If you’re not already in cryptocurrencies…WHAT ARE YOU DOING? I don’t always give tips, but I went ahead to blatantly talk about buying Bitcoin and/or Ethereum last year (and even hosted a webinar) when governments around the world were printing money. If you acted on that, congratulations! You’re probably up by at least 600% now, if not more. If you didn’t…then I hope the last few months have shown you the huge potential that exists in this space.

While risks similarly abound, I still maintain my position (since 2017) that I’m bullish about cryptocurrencies in the long run, and that everyone still has some in their investment portfolio. Opinions vary on how much percentage exposure you should have, but as long as it is an amount that you’re comfortable with (i.e. it doesn’t make you lose sleep, especially given the volatility of the crypto markets), that’s good enough.

A number of you have been asking me about which brokerages to buy crypto on, so I thought I’ll do an updated guide here today – since my last guide (Coinbase) is super outdated by now.

Note: This guide has been updated as of October and now contains 8 exchanges that I personally use and would recommend.

While this is by no means a comprehensive guide to how you may purchase or get your hands on crypto, I have shortlisted several popular methods instead that should suffice to help you get there.

For context, I have had accounts across all the 4 recommended platforms that I’ve listed below for several years now, and have ranked them in order of complexity – for beginners to the more sophisticated users. While I also have accounts on other platforms (e.g. Kucoin, Huobi, Kraken, HitBTC, etc), I find that they may not always be suitable for the majority of retail investors, and hence have not included them in this list.

1. Coinbase

Level: Beginner / Noobs

This is ONLY for those who are beginners and hoping to have some (not a lot) exposure to crypto. The benefits of Coinbase and why I’d recommend them are:

- easy user interface and set up – you can get started within minutes, and the user interface is limited to only a select number of cryptocurrencies so it makes it less confusing for pure beginners to get started.

- convenient – just pay via your linked debit or credit card

- fairly secure – Coinbase maintains 98% or more of their customers’ digital currency in cold storage, with the remainder in secure hot servers to serve the liquidity needs. All digital currency that Coinbase holds in its online hot storage is insured, which means if Coinbase were to suffer a breach of its online hot storage, the insurance policy would payout to cover any customer funds lost as a result.

- no need for a separate cold wallet – you can choose to safely store your crypto in their “vault” for higher security, without having to go through the hassle of buying and setting up your own cold / hardware wallet

- unlikely to close down – they’re not only profitable but also a listed company which adds onto my next point of…

- higher perceived trust – since it was one of the first providers in the market and has been around for ages

On the whole, Coinbase is great for beginners, and I have many friends who simply wish to buy and hold a small amount without having to go through the hassle of too many technical set-ups, logins or multiple wallets.

If you’re keen on setting up Coinbase, you can sign up at www.bit.ly/coinbase13sgd to get USD 10, or you can read my detailed guide here.

The problem with Coinbase is that because your purchases are via your linked debit/credit card, the processing fees can go up to ~4% easily, which can be a huge turn-off if you’re getting serious about crypto and intend to use higher capital sums to invest. As a trading platform, its limited access of alts isn’t anything fantastic either.

So if you have higher capital and you’re looking for a provider with more competitive rates and fees, then I doubt you’ll find Coinbase suitable. In that case, you can consider other alternatives such as:

2. Gemini

Level: Amateurs to Intermediate

If you’re thinking of building up a sizeable amount of exposure to crypto-assets and/or for the long term, then Gemini might be a better platform for you.

What’s more, if you’re based in Singapore, it is also currently the only exchange where you can easily sell Bitcoin for SGD and transfer your proceeds via FAST to your local bank with zero fees.

Other benefits include:

- pretty secure, both in terms of reputation (founded by the Winklevoss twins) as well as technical set-up and processes (it is the world’s first cryptocurrency exchange and custodian to be certified as SOC 1 Type 1 and SOC 2 Type 2 compliant).

- local bank transfers via FAST – deposit or withdraw SGD via FAST transfers, which are handled on the back-end by their partner Xfers

- fairly competitive rates and fees – if you use Gemini ActiveTrader, the fees are 0.35% taker and 0.25% maker.

However, note that there is occasionally a premium for BTC-SGD prices, so if you’re fussed about always getting the best possible rates, then you may want to check and compare right before your point of purchase each time. (But so far in the past few years, any premium that we’ve paid have often turned out to be negligible considering how much the underlying assets have run up since.) Or, you could simply use TT via USD for purchasing, and then sell and withdraw in SGD.

If you wish to sign up for Gemini, you can click here for my referral link to get $10.

But if you want an even more cost-effective platform based in Singapore and also get access to more alt coins, then you may prefer…

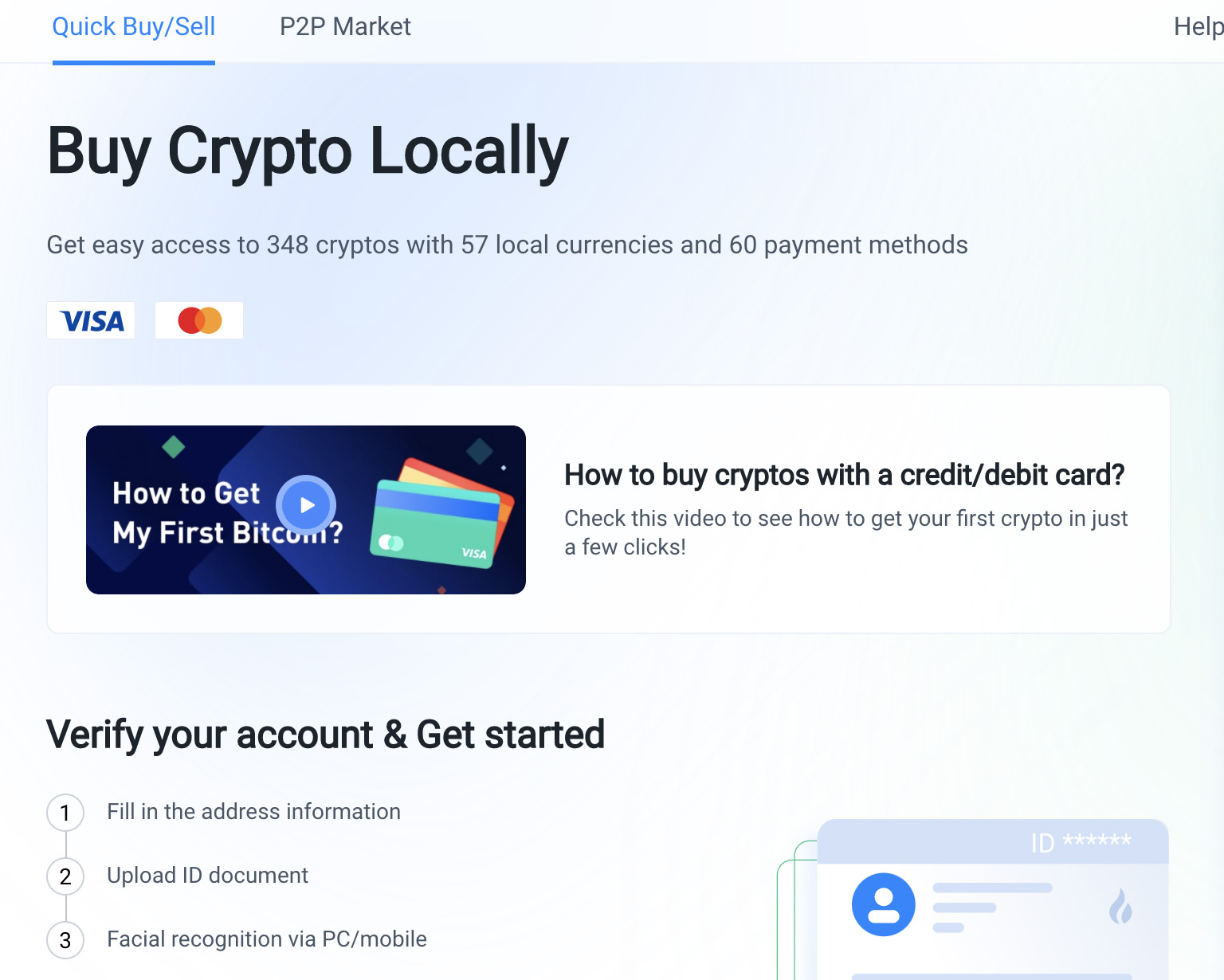

3. Coinhako

Level: Amateurs to Intermediate

The benefits of Coinhako are that it is a Singapore start-up, offers:

- local bank transfers – without you having to set up and link a separate Xfers account

- access to a variety of alts – more than Gemini and Coinbase

- is useful as an all-in-one platform for buy/sell/trading – if you’re not too bothered about finding the most cost-effective one

Everything is also in SGD, which I’m sure appeals to investors in Singapore who prefer seeing it in local currency (not that it matters though, since crypto operates across the globe…).

However, its fees at 1% are still considered high, especially when you’re trading. If that doesn’t deter you and you need a referral code for Coinhako, here’s mine.

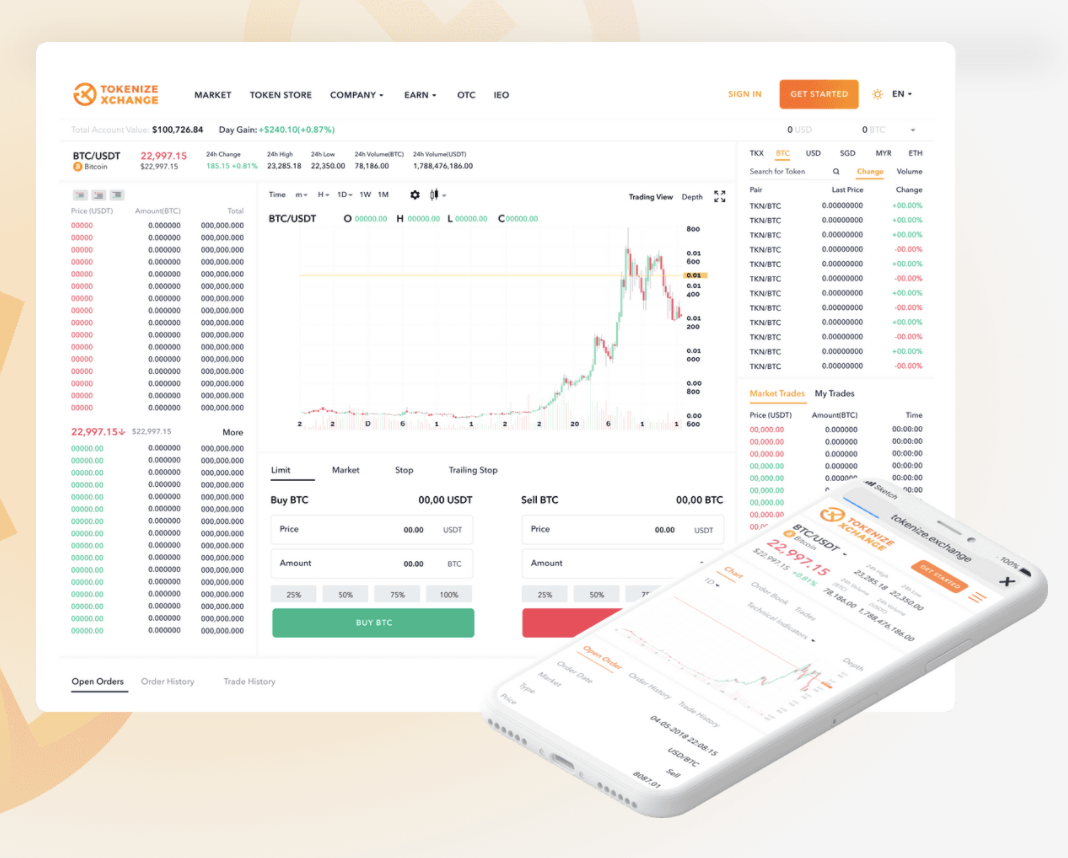

4. Tokenize

Level: Amateurs to Intermediate

5. Binance

It offers one of the best access to alt coins, as well as other crypto instruments such as staking, launchpads and token sales.

More importantly, it is one of the most cost-effectiveplatforms in terms of fees, and definitely lowest compared to Coinbase and Gemini.

Binance.com fees: 0.1%(No longer available for users in Singapore)- Binance.SG fees: 0.6%

The downside of using Binance is that selling to fiat can be pretty complex, which is why I wouldn’t recommend it to pure beginners who are only looking to build up a small stake. And if you’re in Singapore, Binance.SG has fiat-to-crypto partners (Xfers) now so you can convert fund via SGD directly and sell to withdraw your Bitcoin into SGD as well.

I’m personally not on Binance.SG as I feel they don’t compete well with the other exchanges, but if you wish to sign up for Binance.com nonetheless, you can click here for my referral link.

P.S. How many of you remember the days when we bought BNB coins for just $3 – $7?! I’m frankly in shock that it has now crossed $500…even though I’ve never had a doubt that Binance was going to stick around for the long-term and grow to become a leading crypto platform, I never would have imagined that its valuation would rocket to such levels. But I guess that’s just another example of some of the craziness (and insane gains) that can happen in the crypto world 😉

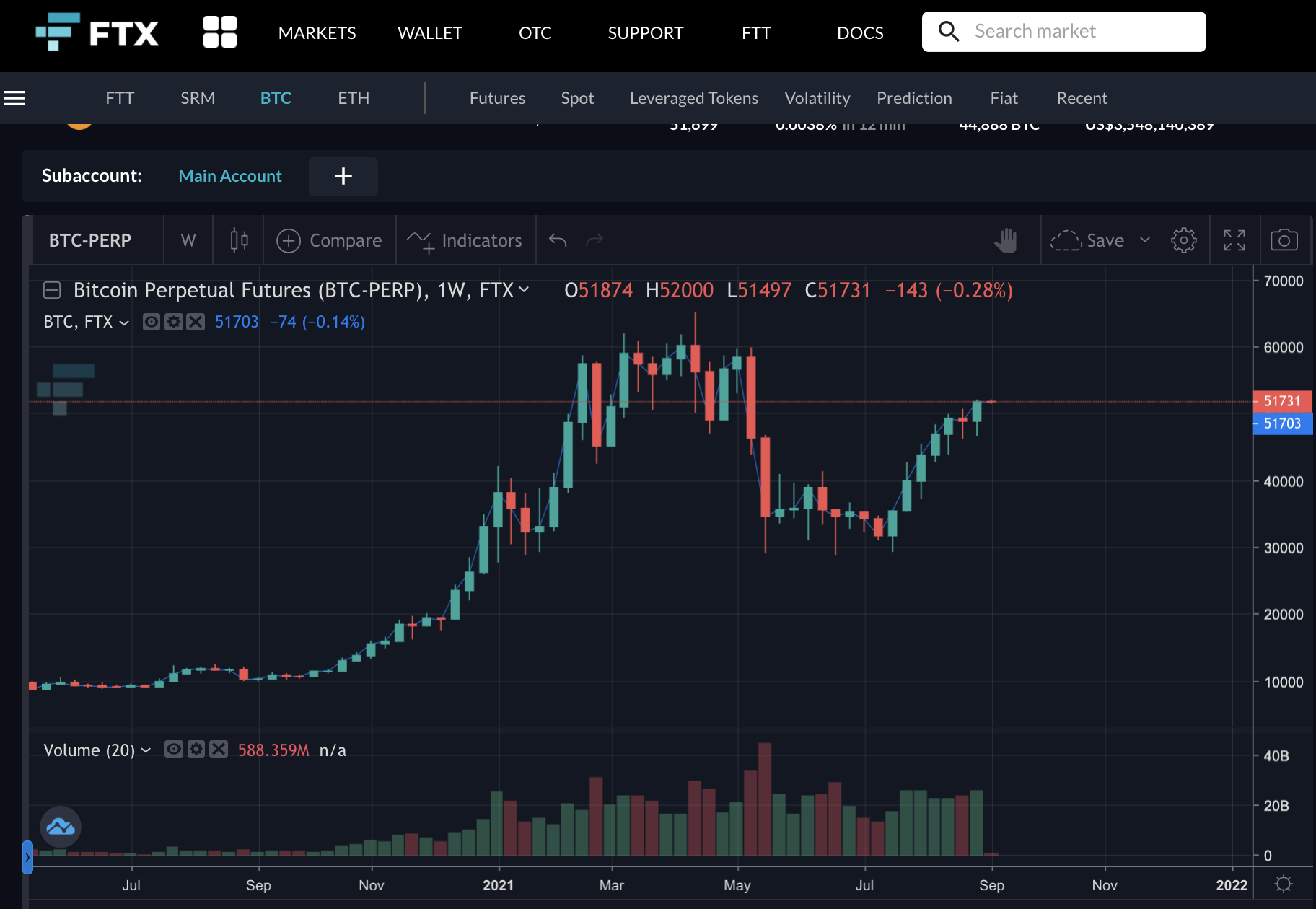

6. FTX

Level: Intermediate to Professional

7. Huobi

Update: Huobi will also be closing all its Singapore-based user accounts by March 2022.

Level: Intermediate to Professional

8. KuCoin

Level: Intermediate to Professional

—–

- Coinbase – only for buying minute amounts of crypto e.g. when I’m out or overseas and the ones which I don’t mind not storing in my own hardware wallet. If I need to make a purchase urgently, it’ll be via Coinbase.

- Gemini – to deposit so I can buy or sell Bitcoin / Ethereum.

- Binance – for trading, as well as to buy Bitcoin and transact other alts. In recent years, I also can now use it for staking and launchpools…I’ve gotten a few “free” coins in this way till date!

- FTX – this has replaced Binance.com for me, ever since Binance stopped offering spot trading in Singapore as of October 2021

With love,

Budget Babe

2 comments

Hi

If I am interested in staking BNB via Binance, what would be the cheapest way to do it?

I am thinking of depositing SGD to Binance SG to buy BNB, then transfer BNB to Binance.

Thanks.

I don't buy BNB via cash now for the purpose of staking so I wouldn't be the best person to ask on this topic. My BNB are all long positions, from a cost price of $7 per BNB way back in its founding years.

Comments are closed.