What you need to know about the account before you sign up. Get 1.8% – 2.13% p.a. realistically on the first S$100,000 only if you’re willing to put your spend on a Bonus$aver card, and note the conditions on the invest/insure tier!

Salary crediting is a precious commodity. Many of the banks reward you if you do credit your salary into your high-yield savings account with them, but with so many options and only one salary credit choice, which one should you choose?

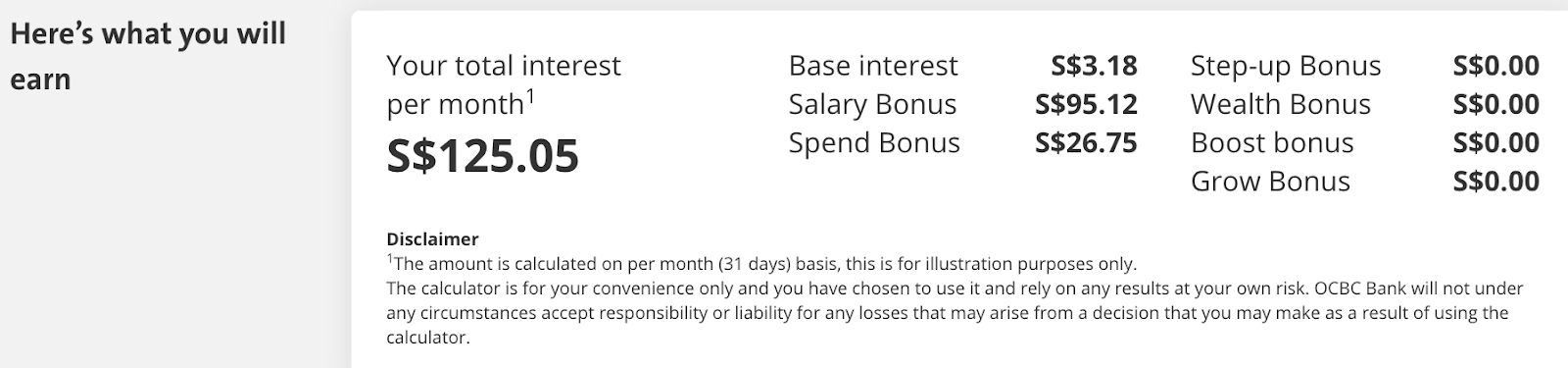

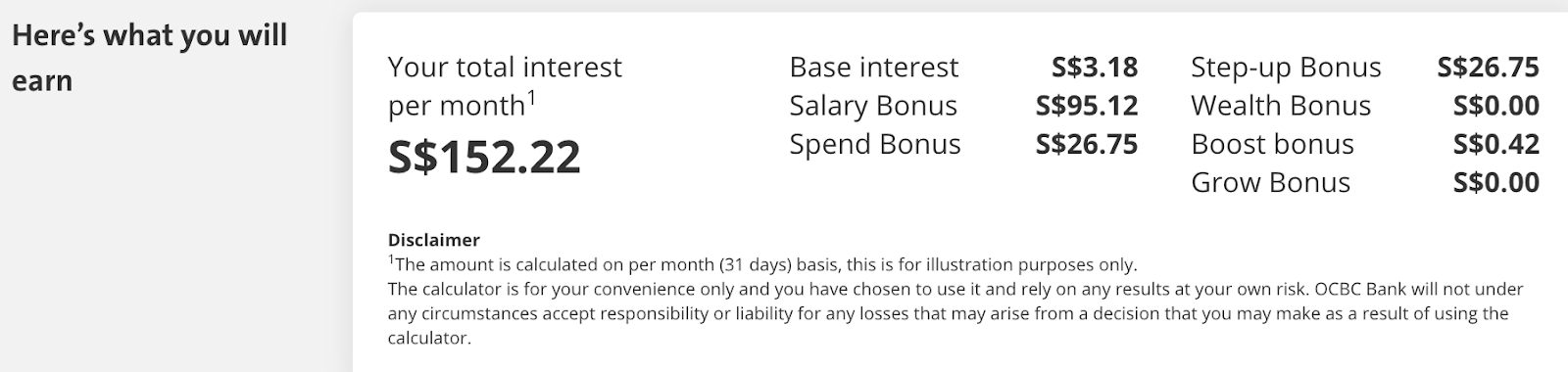

For those of you who earn more than $3,000 and spend at least $500 each month on a credit card, you have two options to choose from: OCBC 360 or Standard Chartered Bonus$aver.

Notes:

- DBS Multiplier is my favourite, but you could technically still fulfil the salary credit requirement without using your own, simply by teaming up with your spouse and opening a joint account to leverage on one person’s salary credit. Read more about my review of the account and other hacks on how to maximise your DBS Multiplier interest here.

- UOB One is another fantastic option, but you could still qualify for the bonus interest by spending $500 on their credit card (the UOB One Card is a pretty good cashback card) + 3 GIRO transactions. This frees up your salary credit for another account.

- Bank of China SmartSaver offers a generous headline rate as well, but it works better for high income-earners (more than $6,000 a month) and high spenders (>$1,500 credit card spend each month). One of their biggest downsides, though, is that their online banking interface is extremely cumbersome, and they’ve much fewer bank branches across Singapore. If you don’t mind the hassle of navigating a poor user-friendly site in exchange for higher interest, then this account might just be best for you.

For the reasons above, I’ve zoomed into OCBC vs. SCB for someone who can do a salary credit + credit card spend + bill payment, and in this comparison, the Standard Chartered Bonus$aver wins IF you’re willing to put your spend on a Bonus$aver card.

Since several of you have asked me about this account recently, I’ll zoom into the SCB offering today. Before you sign up, please note the pros and cons of this account, and evaluate if it’ll be the best match to your personal and financial circumstances:

Here’s the criteria fulfilment:

- Salary credit of min. $3,000

- Spend at least $500 monthly on any SCB credit card

- 3 bill payment of min. $50 each

- Insure or invest with SCB I won’t do this, and you might want to think twice too

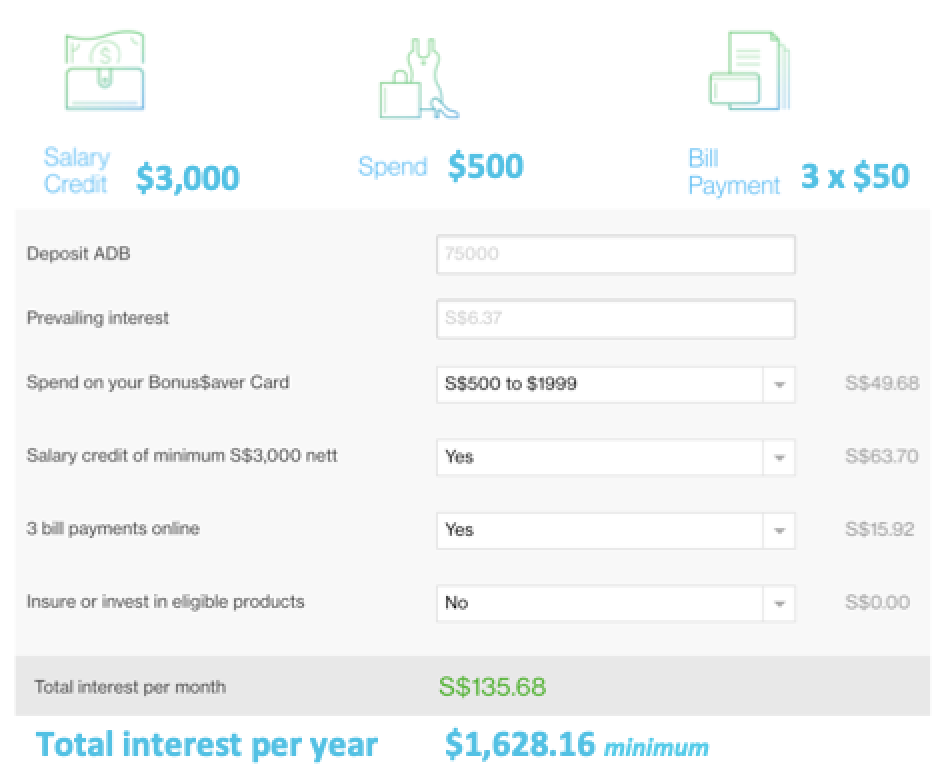

If you’ve $75,000 of funds to park aside, you could be getting more than $1,600 every year through this account. Here’s how the interest breaks down (feel free to play with your own variations here):

Limitations

In contrast to other high-yield savings accounts, SCB has chosen to restrict their customers to spending only on Bonus$aver Cards, instead of picking from their other credit card choices. What’s more, the card itself is neither a good cashback nor miles credit card – it is really just to help you meet the bonus 0.78% interest in your Bonus$aver account.

This means you cannot pair it with the Standard Chartered Unlimited Cashback Card, which is among the bank’s top credit cards as it gives you 1.5% unlimited cashback.

In this regard, OCBC becomes superior because it allows you to pair it with any of their credit cards, such as the OCBC 365 Card – just note the (higher) minimum spending of $800 monthly for the bonus cashback.

Another huge downside I see is that the insure/invest tier is highly prohibitive. I personally would not even consider it for the following reasons:

- Insure: SCB requires you to pay at least $12,000 every year on a Prudential regular life insurance policy bought through the bank. For some context, a $500k whole life policy with critical illness cover would only cost you slightly over $3,000 in premiums every year.

- Invest: You’ll need to invest at least $30,000 in an eligible unit trust sold by the bank to fulfil this criteria, and SCB specifically excludes ETFs and regular savings plans which I’ve mentioned are good investment instruments to look at for beginners (unlike the DBS Multiplier, which rewards you for these!)

What’s more, SCB only rewards you bonus interest for this tier for the first 12 months after purchase, which means if you wish to continue enjoying that 0.75% of bonus interest, you’ll have to buy another (expensive) insurance policy / unit trust again. Thanks but no thanks.

However, if you’re a disciplined saver and you’re confident of increasing your monthly savings by at least $500 every month, then OCBC 360 would serve you better.

Remember to play around with the calculators on both banks websites before you commit to opening an account with them.

Sign Up Gifts

From what I can see, Standard Chartered is currently offering three different gifts – free wireless headphones or travel luggage – depending on how much funds ($10k – $50k min.) and whether you open an account with them online or at one of their branches.

Personally, I’d always pick cold, hard cash over physical gifts anytime, and if you feel the same, then SingSaver’s promotion looks more attractive as you can get S$100 when you open a SCB Bonus$aver savings account through them.

You can apply here, and read the terms and conditions here. I can’t really find any catch except that you need to remember to submit the rewards form to SingSaver, but that’s about it.

Conclusion

“Enjoy our highest interest rate of up to 3.88% p.a.” is the bank’s claim on their Bonus$aver account. However, don’t be fooled by the headline rate and rush to sign up, because you need to understand that it comes with certain limitations as mentioned above.

The account can certainly offer you higher interest than OCBC 360, but if you’re someone who wishes to optimise your credit card spending on a good cashback/miles card, then you might have difficulties meeting the Spend criteria as well.

From what I can see, two improvements need to be made for the account to win over more customers from its competitors, and they are:

- Allow the credit card spending criteria to be on any SCB credit card, instead of restricting it to only Bonus$aver cards.

- Reduce the minimum sum needed to qualify for the insurance and investment tier.

Between the two accounts, which do you prefer?

With love,

Budget Babe

Disclosure: Affiliate links have been included in the above article. If you choose to sign up via my affiliate link, I’ll earn a small referral sum at no additional cost to you.

6 comments

Hi Dawn. Just to highlight, the BonusSaver credit card spend must be done on the actual BonusSaver Credit Card, so the account cannot be paired with any SCB credit card as mentioned in your article. This is unlike the OCBC 360, which can be paired with an OCBC credit card of choice. Thanks

Hi Justin! Ahh you're right, I'd completely missed that out as I'd assumed it could be paired with any SCB credit card! This is a big consideration, let me look into the card right now and update the article. Thanks for correcting me!

Hi Dawn, thanks for the informative article! How would you advise the follwing conditions?

Salary credit: $3,100

Savings: $11,000

Credit card spend: $600 – $900

Potential 2nd salary credit: $2,300

Potential 2nd credit card spend: $1,600

Hey Rachel!

I can't give advice because I don't know enough about your financial circumstances and what your credit card spending is on either. But if I were to work with those numbers, personally I would choose to:

$3,100 salary credit with $11k savings : I would go with DBS Multiplier for reasons of convenience and an attractive 1.85% p.a. interest + 5% cashback by putting $800 on the DBS Live Fresh credit card. That would also give me $40 cashback a month, or $480 in a year on the card spend. That gives me $684.40 in total from the combo.

OCBC 360 is also not bad if I consider that I grow my savings incrementally each month, which should give me $17.69 per month – but that total is only marginally lesser than DBS Multiplier, and significantly lesser if I calculate cashback on card spend because it's not that easy to get $40/month on OCBC credit cards for me. Of course, unless you're able to optimise your spend in that manner, again, this is why I cannot advise you on which route to take.

For the second salary credit of $2.3k and $1.6k (are those numbers right? they look scary – 70% of monthly income on credit card spend – are those discretionary expenses?!) but in that scenario, it'll qualify for 1.88%(cc)+1%(salary)+0.25%(bills) = 3.13% so SCB Bonus$aver would be a no brainer. The only catch is that there's no good way of optimising that $1,600 credit card spend since the tagged SCB card isn't fantastic for cashback. If this was optimised across a combination of cashback credit cards, one could potentially get more than $1.5k a year with the Citi Cash Back Card and another generous cashback card combo for $1.6k monthly spend.

Do carry out your own due diligence and calculations before you decide, since you know your spending habits best instead of me, but hopefully this can help to point you in the right direction and work with some feasible suggestions first!

Only issue with this account is the bonus saver card sucks.

Aivern, I agree, which is why I mentioned it as the first para under Limitations! The credit card facility really factors in a lot into my decision, and a strong miles / cashback card combined with a decent high yield bank savings account would be the superior choice.

Comments are closed.