Things are getting messy at Sabana REIT (SGX:M1GU). Whether you are a shareholder trying to figure out which side to vote for in the upcoming EGM tomorrow (7 August) or a bystander curious about what the hell is going on, here’s my quick take on the situation.

Important Disclaimer: This article represents my independent thoughts after reviewing information and statements from both parties (Quarz Capital vs. Sabana REIT’s manager). I was not paid for this article nor did I receive any in-kind benefits in any way.

You may have first heard of Sabana REIT here on this blog when I mentioned it back in 2018. Since then, a lot has changed, and tomorrow will potentially mark another key milestone for the REIT as it holds its EGM to determine whether activist shareholders will get their way in having the current REIT manager replaced with an internal one.

Here’s a quick timeline of events:

- Sabana REIT went public in 2010 as the first ever Shariah compliant REIT to be listed in Singapore, at an IPO price of S$1.05.

- Unfortunately, after hitting a high in 2013, the share price has been on declining ever since. Shareholders also saw lower distributions with each passing year, thus aggravating their losses (capital and dividend income).

- This was due to a few reasons, including the performance of the underlying properties deteriorating and new properties suspected to have been acquired at overvalued prices.

- In 2017, frustrated activist minority shareholders rallied together to call for an EGM to fire the REIT manager, but failed to gather enough votes.

- In 2019, Quarz Capital started urging for the merger of Sabana REIT and ESR REIT, which took place in 2020. FYI: ESR REIT had merged with Viva Industrial Trust just a year before. The proposed merger, however, was voted against and shut down in 2020.

Sidenote: I sold my shares after that as I felt it wasn't a fair offer - the deal was valued based on Sabana REIT's then-share price rather than its NAV i.e. it was made at a substantial offer to Sabana's book value. There was also not going to be any cash payments involved as ESR REIT simply wanted to create new units to "pay" Sabana REIT shareholders i.e. 0.94 ESR REIT units for every Sabana REIT unit owned.

- But due to ESR’s ownership holdings in Sabana REIT (prior to the proposed merger), this meant that both the managers of ESR REIT and Sabana REIT are majorly owned and controlled by ESR Group, leading to questions around conflicts of interests and corporate governance issues.

- Last month (July 2023), ESR Group filed a court application to prevent its investor Quarz Capital from convening an EGM to remove Sabana REIT’s manager and replace it with an internal one.

- SIAS called for a REIT dialogue last week between both parties and shareholders, while raising important questions for both parties to address (watch the session here).

ESR Group and Quarz Capital are now both in conflict as they take opposite stands on this issue, which I’ve summarized below:

| Quarz Capital’s Claims | ESR Group’s Claims |

| Internalisation of the REIT manager will be highly beneficial and value accretive for all unitholders. Sabana unitholders will now be able to fully own their internal manager with a projected setup cost of only S$3-5million and benefit from a potential S$2.4million of cost savings per year which can increase unitholders’ DPU by more than 7%. | The resolutions proposed by Quarz will lead to significant value destruction for unitholders and a long period of uncertainty that may compromise the future of Sabana REIT. Any potential cost savings out of the S$1.26million of profit generated by the Sabana REIT Manager will be wiped out by the potential increase in borrowing cost and unitholders will be worse-off on an ongoing basis. |

| The current REIT manager does not have complete alignment of interest of unitholders. We should not waste any placements and rights in potentially value destructive acquisitions done solely to boost fees for the external manager. The fully aligned internal manager will also focus on increasing DPU and unit price for its owner, the unitholders, above all else. “Evidence” cited included the current manager leaving 1 Tuas Ave 4 empty for more than 6 years before finally executing on an AEI in 2Q2023, and that the current manager also recommended unitholders to part with NTP+ in the merger with ESR Logos REIT just 6 months before it was due to start contributing rental income to unitholders. The Trust Deed does not provide for the External Manager to ‘resign’ unless approved by MAS or the Trustee. The Trustee has also stated that it expects the External Manager to continue until the Internal or Replacement Manager is appointed. | Each REIT has its own Board (which comprises majority independent directors with diversified expertise), as well as its own strategic direction and investment rationale. The process of internalisation is also unprecedented in Singapore and may lead to staff leaving in the face of uncertainty over their roles, which would cause even more management uncertainty during the transition period. On 1 August, the CEO of the Sabana REIT Manager, Mr. Donald Han, stated that members of his team are already resigning. |

| It is illogical to assume that the External Manager determines the bank loans. Till date, none of Sabana’s bankers have publicly stated that the internalization is a risky and uncertain act. Banks have also consistently extended support in loans and interest rate hedges in all cases of REIT manager and/or management ownership changes since the bank loans are backed by the REIT’s portfolio. | In such uncertainty, Sabana REIT’s lenders (e.g. the banks) could demand immediate repayment of any outstanding loans or increasing the interest rate on their loans. Each increase of one percentage point (100 basis points) could cost unitholders up to S$8.3 million in interest each year, which will reduce DPU by up to 0.75 Singapore cents. |

| Internalization and having an Internal Manager is nothing new in Singapore. Croesus Retail Trust successfully internalized its Manager in August 2016, and its Internal Manager worked hard to rental income and reduce interest cost which eventually led to a favourable buyout offer from Blackstone at a 23% premium to its NAV and 38% premium to its 12-month volume average share price. | The process of internalisation is also unprecedented in Singapore. |

Ok, so what should shareholders vote for?

Let me first reiterate that I am no longer a shareholder (although I’m definitely watching on the sidelines to see if this period of uncertainty could lead to another buy-in opportunity for myself).

I’ve been looking for a (neutral) source that aptly sums up both parties’ positions (or claims, if you may call it) in the last few months while they fought against one another, but there wasn’t…so I decided to finally pen this article. I hope that this provides a good summary, and that you’ll have more information at your hands to make a decision as to what you want to vote for as a unitholder to determine Sabana REIT’s best future interests.

To me, it is pretty clear:

- It is debatable whether the current REIT manager has been operating in alignment of shareholders’ interests, depending on which lens you view it through. ESR Group is using Sabana REIT’s “outperformance” since 2018, citing its outperformance against the STI Index, iEdgeS-REIT Index and FTSE ST All-Share REIT Index and that Sabana REIT was the best-performing industrial REIT in 2022. On the other hand, shareholders have long felt that the manager has not done its best when it comes to getting maximum value out of the REIT’s property portfolio and arguably overpaid for acquiring new properties at the expense of unitholders.

- While an internalisation may be “unprecedented” in Singapore’s REIT landscape, it could arguably provide for more aligned interests with shareholders while removing any qualms of potential conflicts of interest between Sabana and ESR Group at the same time.

- I cannot comment on the costs and potential outcomes of Sabana REIT’s current outstanding loans in the months ahead. Quarz Capital claims that ESR Group is simply doing “fear-mongering”, while ESR Group issued an open letter titled “Save Sabana REIT from Falsehoods and Destruction” – you’ll have to discern and judge for yourself.

What would Budget Babe vote for?

Of course, I’m no longer a shareholder at present, so this entire section is moot. But that’s the burning question in your mind, isn’t it? So I’ll save you the suspense and answer it.

Although I cannot rule out that I may not re-initiate my position in Sabana REIT in the future, should the opportunity presents itself i.e. it has to fit my criteria of what I look for before I invest in a REIT.

IF I were a unitholder who has to vote tomorrow (and that’s a big IF), I would vote for the internalisation and support Quarz Capital.

My three main reasons are:

- The current External Manager Model suffers from a misalignment of interests between the External Manager in question and unitholders of a REIT. Whether this misalignment is simply in theory or in practice, only the current REIT manager will know (and neither you nor I).

- As a former PR practitioner, I have to admit that I cringed when I read ESR Group’s statement and their choice of titles (“Save Sabana REIT from Falsehoods and Destruction”). Up till before the letter was issued, I was still undecided on whose stand to support, but once this came out, I see it as a childish move and that the manager could have communicated its stance in more professional language instead. Quarz Capital is an investor after all, whose financial interests will be affected by whether this deal goes through – surely they aren’t doing it to effect losses upon themselves? While I would also be annoyed if an activist investor of my company tried to push me out of management, but given the (presumably) aligned ownership interests, rather than engaging in civil, constructive discussions with Quarz Capital, why choose to speak and use such words?

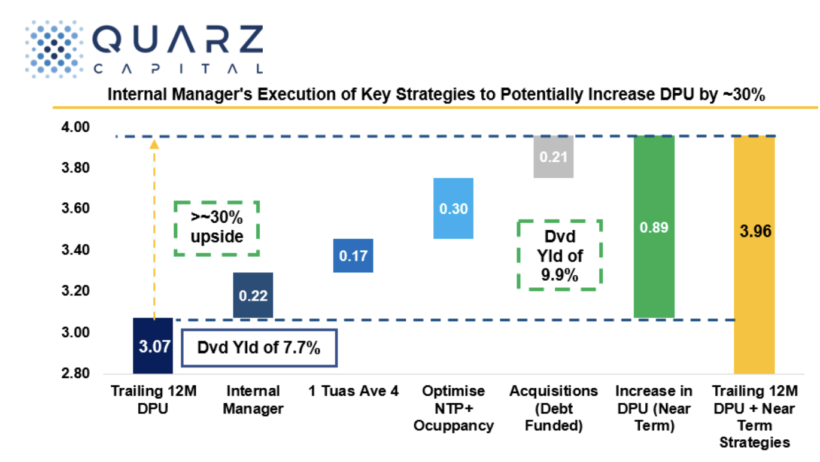

- Quarz Capital is not just an activist shareholder who is making empty talk – it has also taken the extra mile to offer more substantial details in their plan on what an internal manager can do to increase value of Sabana REIT and for shareholders i.e. including completing the asset enhancement of 1 Tuas Ave 4, renting out ~90% of the asset at net rent of at least S$1.45psf/month, developing ~200,000 square feet of new space at NTP+ and more than 1 million square feet of untapped GFA/landbank with focus on sizeable key assets such as 33&35 Penjuru Lane, 26 Loyang Drive which can be transformed into New Economy ramp up logistic hubs or data centres. The amount of effort they’ve put in – despite NOT being the REIT’s current manager – is noteworthy.

What will shareholders vote for during tomorrow’s EGM?

What will YOU vote for?

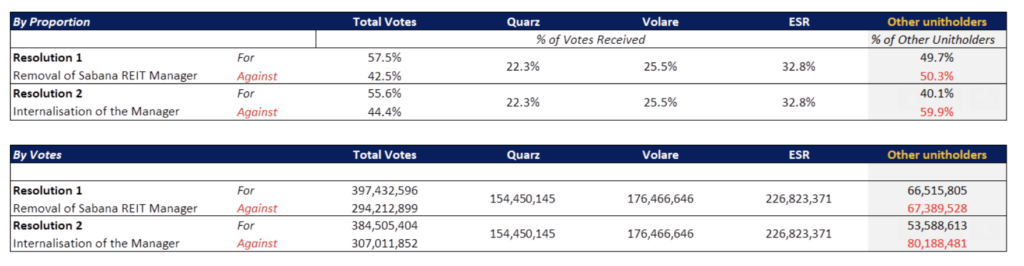

The result: Sabana REIT unitholders have spoken. The majority voted to remove the external manager and effect internalization. The results breakdown is tabled below.