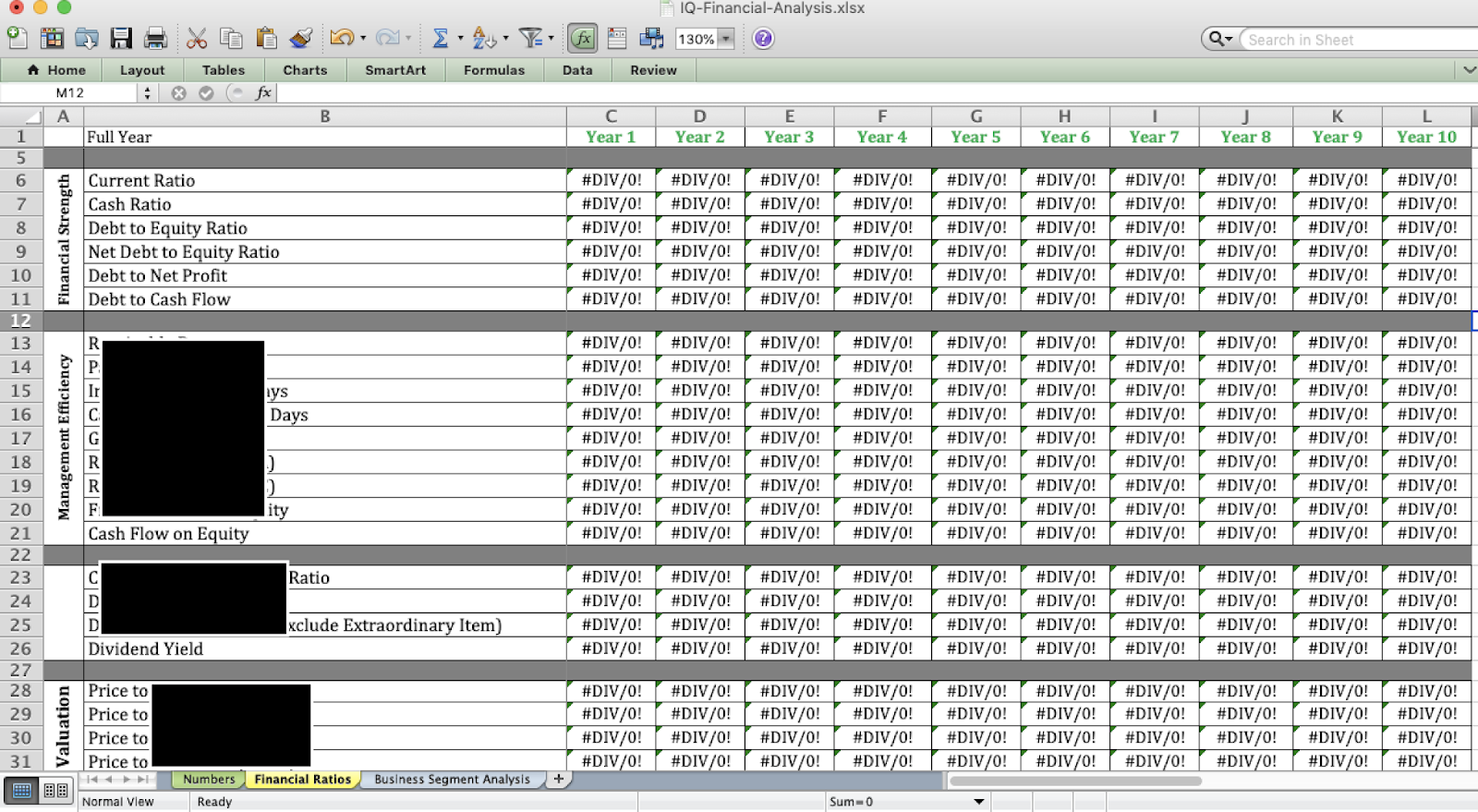

Here’s one of the key spreadsheets I use for analysing stocks:

It makes a lot of the work easier, because all I need to do is to input the relevant financial information from the company’s annual report(s), and the financial ratios are then automatically calculated for me.

If you want a solid strategy and investment framework to follow for spotting profitable stocks, I would highly recommend you use this as well.

Where can I get it?

This spreadsheet was designed and formulated by The Fifth Person for Investment Quadrant, which I feel is Singapore’s most underrated course teaching value investing.

In case you’re not familiar with value investing, it is/was the method that make Warren Buffett rich – his total net worth is over 88 billion dollars now!

Value investing is also my favourite method to invest, because I’ve gotten returns ranging from 30% – 50% on undervalued stocks in a short span of three years. But my friends, Rusmin and Victor, have done even better and managed to turn $400,000 in losses to over $2 million in profits within just 2 years.

That’s no small feat. How did they pull it off?

I found out the answer a few years ago when I attended their course, the Investment Quadrant #paidwithmyownmoney

What’s covered?

Aside from teaching you how to spot wonderful companies, you’ll also learn how to analyse their management, read their financial statements for important metrics, and determine whether the stock is undervalued.

The bottom line is if the company is great and the stock is undervalued, BUY.

Otherwise, add it to your watchlist and wait.

You may have already read plenty of books or online articles talking about the different ratios to use when analysing a stock. But when do you use which ratio? For instance, while the price-to-earnings (P/E) ratio is a great formula, it isn’t entirely appropriate to use on banks or technology stocks.

So how do you know? The Fifth Person will go through the different ratios and when to use what, so you’ll never be confused again…or risk making an investment based on the wrong metric, thus jeopardising your money.

You can read a more detailed review of what’s covered here.

Why don’t you teach me instead?

I wish I could! I love personal finance, investments and education, which is why I spend so much time writing in here. You’ll also find lots of detailed stock analysis that I share from time to time, such as this, this and this.

The problem is, I wish I had more time so I could share more.

Aside from holding a full-time office job, I also teach tuition, analyse and manage my family’s investment portfolio and take care of my baby. Any free time I have, I write in here.

I only have 24 hours a day like all of you, and that doesn’t leave me with enough time to write and teach to my heart’s content.

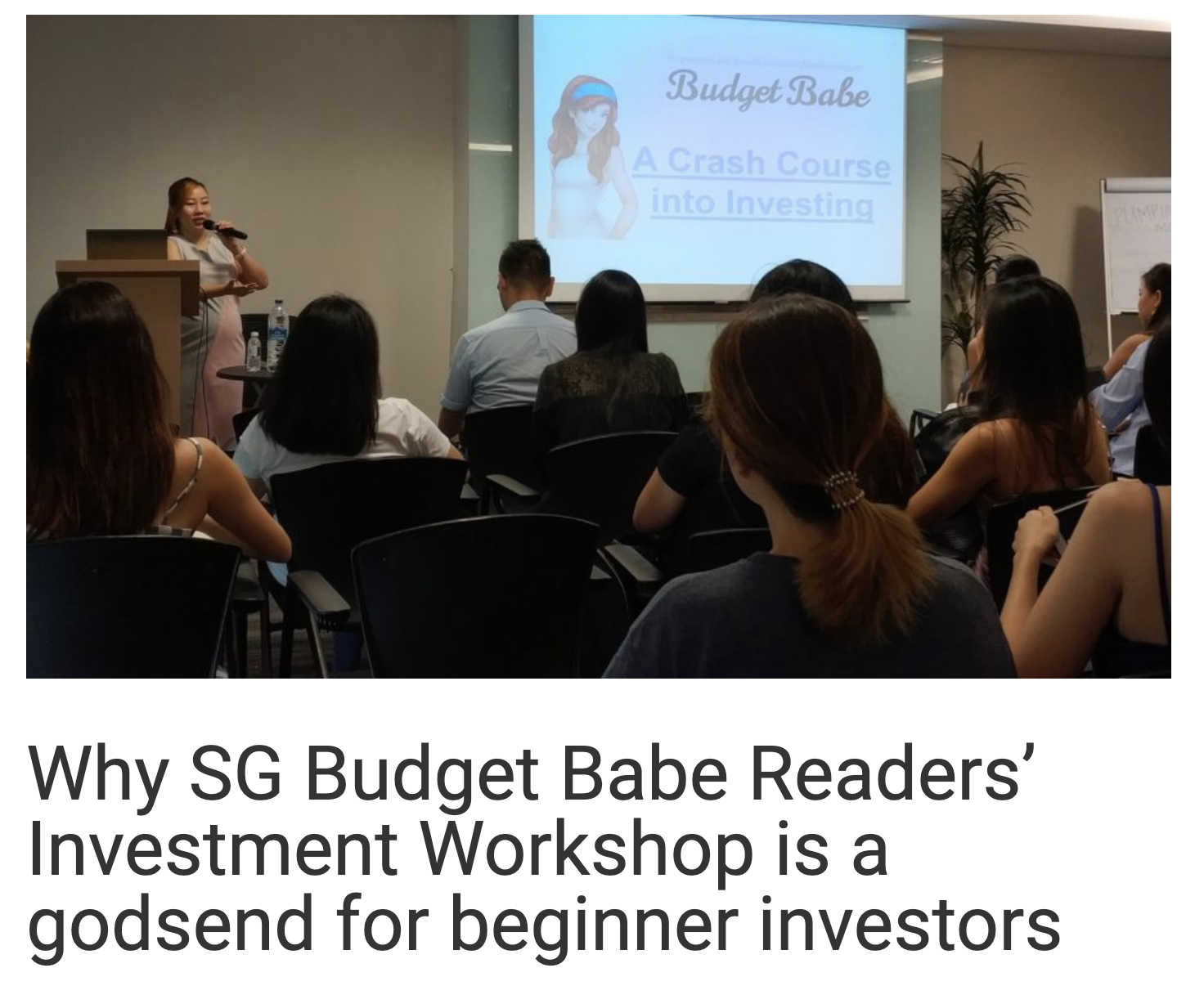

But in fact, I did recently hold a one-day investment crash course for my readers (during my maternity leave):

|

Read the full review here. |

Unfortunately, I don’t have enough time and resources to conduct more of these workshops, at least not in the foreseeable future (maybe when Nate is a little older?).

But in the meantime, here’s another course that I highly recommend where the contents are pretty similar to my personal investing strategy of seeking out stocks with a potential for double-digit returns. The biggest reason why I’m willing to endorse this is because I was once a consumer too (when I paid for the course upon its launch) and a beneficiary of their teachings.

It has solidified and transformed the way I look at stocks and investments, and I believe you’ll similarly go from a zero to hero investor by the end of it.

The best part? For a one-time fee, you get lifetime access to their online resources, which means you get to learn more and more as the years go on without any additional cost. Hey, even your university revokes your e-learning access at the end of every semester / upon graduation.

I’ve learnt new formulas (not found in books) and more, ever since I first paid several years ago. And no, I didn’t have to fork out a single cent more thereafter.

Investment Quadrant is open now for 2019, and you shouldn’t delay any longer lest you miss it again. I’ve not met a single soul who regretted attending Investment Quadrant, which is why The Fifth Person is even willing to place a bet with you: if you sign up and don’t find the lessons useful, you can apply to have your access revoked and your money refunded to you. No questions asked.

But I bet you won’t want to 😉 what, and lose out on a lifetime of free content? No way!

I’ve earned back more than 4 X of my course fees in just one stock which I bought after attending their course, and have made even more profitable stock investments since then. That’s why I’m confident that as long as you learn and stick closely to their principles (they even give you spreadsheets and flowcharts to execute so you’ll never stray), you can achieve the same.

The Investment Quadrant course retails for $397 but you can sign up here to get another $50 off (i.e. just $347 now).

But hurry, because it closes on 12 May 2019, and you’ll have to wait another year for it to reopen again once you miss this.

If you’re a loyal reader, you know I don’t give recommendations lightly, but this is one time where I will because I genuinely believe there’s no other course that is as valuable…except maybe mine 😛 but then again, I don’t give out free formulas nor lifetime access like The Fifth Person does.

I’ll see you in class.

With love,

Budget Babe

2 comments

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

Comments are closed.