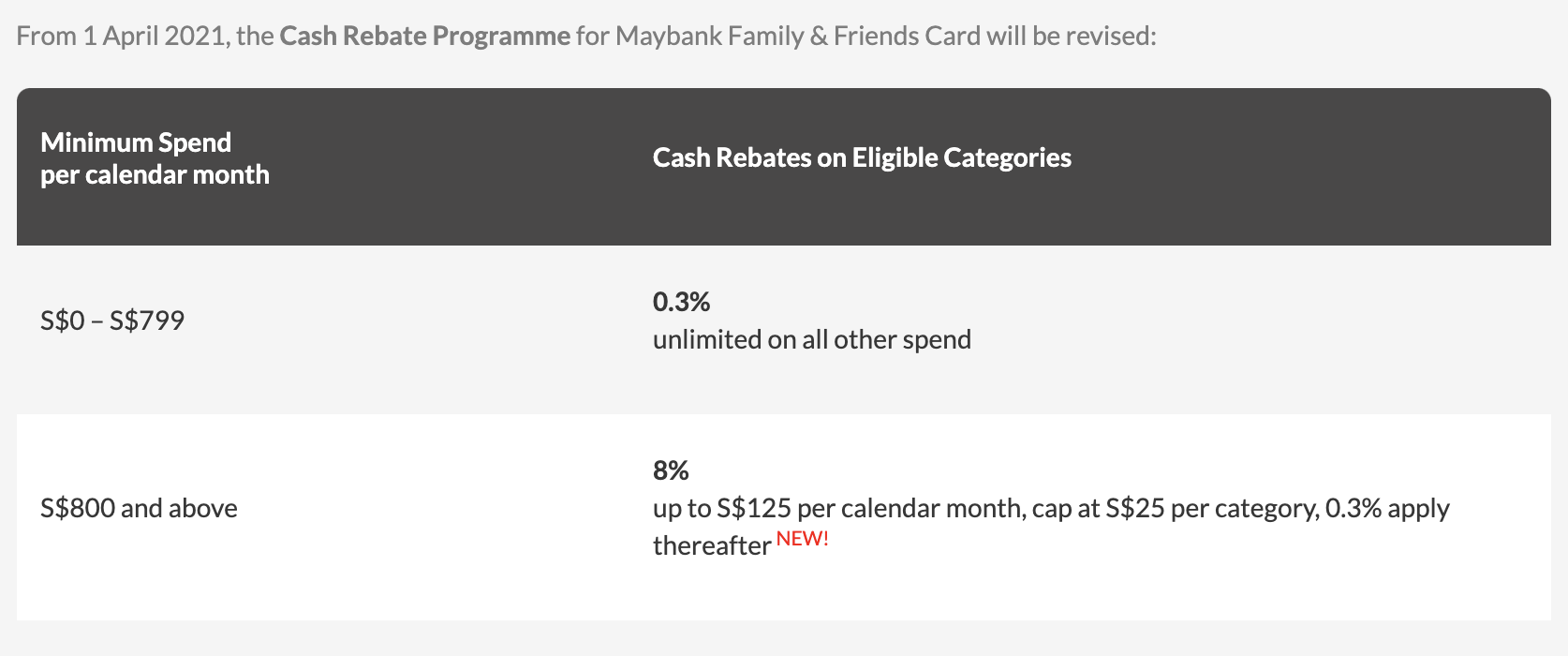

The card’s minimum spend of $500 for 5% cashback has now been removed – you’ll now need to spend at least $800 a month before you can get 8% cashback, capped at $25 per category (five in total).

Once upon a time, the Maybank Family & Friends card was a fantastic cashback card. In fact, I liked it so much that I wrote about it on multiple occasions – here, here and here.

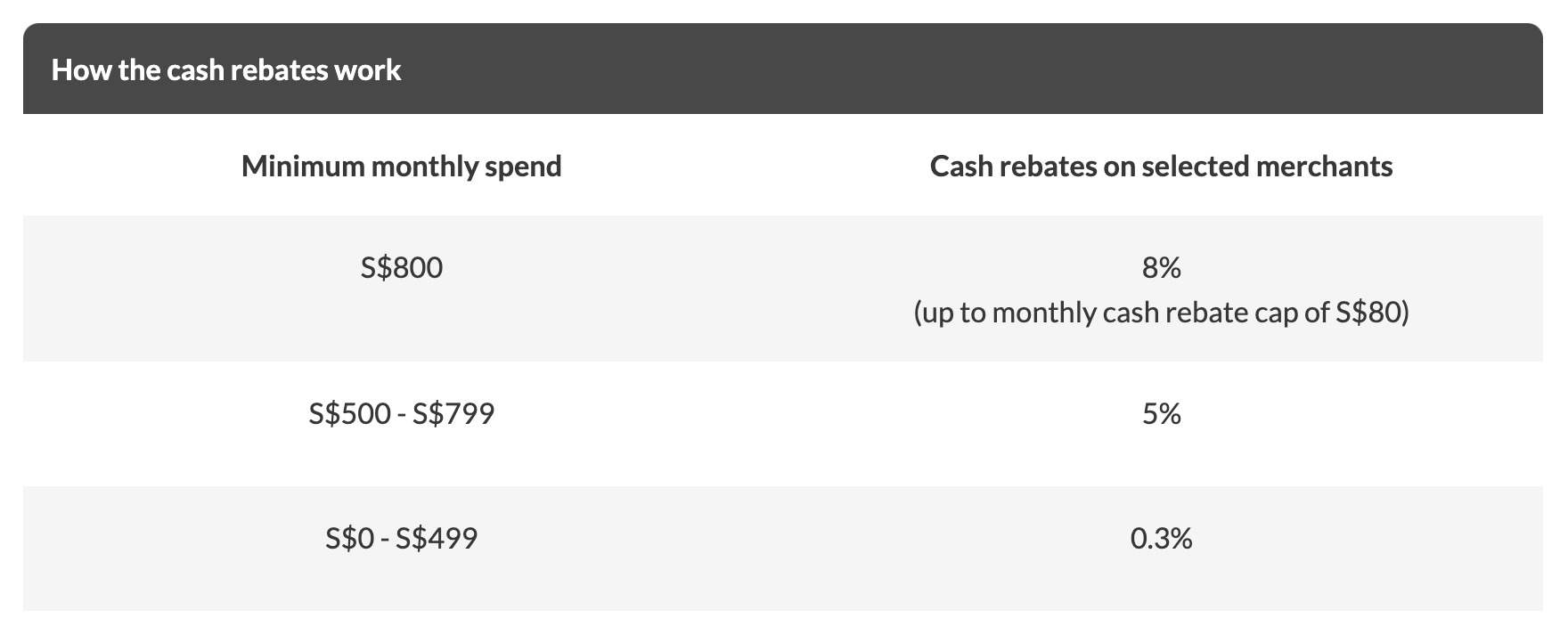

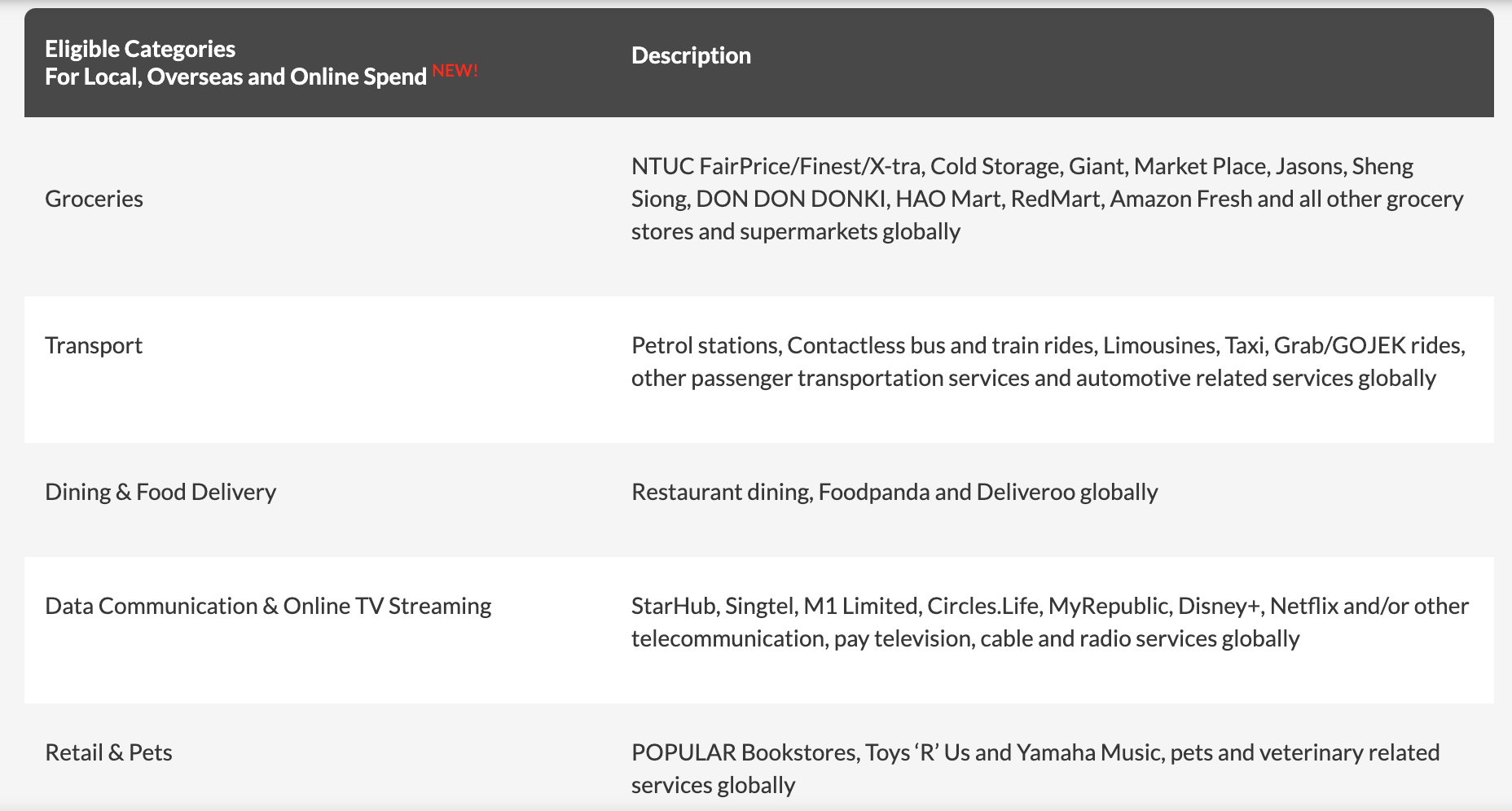

It used to be a great card because the minimum spend of $500 was generally quite achievable for most of us plebeians (commoners), and was good if you shopped for groceries, took public transport (or ride-hailing services), pumped petrol or paid for your telco bills with it. And regardless of whether you even shop at Popular bookstore (which I do fairly frequently, since I teach A Levels General Paper tuition), it was easy to get 5% – 8% cashback using the card.

Unfortunately, these good days are now over because Maybank has decided that effective of 1 April 2021, they will be culling the $500 – $799 category which used to give 5% cashback.

Which means that unless you can spend at least $800 every month, you’d be better off searching for a better cashback card with a lower minimum spend.

Here’s what’s new:

If you’re NOT a plebeian and happen to easily chalk up more than $800 a month for your groceries, transport, dining and food delivery, telco and/or online TV streaming, or even spend at Popular or on your pet, then the card may still be worthwhile to keep for the 8% cashback.

This makes it slightly better than Citi’s Cash Back card, which imposes a $888 now $800 minimum for 6% – 8% cashback across dining, groceries and petrol.

If you’re cancelling yours and looking for an alternative, I personally prefer to adopt a fuss-free combination of

- DBS Live Fresh Card (5% cashback on online and Visa contactless payments)

- an unlimited cashback card e.g. Standard Chartered’s Unlimited Cashback (1.5%) card or Citi’s Cash Back + (1.6%) card

- a miles card

Budget Babe