What a difference a year makes! It has been only 1 year since I last revised my article on Baby Bonus benefits and a comparison of which Child Development Account (CDA) was best to go with, and that was back in 2021 as we prepared for the birth of our second child.

And yet, in a single year alone, our world has ushered in an era of higher interest rates and inflation. Most of the local banks have also been keeping up, and rewarding consumers who continue to bank and spend with them by increasing the interest rates on high-yield interest savings accounts. I was thus curious, what about for the kids, particularly on the Child Development Account where we don’t spend as much or as frequently on?

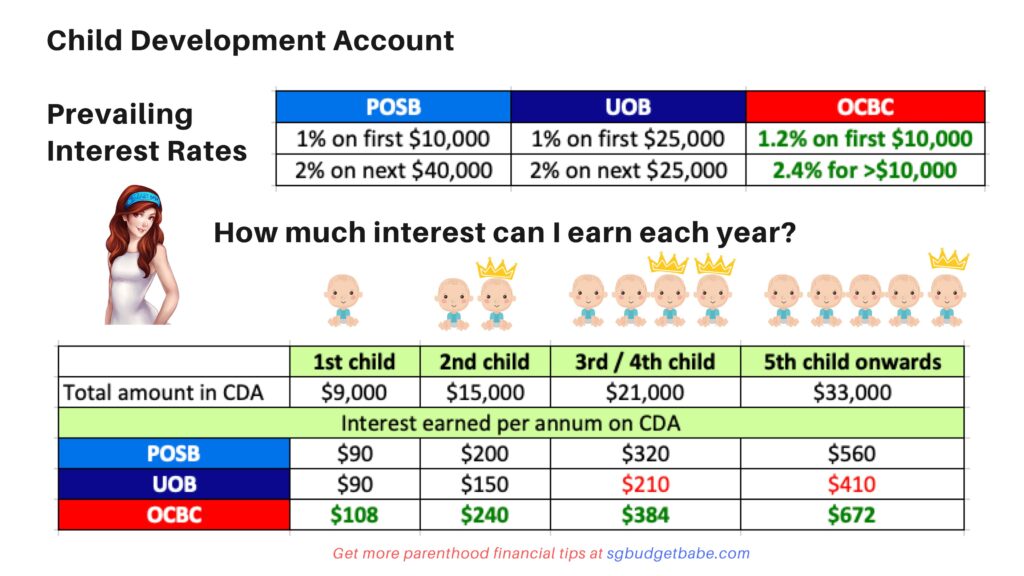

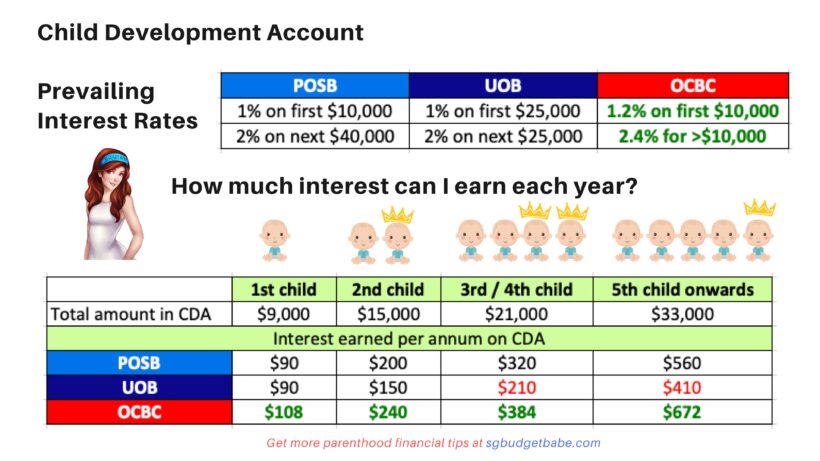

As it turned out, OCBC is the only bank to have raised their interest rates so far. From being the worst to open your child’s CDA account with in 2021 (given their rates of 0.6% – 0.8% back then, as captured here), OCBC is now officially the best CDA account to open if you’re looking at current rates.

Of course, there’s a catch. Unlike your own high-yield savings account(s), parents cannot simply switch their child’s CDA provider at whim; it can only be closed when government instructions are received.

Hence, it is important that you go with a bank that will hopefully minimize your regrets later on, even if rates change. Going with the bank that offers the highest rate right now may not be the case a few years down the road, but if you go with a bank that remains competitive and ideally fair to consumers, then your chances of regret are at least minimized.

You can read my original post here (published back in 2018, while researching for my first child) on how we decided to go with POSB then because of the free SIA infant ticket (which we used for a family trip to Australia) and the various merchant promotions.

In 2021 when my second child was born, we decided to go with POSB still despite not getting the free air ticket anymore, because it would make it easier for me to manage both their accounts (since I can access from a single iBanking login), and the merchant promotions were still superior in terms of what appealed to us. At the same time, POSB’s rates were also the highest last year when we opened the account.

If you’re reading this post in end 2022 or 2023 and thinking of which account to open, you have a harder choice to make because OCBC has now caught up and is officially the CDA provider with the highest rates in the market right now. We don’t know yet if the other 2 banks will adjust their rates anytime soon, but regardless, you have to make a decision based on the current information you have anyway.

If I were in your shoes, I would do this:

- Open with OCBC only if I already have an existing OCBC account

- Open with OCBC if it is for your 3rd child onwards, as the rates are a lot more rewarding at this point given the higher Baby Bonus amount that you get from the government

- Open with POSB if I already have existing POSB CDAs to manage for my other kids

At this point, I’m not leaning towards UOB because I find their lack of merchant tie-ups unattractive, and UOB rates have traditionally lagged behind POSB and OCBC’s for the last 4 years whilst I’ve been doing these research for my kids.

How much did we get from the Singapore government for having our kids?

Both of our kids have a different amount in each of their accounts by the time they each turned 1 years old – Nate has $9,000 while Finn has $15,000 (not including interest payouts).

The reason for this difference primarily lies in the fact that our government boosted the CDA Government Co-Matching Grant in 2021 (prior to Finn’s birth), which resulted in an extra $3,000 being matched. Since we received $3,000 from the COVID19 Baby Support Grant for having Finn during the pandemic, we simply deposited this into his CDA so that it would get matched accordingly.

Of course, if my older son were to one day complain that this is unfair, I’ll remind him that (i) this is just how life works and (ii) he had a massive 100-day and 1st year birthday party where he received a nice 4-digit sum in ang paos, which his younger brother did not have the privilege of holding since it was during the pandemic’s restrictions.

As a parent, if you’re able to do the following steps right from the beginning, you would have set your child up for a greater financial safety net (at least for their education) than everyone else:

- Open the right CDA account

- Deposit the maximum amount for the CDA Government Co-Matching scheme

- Try not to touch CDA funds during their younger years so that you allow the interest to roll (unless you can earn a higher interest on the amount elsewhere, such as through investments)

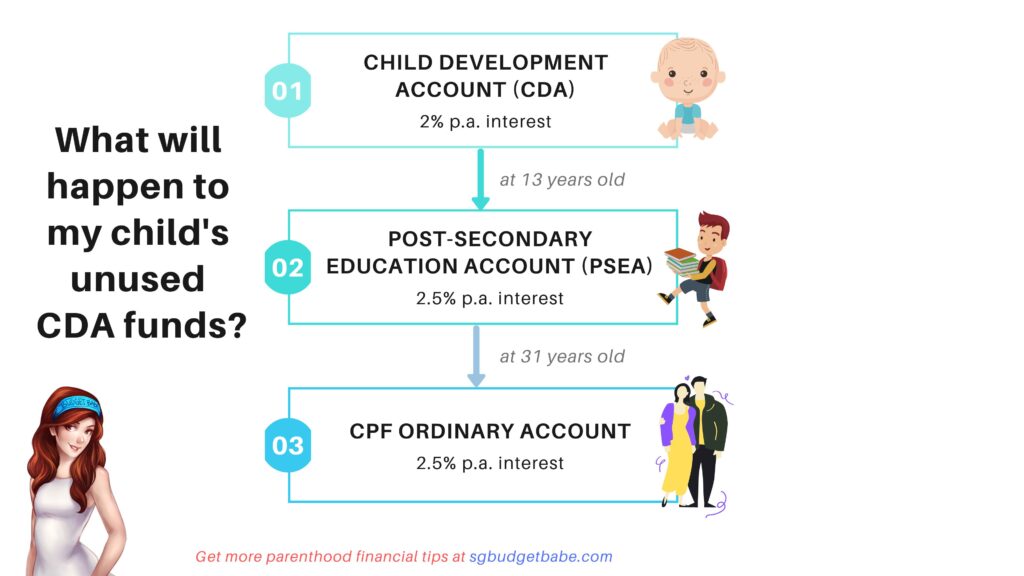

The CDA funds will flow into your child’s Post-Secondary Education Account, which they can use for short courses or workshops later on after completing secondary school. And if there are still any unused funds leftover, it will then be credited into their CPF-OA when they turn 31 (I had $2,000+ left in mine that was credited into my CPF when I reached the age).

Be sure to start with maximizing your child’s CDA benefits, and then move on to other important financial must-dos for your child. Read the next step here.

P.S. Found this article useful? Share it with a fellow parent to help them along on their parenthood journey in Singapore!

With love,

Budget Babe

1 comment

“Try not to touch CDA funds during their younger years so that you allow the interest to roll (unless you can earn a higher interest on the amount elsewhere, such as through investments)”

how do you use the CDA funds for investment? its stuck in there , aint it? only way to use it is thru school or approved ways. etc

Comments are closed.