I’m not a paid influencer, so the concept of over 1,000 shares is still foreign to me. But thanks guys! I really hope my article, and this blog, has inspired you to start saving too and shared some good saving tips 🙂 My intention for this space is also to share on life and career as well, so do check back if you’re keen.

Okay, now for the comments.

As most of you regular readers / those who comment on my blog would know, I try my best to reply each and every one of you. I also reply to all the emails you guys send me. But since Facebook requires me to put my face to the posts (and as you know, I rather keep my identity secret to protect my loved ones), I thought I’ll address a select few here instead.

First of all, let’s look at the dumb keyboard warriors:

I said avoid clubs, or skip clubs totally. Also wrote an article on how guys should stop being stupid and spending so much money on girls who are not even interested in you. For the record, I have never accepted a paid taxi ride back home from the clubs either. But yes, I know of girls who have. Again, generalization is a crime.

Maybe you need to read this.

Wow, talk about slander. If I wanted to pick a fight, I could easily sue this Tan Ka Meng (and win the case) while rallying thousands of Singapore women behind me on this as well, but he’s smart enough to post behind a fake identity. Just look at his profile:

If you have the guts to post such a slanderous comment, why don’t you have the guts to post under your REAL Facebook account?

Anyway, dumb keyboard warriors are just all of that – amusement. So let’s look at the smarter ones:

Thank you Shafiqah. Yes, you see, the main people who will be haters on this are the ones who find it hard to save because they spend unnecessarily and are unwilling to give it up, while being jealous at the same time that people are saving more money than them.

Smart guy! How did he know I cut my hair at Snip Avenue? Hahaha. Also, I cut my bangs myself, so I only have to go to the salon about 3 – 4 times a year to trim my whole hair. Recycling or selling lucky draw prizes, corporate gifts and unwanted presents are also a smart way to reduce expenses while getting some extra cash sometimes. The smart ones have been doing this since the beginning of time.

“Atas” friends? Get rid of them, or just don’t hang out with them too often. Easy.

Wedding dinners and baby showers? Easy. Attend only the ones you actually care about to give a decent-sized red packet.

Exactly. What was the purpose of writing (and you reading) the article? It was to share on savings tips and strategies that helped me build my money. What you choose to focus on and whether you apply these tips to your own life is completely up to you.

Now this guy. The real achiever. Don’t NS men get an average of $800 – $1,200? I really salute him! And see? It’s possible.

This Keith speaks a lot of sense, and this is what I wish more Singaporean girls knew as well. Branded bags, facials, massages and slimming packages are a waste of your money. You’ll be better off putting that money somewhere else.

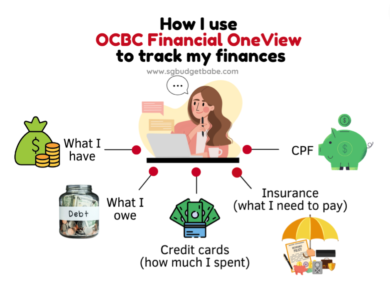

Smart Minz! I’m currently still drafting a post on insurance, as I realized that my savings are going to end up in smoke one day if anything happens and I get hospitalized. Thus I’m in talks with my friend now to arrange for health coverage. Will blog on this once all my files are in order!

Last Words

The article was meant to share on saving tips and encourage people to start saving too, not draw attention on how much I saved.

For all of you who have been supporting this blog and writing in with your encouragements, I thank you. We can never win against keyboard warriors, but you know, if you implement some of my savings tips into your own life too, it’ll be us chuckling to the bank at the end of the day 🙂

With love,

Budget Babe.

3 comments

You just need to include a statement that it is all the Government's fault and those keyboard warriors will start to like you and leave you alone

Hi Kyith, I'm not feeling "high". I decided to post this for two reasons

1) many people simply stay silent against keyboard warriors, but same as in life, you should never go down without a fight. Of course, pick your battles wisely. I'm not the only one facing such comments, I had readers who are also frugal and try to save write in to say they get backlash from their friends as well, so this post is a way of encouragement to show that we are not alone.

b) Yes, it would be pure stupidity to post my bank statement. I don't need to prove anything to anyone 🙂 it is also quite funny to see all these people wasting their time analyzing the figures and trying to bring down credibility, instead of using the time to implement the tips in their own life and see how they can save more. Talk about poor time management 😉

Do not be afraid of those keyboard warriors, when you are above them all.(in terms of your capability to save more than they ever will unless they strike toto). I also do save but not as much as you. another way to continue to benefit from the large amount of savings is to invest them with appropriate returns. So when the time comes, you will sit there and laugh while they continue to work until they are way past retirement age and still struggling to pay their loans.

Comments are closed.