For an average working adult who doesn’t spend too lavishly, which credit cards currently offer the best value for your buck?

In our world today, it seems like there are simply too many credit cards to choose from. With all the different promotions running at different times, it is no wonder that most consumers really have little idea on credit card(s) are the best fit for them. Often, most of us just end up sticking with the one card we’ve been using for years and have gotten accustomed to.

But switching your credit cards can actually bring you a lot more rewards, or savings, or even both!

Before I started my search, these were my criteria:

– Minimum monthly spending has to be fairly achievable ($500 – $800)

– Monthly salary of $2500 – $4000 is eligible to apply

Some cards seem really attractive at first glance ($138 cashback anyone? Or how about $150 Uber credits for your transport needs?!) but when you go into the details, it turns out that the qualifying criteria isn’t that simple. This promotion for the Standard Chartered Manhattan World MasterCard, for instance, is only applicable for 3% cashback if you spend at least $3,000 a month. That is hardly realistic for anyone in their 20s – 30s, if you asked me (unless you’re really rich).

So after spending hours studying the different cards and their promotions now, here’s what I liked:

HSBC Visa Platinum Credit Card

|

Perks

|

Welcome gifts:

– $80 NTUC voucher (SingSaver exclusive)

– $950 Samsonite luggage

– $20 cash rebate

|

|

Min. spending

|

$800 or $400 per month for 3 months

5% or 3% cashback*

|

|

Rewards cap

|

$120 cap per quarter (or about $30 per month)

|

American Express True Cashback Card

|

Perks

|

Welcome gifts:

– $40 NTUC voucher

– $40 Starbucks Card

– $20 cash rebate

|

|

Min. spending

|

$5000 in first 6 months

3% or 1.5% cashback*

|

|

Rewards cap

|

No cashback cap J

|

CIMB Visa Signature Card

|

Perks

|

10% cashback on Wine and Dine and Online Spend in Foreign Currencies.

$150 cash credit in first 6 months

|

|

Min. spending

|

$300 monthly for first 6 months

3% or 1.5% cashback*

|

|

Rewards cap

|

Cashback cap of $60 per month

|

|

Limited to:

|

– Must not have any existing CIMB principal card

|

|

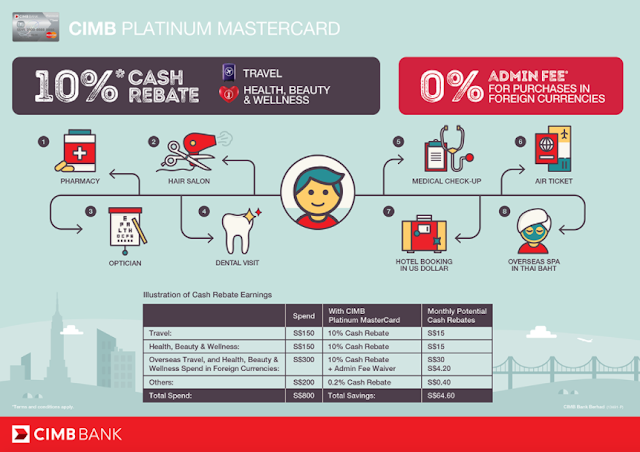

Perks

|

10% cashback on Travel and Health, Beauty & Wellness.

Complimentary one-way airport transfers.

$150 cash credit in first 6 months

|

|

Min. spending

|

$500 monthly for first 6 months

|

|

Rewards cap

|

Cashback cap of $60 per month

|

|

Limited to:

|

– Must not have any existing CIMB principal card

|

If you’re interested in comparing across the different credit cards in Singapore like I did, the website I used was Singsaver.com.sg

Loyal readers will know how big a fan I am of credit cards – I prefer them over cash, as they help give me rebates, cashback or other rewards on top of its convenience and promotional discounts at times.

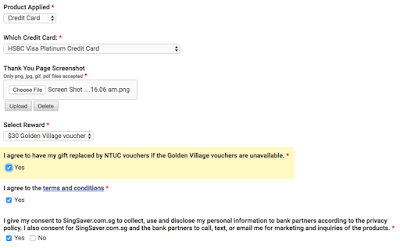

Thus, I’m quite excited to share with you an initiative I’ve been working on with the folks at SingSaver! On top of existing credit card promotions, they’ve agreed to extend an additional welcome gift of $30 vouchers (choose from Golden Village or NTUC) for Budget Babe readers!

You can simply follow the steps here to apply and redeem your vouchers. Let them know you’re a loyal reader of mine to get the extra $30 for a couple of movies at the cinema upon card approval!

Here’s what I received from them after I tried applying for mine:

What other credit cards do you guys like? Let me know if you think there’s anything else I should add to this list in the comments below!

With love,

Budget Babe

2 comments

Using RentalCars you can discover the cheapest rental cars from over 49000 locations globally.

Some banks might not report this accounts to the credit bureaus thus it is significant to ensure that bank does submit this reports if purpose is to get better cardholder's credit score. credit cards

Comments are closed.