So your parents didn’t plan their finances or save for their retirement. They were so caught up in giving you the best of what they could (bless their hearts) that they forgot to think about themselves, and now you find yourself caught in the middle as you worry if you have enough money to take care of your parents while also providing for your children.

What should you do?

In the aftermath of the viral “Worst Parents in the World” ad, I’ve been receiving a number of readers’ questions on what I think would be good action steps for those who were not savvy enough to be like the parents in the video when it comes to planning their retirement.

Is it too late now?

It doesn’t have to be. While nothing will beat a plan that was set up decades ago and has been running since (time in investments is a powerful thing), I believe a plan set in place now will still outdo not having any plan at all.

I’ve recently shared a heartwarming reader’s story here about how her parents failed to plan as well, so when she grew up and got married, she decided to take things into her own hands and managed to turn things around. Today, she’s adequately prepared for what the future might hold for her family. You can read what she did here, but of course, not everyone may be able to execute her methods, given our differing life circumstances.

I know I can’t, but that doesn’t mean it is still a dead end for folks like us. So here are some options:

Disclaimer: For the purpose of simplicity in this article, I’m only looking at general solutions and the products offered by NTUC Income – the folks behind the viral ad itself.

1. Outsource your biggest financial risks to an insurer

Hospitalisation Insurance

If your parents are still young enough (i.e. under 75 years of age) and in good health, get a hospitalisation plan for them so that you can offset the risk of (and emotional burden of having to handle) large hospital bills to an insurer.

This was one of the key things I did for my in-laws since my husband is their only child, and they had zero insurance coverage for themselves before I stepped in.

You can find out more on how integrated shield plans (IPs) work in a previous article I’ve written here, and then compare against all the current IPs in the market to find which is the most suitable for your parents (or for you, if you’ll be paying for it). IncomeShield remains a favourite among many Singaporeans for their affordability, and you can review their premiums here.

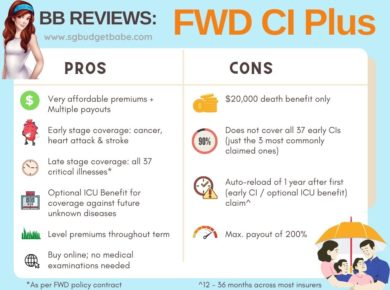

Critical Illness / Disability / Income Replacement Insurance

Depending on your income and affordability, you may also wish to consider whether to add on insurance coverage for critical illnesses and/or disability. These policies work such that in the event that you become physically ill, you can get either a lump-sum or monthly/yearly cash payouts to help you defer against outpatient healthcare costs and/or loss of income.

Personally, we’ve gotten critical illness coverage upon learning that we’ll soon be parents. We’ve not opted for disability insurance at this moment due to liquidity issues, but will consider adding it on later when our finances permit the extra expenditure.

2. Build up your cash savings

You can do this either by

(i) diligently accumulating your own savings and parking it either in a high-yield bank savings account, fixed deposits or investments, and then drawing down from this sum later on throughout your retirement years or

(ii) parking your savings with an insurer, especially if you’ve no faith to manage your own money well to last you throughout

For instance, if you find it hard to be disciplined in doing your own savings, then perhaps turning to an insurer might work better for you instead. For instance, Income’s Limited Pay RevoSave was designed for such a group of people, who are looking to save up money by paying premiums for a limited duration, and then receiving the cash payout after 2 policy years till the end of the selected policy term. Contrast this to traditional endowment plans, where your money tends to be locked in for a much longer duration.

If you and/or your parents have financial liquidity right now and would like to buffer against the future while taking self-discipline out of the picture, then such plans where the premiums will be invested in the underlying PAR funds to give both guaranteed and non-guaranteed returns could be options to consider.

Getting retirement cash payouts

For Singaporeans/PRs, don’t forget that CPF Life payouts can also be a good tool to rely upon if you’re looking for monthly retirement monies. But the question is, will it be enough to cope with rising costs of living?

If you don’t require the cash liquidity of Income’s Limited Pay RevoSave so early, another product would be RevoRetire, which offers monthly cash payouts only from your selected retirement age onwards (so there’s more time to accumulate cash value before starting your payouts). It also comes with a disability care benefit by giving you an additional one month of cash benefit on top of each monthly payout in the event that you’re diagnosed with a disability and need extra cash to pay for treatment or caretakers.

If your parents are 60 years or younger with at least $10,000 in cash savings, but neither you nor them are inclined to invest it on your own and take on the risk, SAIL might just be suitable as you get to:

- Pay in one single premium today

- Choose your desired retirement age from the choices available

- Get regular retirement income over 20 years

Thus, if your parents have some cash lying around without any idea of what to do with it (and you don’t wish to take on any investing risks), you can choose to use this (or your SRS monies) to pay the lump sum premium which is then used by Income to invest in their participating funds to generate returns, which are then returned to you for your retirement later. Even if they lose money, you have a guaranteed buffer of getting at least your capital back (vs. when you invest on your own, you stomach your own capital losses), provided you at least hold until the stipulated period.

And when you reach your specified retirement age, you can either convert your plan into a stream of regular retirement income over 20 years then, or receive a lump-sum cash payout. Additionally, you’ll also be covered for total and permanent disability before age 70 and death.

Choose between Whole Life Insurance or BTIR.

Whole Life Insurance

The debate against term and whole life insurance continues to wage on, but I’m of the stand that when it comes to which is better, this really depends on what you want and prioritise. Term life has lower premiums (but you’ll have to pay all the way until the policy matures, and for some term policies, the accumulated total premiums paid over the policy lifetime can actually be HIGHER than a limited-pay whole life plan) and also typically has no cash value when the policy terminates.

On the other hand, a number of whole life plans offer you an option to pay for a limited period and then enjoying the coverage for the rest of your life (vs continuing to pay even when you’re retired or jobless). If you decide to terminate a whole life plan later on (after the breakeven point, please), you’ll also get a lump-sum cash payout, in contrast to term plans where you may get absolutely nothing.

Some people also see whole life insurance as a legacy i.e. they leave a sum of money behind for their loved ones in the event that they pass away.

Buy Term Invest the Rest

The reason why I still favour term is because I prefer to pay cheaper premiums right now and invest the rest, since I’m already actively investing and spend a significant amount of time analysing investment opportunities as you can see from past articles like here, here and here. However, I recognise that not everyone might be able or want to do the same. As a DIY investor, you’ll need a few things:

- effort (opening a brokerage account, setting up your investments, studying and monitoring your investments, etc)

- emotional competency (to stomach the wild market rides of fluctuating stock prices)

- time in the market (for compound interest to set in and work to your benefit. Generally, the older you are, the lesser risks you can take as well)

- recognise that any capital losses is on YOU

BUT!

The problem I’ve observed is that some people who read about this debate online then decide to terminate their whole life policies and switch to term insurance simply because its premiums are lower, but they fail to invest the difference in premiums (which is the entire concept of why BTIR is superior)! In this case, these folks might have been better off simply holding on to their whole life insurance in the first place. Sorry but that’s the hard truth.

If you fall into this category, then VivoCash Prime is one possible whole life plan to consider. Its key benefits include:

You could technically even use this policy to plan for 3 generations:

- Yourself : get TPD coverage in the form of a premium waiver benefit i.e. you continue to receive cash payouts even without paying premiums for your later years in the event that you’re diagnosed with TPD

- Your child : insure your newborn and accumulate the yearly cash payouts for your child’s education, or for use later as you/they wish once you transfer the ownership over

- Your grandchildren : the centennial maturity benefit paid when your child reaches 100 years of age, or death benefit if he passes on later, can be handed on to your grandchildren

TLDR?

Here’s a quick summary again of the solutions I feel can be used to address the conundrums featured in the ad:

|

Conundrum

|

Solution

|

|

Used up and have little money left for future needs, especially if physical illness strikes

|

Outsource your biggest financial risks by getting a:

– Hospitalisation plan (to protect against large hospital bills)

– Disability / income replacement plan (to replace your loss of income when you can no longer work)

– Critical illness plan (for cash payouts to help with healthcare treatments, care and living expenses)

|

|

Insufficient cash for living expenses during retirement

|

Build up your cash savings by:

– diligently accumulating and investing

– take up a savings plan with an insurer to be reclaimed later

|

|

Leave behind cash for your children and/or loved ones

|

– Buy term invest the rest (and ensure that the investment monies can be easily withdrawn by your loved ones in the event that you pass away before you can do the transfer)

or – Whole life insurance plan

|

If your parents didn’t plan their finances well and are relying on you as their retirement plan, what’s YOUR plan from here?

Disclaimer: This article is written in collaboration with Income. All opinions are that of my own. You should NEVER purchase any insurance plan first based purely on information found online. For more information in assessing whether the mentioned products will be suitable for you, please speak directly with a financial advisor for more details.