The changes are good news for those who are self-employed, have difficulties meeting other bank accounts’ minimum transactions each month, and who are trading or investing via DBS Vickers. But for folks who have more than $25,000 in balances, you should probably take a closer look at the revised interest rates and qualifying categories.

DBS announced 3 major changes to its popular DBS Multiplier savings account recently:

- Salary Credit has been renamed to “Income” with the broader definition to include dividends from CDP (credited via GIRO)

- Dividend crediting no longer qualifies for the Investment category (now changed to “Income”)

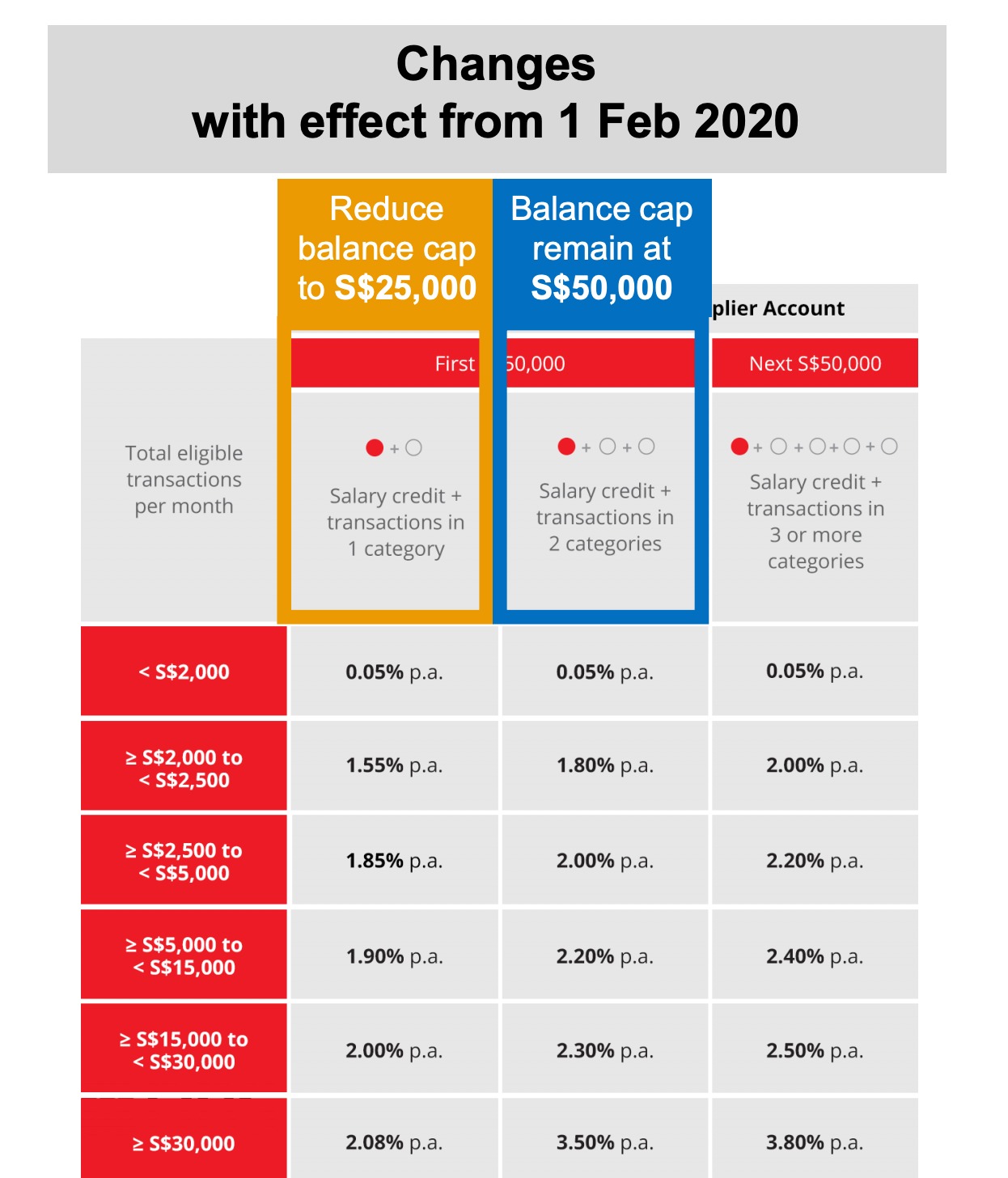

- Those who fulfill Income + transactions in 1 category will have bonus interests up to $25,000 only (previously applied on the first $50k)

What do they mean for us consumers, and should you still stick to the account or move on?

I can’t say I’m too surprised by the changes. After all, other banks have historically had a tendency to change their terms and conditions after the initial customer acquisition phase, so why would DBS be any different?

Even with the changes, DBS Multiplier still remains the best account for those who cannot hit the minimum salary credit requirements and $500 spend on credit cards – a criteria that most of the other banks impose on their high-yield savings accounts.

Of course, the changes also mean that for some of us, we will have to relook how we’ll be using the account from now.

Let’s take a look:

Bonus interest on first $25,000

You used to be able to earn bonus interest on your first $50,000 if you credit your salary and make a transaction in 1 category, but now DBS has reduced their tiering system to apply to the first $25,000 instead.

So for those of you who have more than $25,000 in your balances, you may want to consider meeting another transaction category (more on that later) to still get the additional interest.

Changes in Salary Credit / Income

Good for low-income earners and the self-employed

In the past, the DBS Multiplier was limited to only those who had their salary credited via GIRO, and specifically under the transaction reference codes “SAL” or “PAY”. This excluded the self-employed as well as folks whose employers didn’t pay them in the above methods.

If you’d hung out on Facebook groups and forums enough, you would have seen many people complain that their employer doesn’t pay them their salary in those methods – there are some companies that use cheque, iBanking or even PayNow instead.

Depending on how nice your HR/finance is, you may or may not be able to convince them to make this change because seriously, why do they need to care about your bonus interest when they’re working for the company’s interests? And as for those whose employers have outsourced your payroll to external providers, you’ll be in a position where it is impossible to get any changes made.

There’s the rising gig economy workers as well – for the self-employed, you can now make use of the DBS Multiplier account with dividends contributing towards the Income criteria.

It is actually a good move that DBS is now starting to recognise other sources of income. And the good news is that they’re still the only bank who aren’t imposing a minimum salary credit of $2,000 – $2,500 a month.

Credit Card Spending

I’m glad that DBS has yet to impose a minimum spend on their credit cards, because it is quite silly to force yourself to spend more every month just so you can get bonus interest on your savings.

That’s not the right move to do! It is better to spend the extra money investing rather than spending for the sake of it.

For those who are trying to qualify for this category, you can choose from popular options like the POSB Everyday Card, while those on the miles camp can choose from DBS Altitude or DBS Woman’s World Card to earn up to 4 miles per dollar on your spend. I personally quite like the DBS Live Fresh Card as well, which gives up to 5% cashback, but choose this only if you can hit the minimum of $600 spending each month.

Home Loan Instalments

DBS/POSB home loans still remain one of the most attractive on the market, so if you need to refinance your loan, it is worthwhile to check if they can offer you a better rate than your existing financier.

Both cash and CPF components are recognised for this.

Insurance

Please don’t get an insurance policy just because you’re trying to get more bonus interest. You should only get one if you really need the additional coverage.

I’m frankly not a big fan of this category because the premiums only count as qualifying transactions for the first 12 months anyway, whereas your insurance premiums are usually to be paid for a much longer term of 5 – 25 years. So I’ll skip this category for sure.

Investments (Recommended!)

You can start a regular investment plan such as the POSB InvestSaver where you set aside a monthly amount to be invested, and after the first 12 months of passive investing, you should be ready to move on to trading active counters. InvestSaver also now has more ETFs and unit trusts to choose from, which is greater variety than what they had before.

Finally, DBS’ (robo-advisor equivalent) digiPortfolio may not be counted as an “investment” yet, but I’m waiting for DBS to include it soon!

Of all the ways to earn additional interest, this makes the most sense to me. After all, once you’ve crossed your first $25,000 in savings, it is high time you started looking at how to invest your money for more returns.

TLDR Conclusion

DBS is pretty smart with their latest changes – it isn’t enough to cause too many people to leave, but yet may still do well to attract a new group of people (the self-employed). And whatever you think of it, the fact remains that DBS Multiplier is still one of the most attractive savings accounts if you compare it to the other banks at the same tier:

DBS Multiplier: 1.55% – 2.08% on your first $25k

- no min. salary credit

- no min. credit card spend

- $2k – $30k qualifying transactions in total

OCBC 360: 1.5% – 1.8% on your first $35k

- $2k salary credit

- with min. $500 credit card spend

- save $500 more than the previous month

UOB One: 1.5% – 2% on your first $30k

- with min. $500 credit card spend

- 3 GIRO transactions

SCB Bonus$aver: 2.13% on your first $100k

- $3k salary credit

- with min. $500 credit card spend

- 3 bill payments

It seems clear to me that the recent DBS changes are to embrace the gig economy and move consumers towards trading with DBS Vickers, while nerfing the SSB bond ladder hack for bonus interest (which too many of us were abusing, oops!). But even with the changes, the new DBS Multiplier still isn’t all that bad.

And when you look at all the bank accounts out there right now, there aren’t many who cater to the low income earners, the self-employed, and those who can’t spend $500 on credit cards every month.

Of course, if you already have your home loan with DBS/POSB, then you might pretty much be sheltered from most of the changes anyway (unless you used dividends as your Investments criteria previously).

As for those who don’t meet the home loan criteria, you might want to consider aiming for the credit card + investing criteria to achieve the higher interest.

With more than $25k of savings, you should probably start investing for BOTH capital gains and dividends, so it’ll be best to match that with a bank account that rewards you for this. In this sense, DBS Multiplier is still the best account by far.

This post was sponsored by DBS. All opinions are that of my own.