|

| I found these awesome savings infographics and decided to add on with some of my own! |

Ever since I graduated from being a student to becoming a full-fledged working adult, it seems as though my monthly expenses has gone up exponentially. I still remember my university days when $500 was more than enough for me to survive on, but today, it seems like the busier I get with work (i.e. earning money), the more I inevitably end up spending as well.

A lot of these costs are a result of paying for convenience, such as taking taxis in order to save time, or buying food or drinks from a nearby 7/11 because I didn’t have the time to pack my own water / pop by a mama shop to stock up beforehand.

The easiest way to build wealth in our 20s remains the same, but it can get progressively harder to maintain low expenses when our time becomes the trade-off. After all, you can earn money back, but you can never get back lost time.

Nonetheless, here are some quick tips on trimming your monthly expenses to see a reduction of at least 20% within the next month itself:

1. Skip the snacks

Thinking of skipping lunch hour to finish that submission? Don’t. Not only is it bad for your stomach, you’re also more likely to end up spending more if you skip your meals.

Instead, take time for a proper meal (even if it’s a quick 15-minute one) so you’re less inclined to spend on snacks as a replacement. I discovered this last week when I was so busy with work that I barely had time for a proper dinner before my dance rehearsals, so I ended up buying small takeaways such as bread from Four Leaves or meat sticks from Old Chang Kee. The average cost for this replacement “dinner” worked out to be $5 each, when my average hawker meal would have only been $3.

2. Start packing lunch to work

|

| Credits: easylunchboxes.com |

I like making sandwiches, soups or bento lunch boxes to take to work. They’re simple, fairly easy, and also save me a ton of money since having lunch in the CBD is just so darn expensive. We don’t always have time to walk out to the nearest hawker centre to eat even if we wanted to, you know? I’ve shared some of my recipes which are both healthy and affordable previously (stuffed portobello mushrooms or zucchini carrot balls, anyone?) and will continue to add more recipes when I have time.

3. Replace Starbucks with coffee powder

Getting your daily Starbucks coffee on the way to work each morning can easily add up to over $1000 in a year. In the past, I used to make myself free coffee from the office pantry, but after a while I got put off by the quality of the coffee powder they stocked. Later on, I resorted to buying my own Nescafe coffee jars, which are cheap, tastes great with milk, lasts for a fairly long time, and also allows me to control how concentrated I want my coffee on days where I just need a stronger caffeine fix to wake me up. If you’re not a fan of Nescafe, I’m sure there are other coffee powder brands in the market that you can try instead.

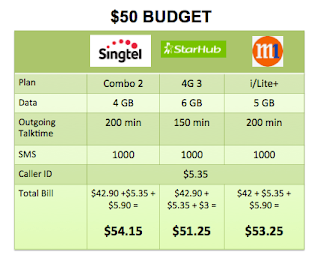

4. Check your mobile plan

Chances are, you might have been paying too much for data every month. I used to have the luxury of 12GB every month on Singtel but lost the privilege when I recontracted to get a new phone, and now the 2GB a month is barely enough for me to survive on. For the past few months, I’ve been billed an extra $30 each time for exceeding 2+GB!

If, like me, you find that you’re constantly exceeding your mobile plan in terms of data, SMS or talktime, perhaps it’s time to consider upgrading to a higher level which fits your usage more accurately. With talks of a fourth telco entering Singapore, the current providers have introduced add-on data plans which I’ve compared in a previous post here. Be sure to read that before you recontract!

If not, switch on your Wifi whenever you’re in office / home, and turn off the auto-download media feature on your Whatsapp. That might help you to keep within the 2GB limit each month so you won’t have to pay for extra. I know it can be a pain, but let’s wait a little longer as I’m sure consumers will soon get to enjoy more generous data plans!

5. Consider buying travel concession

If you travel mostly by public transport, you could consider applying for a travel concession pass to reduce your monthly travelling expenses which gives you unlimited rides on MRT and bus. Check how much you spend each month on your ez-link – if the amount typically exceeds $120, you might want to purchase the adult concession pass instead ($120).

There’s a cheaper option of the $80 Off-Peak Pass, which was introduced last year, but do note that there are strict rules in terms of the timing validity for your travel. I’ve done a breakdown here previously, so check it out to see whether the off-peak pass makes sense for you given your schedule.

Essentially, if you’re an average working adult with office hours of 9am – 6pm, getting the OPP will in fact increase your monthly transport cost, instead of decreasing it. Even if you have activities after work, you’re likely to be only saving on 1 trip each day on the pass. Check out the post for more details.

So there you go! Try implementing these tips and see how your expenses go for next month? Let me know of your progress, I would love to hear how these tips work for you!

With love,

Budget Babe

6 comments

Excellent tips on saving money. Being frugal is a virtue.

Totally agreed! Frugality trumps excessive spending anytime.

Totally agreed! Frugality trumps excessive spending anytime.

Maybe can switch coffee to korean grain tea (which does taste like coffee), for good health and it's even cheaper than coffee XD

Come and see how 1,000's of people like YOU are making a LIVING from home and are living their wildest dreams right NOW.

GET FREE ACCESS TODAY

You made a some good and effective points. I always prefer to read good quality contents and I think I have found it on your post here. Please visit https://goo.gl/JVgA0C

Comments are closed.