Everyone’s fussing about the recent claims that there will be a GST hike soon, but I honestly think there’s no point overreacting.

In case you’re not in the loop, DBS recently released a report claiming that Singapore’s GST could soon increase to 9%. This sparked much public outrage, with some claiming that the hike is too much and it is time for them to migrate elsewhere.

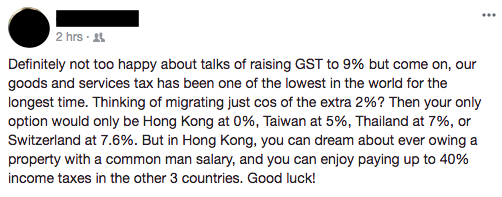

My friend was discussing this on her Facebook page and said this, which I thought was worth sharing:

But don’t forget that every country in the list above has its downsides as well.

In Hong Kong, property prices are exorbitant.

Bangkok struggles with massive traffic jams and air pollution.

Personal incomes in Malaysia and Thailand are 3 times lesser than Singapore.

Taiwan is located at the junction of two tectonic plates with high vulnerability to earthquakes.

Japan struggles with a shrinking economy and has the highest percentage of senior citizens in the world.

And at the end of the day, who will be the ones who have to pay the most due to the rise in GST?

Those who spend the most, of course. (Shopaholics, I’m looking at you.)

Instead of being sour about the impending rise in taxes, wouldn’t it be better to figure out how we can reduce our GST expenditures instead?

With love,

Budget Babe

10 comments

Mixed feelings, given the 2% cash rebate from paying via visa, I feel it lies more on the initiative to turn cashless. We will see how this pans out for singapore in 2019

quite a slipshod effort, coming from a finance blogger.

most are not just unhappy with the GST increase alone, but when it is viewed in tandem with the other recent price hikes (water / carbon / COE reduction etc.)

also, it's pretty myopic of you to think that just because it doesn't affect you significantly alone, the burden will be equally small for others.

This comment has been removed by the author.

It is not right to just compare the absolute GST/VAT numbers because while Singapore's GST is only 7%, it is likely much higher than say UK's VAT of 20% in absolute terms for the middle and low income people because UK's VAT exempt all basic necessities from VAT tax (including raw uncooked food, medicine and medical services, children's products, water, electricity etc)! I am not sure why people are comparing GST/VAT figures directly without taking those exemptions into consideration. Is it because they are ignorant of those exemptions or?

Agreed, it'll be better to figure out how we can reduce our GST expenditures instead! We can't control whether tax rises but we can control how we react.

This article compares primarily between GST and income. It never claimed anything else (or used click bait), so I don't see how it is a slipshod effort. If you have ideas on how to improve, I'm open to hearing them!

Nonetheless, definitely agree with you that a holistic view of all the recent price hikes might be better, but then we'll also have to take into account all those figures for the 5 other countries listed for a fair comparison right? If you have those figures for all 6 countries, I'll be happy to modify the table 🙂

I'm not being myopic. I'm just saying no amount of complaining is going to change whether or not taxes are increased, since that's out of our control. It'll be better to figure out how we can reduce our GST expenditures instead.

For the low income group who would face difficulties in coping with the extra GST especially on basic necessities, I expect the government to help them out (perhaps with GST rebates or vouchers?). If the government doesn't, then well, I'll sign any petition campaigning for it.

To my best of knowledge, I am not aware of exemptions in the countries that I compared above, although if anyone knows and can highlight I'll be happy to change it!

You raise a really good point, if only GST was exempt from basic necessities as well! For the low-income folks, I think this will really help.

Malaysia has GST exemption for many basic necessities, you can read here:

https://www.3ecpa.com.my/goods-and-services-tax-gst/zero-rated-supply-exempted-supply-relief/

Very good read, thank you for sharing! The Singapore government should definitely consider that as well, to ease the burden on low-income households as GST relief vouchers may not be sufficient.

Eh, you should write in and tell them that!

Some general comments: A fairer comparison will need to take into account CPF contribution, local purchasing power and the benefits for citizens (e.g. government subsidies). I am no subject expert, but a comparison of just GST, annual income tax and average monthly income is too simplistic (if one is to decide whether to migrate or to debate whether a 2% increase in GST is justifiable). Of course, the income tax brackets will also differ depending on your personal income, and some countries may not impose GST on essential items. Hence, I think people will view the increase in GST very differently. Personally I am of the (biased) opinion that Singapore is special. It has done better than most countries in the past (e.g. by being more efficient and productive), and I expect it to continue to be that special country that can do more for less.

Comments are closed.