Looking for a savings account that doesn’t require you to jump through too many hoops for higher interest? If you struggle to meet the $500 monthly spend requirement on your credit card, there’s a new product on the market that you might want to consider.

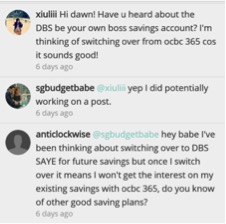

A few readers recently alerted me to DBS’ newest promotion – the Be Your Own Boss (BYOB) savings initiative – and asked me what I thought about it. Nothing gets my attention like another high-yield saving account, so I reached out to DBS and dug out more information. Here’s my take!

The premise is quite simple: DBS BYOB encourages you to pay yourself first when you get your paycheck each month. This is pretty much in line with what I’ve been preaching since my very first post in 2014 (read: how I saved $20,000 in a year), so it gets a thumbs up from Budget Babe.

DBS calls this method akin to saving like a boss. At 4% per annum, that’s a pretty solid interest rate, and one that currently beats all the other high-yield saving accounts I’ve previously reviewed.

What I used to do, before anything like BYOB was available, was to open up separate bank accounts for my savings and expenses. My paycheck went directly into my savings account, and I would manually transfer a fixed sum to serve as my “pocket money” for the month into my expenses account. For those of you who are lazy to track your daily expenses, this is a effortless way to stay disciplined and within a budget.

DBS makes it easier for you by automating this step. Set a figure sum to be automatically transferred to your POSB Save As Your Earn (SAYE) account every month and try to resist the temptation to withdraw money from your SAYE account.

Next, use your DBS / POSB Credit or Debit card to make at least 5 transactions monthly. Unlike many of the other saving accounts which require you to spend at least $500 on your credit card in order to earn bonus interest, there’s no such requirement here as you could technically make as little as 5 x $1 transactions just to qualify! Need some ideas?

- Grab / Uber payments

- Grocery shopping / buying NTUC vouchers

- Watching a movie (my favourite! DBS Mastercard also gives you discounted prices at Cathay)

- Eating or drinking out

- Shopping, whether at physical retail shops or online

For anyone who

- Spends less than $500 on your credit card in a month and / or

- Earns less than $2,000 a month,

this would be the best account in the market with the highest interest rates.

I’ve compared against the other high-yielding savings accounts in Singapore and none offers such a high interest rate with such low requirements at the moment. If you know of any better deal, please jio me!

For the higher income-earners who can afford to park aside $3000 of savings every month but still don’t spend enough to consistently hit $500 on your credit card, you can also take advantage of this promotion to get even higher interest than your existing <2% p.a. on the other banks’ schemes.

|

| View POSB SAYE base interest rates here. Tip: Deposit >$800 monthly to qualify for the highest tier. |

What’s the catch? Well, you’ll have to be a working adult of between 18 – 30 years old with no existing salary crediting arrangement with DBS/POSB between Sept 2016 – Feb 2017. For those of you who are older, you might want to look elsewhere…

Here’s what I recommend you to do in order to maximise the bonus interest of 2+2% p.a. without too much effort:

- Register for the Be Your Own Boss initiative here.

a. Get $88 cash gift if you do this before 30 September!

- GIRO credit your monthly salary into a DBS/POSB savings account.

- Open your SAYE account online here, and select the salary crediting account as the debit account to automate your monthly savings amount between $50 – $3,000.

a. Choose your preferred date for the transfer between the 1st – 25th day of your salary credit.

- Leave your SAYE account untouched.

- Use your DBS/POSB Credit or Debit card on at least 5 transactions a month.

a. For the best debit card, I recommend the DBS Visa Debit Card which gives you 5% cashback on your Visa payWave purchases (min. 5 transactions a month).

b. You can use your card for Grab / Uber rides, or grocery shopping, or at the movies, or offer to pay the bill first when you’re eating out with your friends.

Remember to get this done before 31 September 2017 to enjoy the bonus cash gift!

Before you sign up, you might also want to read about the BYOB promo, its terms and conditions (I’ve highlighted the more pertinent ones in this post), the bonus interest illustration and the SAYE account.

Disclaimer: This article is written in collaboration with DBS (after a reader alerted me to BYOB, which was how I came to know about the product). All opinions are of my own.

20 comments

if my pay is currently being credited into a DBS account by my company, does it meant that i have an existing salary crediting arrangement with DBS/POSB?

A pity I am past the age requirements haha.

Hopefully it doesn't become another 360 account which the terms are changed to earn the interests =X

Is there a cap to how much the 4% interest earned during this 2 year period?

Hi, I really like your blog you’ve written very well. I must say you have lot of knowledge about this but I want to suggest you something that if you are looking forb Free ad Posting Websites http://www.helpadya.com there is one more website www.helpadya.com

Hi, yes if they've been crediting your salary between Sept 2016 – Feb 2017. Usually such promos are to attract new-to-bank customers who don't have existing salary crediting arrangements! The promotions across banks generally aren't that attractive if you're already an existing customer for salary credit.

Hi Jeremine,

The cap is on the monthly savings amount – max. $3000/month. For any ad-hoc deposits into the SAYE account, this will earn the base interest rate, not the additional 2+2%.

So in short, just follow my hack and you'll be fine 😛

Well this won't change in the next 2 years at least!

This comment has been removed by the author.

Hi , i'm interested to find out if is a must to do salary crediting to BYOB acct?

Is it possible to do personal giro transfer of 3k / mth to BYOB acct instead of salary crediting to earn the interest?

Please advise.

Thank you very much

I have registered from the website indicated in your link, and they only required the year of birth to identify age. I am born in 1986, but I am a few months above the 30 years old since my birthday is in the 1st half of 2017. Will DBS disqualify me because of this?

Do you have any idea? I like to check this before I change my salary arrangement.

Hi, may I know why the interest in Aug 2018 for ocbc 360 is only $30 plus as per your table calculation?

I KNEW someone was gonna ask this haha! That's because bonus interest is capped to the first $70k. You can reread OCBC's website where this is clearly stated.

It has to be salary crediting. What you're suggesting won't work with the other high yield bank savings accounts which offer even lesser interest than BYOB, much less DBS BYOB…

Wow that's a tricky question. Based strictly on the T&C I would warrant a guess that you actually don't qualify, but perhaps it'll be best to check with the bank directly and them to provide you black and white acknowledgment proof before you go to the trouble of changing your salary arrangement!

But shouldn't it be stagnant at $87.33 from august 2018 all the way to august 2019? Since that is the maximum interest we could get from $70,000. Why does it reduce to $30 plus on Aug 2018?

Hey Henry, omg you're right! I didn't realise my excel sheet missed out on the other cell which should have been = (balance*0.05%) + (1.5%*70000)! I've since fixed the error, THANK YOU for helping me to spot! 🙂

Hey Min Zhi, as Henry kindly pointed out, I made an error in my excel formula (sorry! did this table at 1am) and left out on the +(1.5%*70000) part after Aug 18. I didn't realise this was what you were asking in the afternoon until I saw Henry's comment. Thank you so much for helping to flag out the inconsistency!

does it mean i have $63k on the 21st month, i will be entitled 4% for full $63k if only i have so much money after wedding and reno la. >D

that should be about right! 🙂

Hi Dawn, one of the conditions is to leave our SAYE account untouched. Does this mean that if we withdrew even a mere $1 from the account, we will not be entitled to the 2% interest?

Comments are closed.