If you (or your parents) are between 55 – 70 this year, check out the newest CPF Matched Retirement Savings Scheme and consider topping up $600 / year for the next 5 years to potentially boost your (or your parents) retirement savings. The government will be doing dollar-for-dollar matching under this scheme, up to $600, so don’t forget to claim your free money!

What is the CPF Matched Retirement Savings Scheme (MRSS)?

Launched 1 January 2021, the MRSS is meant to help senior Singaporeans who have yet to hit the current Basic Retirement Sum (BRS) build their CPF retirement savings for higher monthly payouts in their retirement years.

MRSS will run for a period of 5 years between 2021 – 2025, where the government will match every dollar of cash top-ups made to the Retirement Account (RA) of eligible members, up to an annual cap of $600.

You can read more information on the scheme on CPF’s website here.

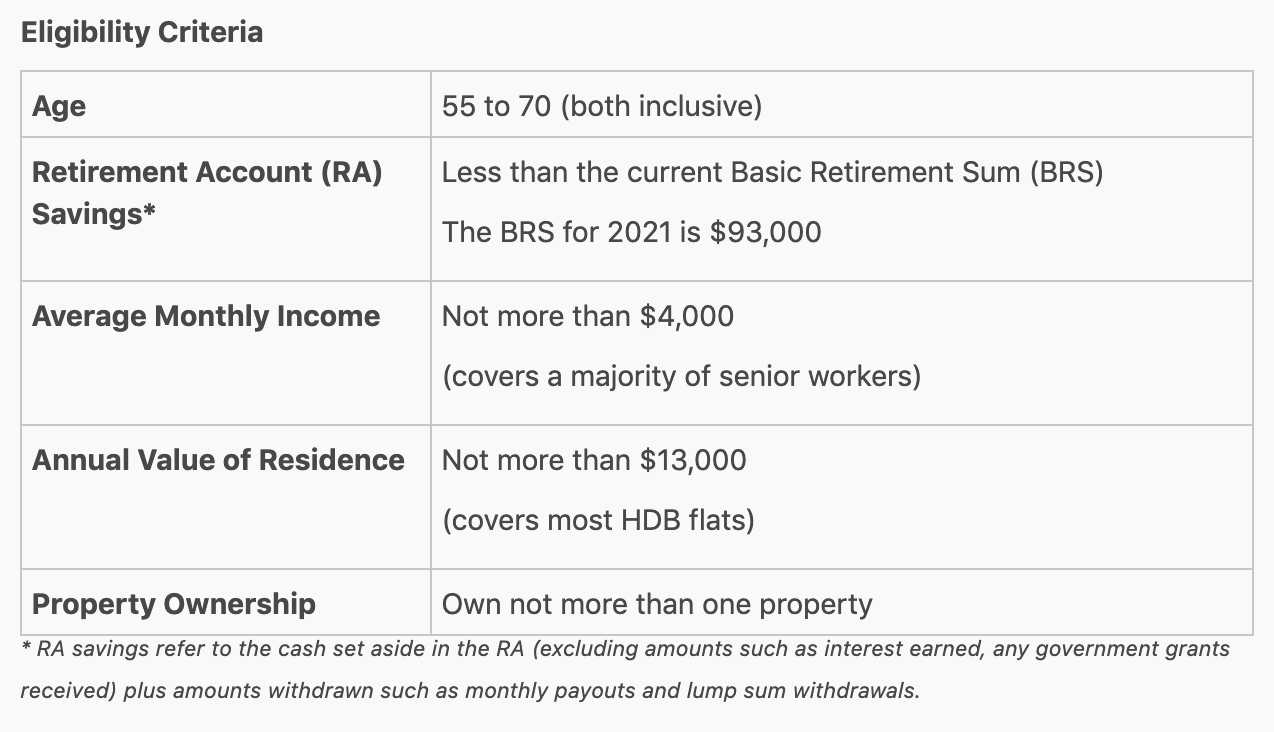

Here’s the criteria for one to be eligible:

How does this benefit me?

If you (or your parents) fulfil the above criteria, this means that you could be getting up to $3,000 from the government (for free) over the next 5 years!

All you’ll need to do is to make CASH top-ups to your CPF Retirement Account.

To maximize the dollar-for-dollar received, you can consider making a cash top-up of $600 / year for the next 5 years.

In addition, you’ll also be enjoying tax reliefs under the Retirement Sum Topping Up Scheme ($7,000 per year for self-top-ups; $7,000 per year for topping up your loved one’s accounts).

Should I top-up?

I’ve written before about the power of topping up your and/or your parents’ CPF accounts for retirement here. You get (i) “free” money from the government in the form of extra interest and (ii) tax rebates, so there’s a lot to like about this arrangement.

And now, the government has announced that they’re giving even more “free” money i.e. up to $600 more.

My personal rule of thumb is, whenever someone offers to give you free money, JUST TAKE!

That’s the same reason why we topped up our child’s CDA account with $3,000 – because the government gave another $3,000 in return. And that goes a long way in helping with living expenses, given that the money in that account is now being used to pay Nate’s $500+ / month childcare fees.

Granted, the condition here is that you have to first top-up $600 / year. But if you break that down, it equates to $50 a month, which doesn’t seem so daunting anymore. Cutting down some of those Grab rides you take each month should easily free up that sum.

So go ahead and take that free money.

With love,

Budget Babe

2 comments

Hey. How to top up the parent cpf account and also receive the tax thingy?

Once you login to your CPF page, select "My Requests" –> "Building Up My / My Recipient's CPF Savings".

Under the (RSTU) Retirement Sum Topping Up Scheme, you can get up to $7,000 in tax relief each year.

So if you're topping up the $600 for each of your parents, for instance, that'll be $1,200 cash top-ups under RSTU and it'll be reflected in your IRAS tax statement to offset your tax bill.

You can read more on CPF website:

MRSS: https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/matched-retirement-savings-scheme

RSTU:

https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme

Comments are closed.