SGFinDex is finally LIVE! For those of you who haven’t caught the announcement, with the recent launch of SGFinDex, this is a game-changer because your financial data across 7 major banks and 3 government institutions (CPF, IRAS and HDB) can now be consolidated in one place.

Say goodbye to spreadsheets and tedious monthly tracking across all your different cards and banks, just because they weren’t talking to each other before.

With your SingPass, you can now easily track all your finances in one place.

One of the easiest ways to do that would be through the DBS NAV Planner (which I’ve been using since 2018 – see here). With SGFinDex, the tool has become even savvier to help me NAVigate my finances (get the pun?) now that I can also pull data from all my other banks.

By bringing together everything – from my income, cash, CPF, property and investments to my expenses and loans – the DBS NAV Planner gives me a bird-eye view of my financial health in a single glance. And if you’re into planning like I am, then you’re gonna love its other features too.

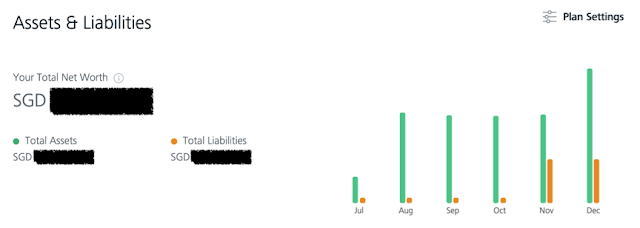

Track Your Net Worth

That means your assets should ideally be more than your liabilities.

A quick way to check this is on your DBS NAV Planner, this where you can get a quick consolidated overview of your assets (other banks + CPF + cash + investments) minus liabilities (HDB housing loan or any other debts).

Using this chart, you can also see your historical assets and liabilities – and keep track of how your net worth has (hopefully) grown. Neat.

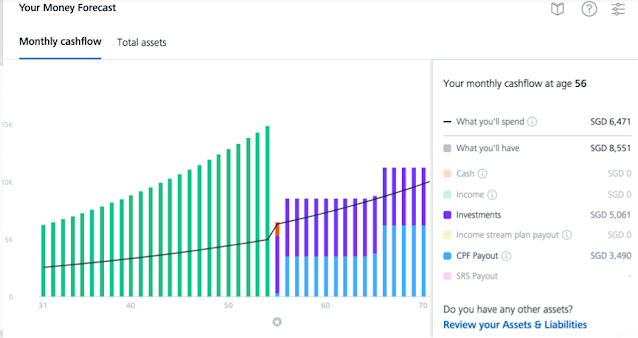

Map Your Retirement Money

Once you’ve taken in account your full assets and liabilities, you can check out the Map Your Money feature. This is a pretty useful tool to help you picture what your financial future could look like.This provides an interactive chart that pulls your data from across the different banks that you’ve linked, to give you an overall idea of whether you’re on track to meeting your financial goals.

You can play around with the different settings and inputs to get a more accurate plan, or see what your future impact will look like if you were to do things any differently. This can help you visualize the impact of your actions today on your financial health tomorrow, so you know what best to do.

Track Your Investment Portfolio

If you have any unit trusts, CPF-IS or SRS – from DBS or any of the other financial institutions SGFinDex can retrieve info from – you’ll be able to see it here.

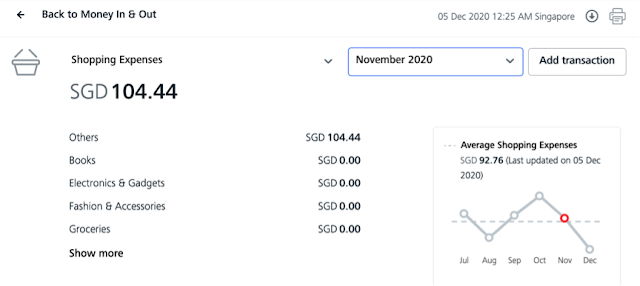

Cashflow

(aka Money In vs. Money Out)

Positive cashflow is simply when you have more money inflows (e.g. salary, dividends, rental income) than your money outflows (e.g. shopping, mortgage repayments) every month.

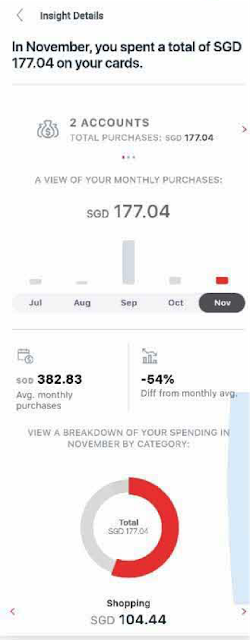

On this tab, it also gives me insights such as whether my shopping expenses are higher/lower than my monthly average.

If your transactions are mainly through DBS or POSB cards (I recommend their Live Fresh card), it also helps categorize your spending for you. Helpful if you’re not one to track all your expenses manually.

If your boss were to suddenly cut your pay or axe your role tomorrow, how long can you survive before you’re wiped out? Your Emergency Savings tab shows you whether you’re in good shape to withstand an income hit.

Very important when you have dependents, or when you have fixed liabilities (like your mortgage or car loan) to repay each month.

Pretty nifty features, aren’t they?

Go ahead and try it out for yourself as well!

In your DBS or POSB digibank app, just tap on Plan to get started.

You’ll be immediately greeted with an overview of your state of emergency savings, insurance and investments.

In other words, do you have enough for a rainy day? Are you sufficiently covered financially if an unfortunate event were to strike? Are you growing your money through investments, or just letting it erode by keeping it in cash?

Note that you’ll need to manually fill in your insurance coverage levels and investments outside of Unit Trusts, CPFIS and SRS that can be pulled through SGFinDex.

The app identifies your protection gaps for you after you’ve keyed in your data. (Yeah, I know I’m still short on one area – I’m already working with my agent towards getting that next year.)

The DBS NAV Planner is available even for non-DBS customers, so there’s no reason why you cannot use this tool to plan your own finances.

Go ahead and download the DBS NAV Planner now.

Disclosure: This post is written in collaboration with DBS. All opinions are that of my own.

1 comment

I just started to use NAV Planner. Where to locate the "Map Your Money" feature please?

Comments are closed.