If you’re not already using the Tiger Brokers app, you’re missing out. Whether you’re a beginner or a seasoned expert, the app’s comprehensive suite of FA and TA tools will definitely impress. You can also get financial ratios at a glance, stock news based on your watchlist, earnings calendars, stock ideas, and more.

Most brokerage apps suck. Their UI and UX generally are terrible and some of the older ones are just a complicated sea of numbers, greens and reds that it makes your head spin.

Enter Tiger Brokers. I first reviewed this up-and-rising fintech player back in July, and have been using it for the majority of my trades ever since. With its low fees (they had the lowest charges, up until another online brokerage started offering commission-free trades) and user experience on both their app (desktop and mobile), no other player comes close.

(Read my review here, and you’ll see why it was a no-brainer for me to switch over.)

Trust me, it is worth downloading the app – even if you’re not going to be making any trades on it. Here are some reasons why:

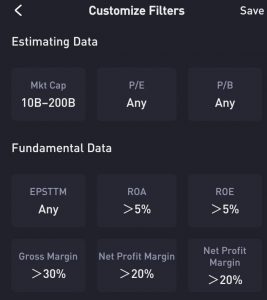

Stock Screener

Discover → Opportunity → Customize Filters

I generally use this to screen quickly for stock ideas that fit my criteria.

You could screen for potentially undervalued stocks using P/E or P/B ratios, or focus more on fundamental factors such as the company’s margins, debt levels, growth rates, etc.

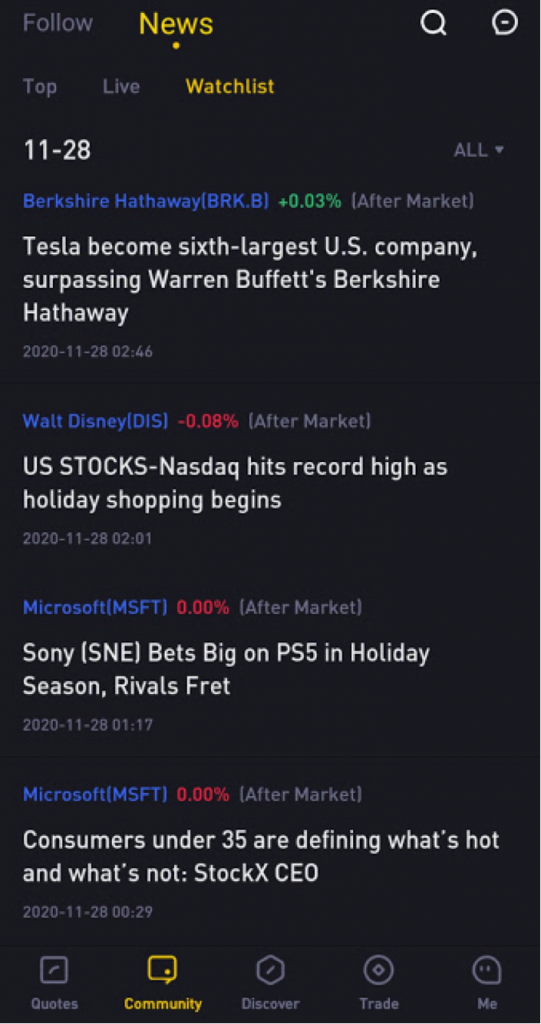

Get News Updates on Your Stocks

Have you always wished there was an app that could deliver personalised news updates on all the stocks you own or are currently watching?

I’ve been using Tiger Brokers mobile app to do exactly this, and pull up my own amalgamated newsfeed based on stocks that I’ve put on my watchlist (you’ll have to add stocks to your watchlist first of course!).

Community → News → Watchlist

Makes it super easy to monitor what’s happening in your universe of stocks, doesn’t it?

If you’re searching for news on a specific stock instead, you can go to

Quotes → (Select Stock) → News.

This is where you can retrieve the latest updates on the company, their regulatory filings, and more.

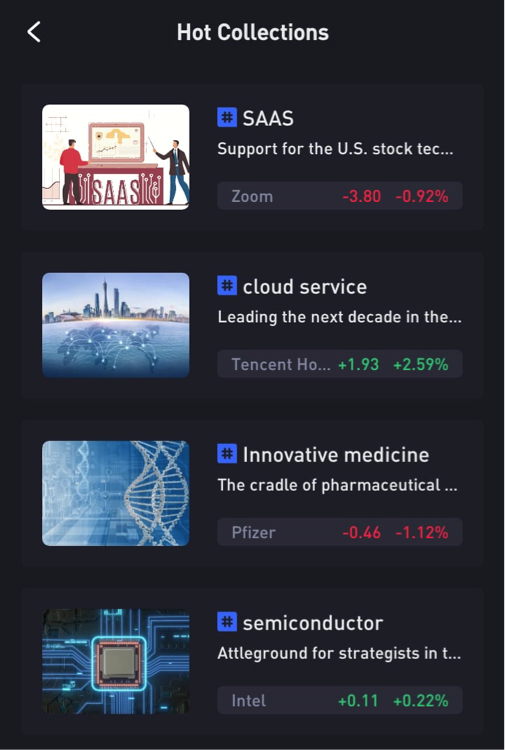

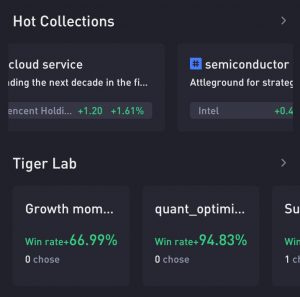

Get New Stock Ideas

As investors, we’re always looking for new stock ideas that could become the next multi-bagger winner.

On the app, you can look for stock ideas based on a multitude of criteria. If you prefer to invest in an emerging industry, you’ll also be able to find lists of SAAS stocks, cloud industry stocks, etc.

Discover → Hot → Hot Collections

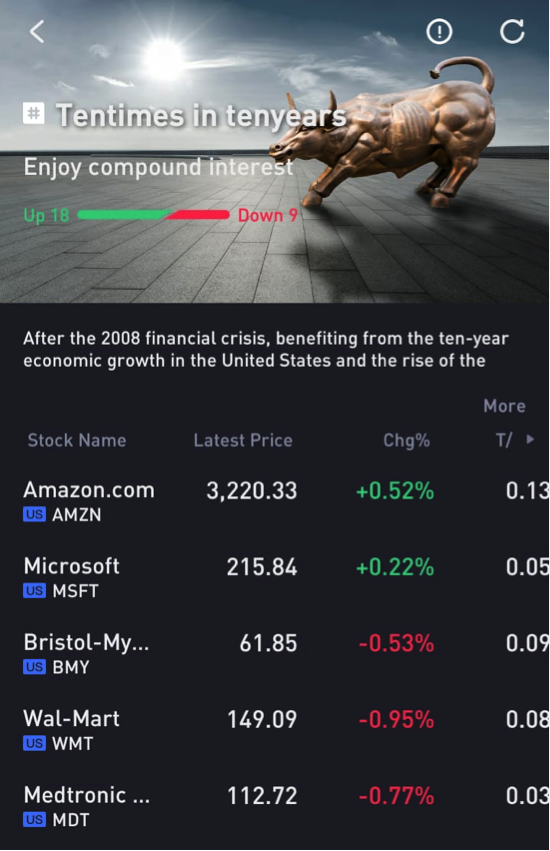

There’s even a list of stocks that went up “10X in 10 years” since the 2008 crisis, if you prefer to invest in long-term leaders with a stronger track record.

For those of you who are fans of Benjamin Graham’s Net-Net strategy, you can also find the stocks that fit the criteria under Discover → Opportunity → Quant Screening

Investors who use a growth momentum strategy will like the Tiger Labs feature as well, which shows you stocks that currently fits the respective strategies. Just tap on Discover → Hot → Tiger Labs and then select the strategy that you want to view stocks for.

Prefer trading instead? Check out the top winners (or losers) in the past XX days (set your period) to see which are the trending stocks of late.

Discover → Opportunity → Periodic Gainers & Losers

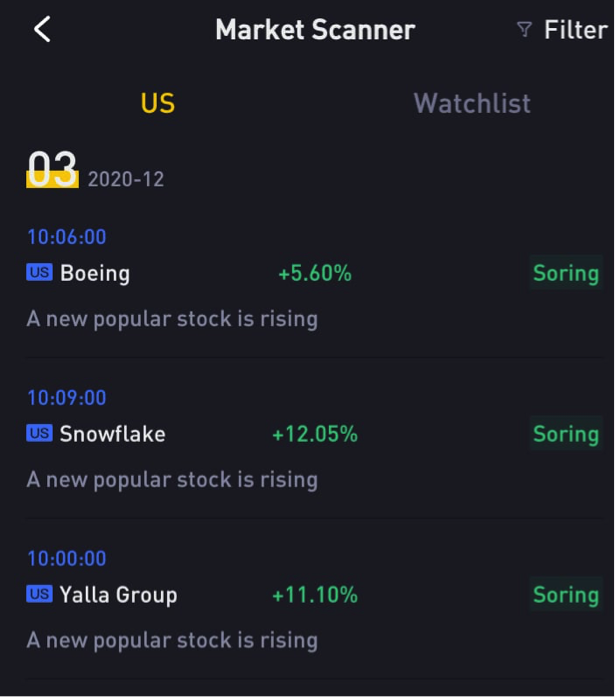

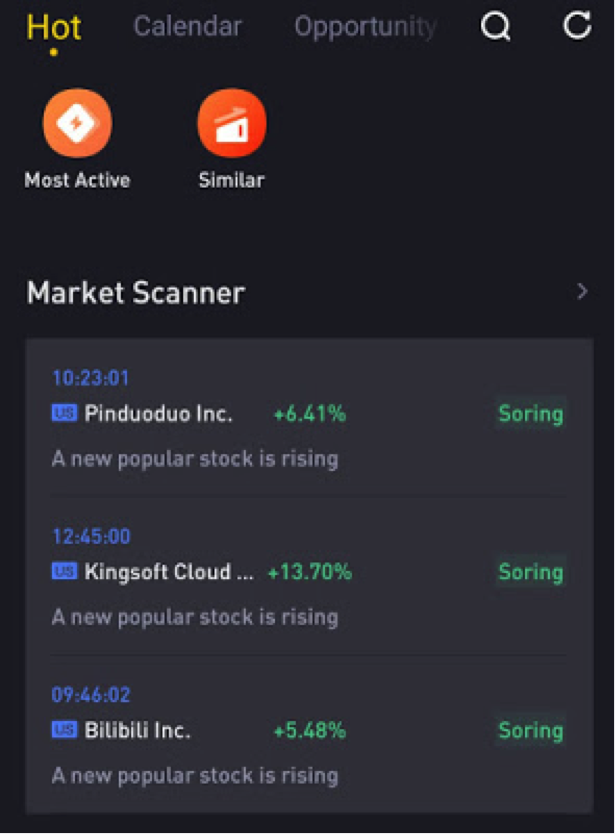

Otherwise, another way you can try is to go into Discover → Market Scanner to spot huge movements in your specified stock market, which will show you what stocks have been trending. Who knows, you might just find your next winning trade idea here.

If you want to know what other users on Tiger Brokers have added to their watchlists, you can also check out Discover → Hot → Most Watched

Analyse Your Stocks Before Buying

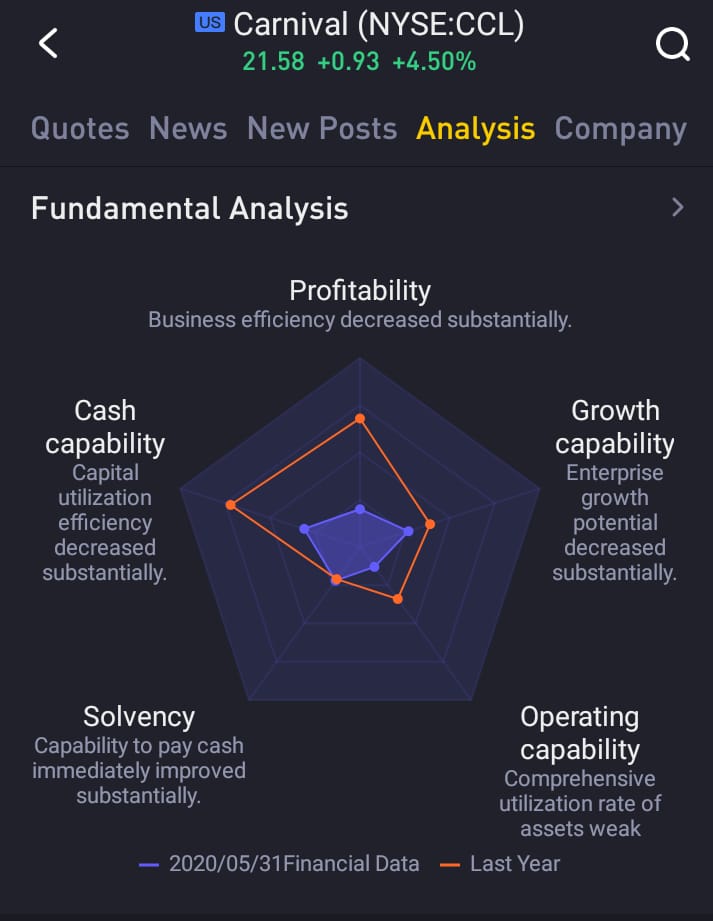

While the mobile app cannot replace my own desktop research, it is nonetheless a quick way for me to get the latest snapshot of the company’s fundamentals at any time.

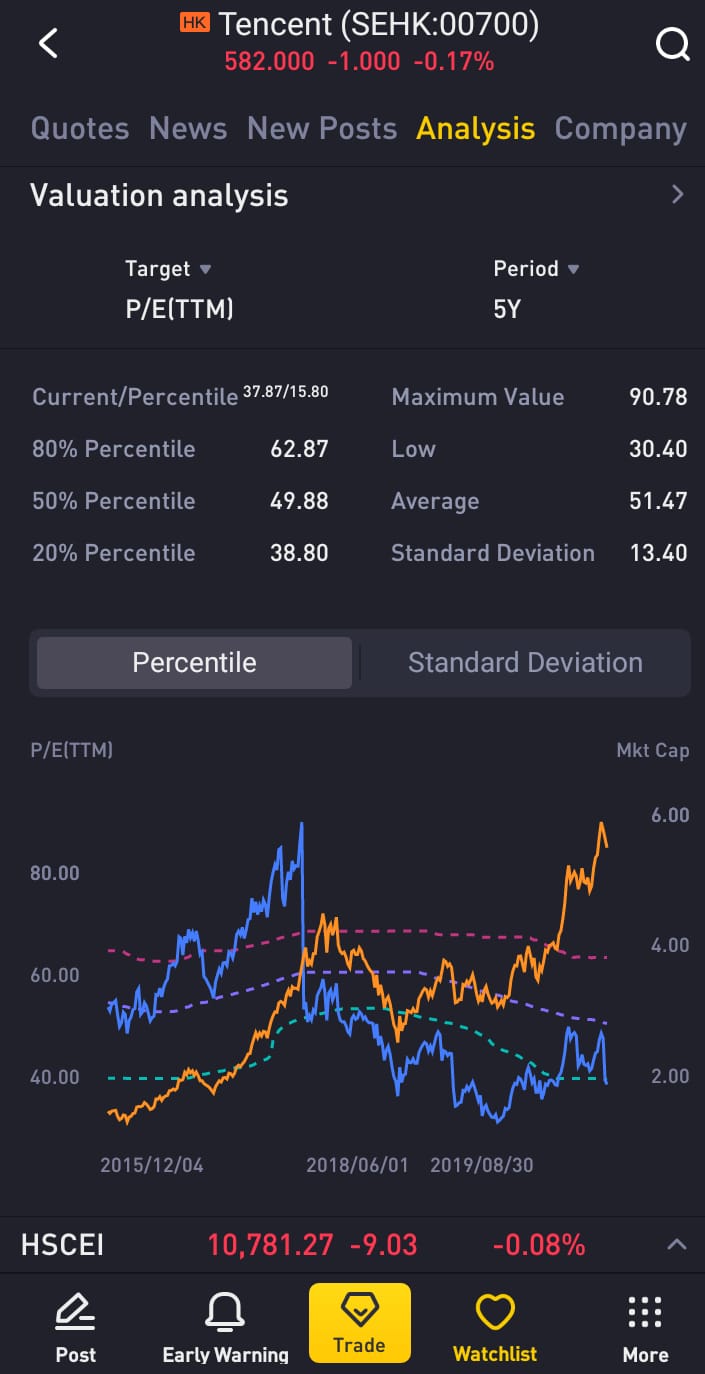

For those of you who prefer to buy when the stock is near its historical low (potentially undervalued), you can conduct a quick check by tapping on

Quotes → (Select Stock) → Analysis

Set the period that you want to view the historical P/E ratios for, so you can compare it against the current P/E value.

When I see P/E values are at its historical high, I will then go back to the stock to re-evaluate its growth potential. This then helps me to decide whether to buy now, or to just buy a small position first and reserve some bullets for later in the event that P/E trends back down to its average levels.

For instance, while Tencent’s share price today may seem high (especially if you’ve tracked it for several years now like I did), the truth is that it is still not at where it used to be, prior to the video game approval challenges it faced with the Chinese government in 2018. Looking at the historical P/E can help an investor to overcome price-anchoring bias and average in at reasonable valuations, even if share prices have run up.

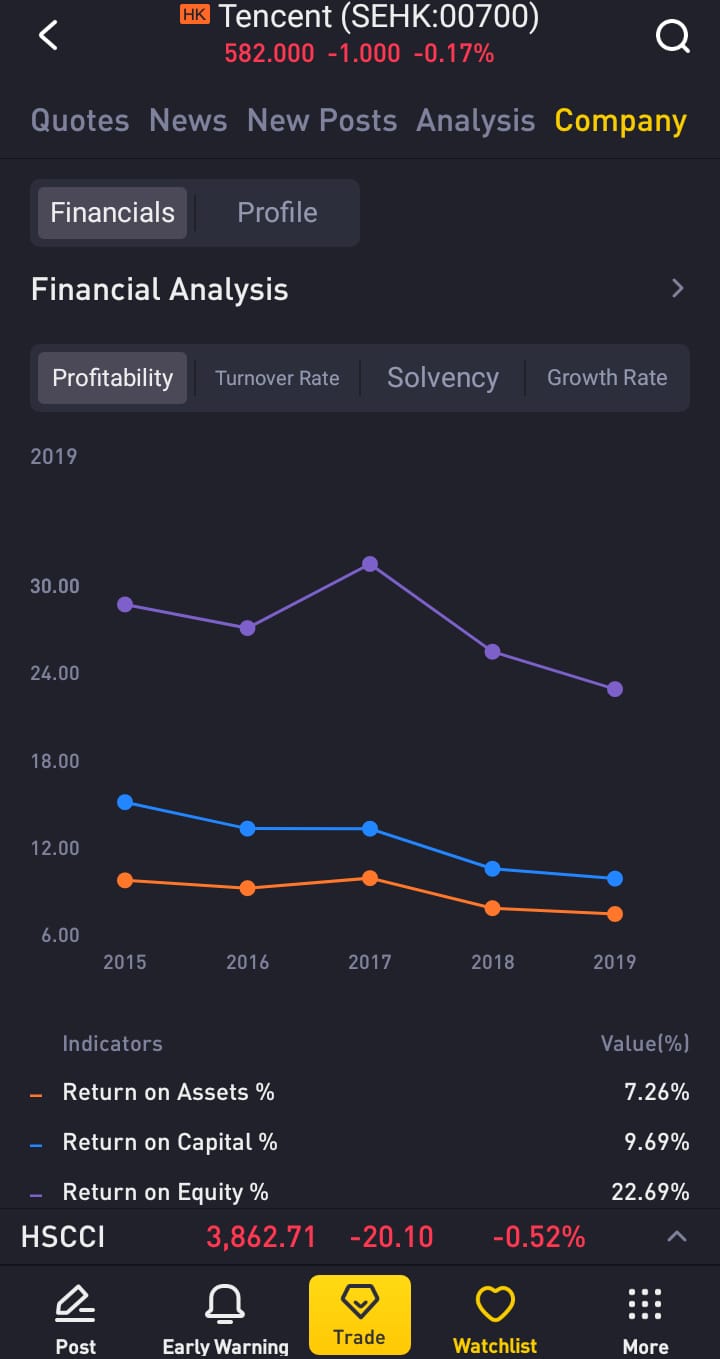

What’s more, you can also check for other metrics such as profitability, solvency, turnover and growth. Instead of having to calculate the CAGR yourself, you can also use the app for a quick check under

Quotes → (Select Stock) → Company → Financial Analysis → Growth Rate

Of course, for larger investment positions I generally prefer to do my own calculations to make sure they’re accurate, but the app offers a quick and easy way to screen or do a refresher before I click the buy button.

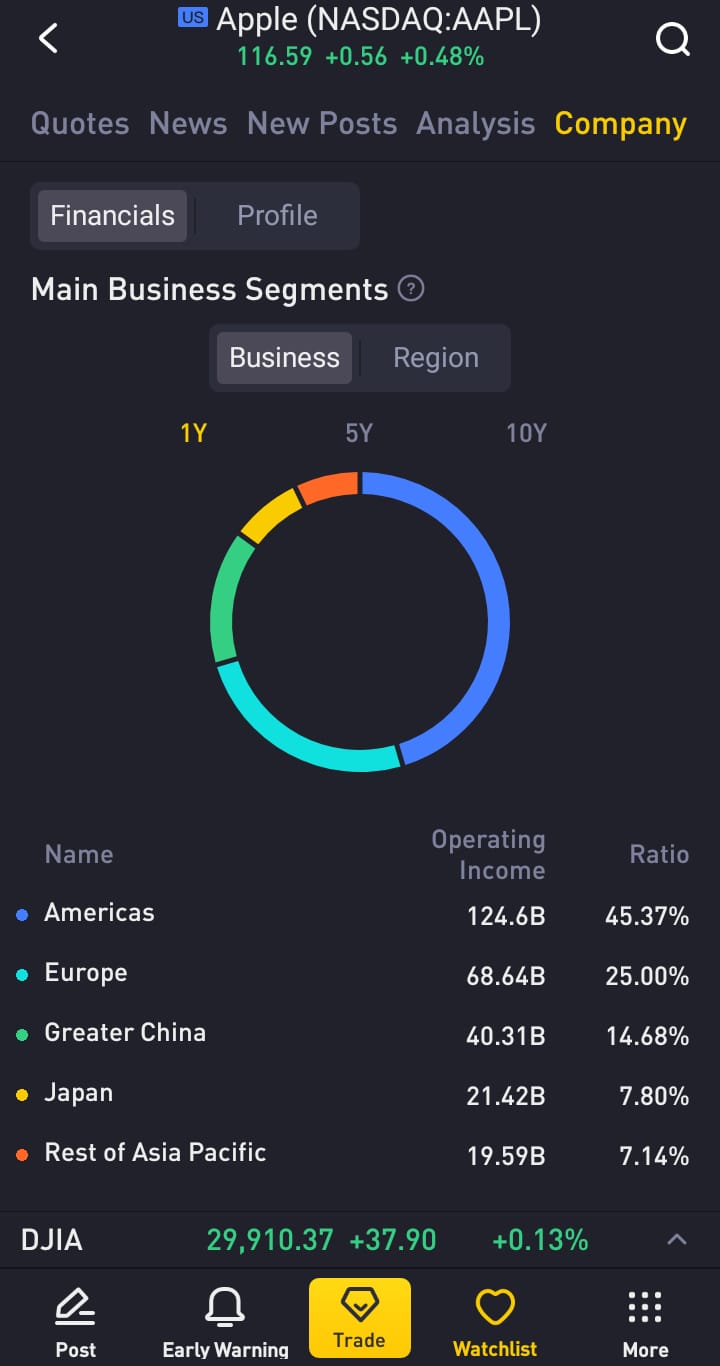

And if you’re concerned about political tensions affecting your investments, you can go into Main Business Segments or tap on Region instead (still under Financial Analysis) to see where the company derives its revenue from. This can then give you a better idea of whether the company might be exposed to any specific country geo-political risks, currency devaluation, or other macro-economic factors. Worried about whether Apple shares will crash if China blocks iPhone sales in retaliation? At 15% revenue, the impact will be felt, but anything more than a 15% drop in share price could hint at overreaction in the markets given present revenue contribution levels.

Discover → Calendar → Corporate Actions Calendar

Some people prefer to buy right before the earnings date, whereas others (like me) prefer to avoid speculation and buy after earnings announcements where we’ll have more information to work with. Over here at the “Corporate Actions Calendar” we’ll be able to check for upcoming earnings, dividends and new IPOs.

Technical Indicators To Help You Time Your Entry/Exit

Many brokerage apps lack in-depth charting tools, and even for the ones that offer some TA, the choice of indicators offered are hardly anything to shout about.

So it was a pleasant surprise when I saw that Tiger Brokers offered a wide range of technical analysis indicators, including MA, RSI, CCI and even KJP???

I generally rely more on FA metrics to determine my entries, but whenever I’m queuing for a stock, I cannot resist the temptation to check whether it is overbought or oversold.

For instance, you can see how a trader who acted on the buy signal for Carnival on 12 – 13 November using the KDJ indicator (the point where the blue J-line dipped below the rest, indicating oversold zone) and then selling today (with the J-line above the rest, indicating overbought zones) would then have earned at least 40% in profits in just 2 weeks!

A Wide Variety of FREE Investment Tools

With all these free tools available on Tiger Brokers, there’s little reason why you shouldn’t download it to make full use of its benefits. Having access to optimal tools for data and trend analysis can greatly improve the quality of your trade decisions.

Especially if your current brokerage app still sucks 😛

For investors trading the Singapore, US, Hong Kong and China market, you’ll be hard-pressed to find a better tool than Tiger Brokers. They also recently opened up access to the Australia markets, so that’s something else to celebrate.

Sign up here if you’ll like to get access to Tiger Brokers!

——

Disclosure: A thank you goes to Tiger Brokers, who not only sponsored this post, but also helped to confirm that I’m using their tools and features in the right manner (before I recommend it to you guys here). All opinions are that of my own, based on my trading experience with Tiger Brokers. Please feel free to click on my affiliate links if you’ll like to sign up for an account!