Yesterday, I detailed why I cancelled my ILP despite suffering a high 4-digit sum for early termination. It was a mistake I made as a financial noob years ago, when I was so focused on doing well in my first job that I didn't really think about anything else.

If someone tells you to buy an ILP because you know you're not good at investing anyway and it will be better to leave it to the experts….don't believe them.

You CAN become good at investing.

Investing is a learned art (and science). I don't think there'll ever be the day when you stop learning. Even Warren Buffett, the greatest value investor of our time, says he's still learning even after so many years.

I'm not the best investor around, but I trust in my investing thesis, which offers up one point of analytical view. I've had much smarter brains and trained finance folks quote my research in their own reports and articles too, and each time they do, it reaffirms that I'm on the right track.

But before you jump into investing, pleaseeee take care of your downside first.

In other words, GET INSURANCE.

Insurance is a protection tool against the odds that life can throw at you, and often really nasty ones. If you don't protect your potential downside, you may find yourself in a situation where you'll have to liquidate your investments early to pay off for something that unexpectedly cropped up (like a $80k hospital bill).

If the market conditions are poor then, your assets will be worth less, and fetch a lesser price. You'll be losing money either way.

Taken from online.

Ok, I'm digressing.

So after I terminated my ILP, I went ahead to buy myself a direct term insurance plan. #dayrefinance #dayreinsurance

The main purpose of insurance is to PROTECT us, and NOT to help us save or invest.

Before the agents slam me…note that I said "main" and not "only".

While some consumers might prefer bundled products for convenience, I’m not a huge fan of those because they don’t always give you the best value for your buck. With plenty of options available to boost your savings and investments, I don’t see a need to use insurance, especially since the low returns, coupled with the lack of liquidity and flexibility, makes it a poor financial tool.

Do you buy 3-in-1 shampoo for your hair? If you value convenience, sure. But if you're like me, and I want the best out of each, I'd rather use the best shampoo I can get, the best conditioner, and the best hair mask. Even if it is a little bit more troublesome…

Do you want the best of everything, or possibly mediocre but bundled together for convenience?

I've already shared in yesterday's post why the returns of fund managers aren't fantastic. If you buy into an insurance product for investment, then you'll definitely be getting a portion of it, but the results won't be as good vs if you learn how to do it yourself.

You don't even need to be GOOD at it to beat these fund managers! (Reread yesterday's post to find out why.)

Since insurance is primarily for protection, it makes sense that we should buy as much as we need while spending as little as can we. In that way, we can then free up precious financial resources for other priorities – paying off our debts, saving for retirement, saving for your child’s college fees, or even just going on our next dream vacation.

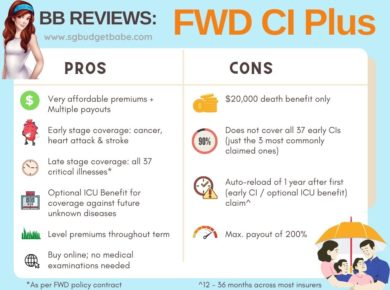

If you’re purchasing insurance for the first time, you’re forgiven if you’re confused as to whether Death / Terminal Permanent Disability (TPD) coverage is sufficient, or if you need to add on Critical Illness coverage as well. There are no right or wrong answers – these ultimately depend on your lifestyle and what your need for the product is. There are no bad products – only badly suited ones.

I'm not saying that ILPs are necessarily good or bad – I'm saying I PERSONALLY THINK they're a bad tool for me.

I'm an investor, so it makes no sense to me to be paying someone else such big fees to do something I can do (equally, if not better, in my own opinion!)

I don't advocate ILPs for folks who are disciplined enough to save, nor for folks who are willing to make the effort to grow their own money. There are many of ways for you to get there without having to rely on the high fees of an ILP.

But for someone who has poor discipline, can't be bothered (now or in the future) to manage their money, simply wants a convenient tool that covers multiple aspects in one…AND are willing to pay for that convenience, then MAYBE the ILP route may be suitable for you. Please confirm if your own agent. If you don't trust yours, I'll be happy to refer mine over email, but I'm not affiliated with them in any way okay so don't hold me responsible if they recommend you the wrong plans.

Term insurance:

People who like the idea of getting their money back if nothing happens to them will HATE this product, because you just pay and pay.

But for investors who are looking to minimise their expenses and free up more cash for their own investments, term insurance is a fantastic tool. Note that this comes as "buy term and invest the rest (yourself)" and NOT standalone term insurance so that you can use the money to spend on other stuff / material luxuries!!!!!?!?????!

In my case, I don't blame my agent for selling me the ILP years ago. I also had a part to play, didn't I, when I signed the forms?

Especially since I signed the MAS declaration that I was financially literate enough to know what I was buying. HAHAHA what rubbish. I obviously had no real clue and just listened to what my agent advised since I thought he knew better than me.

At that point of buying the ILP, I hadn't yet started investing. So it wasn't exactly a mismatch.

BUT I was beginning to show interest. And my agent failed to consider the possibility that I would in time, come to take on investments by myself. He sold me a plan based on my needs years ago without projecting what could happen shortly after based on my personality.

Which was why the ILP then became a liability to me years later, and why I cancelled it.

Loving the discussions below! Please keep them coming guys. I wanted to write about some misconceptions about term insurance for today initially but somehow this transformed into a term vs ILP post because of your comments.

Will push the misconceptions back to my next post! I can see some of you are confused.