Your home loan is generally the largest among your fixed expenses each month. Make sure you lock in the best home loan at the best rates so that you don’t end up paying more when a cheaper alternative is available. Use the PropertyGuru Finance loan comparison tool to search, monitor and get updates on rate alerts.

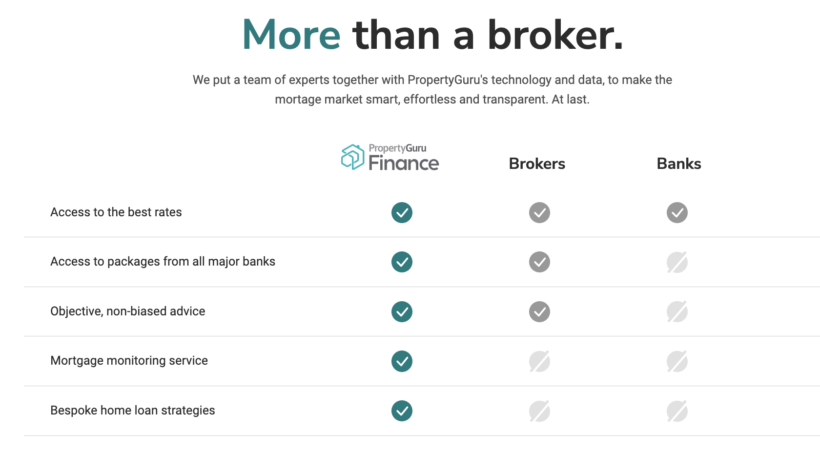

The mortgage market has never been the most transparent – for consumers, it is difficult to get data on home loans offered across all the different banks for us to compare what the best rates are.

That is why the majority of first-time home buyers end up taking a mortgage with the banker that was referred or recommended to them by a friend or agent (one that does not necessarily give the lowest or most competitive rates). Depending on the terms of your mortgage contract, you may end up paying extra interest for a period without being able to refinance to a lower rate.

But thanks to technology, you can now find out what the most competitive rates are for yourself via PropertyGuru Finance.

As the leading property portal in Singapore, PropertyGuru has used their market knowledge, data and technology to revolutionise the mortgage market for good. And that’s great news for us consumers, because it means we no longer have to rely on our banker for rates.

Within seconds, I can easily compare home loans across all the major banks in Singapore by using the PropertyGuru Finance loan comparison tool here.

The tool feeds into the daily data of the following:

- UOB

- DBS

- OCBC

- HSBC

- Citibank

- Standard Chartered

- Maybank

- CIMB

- RHB

- Bank of China

- SBI

- Hong Leong Finance

- Singapura Finance

What I like best is how you don’t have to key in any personal contact information to use the tool.

After all, I prefer to search and reach out to a specialist only if I’m interested and when I’m ready, rather than having to answer to someone else’s follow up with me when I’m not yet ready to proceed.

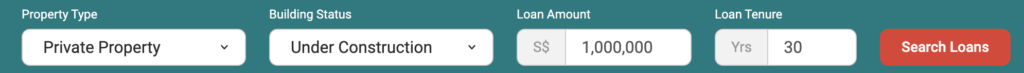

On PropertyGuru Finance, you just need to input the following parameters and it’ll give you the results right away:

What’s more, as different banks offer different rates at different points in time (this is largely based on the demand and supply of their disposal funds at hand), be sure to subscribe for Rate Alerts so you get firsthand updates on the best and lowest rates whenever there are any changes.

100% free with zero commitments

Once you’ve narrowed down your desired home loan packages, this is where you’ll likely want to have a mortgage specialist to help walk you through the T&Cs of the loan and process your loan application with your selected bank.

That’s why PropertyGuru Finance has also assembled a team of 25 in-house mortgage experts to help homebuyers navigate all the technical jargon and complex T&Cs…so that you know exactly what you’re signing up for.

And the best part is, their services are 100% free.

You can reach out to their team for advice on your home loan, or even to get a secondary opinion on any other quotes that you may have received elsewhere.

By partnering with all major banks, their focus is to give consumers access to the lowest interest rates and limited-time bank promotions, while offering unbiased advice.

The decision lies in your hands, rather than theirs.

How can I be sure that I’m getting the best rates?

PropertyGuru Finance has a bold promise: they guarantee you the best rates.

What’s more, there’s no incentive for any of their mortgage specialists to hard-sell or push you towards a certain home loan package, because they get paid by the respective bank when a loan is accepted (and this arrangement is the same across all partnered banks).

That’s why their priority is to match you with the best home loan for your needs instead.

Then, only once you’re satisfied and have decided to proceed with your home application with them, they then get paid by the banks. If you’re not happy, you can always walk away – there are zero obligations for you to commit to anything.

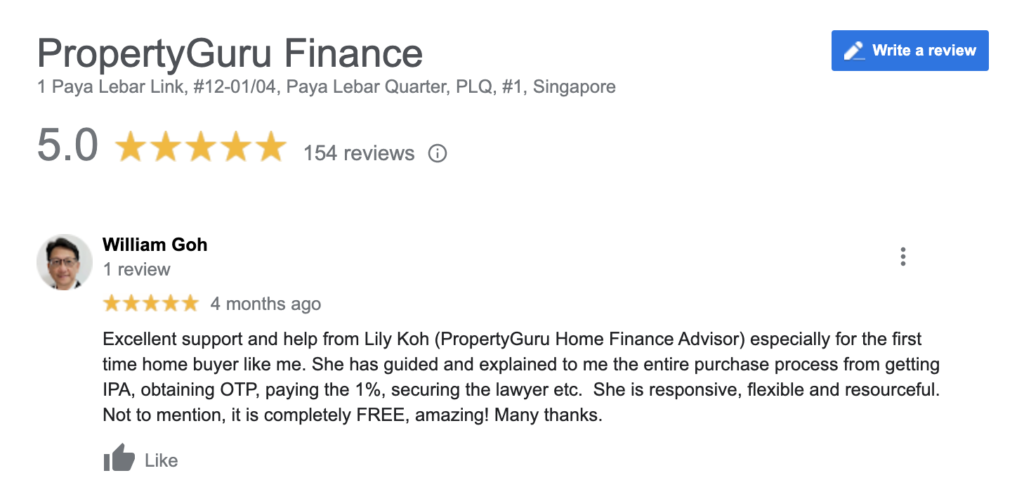

Having helped thousands of homeowners till date, they’ve garnered numerous multiple 5-star reviews on Google, but you’ll also notice something special while scrolling through the reviews: there are different names reviewed for their excellent service – a testament to not just one star player, but to almost the entire team.

Given that you don’t even need to provide any personal information to start comparing, go ahead and bookmark their loan comparison tool here now.

And of course, to make sure you get the best rates, compare and sign up for rate alerts here.

Disclaimer: This post is brought to you in partnership with PropertyGuru. All opinions are that of my own.