Insurance

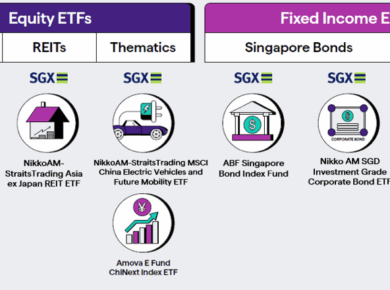

Investing

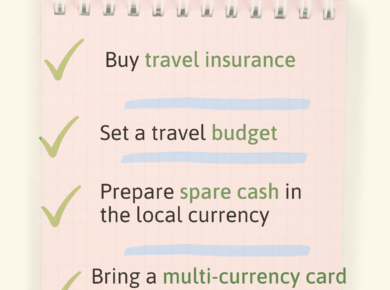

My Travel Essentials List

As overseas travel reopens in a post-COVID world, what should you take note of before you fly so that you don’t end up busting your budget? Set a travel budget…

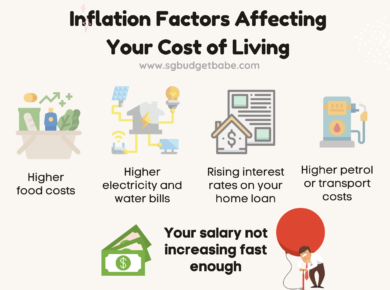

Inflation is bad news for savers. Here’s what you can do instead

If you’ve just received your annual bonus or have savings that you won’t be using in the near term, leaving it in your bank might not be such a good idea anymore, especially as inflation continues to creep upwards. Here are some alternatives you can consider instead.

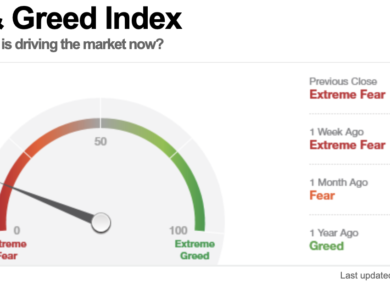

Seeing red? Here’s what you can do for your investments now.

The problem with investing during the last 2 years was that many investors became overly confident due to the bull market. Now that the bear market is here, what should investors do?

A Better Way To Manage Your Family Finances – Autumn App Review

Taking care of your finances – and that of your family’s – should be simple. However, having to track everything across multiple Excel sheets and apps doesn’t make it any easier, especially when you’re trying to keep your eye on the big picture. And if you’re both a mother AND the designated CFO in your household…it can be almost impossible to keep up. With the Autumn app, there may be hope on the horizon.

MOE Kindergarten vs. My First Skool. Which Kindergarten Is Best To Prepare My Child for Primary One?

Is it necessary to switch to MOE Kindergarten in order to prepare your child for Primary One? Here’s why we don’t think so.

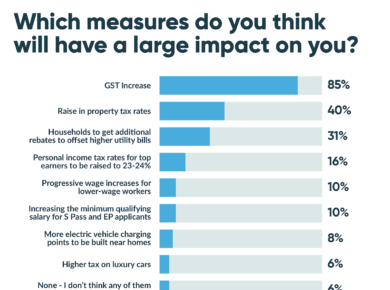

Budget 2022: How do the changes in property taxes affect you?

With the announcement of higher property taxes, do you need to pay more? Here’s the median AV across different property types in Singapore.

Actual Hospital Bill for Normal Delivery – Thomson Medical vs. Mount Alvernia vs. Mount Elizabeth

How much does it cost to give birth in Singapore today amidst the pandemic? If you intend to deliver in a private hospital, these 6 bills from different mothers should give you a good idea of how much to prepare.

Planning to Sail with Royal Caribbean Singapore Anytime Soon? Read this First.

Read this cautionary tale if you’re travelling on Royal Caribbean Singapore anytime soon, or if you intend to.

Tired of Doing Technical Analysis on Your Laptop? You Can Now Chart On-the-Go with POEMS Mobile 3

For many years, POEMS has been one of Singapore’s most popular trading platforms with access to multi-assets, multiple markets as well as your own dedicated Equity Specialist – all for incredibly low fees, much lower than many of our local alternatives. And now with POEMS Mobile 3 being rebuilt from scratch, its newest integration of TradingView charting capabilities now enables you to conduct technical analysis on-the-go!

OCBC Has Fully Reimbursed S$13.7M to Scam Victims – Why this Scam will Go Down in History

OCBC has just announced that it has made “full goodwill payments” to all victims of the recent SMS phishing scam that impersonated the bank. Most have received their payouts, while…

-1-390x290.png)