Traditional ILPs were used to be popular in an era where consumers flocked to hybrid policies that provided both insurance protection and investment returns. However, the cost also meant that customers saw their premiums increasingly get eroded by insurance charges as they got older, with less left for investment. Today, to appeal to the younger generation, many insurers have introduced pure-investment ILPs, with no (or minimal) insurance charges. But are these really worth your time?

The problem with older ILPs

Traditional ILPs were launched as a hybrid policy providing both insurance protection and investment returns, in response to an era where consumers valued 2-in-1 or even 3-in-1 solutions.

However, what was less known was the technical details of how those ILPs were designed to work i.e. your premiums are used to buy into units of sub-funds (investment funds), and then sold to fund the cost of your insurance charges, which naturally go up as you get older.

This structure (which you can check in the fees and allocation table of your policy) meant that for consumers, their premiums got increasingly eroded by charges over time, with less left for investment.

As a result, even for loyal consumers who stuck to the plan for an extended number of years, they started to see their costs go up due to rising mortality charges, to the point where their investment units would soon no longer be enough to pay for the cost of maintaining their protection.

Tough.

Have modern ILPs improved?

Today, we know better. In response to all the discussions surrounding traditional ILPs, many insurers have also kept up with the times and have now introduced pure-investment ILPs, with the following improved features:

- 100% of your premiums get invested from Day 1

- No (or minimal) insurance charges

- Welcome bonuses and loyalty bonuses to reward you for staying loyal to the plan over the years

These essentially addressed what consumers didn’t like about traditional ILPs:

- Premiums go towards paying for sales charges first (front-loaded)

- Less premiums get invested from Day 1 (consumer doesn’t get the full effect of compounding)

- Rising insurance charges with age

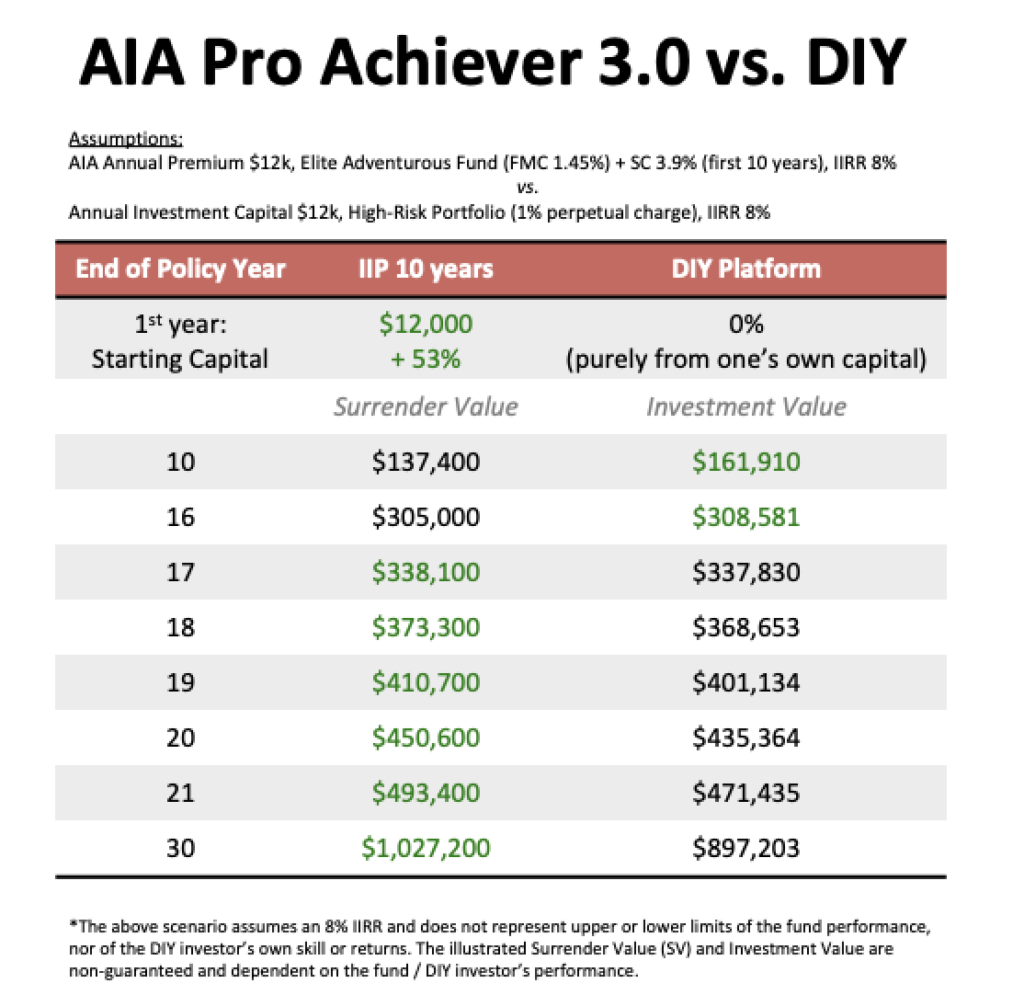

What hasn’t changed is the cost; obviously, investing your money through an ILP will cost more than if you DIY.

Just like how ordering a birthday cake from an established baker will cost you more than if you bake your own cake.

Hence, if you *do* decide to go with an ILP, you should not be comparing with the costs of DIY, but rather, evaluate the trade-offs and determine if they make sense for your profile.

Here’s an example, using AIA Pro Achiever 3.0 to illustrate:

Important disclaimer: this is merely a general illustration and NOT financial advice.

Using an ILP to ensure you don’t veer off-course

Let’s imagine Jack, who is a dad of 2 and wants to invest for both his retirement as well as his children’s futures. He has $50,000 in liquid savings that he wants to grow, but isn’t sure of where he should put it in. He tried investing during the pandemic, but is uncertain if he wants to do it himself for the long-term, especially as many of the stocks he was influenced to buy back then (Tesla, Palantir, Roku) are very much in the red.

He meets up with his Financial Services Consultant who then recommends AIA Pro Achiever 3.0 to him, and he likes the idea that he can use the plan to achieve the following investment objectives:

- 100% of his premiums get invested from Day 1

- He can choose his own investment duration with Initial Investment Periods (IIP) (10/15/20 years)1 to “force” him into staying committed to the investment plan, so that he does not “chicken out” of the market even during bad or emotional times

- Free fund switching so that if his risk appetite changes, he will not incur any transaction fees in changing his investment portfolio

- Supplementary Charges are only for the first 10 years

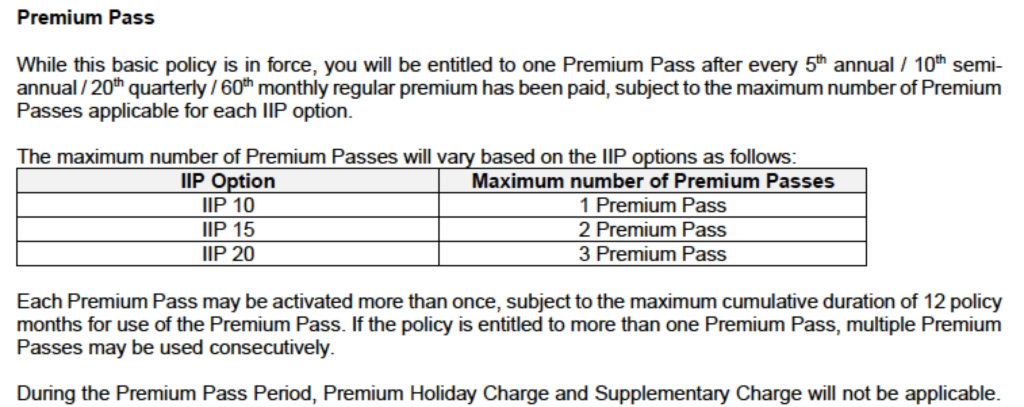

- For every 5 years of premiums paid, he gets 1 premium pass (option to take a break from paying premiums for up to 12 months, with no charges unlike a premium holiday)

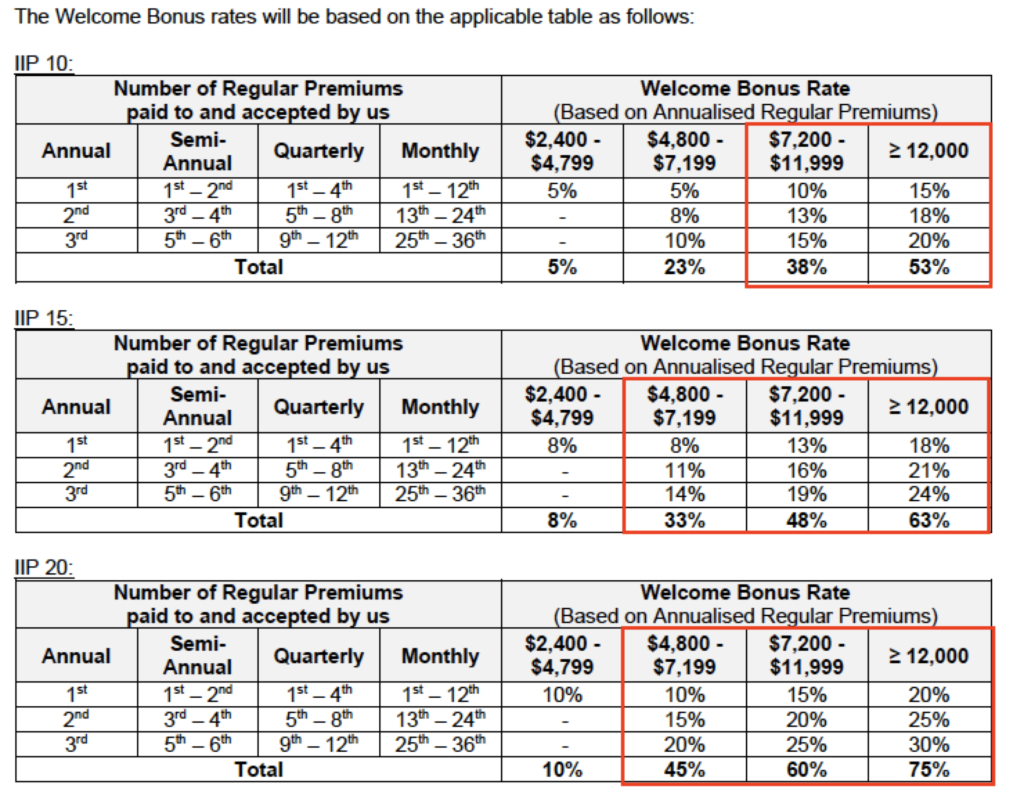

- High welcome bonus2 of up to 75% (53% if he can afford to invest $1,000 a month, for IIP of 10 years)

- Aside from top-ups, customers also can continue to pay regular premiums (beyond the initial investment period) and earn Special Bonuses3 of up to 8% of regular premiums

Of course, he also takes note of the following trade-offs:

- If he wants to invest more than what he initially committed to, there will be a 5% sales charge (on ad-hoc top-ups)

- If he buys this plan, he needs to ensure he is committed to it and does not cancel it halfway through, otherwise he will incur hefty penalty charges

While he’s not a fan of the lock-up period, he likes how the illiquidity will ensure he stays on track to his long-term investment goals, especially as he worries that he will panic and sell his liquid investments again at the first sign of trouble (like what he did with Tesla).

Jack decides to take some time to mull over it, and calls his savvy DIY investor friend out for a cup of coffee, who then tells him this:

- “ILPs have higher costs, you’d be better off DIY-ing! Come, I teach you.”

Unfortunately, after spending a week with his investor friend trying to learn how to DIY, Jack starts to struggle because he realizes that he has absolutely no passion to study businesses or keep up with their news, and that he is too emotional for his own good (he recalls buying Tesla at $300 in 2021 when Youtubers were talking about it, and then selling it off at $120 in December 2022 after hearing that its CEO Elon Musk cashed out over $3.6 billion of the stock, only to regret it now that Tesla has rebounded back to $200). Deep down, Jack also feels that he’d be better off focusing on his career to earn money, where he has been steadily climbing the corporate ladder and is poised to get promoted to Director in a couple of years.

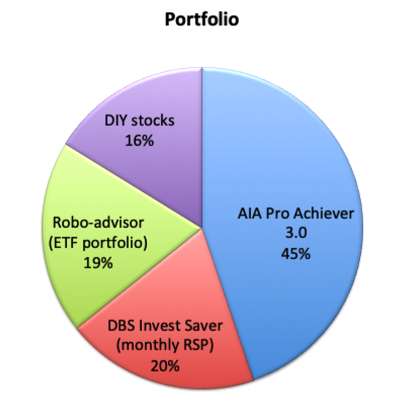

Jack makes his decision: he will commit to investing $1,000 a month into AIA Pro Achiever 3.0 with IIP of 10 years, and try to DIY the rest by himself.

To make sure he will never be caught in a situation where he has no choice but to cancel his policy (since there are penalty charges at stake), Jack decides to set aside $24,000 into short-term fixed income options, switching between MAS T-bills, Singapore Savings Bonds, cash management products and fixed income deposits so he retains liquidity.

With the Premium Pass4 feature that allows him to pause the policy (without incurring charges) if he ever needs to, Jack figures that even in the worst-case scenario (although he doubts he will ever be unemployed for more than 2 years) he decided to play it safe since there are penalty charges at stake once he takes up this policy.

With his remaining funds, he decides to set up 2 investment accounts:

- $500 monthly into a Regular Savings Plan for unit trusts (at 0.82% sales charge monthly)

- $500 monthly into a robo-advisor for ETFs (0.65% p.a. management fee per annum)

- $5,000 to kickstart his stocks portfolio

- $6,000 to keep as cash

A year later, Jack has decided that this combination works for him best as it gives him enough room to DIY some investments without too much stress, while concurrently building his career (where he has just gotten a promotion, hooray!).

Although his investor friend boasts of how he’s able to pay less than 1% in fees, Jack feels the charges he pays to AIA for his ILP is worth the trade-off, especially since the fees cease after the first 10 years vs. his other friends who are being charged 1% platform fees perpetually on their portfolio.

The best thing he likes is that after 10 years (his chosen investment period), he gets to decide whether he wants to continue paying premiums or to stop and let the policy roll. At the same time, he will have the liquidity by then to withdraw as and when he likes.

Of course, Jack is an imaginary character, but I hope it gives you an idea of how you might be able to tweak or come up with your own as well.

When is an ILP unsuitable?

Obviously, for Jack’s good friend who is a skilled and disciplined DIY investor who does not bail at the first sign of market volatility, a plan like this may not work for him.

Neither would it be suitable for those who have commitment issues, or those who will be the first to cancel their insurance policies during financial hardship.

It is also not suitable for folks whose ultimate objective is to go for low-cost, because there are always higher fees when you outsource something instead of DIY.

Conclusion

If you’re tempted into buying an ILP, the key questions you should first ask yourself are:

- What will you do with the funds if you’re not investing it into an ILP?

- Will you, and can you, DIY?

- If not, are you willing to learn how to DIY investing?

- Are you confident of investing for your own returns if you go for lower-cost options?

Your own answers to the above questions should give you a good idea of what financial tools will be suitable for you to deploy in your own investment portfolio.

And if you’ve considered all these factors and decided that DIY investing would be better for you instead, then I’ll point you to these useful resources here to help you up your investing skills.

Of course, AIA Pro Achiever 3.0 is not the only ILP in the market, but with the higher welcome bonuses and allowing for a premium pass (instead of a premium holiday), you can explore it further to see if it’ll be suitable for you – and weigh its pros and cons like how Jack evaluated it for himself.

Disclosure: This article is sponsored, and has been fact-checked, by AIA to ensure product accuracy. While Jack is an imaginary character, he is inspired by the conversations I’ve had with readers who told me why they decided to buy an ILP after attempting to DIY by themselves during the pandemic, so I hope this article helps to cover the different considerations you should bear in mind before committing to one.

For detailed product terms and conditions, please head over to AIA’s website here.

Notes on AIA Pro Achiever 3.0: 1 The plan offers IIP options of 10, 15 or 20 years. During the IIP, certain charges may apply, such as supplementary charges (if applicable), premium holiday charges, premium reduction charges, full surrender charges and partial withdrawal charges. Any dividend payouts (if applicable) will be automatically reinvested into the policy during the IIP. 2 Welcome Bonus on your regular premium will be payable for the 1st, 2nd, and 3rd annual premium received (subject to the annualised premium amount and IIP). 3 Special Bonus of 5% of regular premium will be payable for the 10th - 20th annual premium received, and increases to 8% of regular premium from the 21st annual premium received onwards. 4 You will be entitled to one premium pass after every 5th annual regular premium has been paid, subject to the maximum number of premium passes for each IIP option. Each premium pass may be activated more than once for a maximum cumulative duration of twelve (12) policy months.

Important Disclaimer:

This insurance plan is underwritten by AIA Singapore Private Limited (Reg. No. 201106386R) (“AIA”). All insurance applications are subject to AIA’s underwriting and acceptance. This is not a contract of insurance. The precise terms and conditions of this plan, including exclusions whereby the benefits under your policy may not be paid out, are specified in the policy contract. You are advised to read the policy contract. AIA Pro Achiever 3.0 is a regular premium Investment-linked Plan (ILP) offered by AIA. Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s). The actual policy value will depend on the actual performance of the policy as well as any alterations such as variation in the Insured Amount or premium, such as premium holiday or partial withdrawals. There is a possibility that the policy value will fall to zero and in this case, the policy will be terminated. Policyholder can avoid the policy lapsing by topping up additional premium. You should seek advice from a qualified advisor and read the product summary and product highlights sheet(s) before deciding whether the product is suitable for you. A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from your AIA Financial Services Consultant or Insurance Representative. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s). As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should consider carefully before terminating the policy or switching to a new one as there may be disadvantages in doing so. The new policy may cost more or have fewer benefits at the same cost. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information is correct as at 25 February 2023.

2 comments

Is this the same product similar to FWD invest first plus ? Thanks

Similar but different! I compared both and the welcome bonuses / charges / funds differ. If you’re unsure which is more suitable for you then I would suggest speaking with advisors from both companies so you can get a better understanding and decide from there!

Comments are closed.