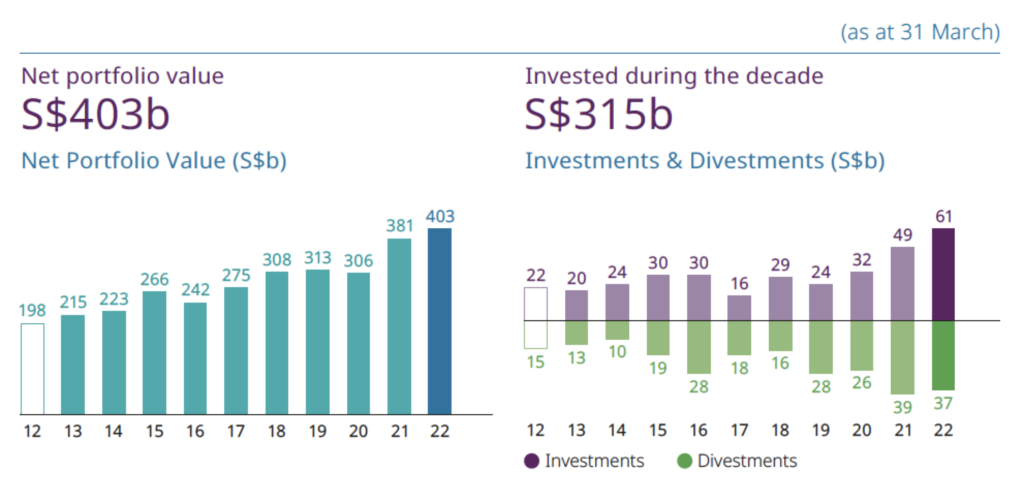

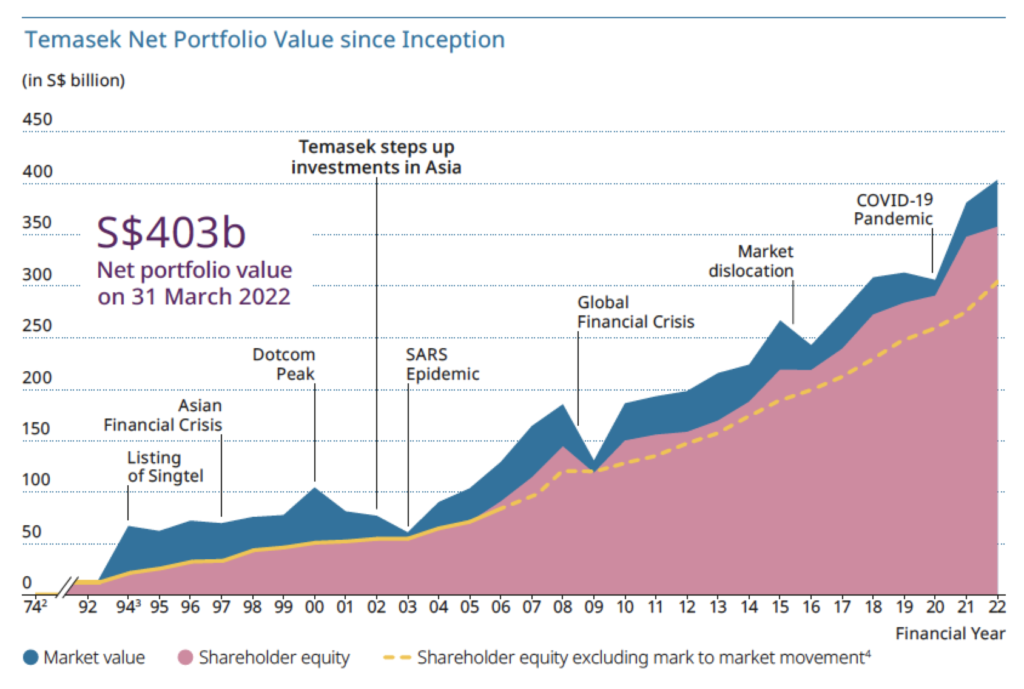

In a year where most major markets have gone into bear territory, Temasek surprised on the upside with their net portfolio value hitting a record high of $403 billion, broken down into a one-year investment performance of 5.81% (or an annualised 14% compounded since its inception in 1974).

I had the privilege of being invited to their 2022 Temasek Review, where they shared more insights that weren’t covered in the press release. Here are some key messages that stood out for me:

A diversified portfolio based on intrinsic value picks

Temasek’s investment discipline is centred around intrinsic value vs. a risk-return framework. In other words, the thesis for every investment needs to point to a clear intrinsic value and future growth, which is then measured against the corresponding risk-adjusted cost of capital. Higher risk sectors or markets naturally get assigned higher costs of capital.

There are over 400 companies in the portfolio, so the above does not capture the full picture; instead, it is a consolidation I’ve done of the companies that feature as top investments on their public website here.

How did Temasek achieve positive returns in a year where most market indices are negative?

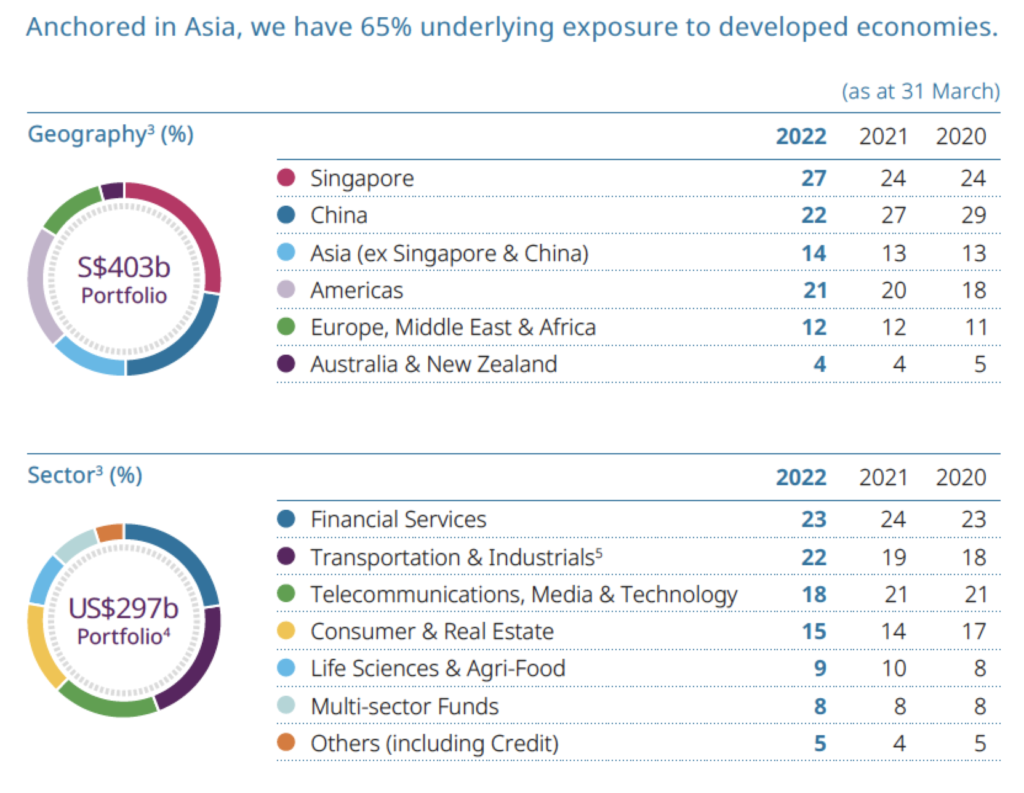

Aside from a disciplined investment mandate, the clues can be found in how Temasek’s exposure and portfolio allocation is being managed:

You’ll notice that the portfolio is fairly diversified across different geographies and sectors. Hence, while there are some positions in the red e.g. Roblox, Temasek was largely spared from the recent meltdown in growth / tech / US stocks.

The increased exposure to Singapore comes from a mix of 2 factors: (i) valuation multiples in Singapore did not compress as much as China / US (ii) Temasek also invested $6.2 billion in SIA and took part in the rights issues for Olam and Sembcorp Marine.

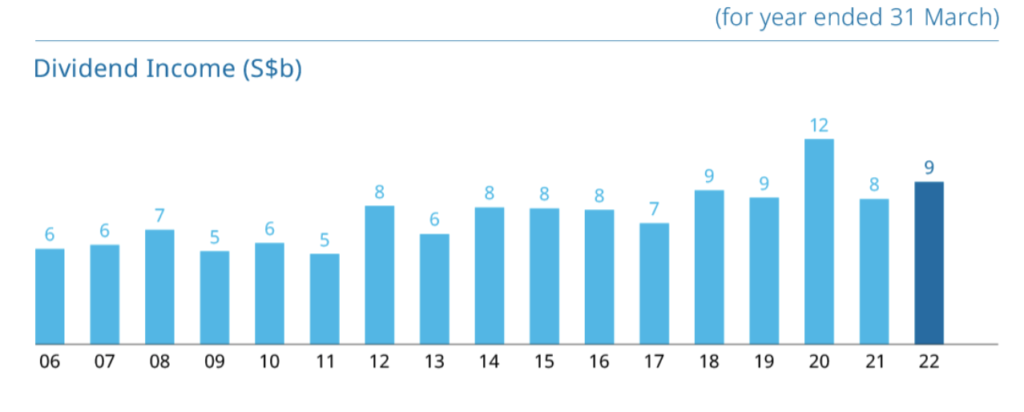

Temasek also continued to collect sizeable dividends i.e. $9 billion in total.

What does Temasek look at before deciding to invest?

By now, I’m pretty sure most of you are intrigued on their investment process, like I am. So I took the chance to ask them more about their thought process behind every investment decision, and here are some of the considerations shared:

1. There is a detailed thesis for every investment

The Temasek folks shared about their extensive due diligence prior to making an investment, as well as actively monitoring and engaging stakeholders even post-investment. Internally, this is all consolidated in an investment slide deck that the rest can also review.

Notably, each thesis also lays out frameworks and scenarios guiding their entry and exit from the investment. While at best an estimate, but there is at least an approximate holding period set out for each to guide their decision-making.

2. Intrinsic value and risk factors are important

An attractive growth story is not enough to make Temasek act on the investment; instead, there needs to be a clear intrinsic value as well. This is then weighed against risk factors and cost of capital before Temasek decides if the investment will be worthwhile.

What’s more, depending on the size and nature of the investment, either quarterly or monthly reviews are carried out to measure against the original thesis.

3. Management quality is crucial

Management quality is one of the top things that Temasek looks at, as the capabilities of the leaders running the business matter. During COVID-19, this was harder to assess as the Temasek team was unable to fly overseas and meet with the managers in person, but this has since lifted as business travels have resumed.

Divest once the investment thesis has played out

Temasek’s Director of Public Affairs, Paul Ewing-Chow, said something that I felt was worth repeating.

“We are mid to long-term investors, and not permanent investors.”

Unlike some investors who hold on to their positions for an indefinite amount of time, Temasek sees no qualms in divesting when the thesis has played out, or when there are more compelling opportunities for them to re-allocate capital to.

This might help to explain why Temasek sold Nio (and at an impeccable timing too, before Nio’s stock price started crashing) right before the correction.

Risk management in a globally uncertain world

While its past one-year and historical returns look good, let’s not forget that even Temasek is not immune to periods of significant drawdowns as well.

But more importantly, Temasek’s investment posture is to ride out short term market volatility and focus on generating sustainable returns over the long term. While Temasek is open about how it expects its portfolio to have higher year-to-year volatility of annual returns (with higher risks of negative returns in any one year), the goal is still focused on long-term returns.

In a period of sustained market volatility and an uncertain future (recession? persistent inflation? stagflation? rising interest rates for longer?), individual investors will do well to remember this.

With love,

Budget Babe