|

Standard Chartered offers basic bank accounts for low-income Singaporeans,

but have just announced that they will be imposing a $2 monthly account service charge

regardless of your bank balance. |

Earlier this morning, I was alerted to the changes in Standard Chartered’s banking fees by Kenji. Surprisingly, I haven’t heard much about this from the mainstream media, so I decided I just had to share this with all of you readers, lest any of you get affected as well.

Current SC account holders should have already gotten a letter about these fee changes, so I hope you read them. If not, here goes.

Read and take note.

Disclaimer: All information from this post are facts obtained from Standard Chartered’s website. Budget Babe will not be held liable for any decisions made regarding one’s bank account after reading this post. Readers are encouraged to contact Standard Chartered directly here for further clarifications on their accounts.

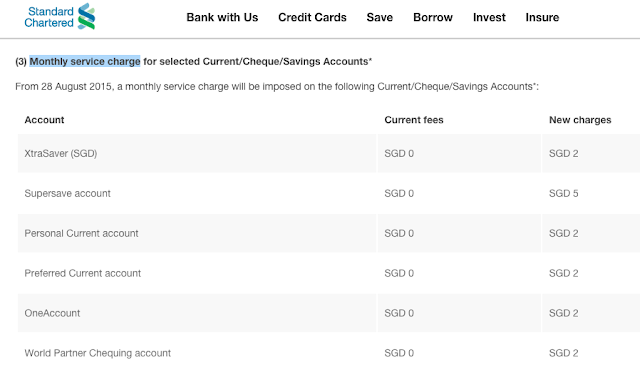

In summary, Standard Chartered has just announced that they will be:

1. Increasing the annual fee for their Bonus$aver & XtraSaver debit cards

2. Imposing a new fall-below fee for selected accounts

3. Imposing a monthly service charge for selected accounts

The ones you might want to take note of are (2) and (3).

1. Extra $5 for owning a Bonus$aver or XtraSaver debit card.

2. Make sure you maintain your average daily account balance over the minimum fees below. If it lapses for even one day, I cannot confirm whether SC will charge you $5 for it.

3. Regardless of your account balance, there will now be monthly service charge implemented just to keep your account going.

Consider the following 2 scenarios where Account A gets charged whereas Account B does not:

|

|

Account A

|

Account B

|

|

Average daily balance for April’15

|

980

|

1080

|

|

1-Apr-15

|

1000

|

1000

|

|

2-Apr-15

|

900

|

700

|

|

3-Apr-15

|

900

|

700

|

|

4-Apr-15

|

900

|

700

|

|

5-Apr-15

|

800

|

700

|

|

6-Apr-15

|

700

|

700

|

|

7-Apr-15

|

900

|

700

|

|

8-Apr-15

|

900

|

700

|

|

9-Apr-15

|

900

|

700

|

|

10-Apr-15

|

900

|

700

|

|

11-Apr-15

|

1100

|

700

|

|

12-Apr-15

|

1100

|

700

|

|

13-Apr-15

|

1100

|

700

|

|

14-Apr-15

|

1100

|

1400

|

|

15-Apr-15

|

1100

|

1400

|

|

16-Apr-15

|

1100

|

1400

|

|

17-Apr-15

|

1000

|

1400

|

|

18-Apr-15

|

1000

|

1400

|

|

19-Apr-15

|

1000

|

1400

|

|

20-Apr-15

|

1000

|

1400

|

|

21-Apr-15

|

1000

|

1400

|

|

22-Apr-15

|

1000

|

1400

|

|

23-Apr-15

|

1000

|

1400

|

|

24-Apr-15

|

1000

|

1400

|

|

25-Apr-15

|

1000

|

1400

|

|

26-Apr-15

|

1000

|

1400

|

|

27-Apr-15

|

1000

|

1400

|

|

28-Apr-15

|

1000

|

1400

|

|

29-Apr-15

|

1000

|

1000

|

|

30-Apr-15

|

1000

|

1000

|

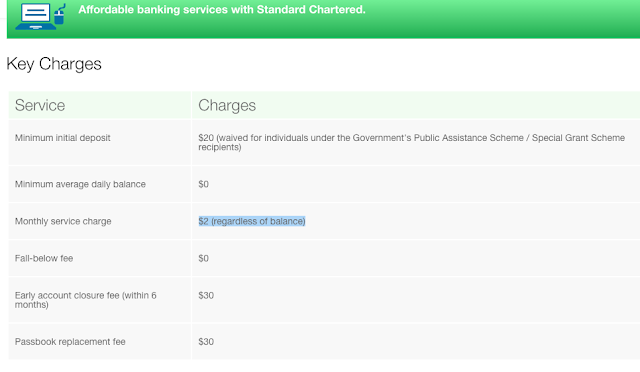

Their basic banking account created for low-income families will not have any incremental fees, save for the current $2 which is already being charged each month. If you have a basic banking account, I hope you already know about this small monthly charge, because none of my other bank accounts charge me a servicing fee each month to keep my account alive.

(Update: Standard Chartered has written to me to clarify that this fee is waived for recipients of the MSF Public Assistance Scheme / Special Grant Scheme.)

Apparently, some of my more financially-savvy friends have already terminated their accounts after hearing this news, whereas a few others are still trying to call through the customer service lines (without much luck, from what I heard).

Those who are on GIRO are going to be immensely affected by this change though, and it won’t be that fast nor easy for them to switch immediately, even if they wanted to. Some may even just decide to deal with the charges in the name of convenience.

I feel lucky that I’m not affected, but it comes as another key reminder to always check my bank statements and letters every month lest there are any undesirable changes such as this.

In some of my older posts, I’ve explained the importance of looking out for the little expenses, as they can insidiously accumulate damage without you realizing.

When I was still in university, I opened up a savings account in another bank in order to put in my exchange studies funds. After I came back to Singapore, I happily left the remainder money in the account without doing anything, thinking that I now had extra savings to fall back on just in case my main account ever runs low.

I had no intention to touch it, so neither did I bother reading my monthly account statements. After all, since I didn’t do anything, there was nothing new for me to care about, right?

WRONG.

About 2 or 3 years later, I decided to take a look at the bank statement just to remind myself of how much I had.

Instead, I got a rude shock.

I realized I had unknowingly been charged $10 every month as my account balance had fallen below $5,000.

I didn’t even know when it started happening, but I estimate that I lost at least a few hundred dollars before I realized what was happening…and immediately topped up my account. There was, however, no way to get back the fees charged. “Not knowing” was a lousy excuse as well, because I had only myself to blame for not checking my bank statements.

I didn’t cancel my account because I have multiple credit cards under that bank – credit cards which I love, and had no intention of terminating.

This taught me a very important lesson – always read your bank statements at the end of the month.

If you don’t have the habit of reading them, now is a good time to start.

|

| That is the million-dollar question. |

4 comments

I realized I had unknowingly been charged $10 every month as my account balance had fallen below $5,000. <– care to share which bank it is? thanks

Hi BB, there is a option without fall-below fee through the DASH account by SC. It is not advertised on the SC website, I was told my the customer service lady. There is a promotion counter at Clementi for signing up.

I intend to use the DASH account and close my e-saver account as I usually don't maintain the min. $1,000.

Hi, you can actually find that out from a quick Google search 🙂

Hi Lester,

Thanks for sharing! I'm sure this will be useful to many readers as many people use DASH for its benefits.

Comments are closed.