Get S$228 when you successfully apply for the Standard Chartered Unlimited Cashback Credit Card – an incredibly fuss-free credit card that gives you 1.5% cashback on eligible transactions, with no minimum spend required and no cashback cap. I’ve been raving about this card since 2017, but in today’s climate where we’re all trying to trim our budgets, having a no min-spend card is becoming increasingly useful.

This exclusive offer for SGBB readers is valid only for new Standard Chartered Credit Cardholders from now till 31 March 2021, when you successfully apply and charge 3 eligible transactions (no minimum spend required) to your new Unlimited Credit Card within 30 days of card approval. What’s more, receive 1% cashback on your approved Credit Card Funds Transfer amount.

Most cashback cards give you bonus cashback for specific categories, such as grocery / dining / online shopping / travel / petrol and more. This usually comes with 2 common limitations – (i) you’ll have to hit a monthly minimum spend and (ii) monitor what you’ve spent on so that you don’t bust your maximum cashback reward per category and end up with nothing for your remaining spend.

But what if you’re unsure whether you can hit the minimum spend ($500 – $888 per month), or if you don’t normally have a specific category where you tend to spend more money on?

Well, here’s Standard Chartered’s Unlimited Cashback Credit Card to the rescue.

A must-have credit card for all cashback lovers

As most long-term readers might recall, there used to be a phase in my life when I spent huge effort in gaming the various credit card systems, even splitting my expenses to make sure I was getting maximum cashback and not busting any of my category cashback caps. At that time, my wallet held close to 10 credit cards in total, and I was (almost) an expert at knowing which card to swipe for what expense or merchant.

So, what has changed?

Fast forward to today, and I no longer have the time and energy for that. If you spend a significant bulk of your time / mental energy on your work or caring for your family, I’m sure you can relate. And when you add in the fact that we’re dining out and socializing a lot less since the pandemic started, our expenses have dropped as well, making it difficult to maintain my previous level of credit card spending habits of the past.

Which is why I’ve been turning to our trusty Standard Chartered Unlimited Cashback Credit Card a lot more these days, given that it is such an uncomplicated and fuss-free card. In fact, it has always been one of the mainstays in our (family’s combined wallet) wallet ever since I listed it as among my favourites here on the blog several years ago (I’m a firm believer that almost everyone needs at least one cashback credit card with no minimum spend or no cashback cap!).

Main Benefits

- 1.5% cashback on eligible transactions

- No minimum spend

- No cashback cap

For one, I no longer have to worry over whether we’ve hit the required minimum spend each month. Most of my other cashback credit cards require a $600 – $800 minimum spend, but ever since the Circuit Breaker began, there were several months where we’re not able to hit that (especially since we have the habit of getting our groceries from both the wet market and the supermarket only when our supplies run out, so the irregularity makes it even harder to plan).

There’s also no longer a need for me to track our category of spending. When I was younger, I was extremely diligent about tracking, but I have to confess that ever since giving birth, I haven’t had the time (nor energy) for this anymore. That explains why the cards with a fixed maximum cashback per category have been sitting idle in my other wallet ever since, to the point where I’m considering whether I should cancel them.

We initially signed up for the card back then because we had a big-ticket item coming up (our wedding), and ever since, there’s been more big-ticket items that came up along the way as well – our renovation and furniture purchases, delivery bill, and more. The card has seen us through several life milestones. Because of its unlimited cashback feature, we get 1.5% cashback on all of these big-ticket expenses as well, without having to worry about busting the cashback cap.

We each have different credit cards that work best for us at different phases of our lives, and at this stage of mine, the Standard Chartered Cashback Credit Card is definitely one of the mainstays.

Don’t forget you’ll also be able to tap on The Good Life privileges^ for discounts on staycations, food, e-commerce and more!

For new Standard Chartered Credit Card customers

As a new Standard Chartered Credit Card customer, you will also be eligible for:

- 1% cashback on your approved Credit Card Funds Transfer amount

- up to $228 cashback from now until 31 March 2021 ($80 upon successful sign-up, and up to $148 if you make 3 eligible transactions, with no minimum spend required, within the first 30 days of card approval)

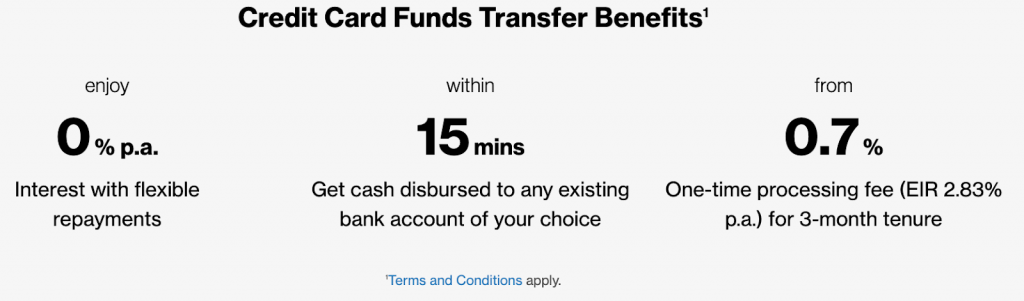

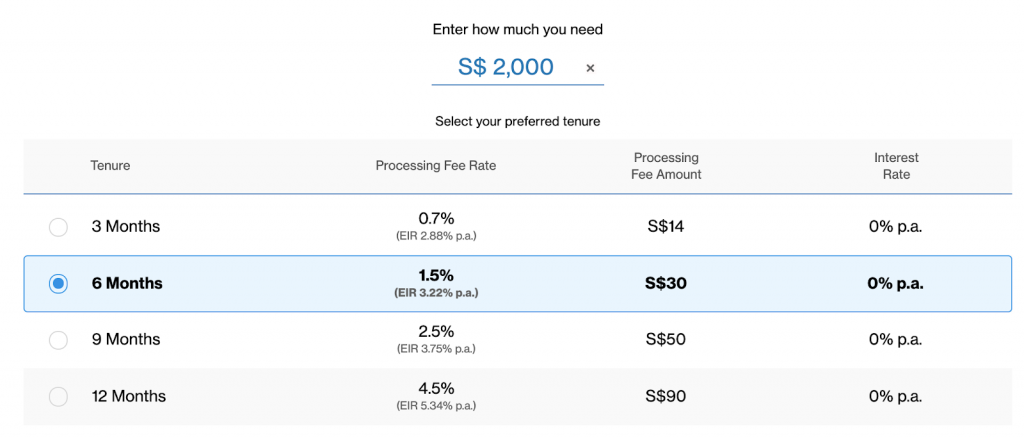

Otherwise known as a balance transfer, a Credit Card Funds Transfer with SCB basically allows you to get cash for your immediate needs at 0% interest for 3/6/9/12 months tenure with a one-time processing fee from 0.7% (EIR from 2.83%). This is often used to help with short-term cashflow needs, such as when you need to pay for purchases upfront (e.g. renovation fees to contractors or IDs who don’t accept credit card payments).

If that sounds like something you need, you can also get 1% cashback when you apply for a Credit Card Funds Transfer of at least $1,000. If you’re not an existing cardholder, you can apply here for the Unlimited Cashback Credit Card and borrow up to a maximum of 95% of your credit card limit.

There’s also a 1.5% processing fee on the approved amount for a 6-month tenure, and the promotional cashback of 1% on your approved amount is valid until 31 March 2021.

Note that while there’s a 0% p.a. interest rate, this promotion is only valid for the first 6 months, so I would first make sure I can repay the sum in full. Otherwise, the bank’s prevailing interest rate will apply from the 7th month onwards, and the interest charges are subject to compounding interest if not paid in full.

I recommend that you read through the T&Cs here before you proceed.

Get $128 when you refer a friend!

If you’re already an existing Standard Chartered principal Credit Cardholder, you should totally share this post with your friends and refer them to apply with your own referral link. You and your friend can get $128 cashback each!

(And if you’re one of the top 3 referrers during the campaign period of 8 Feb to 31 March 2021, you’ll even get an additional $888 cashback! I’ve no idea how we can track whether we’re the top though since there’s no real-time live feed counter…)

Sign-up Perks

So in summary, if you’ve yet to apply for a Standard Chartered Unlimited Cashback Credit Card, what are you waiting for?

You can get up to $228 in this way:

- $80 cashback upon successful sign-up

- a further $148 cashback when you make 3 eligible transactions

You can apply for the Unlimited Cashback Credit Card here!

This offer is exclusive to SG Budget Babe readers, so go ahead and apply now!

Disclosure: This article is written in collaboration with Standard Chartered Bank (Singapore) Limited (“Standard Chartered”). All opinions are that of my own, and you may want to note that I’ve had a SCB Unlimited Credit Card since 2017 prior to this. To maintain objectivity, I have also opted not to receive affiliate referral payments on this post.

All views expressed in the article are the independent opinions of the writer. All information provided is for informational purposes only and is not intended to be construed as advice or an offer for any product or service. Standard Chartered is not liable for any informational errors, incompleteness, delays, or for any actions taken in reliance on information contained herein. For full Unlimited Cashback Credit Card Terms & Conditions, please click here. ^For The Good Life Terms & Conditions, please click here.