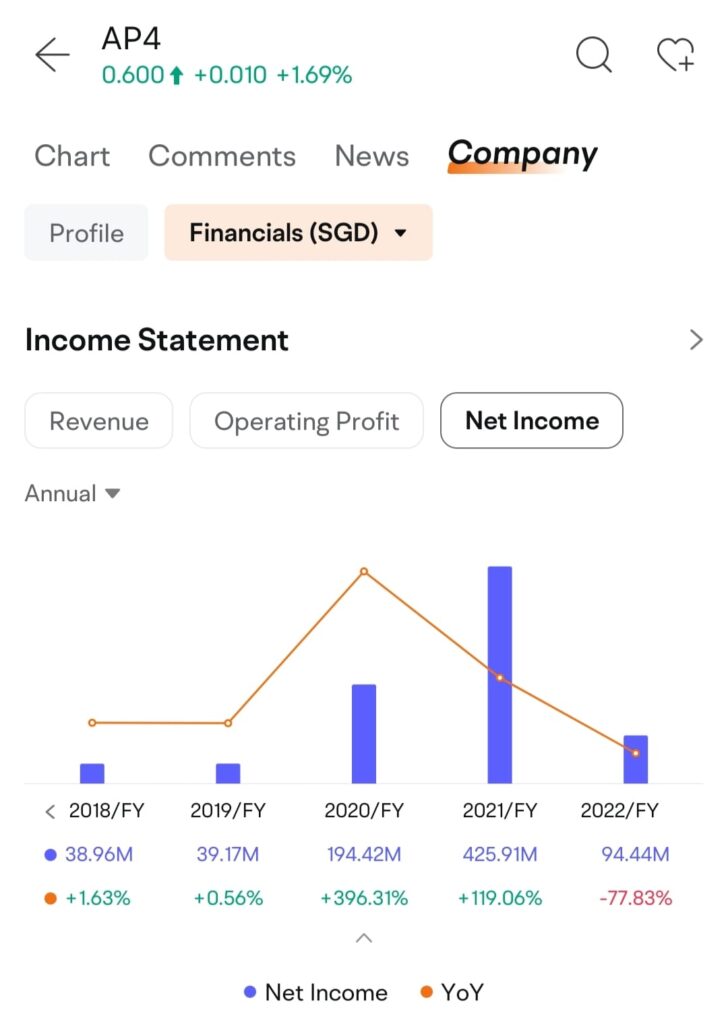

Going into the Net Income, you can see it rose spectacularly during the pandemic, but has since tapered off ever since COVID came under control. This also explains the surge and fall of Riverstone’s share price during the same period.

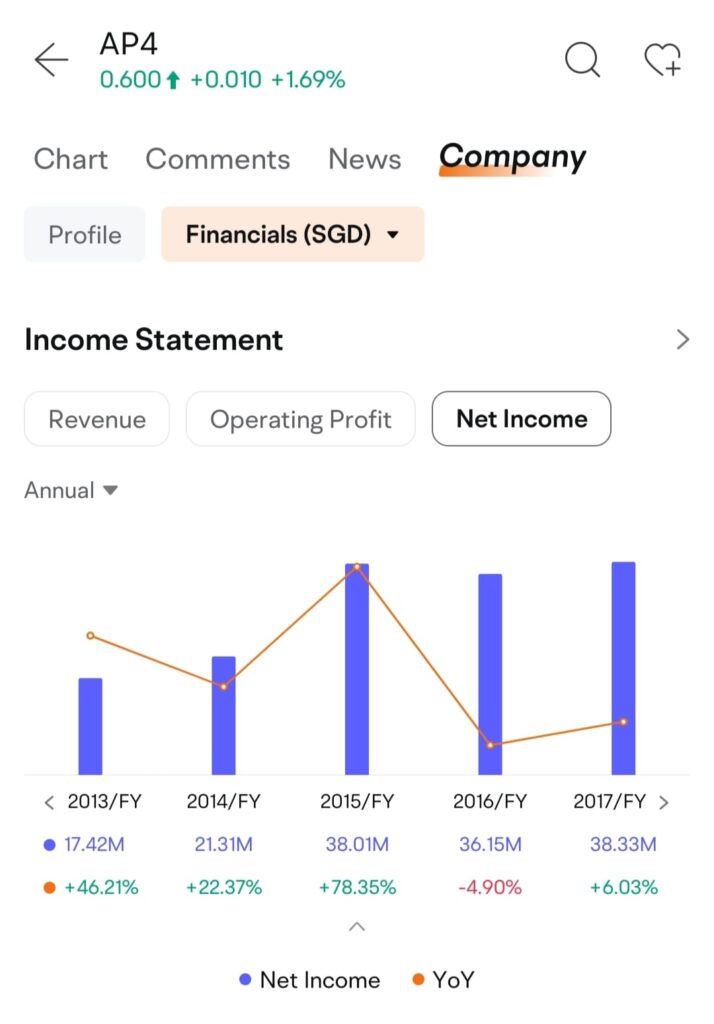

However, what seems promising is the fact that while Riverstone’s income has fallen, it is still higher today than before the pandemic started. The moomoo app allows me to confirm this by toggling between the various years, where you can see it ranged between 17 million – 39 million since 2013.

Knowing Riverstone’s dividend history, its usual dividend typically hovered around $0.07 in the years before the pandemic, which increased rapidly to $0.30 in 2021 and $0.54 last year. However, since its income has fallen so much, it is unlikely that it will be able to maintain its > 20% dividend yield.

Thus, if you invest in Riverstone expecting a similar dividend payout at this point, you’d only be disappointed at the end of the day.

Whereas I would have normally brushed off an idea like this, the moomoo app helped me see that there might be merit in digging deeper into Riverstone’s annual reports and business projections to understand what its future post-pandemic will be like.

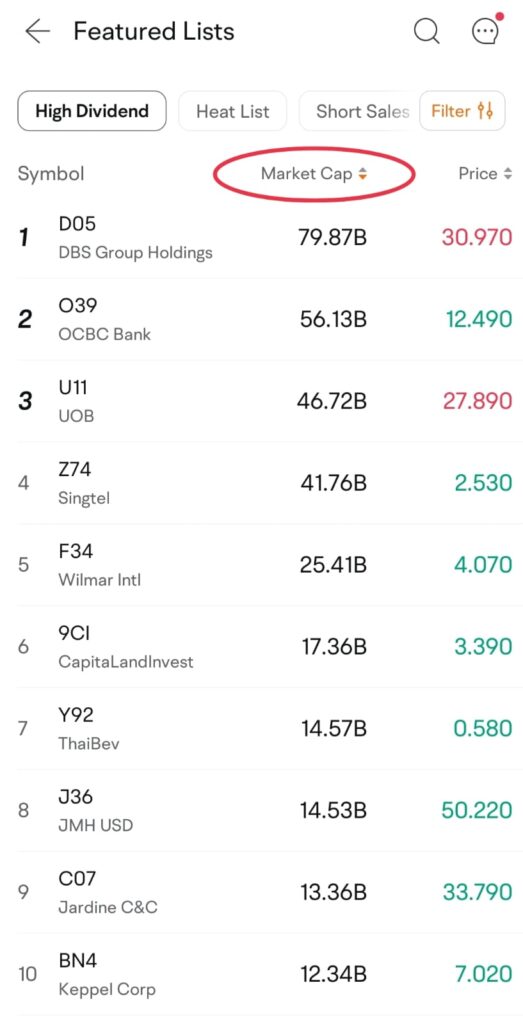

This is why, instead of being lured by high dividend yields alone, I like to also check against the size of the company and its underlying fundamentals.

You can do this by tapping on “Market Cap” so that the screener will now show you the largest companies that meet your dividend criteria:

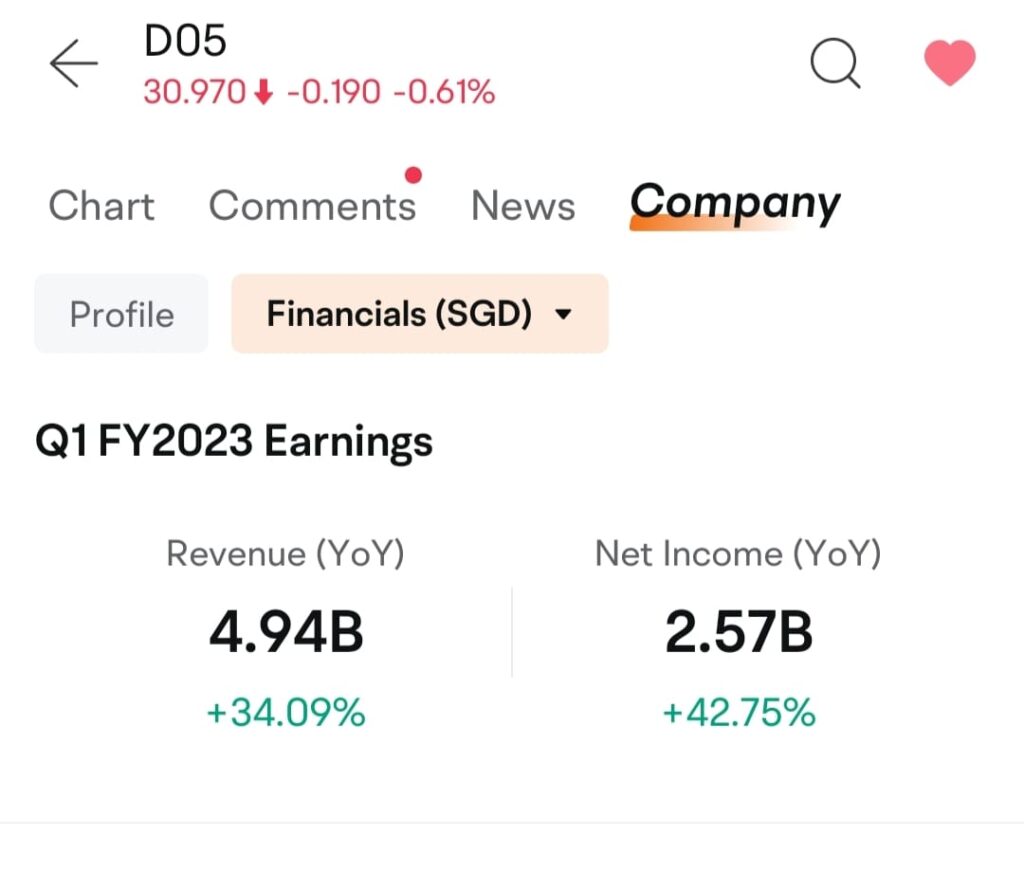

Currently, DBS shows up as the largest blue-chip in this list and yields an attractive 4.81% historical dividend, so let’s take a closer look since my friend suggested it as well.

At first glance, DBS certainly looks good, especially given its stellar Revenue and Net Income growth.

I can also see that its Earnings Per Share (EPS) has indeed been growing over the years.

But does this mean DBS is a good dividend blue-chip stock to consider right now?

Of course, more work will be needed to confirm, but at least at this point I know that I can look deeper into both DBS and Riverstone as potential candidates.

And in that way, the app has quickly given us two decent stock ideas to look at and explore deeper into.

Using moomoo to discover dividend stocks in Singapore

If you’re still using desktop screeners, try using the moomoo app instead so that you can quickly discover and filter ideas on the go.

That way, it’ll enable you to be more productive and reserve your desktop research to dig deeper into stocks that seem to hold a little more promise.

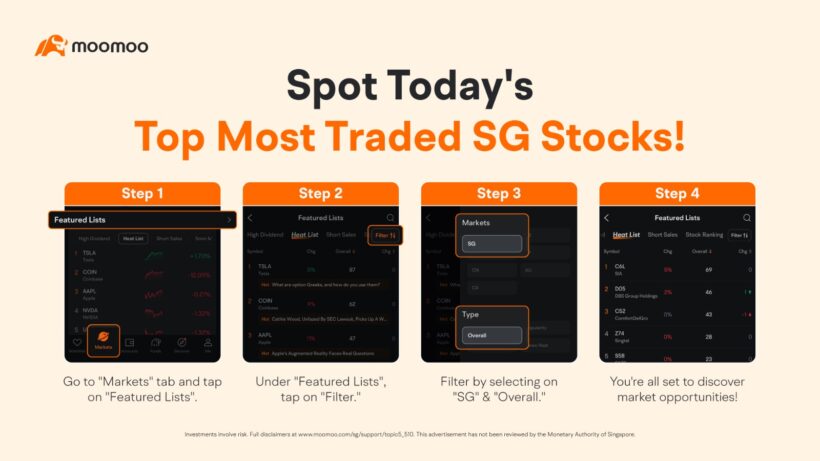

Alternatively, if you prefer to get ideas based on stock momentum, moomoo also allows you to check the top most traded Singapore stocks – here’s how:

How are you using the moomoo app to discover Singapore stocks for yourself? Share with me in the comments below!

Disclosure: This article is brought to you in conjunction with moomoo Singapore.

Now, you can get 1-year free commission when you trade Singapore stocks on moomoo!

Sponsored Message

Already an existing moomoo user? You can still get rewards when you fund your account or add more to your current position(s) and get up to S$200 cash coupons.

Sponsored Message by moomoo Singapore

Start growing your wealth today with moomoo.

Disclaimer: All views expressed in this article are my own independent opinion and the illustrations of Riverstone and Tesla are neither a buy/sell recommendation. Nothing in this article is to be construed as financial advice as I do not know your personal circumstances or investing goals. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. All information provided is accurate as of June 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

4 comments

Hi, nice sharing! See my view for DBS : https://sporeshare.blogspot.com/2023/06/dbs-bank.html

Hi, Thanks for the sharing! Just added a bit at 12.42. More than 5% yield looks gd to me! https://www.spore-share.com/2023/06/ocbc.html

Nice, good for you!

Personally, I demand a higher MOS for OCBC so it hasn’t hit my target levels yet.

Oic! If it goes below 12.00 would certainly see bargain hunters coming back for ocbc.

Comments are closed.