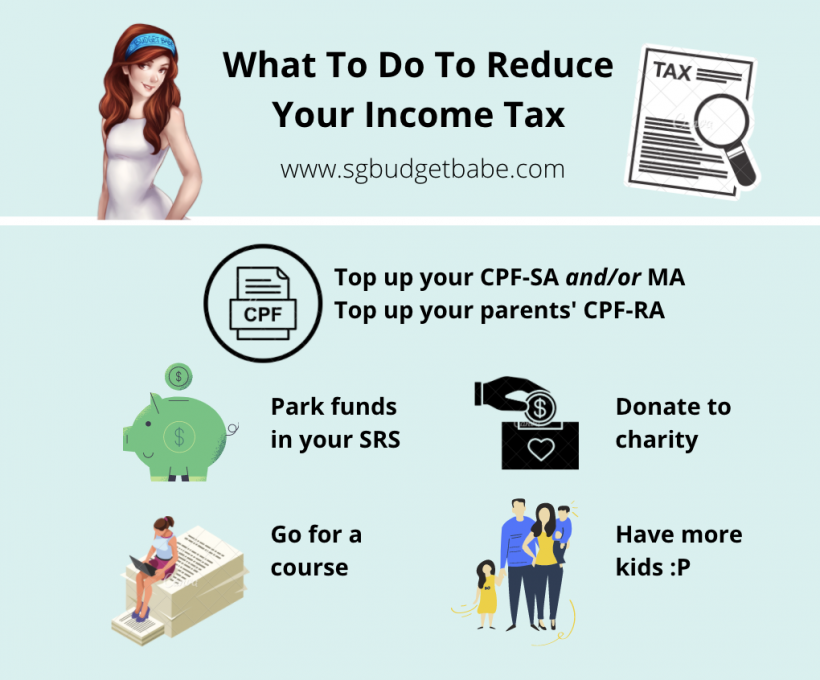

Thinking of how to reduce your income taxes for YA2020 before the year ends? Check out these methods and implement them before December is over!

1. Top up your CPF-SA

If you didn’t already know, doing a voluntary top-up to your CPF Special Account under the Retirement Sum Topping Up (RSTU) scheme can help reduce your chargeable income up to $7,000. I’ve written previously about why this move not just gives you tax benefits, but with an interest rate of 4% p.a., the compounded interest you earn will also help to supercharge your CPF for your retirement years – check out the article here.

2. Top up your CPF-MA

If you’d rather not lock your funds up until your retirement age, another alternative can be to top up your CPF MediSave instead under the Voluntary Contribution scheme, as it offers slightly higher liquidity than your Special Account, given that you can use your MA for hospital and healthcare bills.

What’s more, once you hit the Basic Healthcare Sum (BHS), your subsequent MediSave contributions will overflow into your SA instead – for as long as it is still below the Full Retirement Sum.

Note that Voluntary Contributions to your CPF-MA will be subject to the CPF Annual Limit, so be sure to first check that you’ve not reached the limit yet.

3. Top up your parents’ CPF-RA

If doing the above 2 still isn’t enough, you can reduce your chargeable income by a further $7,000 by topping up your parents’ or grandparents’ CPF Retirement Account. Read my previous article on “filial piety tax rebates” here for more details.

But before you rush to do so, check to ensure that your parents/grandparents have yet to hit the Full Retirement Sum (this is $181,000 in 2020) because if they’ve already exceeded this, then you won’t be getting any tax relief for the contributions.

4. Park money in your SRS account

Need to reduce your taxes even further? You can also consider putting cash in your Supplementary Retirement Scheme Account (SRS), which acts somewhat like your CPF-SA in the sense that you can only withdraw funds after retirement.

If you’re choosing this option, be sure to invest your SRS funds to avoid eroding the value of your cash due to inflation, especially since the paltry 0.05% interest rate on SRS accounts is hardly worth shouting about.

5. Sign up for a course

Did you know that you can also get tax reliefs of up to $5,500 if you went for a course to upgrade your skills?

You can claim for your course fees and exam fees under the Course Fees Relief scheme if you took a course relevant to your current employment. This will then be deducted from your chargeable income as well.

6. Donate to charity

Do a good deed and donate to an IPC-registered charity of your choice, and get a 250% tax deduction while you’re at it. This means that if you donated $1,000, you’ll get $2,500 taken off your chargeable income, which might just help you to move down another income tax tier!

7. Consider having more kids

If this sounds like a joke, I’m actually being perfectly serious. I wish this section was sponsored by the Ministry of Social and Family Development (MSF) but unfortunately it isn’t 😛

Thanks to my cousin (who has 3 kids) who pays almost nothing on her income taxes despite her high salary, I learnt that being a working mother in Singapore really pays off in the form of tax deductions! As a working mother myself, this really helps because I incur additional expenses for childcare help so that I can continue to work, and not risk losing my job due to having to take multiple days of childcare leave each time my child falls sick or whenever his school has an off day.

Having three kids is the magic number, because your chargeable income then gets reduced by 60%, so you can imagine how you could end up not paying a single cent once you implement the other hacks listed above…which is what my smart cousin did, heh.

What’s more, don’t forget about the Parenthood Tax Rebate of $5,000 for the 1st child, $10,000 for the second, and $20,000 for your 3rd or subsequent child. This is a rebate and not a deduction, so I’m looking forward to when we’ll get 5-digit rebates for our subsequent kids since we’re already planning to have more than just 1. I’ll update on this blog when that happens!

Of course, please make sure you genuinely want to have multiple kids in the first place, and that you’re financially able to support them!

So if you don’t want to get a heart attack from your tax bill when tax season arrives in April next year, go ahead and execute the above steps (except maybe #7, heh) before the year ends.

With love,

Budget Babe

2 comments

Hi Budget Babe, RSTU SA is separate scheme and is not subjected to CPF Annual Limit. You can verify this from the CPF website as well. https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme. Cheers.

aye you are right! I got confused by the CPF letter that was sent to me on the same day I wrote this post, talking about how my VC is almost reaching the Annual Limit.

As employees, VC to MA is subject to the Annual Limit, whereas cash RSTU is not.

I've also reached out to CPF to double confirm this (unfortunately this article did not get vetted by them prior since it isn't a sponsored article haha) and have made the edits as well.

Thank you for correcting me!

Comments are closed.