Don’t make the mistake of paying for your income taxes via GIRO, because that earns you absolutely NOTHING on your payments. Here’s what I’ve been using to earn miles on payments that my credit cards wouldn’t otherwise give me rewards for.

Now that you’ve successfully filed your income taxes to IRAS, it won’t be long before you receive your tax bill. Whether you choose to go for monthly repayments or a one-time yearly bill, the bigger question would be HOW to make payment – specifically, what mode of payment should you use so that you can still earn miles from this?

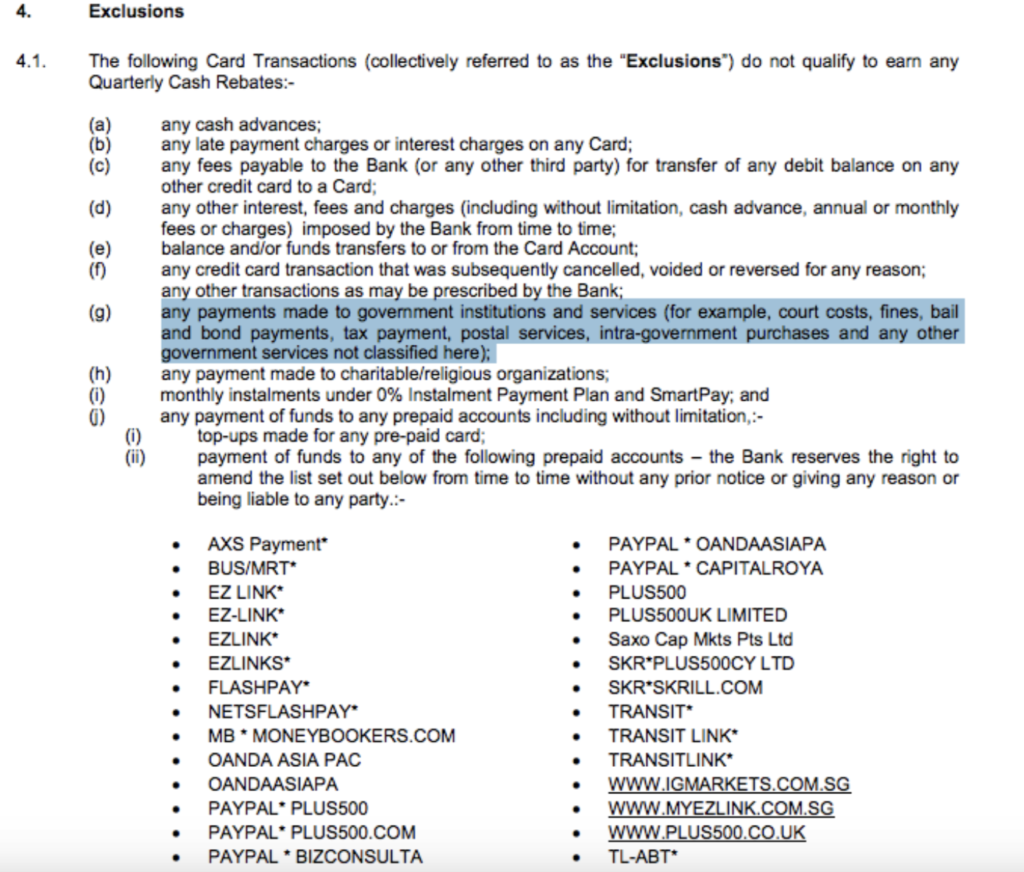

We already know that most credit cards reward you based on your discretionary spending i.e. products or services that you want to buy instead of the stuff that you need. And that’s exactly why you see categories like dining and shopping get such generous rewards (e.g. 10X for dining!), because you could technically live without eating out and buying new stuff.

The harder piece to solve is usually how to earn rewards on our non-discretionary spend i.e. regular payments that you HAVE to make and cannot avoid, such as when you pay for your insurance premiums, income taxes, or electricity.

Enter CardUp, which has been solving this problem for Singaporeans since 2016.

If you haven’t already heard of them / started using them, then that’s because you haven’t been following this blog closely 😛 I’ve raved about them multiple times since discovering the service in 2017, and meeting the founders in person (at an event) who helped me truly understand what they do and how it works.

Simply put, service providers like CardUp charge your credit card for the payment plus an administrative fee (1.9% – 3.3%), which they then make the payments on your behalf using bank transfers.

This way, you can enjoy cashback, miles or reward points on these payments that credit card companies typically exclude.

Of course, this was a shocker to the financial industry, and in the years that followed, I’ve watched as some banks proceeded to exclude CardUp transactions. However, 7 years on, CardUp is now generally accepted for the base mile / cashback earn rate, while being excluded for the high online spend category or any bonus programmes.

That means if you’re using a card that rewards you generously for online spending e.g. DBS Woman’s Card (5X) or DBS Woman’s World (10X), you will only earn the base rate of 1X DBS Points if your online transaction is through CardUp.

So the trick with using CardUp is to find a card that gives you a decent base reward rate, which you can check here. In my case, for instance, I’ve been using my UOB PRVI Miles card to pay for all CardUp transactions in the past 6 years.

Should I use miles or cashback cards with CardUp?

In the beginning, I used a cashback credit card to pay via CardUp.

But as the banks kept changing their T&Cs, it became too much of a hassle to keep up, so I switched to a miles card instead and settled for the base reward rate. Today, I wouldn’t really recommend using a cashback credit card with CardUp, because the admin fee of 2.6% means that you’ll have to find a cashback credit card that rewards you a higher earn rate than that – that’s a tough call.

It has become far easier – and less of a headache – to just stick with a good miles card on CardUp.

Is it really worth paying for the admin fee?

This is a question that only you can answer for yourself.

You’ll need to weigh the costs vs. rewards and decide if this makes sense for you. Here’s an example of how I do it:

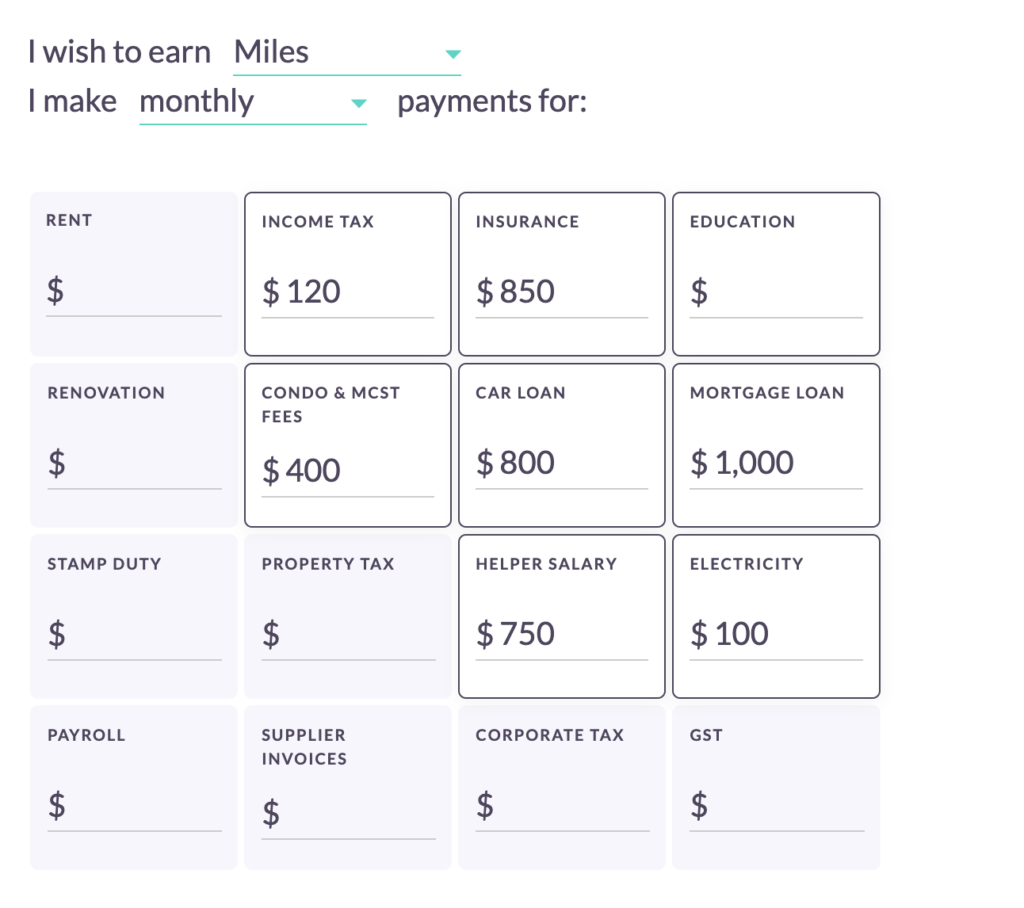

First, go into CardUp’s website here and key in your estimated expenses to find out how much the service will cost you:

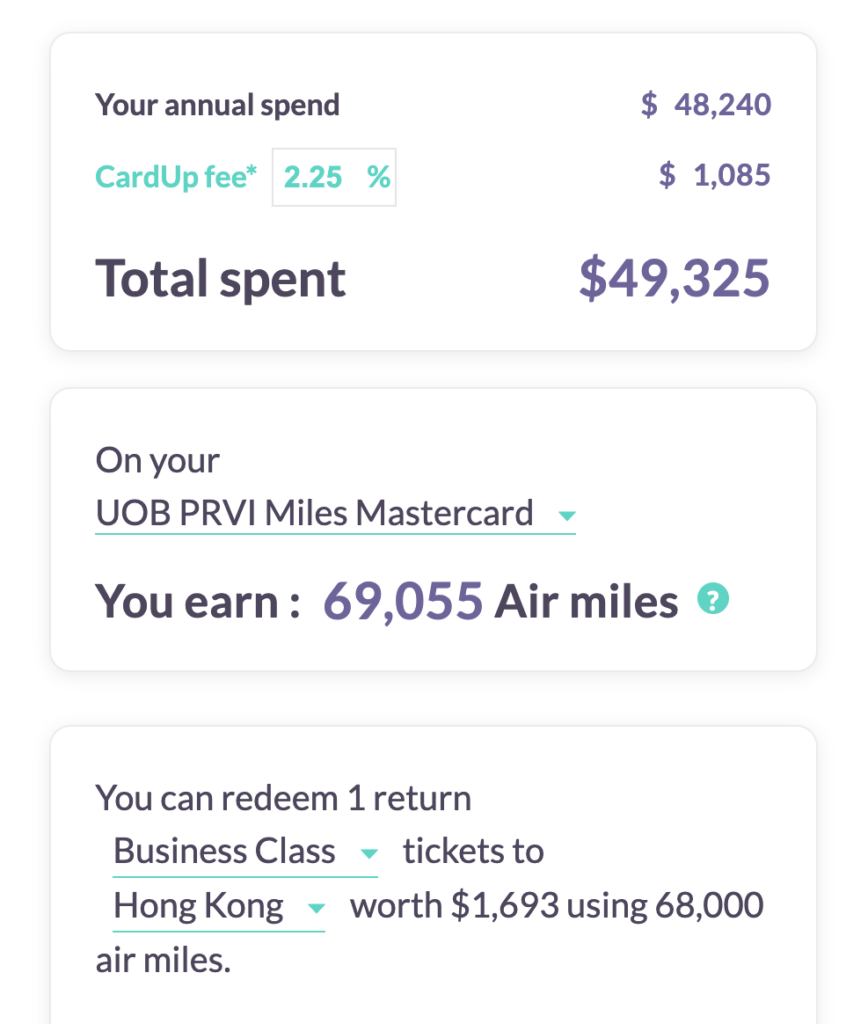

Next, select your credit card from the list and check how much rewards you’ll be able to earn if you were to route your non-discretionary expenses through CardUp:

So in the above scenario, the question to ask is whether you’ll be willing to pay $1k+ for the relevant miles. My answer is yes, because doing so still allows me to save ~$600.

Are there other options to CardUp?

Of course, CardUp is not the only service provider of its kind – you could also opt to use other similar services by ipaymy, or via the banks i.e. Citi PayAll, Standard Chartered EasyBill and UOB Payment Facility.

| Cardup | ipaymy | Citi PayAll | SC EasyBill | UOB Payment Facility |

| 2.6% | 1.99% – 3.30% | 2.6% | Up to 1.9% | 1.9% – 2.3% |

Unsurprisingly, the banks limit this service only to their cardholders, which means Citi PayAll only benefits a Citi-cardholder, whereas SC EasyBill is only for Standard Chartered members and UOB Payment Facility for just UOB cards.

For those of you who need recurring (monthly) payments, then SC EasyBill is out as it currently doesn’t offer this function.

UOB cardholders who wish to earn miles via UOB Payment Facility get charged different fees ranging from 1.9% – 2.3%, depending on which card you’re using with it.

Why choose CardUp?

Personally, I chose and have stayed with CardUp for the following reasons:

- It has the widest range of supported payment categories.

e.g. CardUp used to be limited only to 10 types of payments back in 2018, but they’ve been quietly expanding the list (now 16) over the years. - It supports the widest number of credit cards.

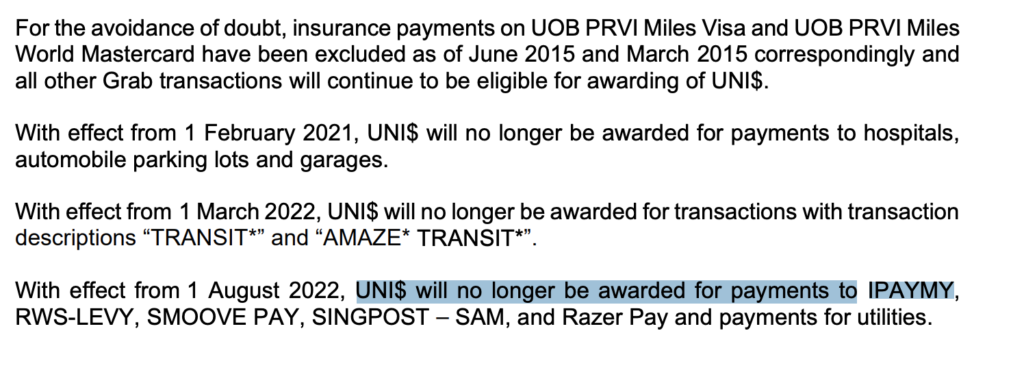

Including UnionPay. If you use more than one credit card (or should you change credit cards due to strategy in the coming years), CardUp has the least exclusions vs. the others. - ipaymy has since been excluded from some cards.

Particularly UOB, which is what I’m on.

Some other good miles cards to pair with CardUp would be:

- Citi Premier – 1.2 mpd

- DBS Altitude – 1.2 mpd

This excludes premium cards like DBS Insignia (1.6 mpd) and DBS Vantage (1.6 mpd), which are typically not accessible to the mass market who aren’t high income earners.

Like this hack? Remember to share it with your loved ones so they can stop shortchanging themselves of miles they could have otherwise earned!

Save on your CardUp payments when you use my affiliate promo code BUDGETBABE

With love,

Budget Babe