If your new year’s resolution for 2018 is to save more money, one fantastic way to start is to get maximum cashback and rewards from your expenses.

Imagine if you could get cash back on your income tax payments to IRAS (or other mandatory expenses like utility bills, school fees and rental), and be rewarded for every dollar you spend on food, travel and shopping. As I mentioned in my previous post here on how I managed to double my net worth within a year, one of the important factors was in all the cashback I received on my expenses. Every dollar counts.

- Best credit cards for cashback

- Bonus: Best debit cashback card

- Best high-yield bank savings accounts

- Cashback for insurance, loans, and other non-discretionary expenses

- This tool gives you 2X the cashback

- Buy 4D on weekends and keep your ticket price regardless of whether your numbers win or lose (instead of donating it to Singapore Pools)

- Getting free miles on top of your cashback

- Getting 50% discounts all the time, any day and every day

- Cashback apps that are a waste of time

- Promo codes and reader offers

Note that I’m not paid a single cent to write or give out this guidebook, and none of the content in the guidebook are sponsored by any of the brands mentioned. If you appreciate the work that I’ve done and in keeping this as a free resource, please consider supporting me on my Patreon page here.

Here’s how you can access a copy of

The Ultimate Guidebook to the Best Cashback Tools in Singapore:

- For readers subscribed to the mailing list, you would have received an email from me with a password. Click here to unlock your copy.

- A copy has also been provided to the partners who have provided valuable assistance in making this guidebook possible. If you’re a staff / user with the below companies, you can access your copy here with the provided password that has been disseminated to your marketing lead through these respective links:

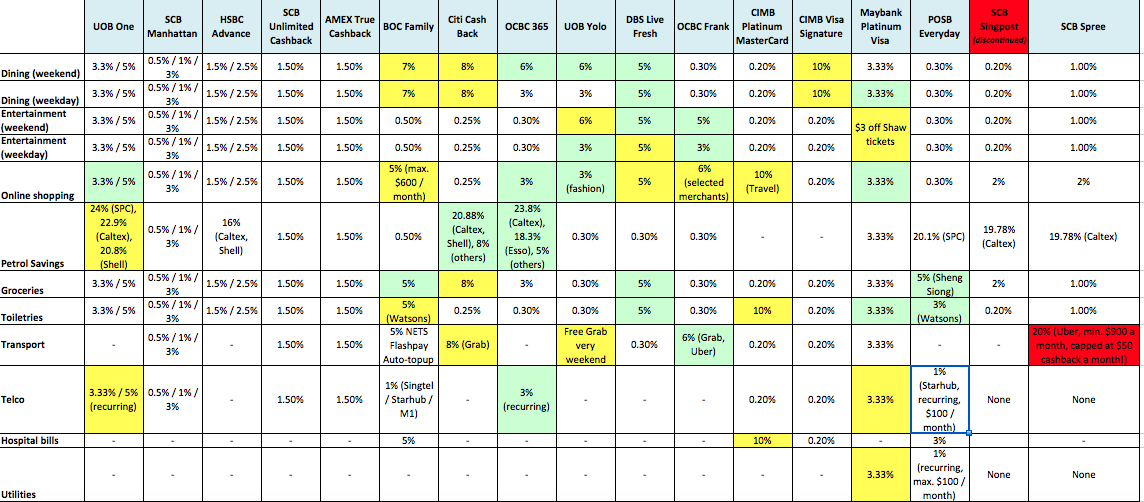

The full comparison table of all cards reviewed in the guidebook are provided below.

Have a fantastic 2018 ahead, and may this help you to maximise all your cashback this year!

With love,

Budget Babe

11 comments

hi, this is great. however, some credit cards required minimum spending to qualify for the cash rebate %, otherwise will be very low % of cash rebate. perharps put in that info will be great helpful.

Haha I already did! It's emphasized twice for every card 🙂

Hihi, I just made a pledge to you on Patron. Can I know when will the information rewarded according to amount plegded be disseminated?

Hi, how do I access a copy of the guide?

could you re-send the password to subscriber?

When I send it goes out to everyone on the list, and I don't want to keep flooding everyone's inboxes.

If you were on the mailing list as of 31 Dec but haven't received it, please check your spam / junk mail to ensure you've whitelisted my email address so whenever I write to you guys, you won't miss it.

If you only joined the mailing list after this post was published, then please do give me a few days to consolidate all the new-joiners before I send out the password again.

Thanks!

Hey Pamela! I've emailed you 🙂

Hi Becker, instructions are in the previous post, and almost all the posts that were published in December as a reminder. You'll have to be on the mailing list as I'm trying to avoid intellectual property theft (yes, others have stolen our articles on personal finance and passed it off as their own work while using it for their own commercial purposes) that is inevitable if I release all 50+ pages here on the blog.

Thanks!

Hey Dawn, this is great!! have signed up, thanks for compiling! :):):)

I'm in the investments space, & am wondering if you've done/doing similar research on the investments space? 🙂

Appreciate all the effort you've put into making this guide! Thanks alot Dawn 🙂

Hi Dawn,

I joined the mailing list shortly after this post came out. Will you be sending out the password again soon?

Thanks!

Comments are closed.