2017 has been an amazing year – I got married to the love of my life, officially moved in with my in-laws, finally visited Venice, went into cryptocurrencies right before its massive bull stream that catapulted it into mainstream consciousness, wrote an entire cashback guidebook (look out for the password to access it tomorrow in your inbox!)…and did a whole bunch of speaking engagements for CPF, DBS, Seedly, and more. It has been such a memorable year and I’ve learnt so much.

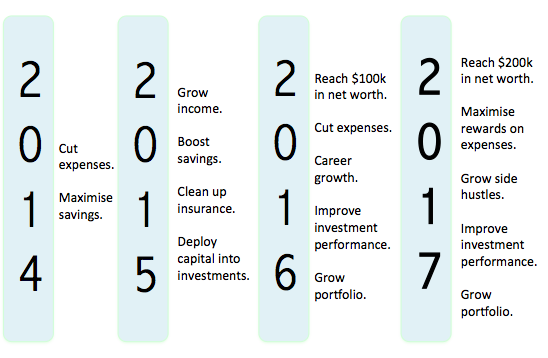

We’re now nearing the end of the year so it is time for an annual review of how I fared this year in terms of meeting my financial goals. Here’s a quick recap of previous years:

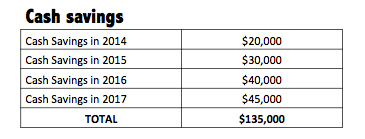

- 2014: Saved $20,000

- 2015: Saved $30,000 and grew income

- 2016: Saved $40,000 and grew income, hit $100k in net worth at age 26 including CPF

My initial focus in 2014 was all about cutting down expenses and maximising my savings, but over the years, I soon came to realise that there’s a limit as to how much you can reduce expenses. If I wanted to save more, the key would be to grow my income – whether through my job or through side hustles such as selling stuff on Carousell and gleaning ad revenue from the blog (Google Adsense in particular).

Therefore in 2017, I decided that “cut expenses” would no longer be a realistic goal. Instead, I focused on “maximising returns from expenses”, which is why there was so much talk about cashback and other reward programs this year (you’ll find them consolidated in the upcoming Ultimate Cashback Guidebook). Most of the other goals remained constant, because when it comes to investing, it truly is a lifelong quest for learning and self-improvement.

So here’s how I fared in 2017:

1. Grow savings – ACHIEVED!

I was initially expecting a drop in savings, as we needed to spend money for our wedding this year, but fortunately all the hard work and late nights that went into planning a budget wedding really paid off. This included being savvy about the right credit cards we used in order to maximise cashback on wedding expenses as well. Being able to see my fairytale wedding dream come alive at a mere $88 per guest (when hotel banquet rates are typically $120+) was no mean feat, but was entirely worth it. As a result, we managed to recoup the majority of our expenses from the ang paos received, which helped to usher in the beginnings of a great marriage.

By opting to go for a budget honeymoon (where we backpacked), we ended up only spending $3000 per person for a 14-day trip around Italy, and even had funds left over to go for a $705 Vietnam holiday later on.

My cash savings this year came in at $45,000 which was aided by a rise in income (and yes, I’ve to pay higher income taxes as a result, but I guess it is a good problem to have). I’m pretty satisfied by how I’ve fared in this aspect.

2. Increase net worth – ACHIEVED!

I had originally targeted to hit the momentous milestone by age 30, and even detailed out a plan on how to reach that goal here. Last November, I managed to reach $100k in net worth (cash + investments + CPF)…this year, my net worth has doubled to $200,000!

(How I calculate my net worth : liquid savings + investment portfolio + CPF)

How was this possible? I wondered the same, so upon digging deeper, I realised this was achieved through a combination of factors:

- Investing in a government-grade AAA bond (a.k.a. topping up my CPF + that of my parents. This is also why I count my CPF as part of my net worth, given my cash injections)

- Bank interest on my high-yield savings accounts

- Cashback from my credit cards and other tools

- Dividend payouts from stocks

- Capital gains on stock investments (2 of my bigger stock holdings doubled, which really helped boost the portfolio)

- Gains on cryptocurrencies (500% on Litecoin, 250% on Ethereum, 300% on Bitcoin and Cardano)

What I learnt from seeing my net worth double within a single year was that it gets easier over time, and the growth is truly exponential as long as you’re patient enough to let your seeds harvest. All the effort spent in the earlier years helped to allow compound interest to snowball, and all I had to do was to let the magic happen.

3. Improve investment performance – Somewhat ACHIEVED

I’ve made some good investment decisions, and some bad ones this year (you can read about them here). So as always, while there has been some stocks that have given me excellent returns this year, there are bound to be some losers dragging down the portfolio as well. This is where portfolio sizing is key, and having the conviction to continue holding until their value is achieved. I remain confident that the stocks I’ve bought will eventually have their true value recognised by the market, and will continue holding, or even adding on, when the price dips.

Given how bullish markets were this year, it was difficult for me to find stocks trading at a discount, so I mostly added to the ones I already had, and took positions in other stocks which lost favour with the public this year (but I’m still bullish on, in the mid to long term). How did I fare in the stock market? Well, all I can say is that I can definitely still do better.

In the world of cryptocurrencies, I studied it for close to half a year before I was confident enough to put a portion of my money in, and the effort seems to be paying off at the moment, with my portfolio gains surpassing that of what I’ve made in stocks. Am I making money? Yes. Have I made MORE money than what some other people have made in buying (shitcoins, in my opinion) IOTA and Ripple? No.

There’s so many people rushing into cryptocurrencies now because of FOMO, chasing after coins that have already gone up by multiple times. Do you really understand what the coin does? Do you know the security measures required to safeguard your coins? Do you know how to transfer coins? Do you know that you can LOSE ALL YOUR COINS if you transfer to the wrong wallet address and YOU CAN NEVER GET IT BACK?

Here’s an example of some coins I view as undergoing the mania phase right now: Ripple, IOTA, Cardano (ADA). These are coins which I feel are completely NOT worth their valuations right now (but hey why would you trust the opinion of some girl on the Internet right?) I bought ADA when it was at a much lower price, believing it was worth at least 2 to 3 times more. I’m now sitting on 500% gains for it and am seeing everyone rushing into ADA now, but errrrr no one can seem to justify to me why ADA is worth its current market cap!?! Would I pay for ADA at the price I bought it at? Yes. Would I pay for ADA at its current price today? No. What’s the difference? I think its valuations today surpass what it actually is deserving of (do you know that ADA Is just a whitepaper vision now and its decentralized PoS blockchain is not even ready, unlike other coins who already have their own working product?) I rest my case.

I quote Charlie Lee, the founder of Litecoin (and also the one that gave me supersized returns) on this:

|

| Source |

(Please don’t get the mistaken idea that cryptocurrencies are a sure-win investment. They are extremely volatile instruments and for the high returns, you’re taking on high risks as well. You may want to read this post where I talked about a friend who lost $500,000 overnight when the markets crashed on Christmas…are you sure you can stomach the ride? If you’re not prepared to lose it all, then perhaps you might not be able to handle investing in cryptocurrencies especially given the number of shitcoins out there.)

As always, I continue only to invest in only stuff that I understand, which are either undervalued, solve a real-life problem, or are changing the world. Whether in stocks or cryptocurrencies, this underlying philosophy remains the same and has served me well this year, so I don’t foresee it changing anytime soon.

Could I lose all my money? Yeah if Bitcoin crashes or go to zero, there’s no saying what will happen. So my mantra is only to invest in cryptocurrencies using money that I can afford to lose. If I’m wrong about cryptocurrencies (but I don’t think I am, lol) and lose my capital, I’ll just suck thumb and delay my FIRE plans. But if I’m right about this…heh.

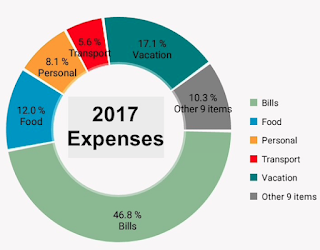

4. Maximise returns on expenses – Somewhat ACHIEVED

You’ll find a recurring trend in my expenses – bills take up the biggest portion without fail, every single year. The bills portion went up significantly this year because I started contributing to my in-laws household expenses since I’m now a permanent member of the family, and also because we clocked quite a bit of expenses for the wedding under my cards and funds.

Bills are non-discretionary expenses which are hard to reduce further. But even trimming discretionary spending has proven difficult in the last few years. There’s only so much a girl can do to skimp and save further, especially when I already live a pretty minimalistic lifestyle. (I prefer hawker meals and homecooked food over cafe brunches, I don’t drink or party, I mostly take public transport unless I’m cabbing for work, I don’t buy branded stuff or shop excessively on clothes / shoes / makeup…)

Therefore, instead of trying to make my life more difficult in trying to cut my expenses even further, I decided that the goal for this year was to maximise my returns on every dollar spent instead. By combining the right credit card strategy with various cashback tools and saving apps, I was able to make every single dollar go further. For instance, I got a few hundred dollars of cashback from routing my online purchases through Shopback, and managed to get rewards even on my tax payments to IRAS by going through CardUp!

2018 will be even better, now that I’ve finally gotten the Ultimate Cashback Guidebook out. This will be available only to subscribed readers and members of the merchants I’m working with, therefore, be sure to look out for the link and password in your inbox over the next few days!

The most important lesson I learnt this year? That it really does get easier. Once you hit your first $100,000, you would have established the key lifestyle habits crucial to growing your wealth. Thereafter, the rolling effect of compound interests really do start to become more prominent. And if you need some ideas on how to reach your first $100k, check out this post.

What about you, how did you fare this year? Did you meet your financial goals? If not, what’s stopping you?

With love,

Budget Babe

7 comments

Good way to do a progress check for year 2017! Those are great achievements and indeed inspiring! Agree with you that once good lifestyle habits are established, wealth building does become easier and being good in expense management is not that difficult.

I have also done my year end portfolio and financial position status check. Not too bad and will look forward to year 2018!

Budgetbabe,

It is good to know that you seem to be on the right track towards your financial goals. However, I am sure readers will be interested to know how you could possibly keep up with such rate of savings and investments when you eventually purchase a car. As you have personally alluded to before, owning a car is the biggest destroyer of wealth for Singaporeans. Your cash savings in 2017, according to your latest post, was $45,000. Taking into account that the depreciation and operating costs of an average car are anywhere between $22,000 to $26,000 per year, your annual savings will no doubt take a catastrophic hit from now on. Just the petrol expenses of the car alone would be much more than the cashbacks you prided yourself to have earned from jumping through hoops. Let’s hope that you’d still have enough left in your coffers to invest meaningfully, and continue your journey as a financial blogger espousing a frugal lifestyle to the masses while at the same time making such an enormous personal outlay on this luxury item. You might then say that the expenses of the car can be split between husband and wife, but if one were to be honest to himself the sum is still hefty especially for a couple in their mid-20s.

It was mentioned that your husband felt driving a car was a necessity since his colleagues all have one and he needs to drive to appointments and meet clients. Given the number of trips he seems to be making, fuel and maintenance expenses would correspondingly be much higher than an average daily driver. Just ask around and we would know that salespersons like property and insurance agents can spend $800 or more on just petrol alone in a single month. It is not certain whether your husband is being reimbursed for his car expenses but given the astronomical amount involved it would better be.

A car is sometimes not as reliable as what is perceived to be. You need to possess a fair amount of technical knowledge especially when you are buying second-hand. And there are also plenty of unethical workshops and dealers who are out to hoodwink the average car owner. So it’s good to be wary.

In your post written in collaboration with BankBazaar, you listed out a number of car loans available in the market. However, a quick glance of the numbers tell us that the rates for used car loans are still obscenely high as they are all way above 5% EIR. Could you share with readers how you would deal with such a high borrowing rate? What percentage of loan would you take and what would be the rationale? If you take a loan with such high EIR, does that mean you have in mind some risk-free investments that could generate even higher returns?

And to go back to the notion of frugality (the theme of this blog), if we have to resort to taking a high EIR loan just to buy a car, aren’t we spending future money and living beyond our means? It is a thin line line to cross, but if we think deeply about it, that does not make us any different from the average man on the street who is financially illiterate and imprudent.

This comment has been removed by the author.

Hi Paul,

Thanks for your concerns! To make things clear, we’re NOT “spending future money and living beyond our means” like you claim. We have enough liquid cash on hand to pay for the car in its entirety as well as a year’s worth of its associated expenses, so I don’t think we’re as “financially illiterate and imprudent” as you describe.

I’m also friends with some of the other financial bloggers who also own a car because they believe it is essential for their work. Are they financially illiterate and imprudent? I don’t think so.

Anyway, I'm not sure why I'm being attacked for my husband's decision to buy a car when I’ve clearly stated that it is HIS decision, not mine. As I mentioned before, I was never for the car. But since my husband argues that he needs a car because it will help him to boost his income, if he says so, then as a wife who trusts him, I will take him at his word.

We’ve deliberated over the financial implications of purchasing a car and find the expenses a reasonable figure that we can handle at this moment. Of course, that means we’ll have to delay buying a house, and I personally prefer getting a house before a car, but this is the trade-off we’re made.

Having a car does not affect my net worth because the car belongs to my husband, and I’m not using nor driving it, therefore he is the one paying for it and not me. Again, this is something we’ve agreed on as a couple as part of the conditions tied to this purchasing decision.

I've already mentioned on this blog as well as on the BB Facebook page that I supported his decision not from the perspective of Budget Babe, or from any angle of a personal finance blogger, but solely because I'm his wife and I couldn't talk him out of it.

Regarding the loan and interest rate, it isn't something I'm happy about either but we paid a huge portion of the total sum in cash so that we can reduce the interest charged. The total interest over the entire loan duration works out to be 1 month of salary, so we decided we can live with that.

Do I have a risk-free investment that can generate even higher returns than the loan EIR? Yes, that's (i) my husband (since this is supposed to boost his income) and (ii) my personal investments. My investment returns have been higher than the loan's EIR so far so I think I can live with that. The car has indeed boosted his income so far so let’s see how it continues to fare. I realised over the years that not everything can be quantified, and the convenience and lesser stress that having the car has brought to him has indeed made him a better performer at his work, translating into a higher income. If higher expenses are matched with higher income, that’s not a big problem to me.

I'm with you that a car is not necessary for most people, but I don't think a personal attack is necessary for a decision that isn't even mine to begin with.

Hi BB,

Congrats on your savings! You've indeed come a long way.

As you've mentioned that your husband and you would be planning to BTO, would like to hear your thoughts on using the OA account to pay for your BTO, if not, would you consider transferring it to your SA for the higher compounded interest?

Right in good time ! I've been drafting a post on this and you'll find my detailed answer up on the blog next week once I'm done 🙂

oh that's great! I can't wait 🙂 thanks for the head's up

Comments are closed.