SingSaver is running their latest promotions in light of the Great Singapore Sale (GSS) where everyone stands to get up to $300 cash and a chance to win a $669 Nintendo Switch!

Get $300 from SingSaver if you’re a new customer applying for ANY Citi cards during this GSS! Card spend is required in order to be eligible, so remember to activate and start using it for your next food delivery, online shopping, etc.

I took a quick look at the promotions ongoing for this GSS and here are my top picks:

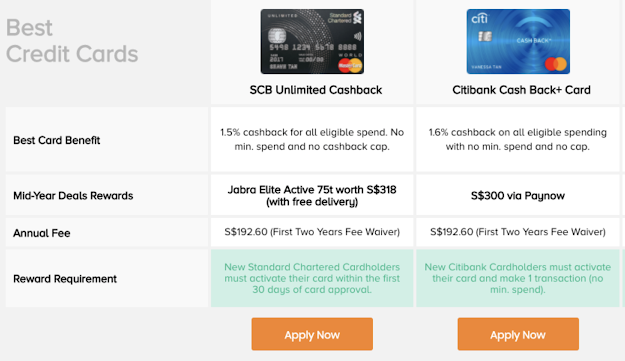

$300 with the Citi Cash Back+ (Credit Card)

Get $300 when you sign up for the Citi Cash Back+ card (read my review here) + 1 lucky draw entry for a Nintendo Switch. This applies only for new-to-bank customers; existing customers will only get $30 and 1 lucky draw entry instead.

I like the Citi Cash Back+ because it is the only unlimited card with no minimum spend and yet offers the highest cashback at 1.6%. This makes it ideal for those whose expenses are generally low and have difficulty meeting the minimum spend for other cashback cards, as well as folks who have a large purchase coming up (thus crossing the max. limits on other cards). Card spending is required in order to qualify for the rewards.

If you missed the $350 offer earlier this year in February, this is the next-best offer from SingSaver I’ve seen. And if you win the Nintendo Switch as well? Touche.

$318 Jabra Wireless Earbuds with SCB Unlimited (Credit Card)

Also in the category of unlimited cashback with no minimum spend required is Standard Chartered Bank’s Unlimited Card, where you’ll get one of the much-coveted Jabra Elite Active 75t wireless earbuds (worth $318) for signing up + 1 lucky draw entry for the Nintendo Switch.

Existing customers get $50 + 1 lucky draw entry, which isn’t too bad either. You’ll need to activate your card to qualify.

Now, I normally don’t recommend taking up loans, but I’ve seen how Covid-19 has caused many people I know to suddenly run into cashflow problems as their business or income dried up. If that describes your situation as well, and you need a personal loan to tide you over in the meantime, you might as well shop around for a competitive one (i.e. lowest interest rate) which also gives you a bonus for signing up with them.

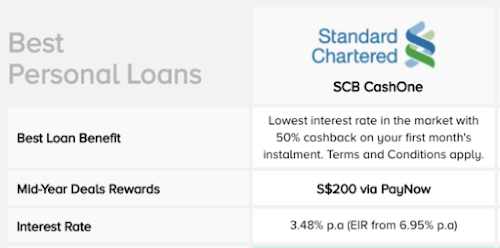

$200 with a SCB CashOne Personal Loan

If you decide on the SCB CashOne Personal Loan, you can get an extra $200 cash once your loan application has been approved by Standard Chartered Bank.

This applies for both new AND existing SCB customers, and you’ll also get the 1 lucky draw chance for a Nintendo Switch. Please do NOT be silly enough to sign up for a loan just for this prizes though – you should only be loaning if you need it for your cashflow during this period!

$100 with a UOB Personal Loan

If for some reason you prefer to borrow from UOB instead, then remember to get your $100 + 1 lucky draw chance once your UOB Personal Loan approval has been granted.

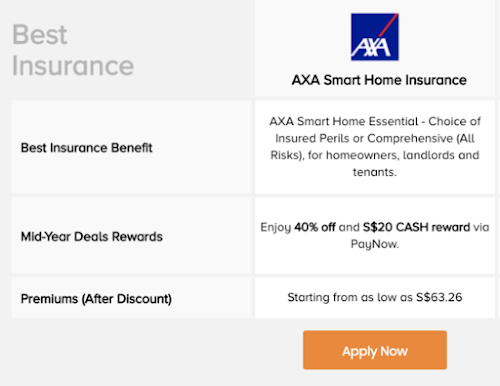

Home Insurance

If you haven’t already gotten your home insured, check out the AXA Home Insurance with premiums starting from ~$63 to give you coverage for your fixtures, fittings and renovation, protect against loss of rent, tenant coverage, and more.

Get 40% off premiums and $20 cash upon successful application + 1 lucky draw entry for the Nintendo Switch.

Maid Insurance

If, like me, you were cornered into getting your helper insurance from the maid agency that you engaged, then make sure you shop for better and lower-cost alternatives the moment you can (usually after 1 or 2 years, depending on contract).

The MSIG Maid Insurance gives you $30 while you’re at it + 1 lucky draw entry for SingSaver’s GSS grand draw. Aside from medical fees due to accident, it’ll even cover you for expenses incurred if you need to get a replacement maid, or if you need to to repatriate your existing helper. Pretty comprehensive – go check out the policy details and see for yourself.

Cancer Insurance

If you’re worried about not having cancer insurance and want something right away, MSIG Cancer Insurance could also be a good one to look at, where a $100,000 coverage starts from $4.45 per month. No medical examination or health check is needed, and they’ll provide immediate policy issuance.

Note that I haven’t compared this against FWD or Singlife though, which has usually been among the most competitive, so please do your own due diligence and NOT sign up for a cancer insurance plan just because you want the SingSaver GSS rewards. But if you do ultimately decide that this is a good plan for you, then remember to claim your $20 cash + 1 lucky draw chance upon successful approval.

Read the full T&Cs here.

My top pick is definitely the Citi Cash Back+ as it is the undisputed winner among unlimited cashback cards AND you can now get $300 for signing up. In these times where we’re heading into a recession and we need to tighten our wallets, such a card with no minimum spend will definitely come in handy.

Don’t forget to claim your SingSaver rewards after!

With love,

Budget Babe

Disclosure: This post contains affiliate links, however, I have chosen to only mention the products that I personally feel are worth signing up for. For this GSS special, all Citi and Standard Chartered credit cards (except the X card) applied via SingSaver will come with the same rewards, but I have not featured them here as I wouldn’t pick them at this stage. All opinions are that of my own.