I’m a bit late to the game, but it was only recently that I found out about the DBS Multi-Currency Account (MCA) when I went to watch Pirates of the Caribbean at the cinemas and laughed like mad after this ad played.

Just watch the incredulous look on the shopkeeper’s face as he tries to process why his customer is telling him that he just made a rainbow in his pants LOL.

|

| Whoever came up with this ad deserves an award. |

Anyway, I digress. An account that lets me pay like a local overseas with no foreign exchange fee incurred, while letting me buy currencies at my preferred rate sounded pretty awesome to me.

It is no secret that I’m not a huge fan of cash. I pay by credit whenever I can in Singapore, and I’d love to swipe my card overseas too, but everyone knows you’re subjected to unfavourable foreign exchange rates and forex conversion fees when you do that.

Not anymore.

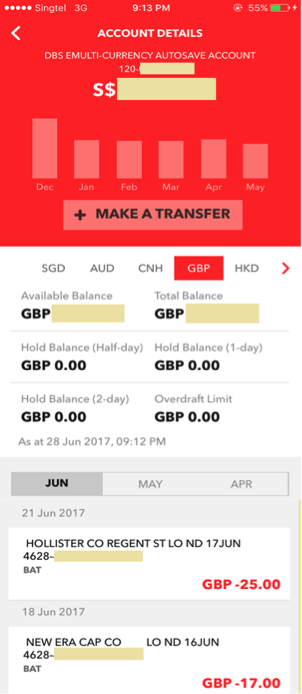

The MCA, together with a primary linked DBS Visa Debit Card, can now enable you to make overseas transactions in the local currency – directly from your bank account – without incurring these forex conversion fees. The savings are quite substantial – you save between 2.5% to 15% of forex fees and Dynamic Currency Conversion charges!

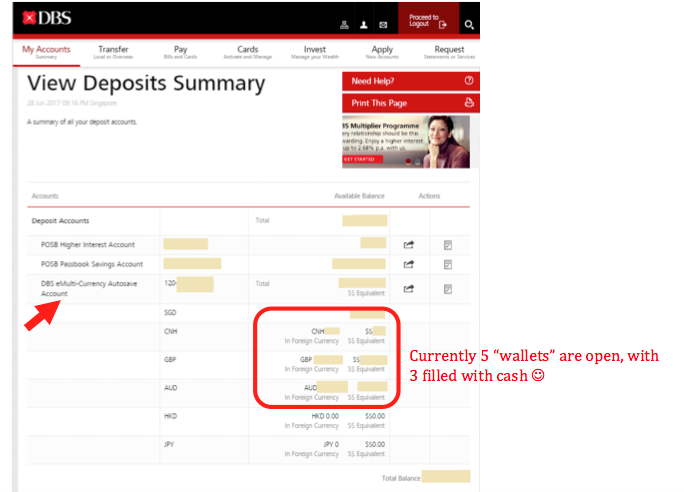

You can also store up to 12 currencies in your MCA account, including the USD, EUR, HKD, THB, JPY, AUD and more, and pay in up to 11 currencies using your linked DBS Visa Debit Card,which I’ve reviewed previously as the best debit card in the market.

How to use your MCA for maximum benefits

Use the MCA when you shop online

Frequent online shoppers will know that when you pay in the local currency (usually USD or EUR) using your credit card, you’ll be in for a huge shock at the end of the month when your statement arrives. The result? You usually end up paying more than you thought you would for that item you bought online, thanks to the high conversion fees.

Then there are the hacks that tell you to shop in a certain currency because it is cheaper that way (psssst, here’s an ASOS hack: shop in EUR to snag your buys at the lowest rates!). But again, you suffer from the conversion fee when your monthly statement arrives.

|

|

(101.25 EUR = SGD 156. See how the price becomes cheaper?)

If I had the DBS Visa Debit Card linked to my MCA sooner, I could have bought more EUR when the price dipped to 1.48 earlier this year, and simply kept them in my digital wallet until now. This dress would then cost me even less!

Use the DBS Visa Debit Card linked to your MCA when you’re travelling overseas

When you book your train tickets and accommodation in advance for a trip, you can also use your MCA Visa Debit Card to pay in the local currency and skip all the FX / DCC charges!

You can also skip that trip to the money changers to convert your cash right before your trip, and avoid being stuck carrying huge wads of cash around hoping that you won’t be robbed (whether in Singapore or overseas). Just swipe with your card overseas and pay in the local currency.

Ran out of cash overseas? No need to be fleeced by the ATM or foreign moneychanger’s rate when you can simply withdraw from your MCA overseas (just pay the nominal ATM withdrawal fee – it is a small price for convenience and is usually about S$5 per withdrawal). Have insufficient foreign funds in your MCA? No worries, simply log on and transfer the foreign amount you need, and continue spending using your debit card overseas. No sweat!

You will no longer have to try and force yourself to shop at the airport in a bid to use up your remaining local currency before you fly home either. Just use your MCA 😉

Stock up on foreign currencies at favourable rates

Now here’s the trick: “stock up” on your foreign currency at favourable rates and keep them until you need it.

You can monitor exchange rates on the DBS FX website and make conversions when you see an attractive rate.

Remember how everyone was rushing to moneychangers to exchange for EUR when Brexit happened? I wanted to do that too, but I hated the idea of keeping thick wads of foreign cash in my drawer at home, especially when I can’t be sure that my pesky sibling isn’t going to steal it.

Well, I can just do it online with my MCA next time via iBanking!.

Note that this is ultimately a debit card

For those of you who are into the miles or cashback rebates game where you spend using your credit card overseas to chalk up rewards, note that these rewards do not apply for your DBS Visa Debit Card.

So you’re basically choosing between (a) zero forex fees + no DCC charges or (b) credit card rewards but incurring the additional FX & DCC charges

My preference is still for Option A, because I already try not to spend using my credit card overseas unless I have to (not entirely a fan of all those extra charges just for 10x more rewards!).

The fine print

– There is a fall-below fee of S$7.50 (for balances <S$3,000 equivalent) but it is waived for the eMCA account if you’re up to 29 years old).

– Store sufficient foreign currency funds in your MCA before you swipe your card to pay. If you don’t have enough foreign currency in your MCA, the transaction will be deducted from your SGD funds instead and you’ll end up incurring FX fees at the prevailing bank rate (eg. JPY à SGD à JPY).

– Your spending will have to be in full i.e. if you have only AUD 500 left, your AUD 1,000 purchase will be deducted in full from your SGD balance instead of just converting the remaining sum.

– This is a debit card, so you won’t be getting any miles from overseas spend. Nor will you be entitled to the 5% cashback on the DBS Visa Debit card (as that only applies to local Visa payWave spending).

– If you deposit or withdraw foreign currencies at the bank branch, you’ll have to pay the nominal fees charged (as a percentage of your withdrawal sum; similar to other banks’ practice). Skip this headache by simply going cashless!

Read more of the fine print here, and more FAQs here.

How to sign up

Existing POSB / DBS customers

Do it instantly online. Log into your DBS iBanking à select Apply à Deposit Accounts à DBS eMulti-Currency Autosave Account

Remember to also apply for the DBS Visa Debit Card separately if you don’t already have it. Link it to your MCA account so that it becomes your primary debiting account when you use the card.

New DBS customers

You can apply online as well and the DBS Visa Debit Card will come automatically with the account.

This truly is an innovative product, one that you should consider if you’ve always disliked the fees involved whenever you make payments with foreign currency. I’m now waiting for the rest of the banks to follow DBS’ lead.

SGD deposits are insured up to S$75k SDIC.

This article is written in collaboration with DBS (after I watched their rainbow sprinkles ad in the cinemas, which was how I came to know about the product). All opinions are of my own.

|

1 comment

Good stuff, thanks for the share! 🙂

Comments are closed.