After my recent review on Grab’s newest PayLater service, I decided to delve in deeper into the wider Buy-Now-Pay-Later (BNPL) scene and check out what their competitors are offering. This opened up an entire Pandora Box, and to be frank, I was caught off-guard by some marketing tactics I saw and the lack of transparency when it came to communicating late fees. It is no wonder that the rise of BNPL services have been raising concerns among the authorities, who worry that it might lead to customers being “at risk of spending more than what they have budgeted for”.

There’s been a lot of flak towards BNPL services lately. Even our national newspaper wrote a scathing piece on this over the weekend:

|

| Source: The Straits Times. |

In this article, I’m going to teach you about the Pros and Cons of BNPL services, and to be fair, I’ll also talk about the (hidden) costs or late fees that most consumers aren’t aware of.

First of all, let me first caveat that I am not totally against BNPL services. Like any other financial tool, what’s crucial is knowing how to use it right and what to do so that you avoid becoming a victim of it.

1. BNPL are better than Credit Card Instalments

BNPL services are also preferable over credit card instalment plans, because their fees are ultimately lower than what you could rack up on your credit card bill.

Most credit cards in Singapore charge an average interest rate of over 25% p.a., and late payment fees up to $120. When you compare that to paying instalments using BNPL service providers instead, it is pretty unlikely that you’ll rack up charges anywhere as high as these.

|

| If you forget to pay your BNPL bill, most providers won’t end up charging you anywhere close to $500. Grab charges you no more than $10 (to reactivate your account after defaulting) while some other players cap it at $60 max. |

2. BNPL does NOT make the item any cheaper

This is from what Pace’s founder told CNA:

An item may have been too expensive previously but by splitting payment into three, the item is now more affordable and customers can manage their cost. – Turochas Faud

He should have been more explicit – the item now APPEARS more affordable, but the price of it has not changed.You see, if you need to split payment into 3 tranches before a product becomes “affordable” to you, then that’s likely not a product you should even be purchasing in the first place.

3. You may still incur late fees on BNPL

Another unexpected downside of using BNPL services to pay your bill is that your BNPL repayments adds to your monthly card balance, so there’s a chance that you could risk maxing out your credit limit quickly if you’re not carefully monitoring your expenses. This may in turn lead to subsequent repayments being declined by your credit cards, which then causes you to be late on your BNPL repayments.

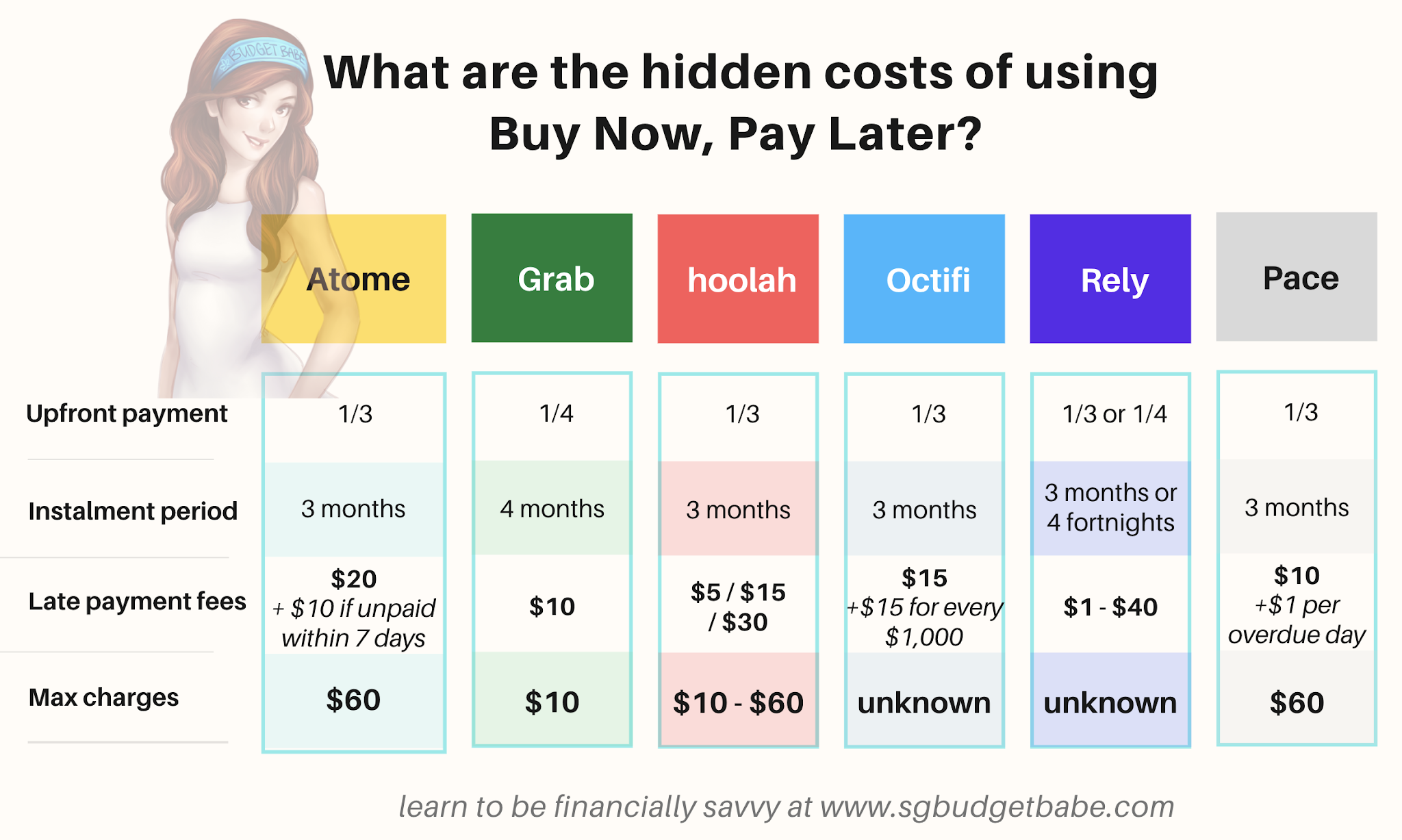

Here’s the costs of using BNPL services. I describe it as “hidden” costs in this graphic because they aren’t always being transparently communicated to most folks:

While Atome seems to be the most popular on social media, they also have one of the highest maximum charge at $60.

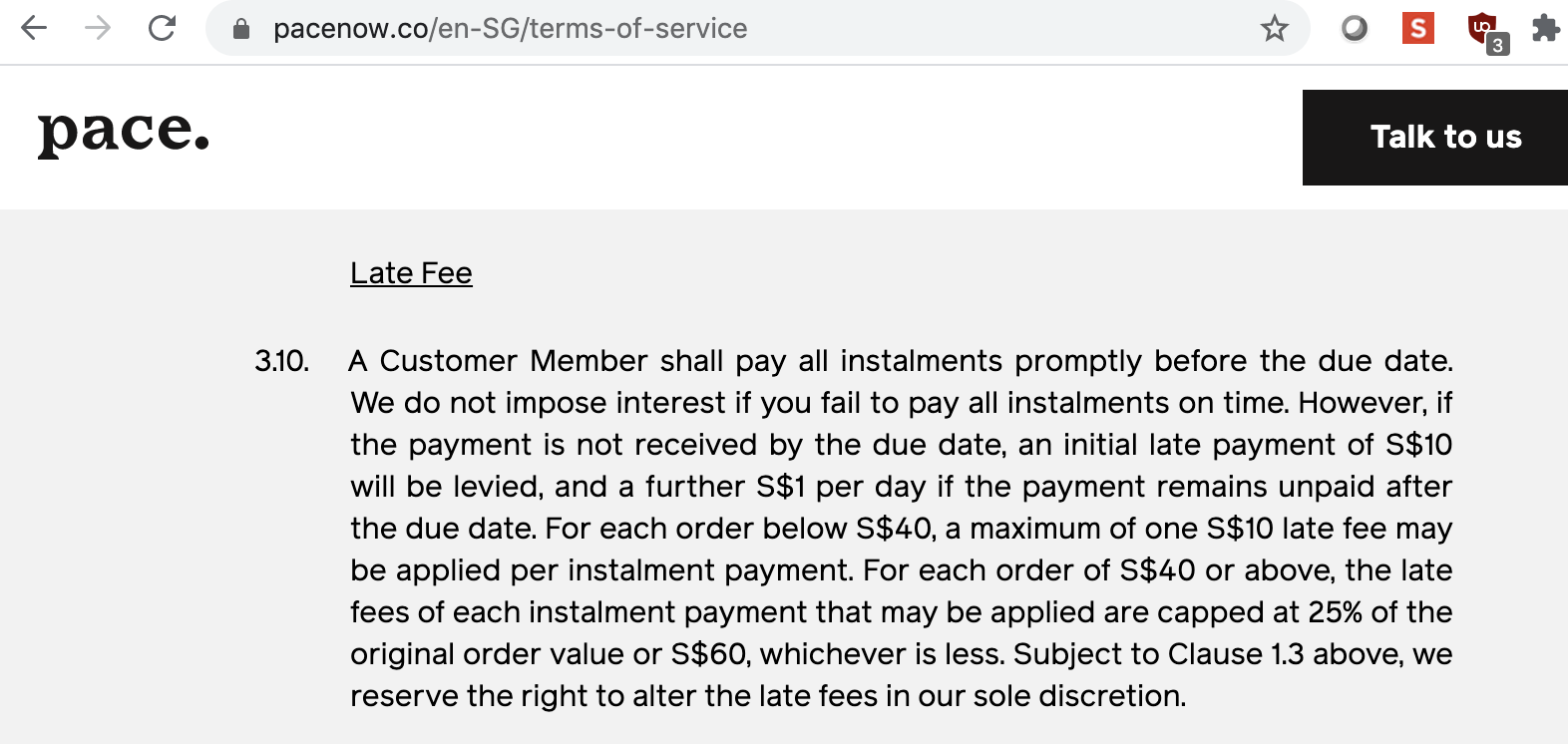

For hoolah, you pay either $5 / $15 / $30 for every late instalment based on your order size. Since there’s only 2 instalments remaining after you make you upfront 1/3 payment, that works out to be a maximum late fee charge of $10 / $30 / $60.

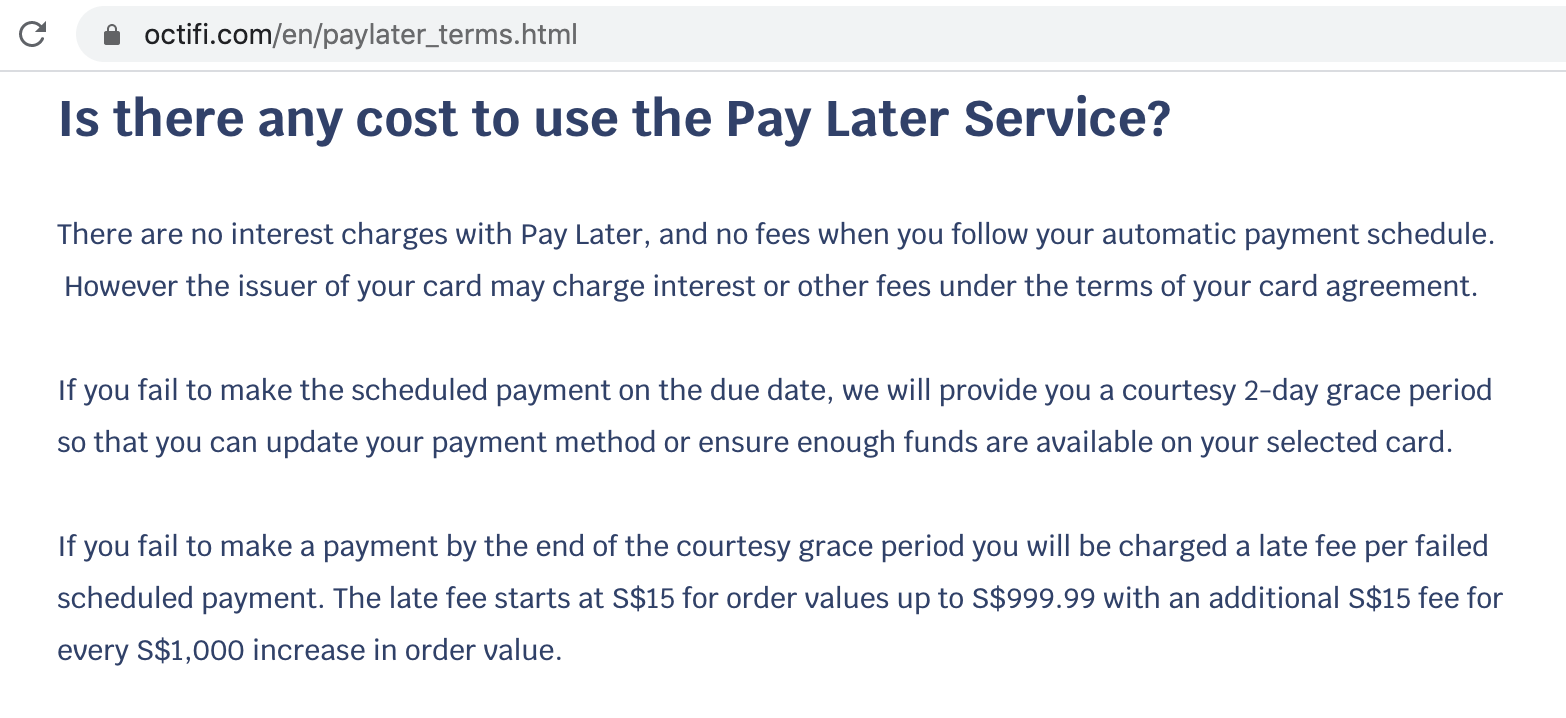

I’m not too sure about Octifi and Rely as there weren’t any caps stated (but welcome anyone’s inputs if you know otherwise, so I can edit and improve this piece further for greater information transparency).

Using Grab seems to have the lowest “cost” – even if you miss payments, the maximum you’ll be charged extra is $10 (an admin charge for reactivating your defaulted account). That’s it.

While the authorities are concerned,

[BNPL services might lead to consumers being] at risk of spending more than what they have budgeted for. Where consumers are not careful and overspend, such schemes can result in overstretched finances and cause potential financial distress. – Monetary Authority of Singapore

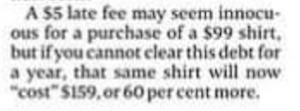

|

| The Straits Times: “A $5 late fee may seem innocuous for a purchase of a $99 shirt, but if you cannot clear this debt for a year, that same shirt will now “cost $159, or 60% more” |

Why? Because this example only applies if you’re using Atome.Using the writer’s example (as published in The Straits Times), defaulting or being late on paying your instalments for a $99 shirt would work out to be the following fees on each of the local BNPL providers:

- Grab: $10

- hoolah: $10

- Octifi: $15 onwards (unknown maximum cap)

- Rely: $1 – $40 (unknown maximum cap)

- Pace: $24.75

But when you read that paragraph alone without this knowledge of the other BNPL providers and how much they charge, naturally, you might feel worried.

4. What I don’t like about current BNPL services

- engage in what I see as irresponsible marketing, in a bid to reach out to consumers

- not being as upfront and transparent about hidden costs or late fees

But that isn’t surprising, especially when you consider how the people / influencers / platforms who have been engaged to promote Atome’s services to the masses are raving about its benefits, less is known (or being communicated) about their hefty fees – and I certainly don’t see many influencers talk about it in their sponsored posts.

5. Are BNPL players marketing their services irresponsibly?

Let’s just look at what happened with my friend, J. She was introduced to Atome while shopping at Sephora, when a sales promoter approached her to say if she were to download the Atome app, she could get a $X voucher off their purchase and also pay less for the item.

- cashback or discount

- pay less (or “only 1/3 of the full amount”) upfront

- zero interest and service charge

Notice that none of the influencers talked about the potential repercussions of using the service, nor did they warn you about the late fees that you might incur if you were to miss repayments.

6. Why are the fees so hard to spot?

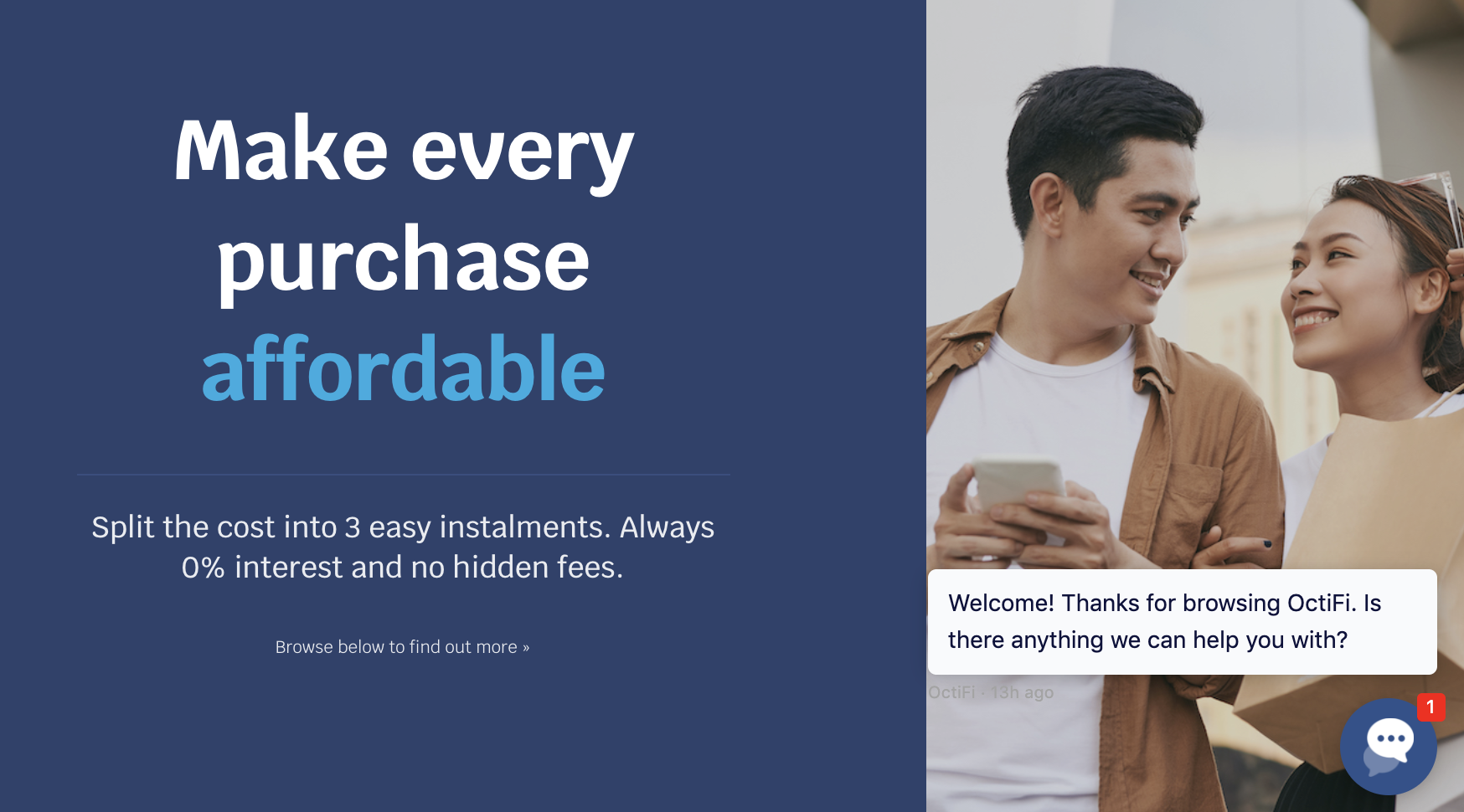

|

| Octifi’s homepage |

Among all the BNPL players, only Grab made their fees clear upfront on their website. With the rest, looking for details on the late fees and repercussions of missing payments on their website felt like I was digging around for a needle in a haystack, so I’ve consolidated it for you guys here:

- Atome: found on their Help page, linked all the way at the bottom of their website and as the last question among the FAQs

- Hoolah: click on Terms and Conditions at the bottom of their website, and then scroll allllll the way to the 27th clause which then links to their lengthy Payment Purchase Contract page.

- Octifi: Clicking on the Pay Later Terms at the bottom of their webpage links to a wordy page which (hooray!) tells you the late fee charges without making users scroll too much.

- Pace: Click on their Terms of Service at the bottom of the webpage and you’ll be redirected to this site where Clause 3 talks about the late fees.

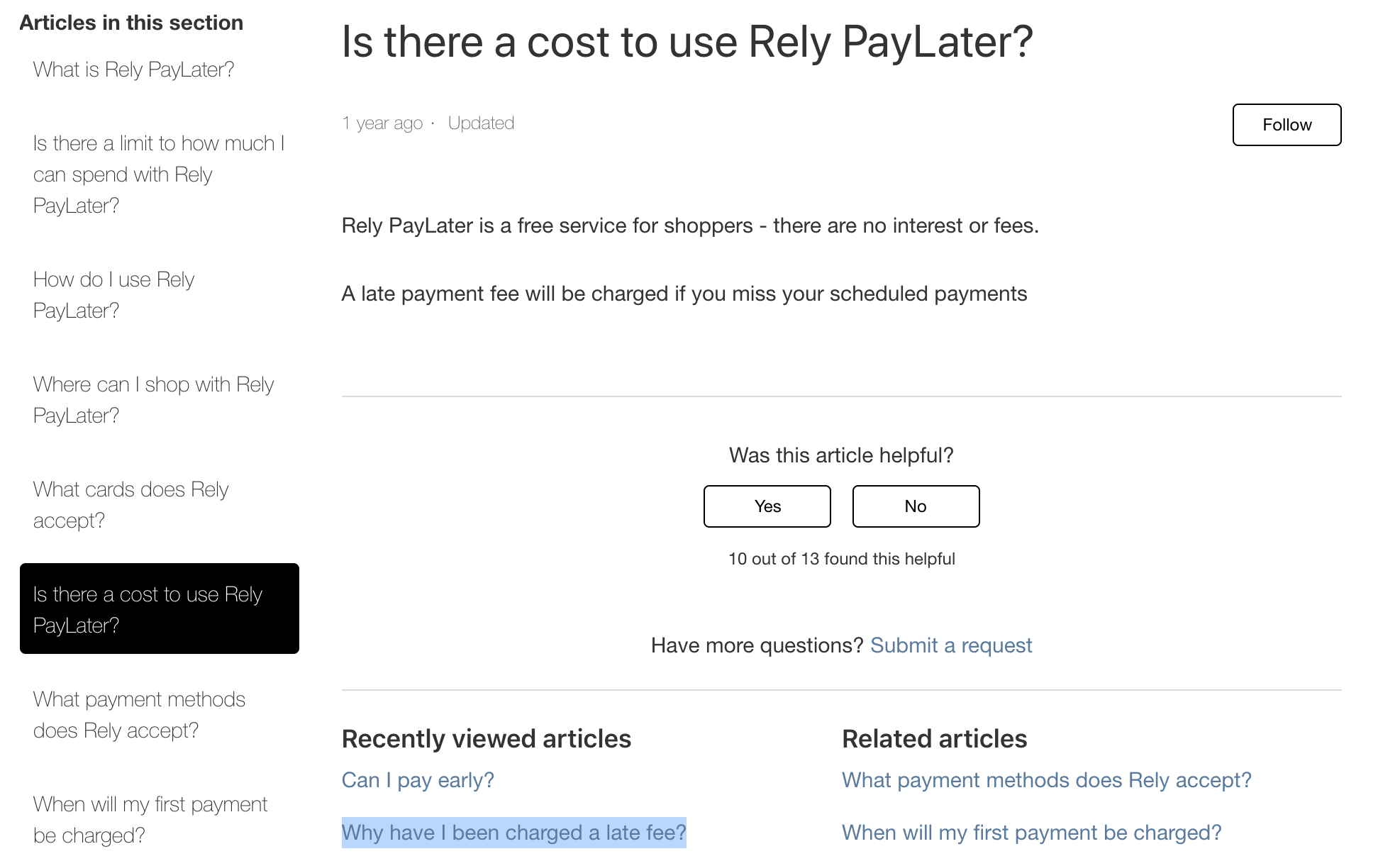

- Rely: Under Terms of Use, they mention there may be a late fee, but does not explicitly tell you how much (you’ll have to use their app first before you can find out).

I had to click on Help at the bottom of the webpage, which then went to a Support page with FAQs (you have to click on the question you’re interested in to load it as a new page). I gave up halfway because even after clicking on the below question and “why have I been charged a late fee”, I still couldn’t find out how much their late fee charges are.

I had to click on Help at the bottom of the webpage, which then went to a Support page with FAQs (you have to click on the question you’re interested in to load it as a new page). I gave up halfway because even after clicking on the below question and “why have I been charged a late fee”, I still couldn’t find out how much their late fee charges are.

I’d argue that BNPL providers need to exercise more responsibility in their marketing and make it clear what are the potential downsides of using their service. However, none (except Grab, see this post) puts that upfront on their main page for you to see. You’d need to (i) know that there are fees involved and (ii) go digging to find out how much.

7. Why the regulators are concerned

Many more questions about the BNPL model have emerged, such as whether consumers might be spending more than they can afford and hence accumulating unnecessary debt.

8. TLDR: Use BNPL services wisely

Now, there’s no doubt that BNPL offer you an interest-free option to pay for your purchases, but so do credit card companies.

If you still wish to use them anyway, here’s a guide on using them responsibly – sponsored by a BNPL provider (Grab PayLater) who agrees with me that responsible usage is key, and wants you to learn how you can best use BNPL without incurring any fees.

With love,

Budget Babe