What you need to know about the SIBOR to SORA transition, and what you need to do if you have an existing home loan pegged to SIBOR rates.

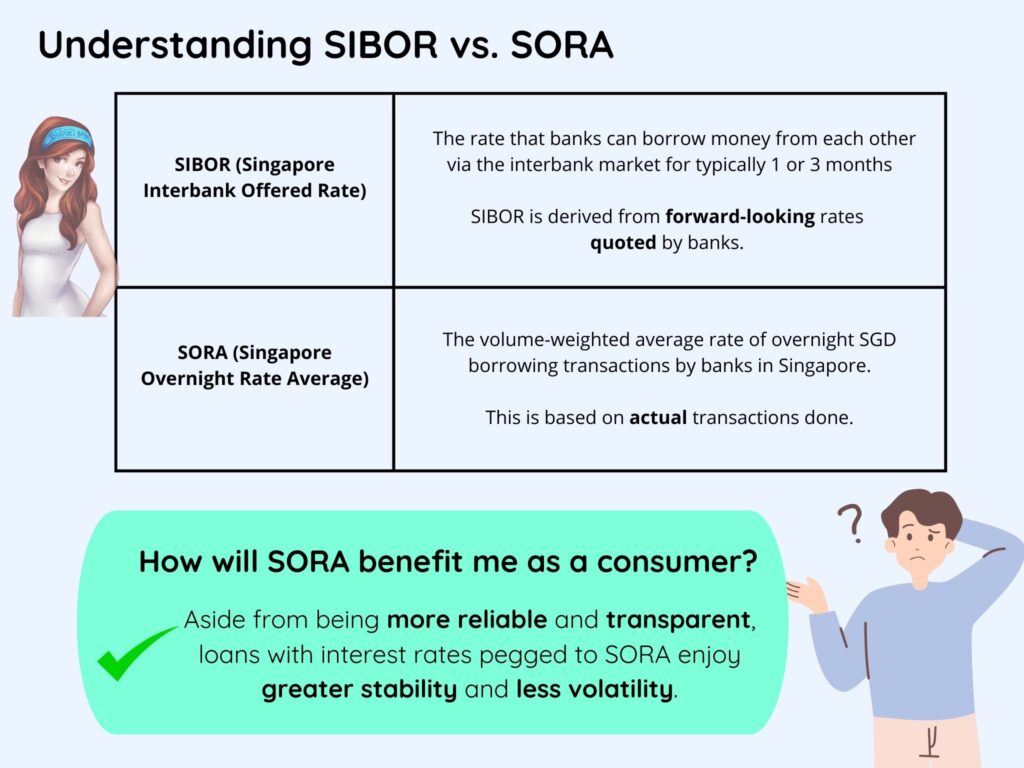

PSA: If you have a SIBOR-based mortgage or property loan, you need to know that SIBOR (Singapore Interbank Offered Rate) will be discontinued soon. In its place, SORA (Singapore Overnight Rate Average) will now be used as the main benchmark for SGD-denominated loans.

So if you’re an affected borrower, you can either proactively switch now to a home loan of your choice i.e. convert your existing SIBOR-based home loans either to a SCP (SORA Conversion Package), or to one of the prevailing home loan packages offered by your bank.

Otherwise, if you choose to do nothing during this period of active transition (until 30 April 2024), you will eventually be automatically converted by your bank in June 2024 at a fixed adjustment spread of 0.2426% and 0.3571% respectively for loans referencing 1-month and 3-month SIBOR to 3-month Compounded SORA.

SIBOR will be officially discontinued after 31 December 2024.

Since interest payments can no longer be calculated for SIBOR-based loans after that and if no action is taken by 30 April 2024, all outstanding SIBOR home loans will therefore be automatically converted to the SORA Conversion Package in June 2024.

If you wish to have a choice as to which home loan package you prefer to switch to, then you’re encouraged to contact your bank during this active transition period.

How will SORA benefit me as a consumer?

Aside from being more reliable and transparent, loans with interest rates pegged to compounded SORA will enjoy greater stability and less volatility.

SIBOR contracts typically use a single day’s reading of the benchmark for each interest payment period. The downside is that borrowers are exposed to market conditions concentrated in one single day. For instance, some borrowers may experience higher interest payment for an entire three-month period if the SIBOR spiked on particular day due to a global risk event.

In contrast, interest payments on SORA loan packages are based on compounded SORA, which is computed as an average of individual SORA readings over the inter-payment period – e.g. monthly or quarterly, depending on how frequently your loan interest payments are calculated. Thus, the use of compounded SORA results in a rate that is less exposed to sudden changes to interest rates. Due to the averaging effect, interest rates spiking higher on one or a few days will not impact your interest payments by as much due to the averaging effect. It also means that any change in market conditions will only be gradually reflected over time.

What are my options if I have an existing SIBOR loan?

Ok, so how does this change affect home borrowers?

If your current housing loan is tied to the 1M or 3M SIBOR, you can choose between two options now:

1. Switch to the SORA conversion package (SCP), or

2. Opt for any other loan package offered by your bank.

Alternatively, if you take no action by 30 April 2024, your bank will auto-convert your SIBOR-based loan to the SCP in June 2024.

The good news is, converting your existing SIBOR loan to the SCP or any of your bank’s prevailing loan packages with the same bank now will NOT incur any additional fees or lock-in period. Yes, these are part of a wider industry initiative to support customers who switch out of their SIBOR retail loans during this active transition period.

You’ll also be exempted from recomputing your Mortgage Servicing Ratio (MSR), Loan-To-Value (LTV), and Total Debt Servicing Ratio (TDSR), as long as the alternative loan package you’ve opted for is with your existing bank.

Note: If you’re intending to refinance your property loan and switch to another bank, you’d want to check if any other TDSR exemptions apply e.g. borrowers who are owner-occupiers are exempted from TDSR when refinancing your property loans.

Will this count as a refinancing of my property loan?

No. MAS has previously confirmed that the taking up of the SCP and prevailing packages offered by the banks to customers with existing SIBOR property loans will not be regarded as a refinancing of property loans under the regulator’s property loan rules.

Should I switch now or later?

There is still time, so you don’t have to rush into a decision just yet. However, this article is meant to give you a heads-up that if you are an existing SIBOR home loan borrower, you’re encouraged to speak to your bank early to explore the available options.

That way, you’ll have more time during this period to decide on what will be the best move for you.

Should you choose to do nothing for now until 30 April 2024, your SIBOR loan will be automatically converted by the banks starting from 1 June 2024. And no, you will not be able to keep your SIBOR loan, because interest payments based on SIBOR cannot be computed anymore after SIBOR is discontinued.

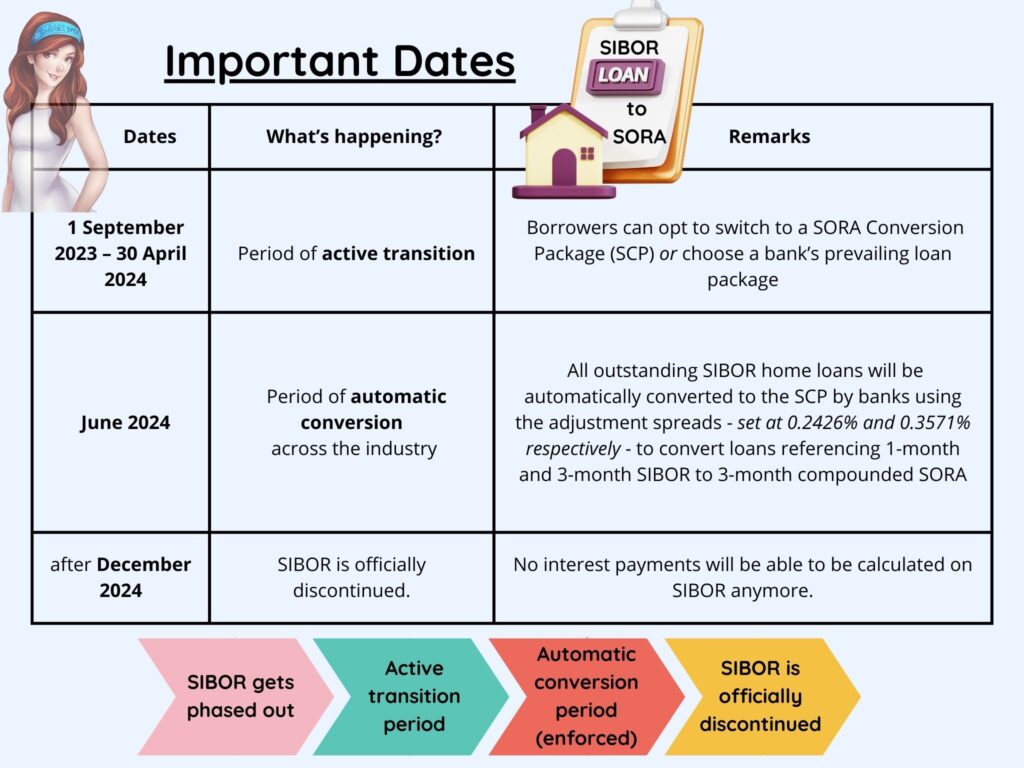

| Dates | What’s happening? | Remarks |

| 1 September 2023 – 30 April 2024 | Period of active transition for borrowers to switch to a SORA conversion loan or a bank’s prevailing loan package | The SCP will be structured as: 3-month Compounded SORA + customer’s existing SIBOR margin + Adjustment Spread (Retail). The Adjustment Spread (spot-spread) will be determined as the average difference between the applicable SIBOR and 3-month Compounded SORA over the preceding three-month period. |

| June 2024 | Period of automatic conversion across the industry for all outstanding SIBOR retail loans to SORA. | Your bank will apply the SCP with the Adjustment Spread (historical median) set at 0.2426% and 0.3571% respectively to convert loans referencing 1-month and 3-month SIBOR to 3-month Compounded SORA. These represent the 5-year historical median spreads between the applicable SIBOR and 3-month Compounded SORA over the period 30 June 2018 to 30 June 2023. |

As you can see, it is definitely more advantageous to start thinking about whether you would like to switch to an alternative home loan when you can, and not when you have to.

Taking action now to contact your bank to choose a loan that’s suitable for you before SIBOR loans are entirely phased out can be beneficial, because you’ll be minimising disruptions to your loan when SIBOR is discontinued.

You can also avoid scrambling to take up any mortgage package your bank offers you when the deadline comes, which may or may not be the best offer then.

What if I want to switch my home loan to another bank?

If you are going with the SCP, which is a standard package that all banks are offering, then there is little reason to switch banks.

You will have to stick with your current bank in order to enjoy the benefits (fee waiver, exemption of MSR, LTV and TDSR).

However, if you intend to switch to another loan package offered by a different bank instead (e.g. to take advantage of a limited-time promotional rate), then do note that it will be the same as the usual process involved in refinancing your loan(s) i.e. you will have to pay all the usual administrative / legal fees, and be subject to MSR and TDSR reviews (unless you have exemptions from these for other reasons, e.g. borrowers who are owner-occupiers are exempted from TDSR when refinancing your property loans).

What are the prevailing packages available in the market?

The prevailing packages offered by your bank could include

- floating rate packages, typically based on compounded SORA or bank board rates, and/or

- fixed rate loans.

Please approach your bank to find out what are the prevailing packages they offer.

If you’re considering SORA-based loans, its key benefit lies in its transparency, since the SORA rate is published on MAS website on each business day at 9am. As the spread that each bank charges over compounded SORA is clear to see, it becomes easier for us as borrowers to compare home loans against another bank!

Another alternative is to go for a floating loan pegged to the bank’s board rate, which is fixed internally by the bank. However, these board rates have hardly any transparency as they are determined solely at the bank’s discretion, making it much harder to compare loan packages.

Should I choose a fixed or floating rate home loan?

In the last decade, floating-rate home loans have generally been cheaper than fixed rate loans due to the low interest rate environment then. The downside is that these loans are subject to interest rate fluctuations, which can cause financing issues for borrowers who do not have spare cash to deal with the changes when interest rates rise. With the uncertain interest rate outlook today, it is anyone’s guess whether these types of loans will remain affordable in the short to medium term.

If you are risk-averse, a fixed-rate home loan may be more appropriate for your risk appetite as there will be no need to panic even if interest rates rise suddenly, since you’ll still be paying the same amount regardless of any fluctuations in interest rates. At times, you’ll even get to save more on the monthly instalments during spikes in interest rates.

The trade-off? Fixed-rate mortgage rates are often higher than floating rates, although some people don’t mind paying higher mortgage interest rates in exchange for stability and a peace of mind.

Tip: Plan based on your risk appetite and financing ability, rather than purely based on prevailing interest rate offers. If you do not have the spare cash or emotional bandwidth to deal with sharp fluctuations in interest rates, then a fixed-rate loan may be better for you. Speak to your bank early, who will be able to provide further advice on your options.

What is the best mortgage loan interest rate?

Given that a mortgage is likely to be one’s greatest financial liability, we need to make sure we proactively manage our home loans, especially in this period of economic uncertainties and global interest rate changes. Whether you’re planning to refinance or you’ve set your eyes on a new home, you may face a dilemma when deciding which is the “best” mortgage loan package.

If you’re unsure, you are encouraged to contact your bank to seek advice from their mortgage specialist, as proactively managing your mortgage is an important step in building a sound financial plan.

You can even put any interest savings to good use, such as leveraging higher interest-yielding savings tools to inflation-proof your emergency funds.

Conclusion

The active transition period for borrowers to convert their existing SIBOR-based loans to an alternative loan package is happening now till 30 April 2024, and you will get to enjoy the following benefits when converting your loan with your bank:

- A one-time fee waiver

- with no additional lock-in period

- you’ll be exempted from recomputing your Mortgage Servicing Ratio (MSR), Loan-To-Value (LTV) and Total Debt Servicing Ratio (TDSR)

More importantly, you have the ability to choose a home loan package that you prefer now, rather than scrambling around when the deadline arrives. It is thus worth exploring your options today to see what will suit you best.

For next steps, you can either approach your bank or a mortgage specialist to find out what options are available to you.

Disclosure: This article is written in collaboration with The Association of Banks in Singapore (ABS), as part of their educational outreach efforts to raise public awareness about being able to switch to SORA or other home loan packages during this active transition period before SIBOR is officially phased out. The contents and slant reflect both the author's perspectives and ABS' inputs for factual accuracy.