2023 has been a year full of ups and downs. If someone had told me in the beginning of the year that we would see the Russia-Ukraine war continue into its second year, and that October would see Israel launch a full-blown attack on Gaza leading to 15,000 lives lost in under 2 months…I would have found it hard to believe.

But that’s exactly what happens – Life often has its way of surprising us.

As 2023 comes to an end, this is my annual review of my finances to check where we are now and ensure that we’re not falling too far off from our goals. During this yearly review, I typically examine my income growth, expenses, savings, insurance coverage, and investment performance – which helps me to better strategize for the new year.

Time flies, this marks the 10th year that I’m doing this on the blog! Before I go into this year’s review, here’s a quick recap of previous years:

- 2014: Saved $20,000

- 2015: Saved $30,000 and grew income

- 2016: Saved $40,000 and grew income, hit $100k in net worth at age 26 including CPF

- 2017: Saved $45,000 and doubled my net worth in a year

- 2018: Saved $50,000

- 2019: Saved $35,000 (didn’t realise I completely missed out on a round-up post, but here’s our child-related expenses instead)

- 2020: Saved $30,000 and achieved crazy (abnormal) investment returns

- 2021: Saved $40,000, grew income but saw reduced investment returns

- 2022: Saved $45,000 and battled a bearish investment climate

Savings & Income

This year’s savings hit an all-time high, largely fuelled by the growth in my income – which more than made up for higher household expenses due to inflation.

| 2014 | $20,000 |

| 2015 | $30,000 |

| 2016 | $40,000 |

| 2017 | $45,000 |

| 2018 | $50,000 |

| 2019 | $35,000 |

| 2020 | $30,000 |

| 2021 | $40,000 |

| 2022 | $45,000 |

| 2023 | $60,000 |

Loyal readers might recall how I chose to take a step back in my career after welcoming my second kid. In 2021, I gave up my Director role and was headhunted to join a competitor, where I requested for a less-demanding Senior Manager role instead, clocking in just 3 days a week (and more during crunchtime). But in late 2023, I got promoted to a new portfolio as Director, working closely with the government on new policies and I now manage a team responsible for bringing in and maintaining a huge bulk of our company’s Singapore revenue base. As a result, my salaried income doubled.

However, it is worth mentioning that I didn’t earn any (corporate) income for half of the year because I had to take time off work due to my youngest son needing surgery.

Nonetheless, my side hustles continued as BAU (business as usual), but I noticed something powerful kick in this year: the power of referrals. Word about the work that I do (for weight loss) really started spreading as my initial base of customers (who successfully lost weight) shared their “secret” with their friends and family members, which resulted in referrals and plenty of new business from folks who never otherwise heard of me (or Budget Babe).

Next year, I’m looking to build another new source of income, so we’ll see if that kicks off!

Expenses

Due to inflation and rising prices, our family expenses have risen significantly. We got hit by a higher mortgage rate (since we opted for a bank loan when we signed our mortgage pre-COVID at 1+%) and higher household bills at the same time, just like everyone else who’s a homeowner and pays for their family in Singapore.

Our current monthly household income has risen to:

| Nate: childcare & enrichment | $1,200 |

| Finn: childcare & enrichment | $1,000 |

| Helper salary and levy | $1,000 |

| Mortgage & home insurance | $1,300 |

| Town council, carpark and utilities | $650 |

| Dining & groceries | $1,400 |

| Family insurance policies | $1,200 |

This excludes our individual dining expenses, the allowances that we give to our parents (a 5-figure sum each year) and other miscellaneous expenses that aren’t recurring in nature, so you can imagine how the actual sum is a lot higher.

Our bills (fixed expenses) have gone up, but the biggest pain has definitely got to be from the cost of eating out, which has increased significantly as F&B outlets hiked their prices this year. To adapt, we’ve been trying to cut down on this in order not to bust our budget (although it is hard to run away from it entirely, especially when you have kids who request to eat at certain places on weekends).

For overseas travels, we brought our family (and parents) to Taiwan for a 2-week trip and spent 4D3N in Cameron Highlands, so our total holiday budget rose from $5k last year to $13k this year.

Insurance

My husband and I added 2 new insurance policies this year to our portfolio to increase our coverage for critical illness, especially after MOH ruled that cancer will no longer be covered 100% under conventional insurance plans.

We lost a few friends to death this year and saw several others got diagnosed with cancer, so we decided to act while we’re still in good health.

Investments

But you know what was even more unexpected?

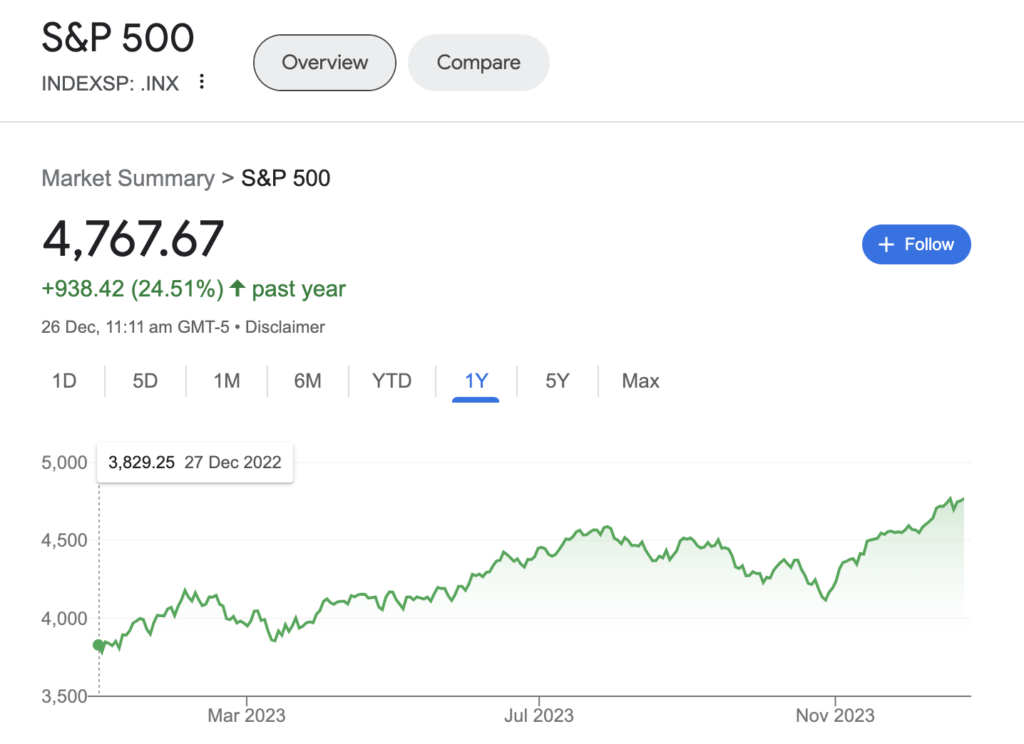

That the stock market would officially bottom out in December 2022 and see the start of a new bull ushered in by ChatGPT’s launch (on 30 Nov 2022, marking the stellar rise of Artificial Intelligence stocks (and hype?).

And that the S&P 500 would go on to gain 25% in 2023 alone, mostly driven by mega-cap stocks including Microsoft, Apple, Alphabet, (new-darling) Nvidia and Meta, etc.

If you had diligently stuck to your investing throughout (instead of giving up like what most retail investors did, when the bear market triggered by the tech stocks crash in 2022 persisted for much longer than most people expected)…congratulations, you would have seen your portfolio move from being in the red to into the green.

When I wrote this last year,

“In total, my investment portfolio is currently down by about ~35%”.

SG Budget Babe, 30 December 2022

I certainly wasn’t expecting the market to reverse so soon and for my portfolio to go back into the green so quickly, but that’s exactly what happened.

On another good note, my dividends payout have also hit an all-time high this year, with a significant boost coming from DBS’ hike earlier.

All in all, my investments are back on track.

Conclusion

I’m surprised that my savings hit a new milestone this year – considering how the last time I hit $50k was before I had kids, I certainly wasn’t expecting to surpass the number this year due to inflation. If not for the fact that I took 6 months off work, it is possible that my savings might have been higher, too.

And that’s the power of increased earning ability. If anything, this year has truly been a good reminder that we should continue to work hard and build through our 20s and 30s, so that we can have an easier time in our later years.

When I started this blog in 2014, I wrote that my goal was to retire by age 45. Looking at my own financial report card and progress since then, it is safe to say that barring any unexpected events, I am well on track to achieving it.

My 2023 financial summary would thus be:

- higher income (due to a promotion at work, and more referrals),

- higher expenses (due to inflation),

- a more resilient insurance portfolio, and

- improved investment performance (as the stock market turned bullish).

The next big item on my financial agenda will be to build my dividends portfolio to the point where my dividends will be enough to pay for my living expenses. I estimate that this will take me 2 – 4 years to execute, so I’ll update once I clear that milestone.

See you guys over in the new year!

With love,

Budget Babe